-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Morning FI Analysis: Focus On European Growth

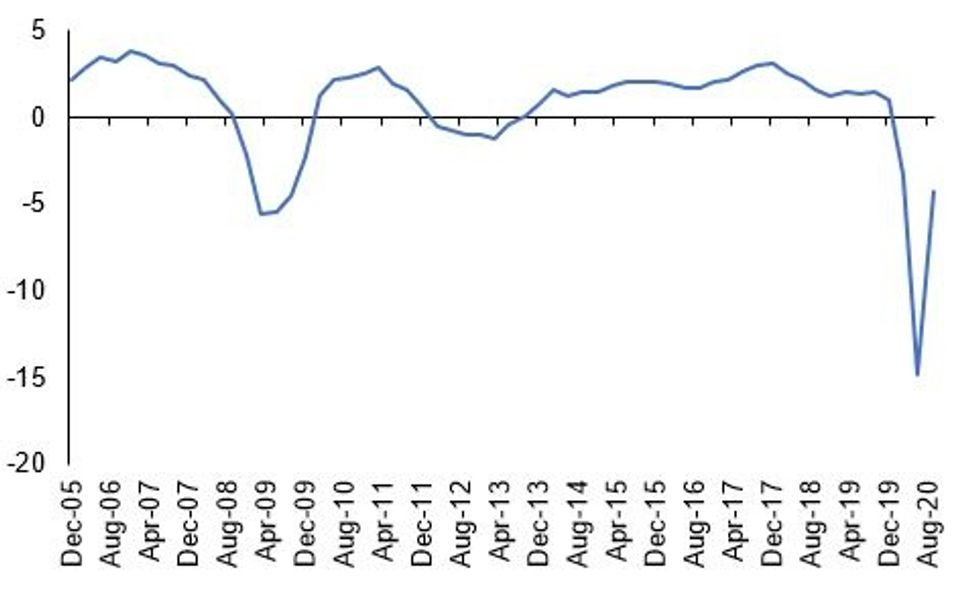

Fig 1 Eurozone GDP, % Y/Y

Source: MNI/Bloomberg

US TSYS SUMMARY: Data Eyed As Candidates Hit The Midwest

Weakness in tech stocks post-earnings after the bell Thursday carried on into the overnight session, with Tsys moving off Thursday's lows. But equities found a footing in early European trade and Tsys have retreated in sympathy, now in the middle of the overnight range.

- Some data out later this morning, but with little else scheduled, market participants could be forgiven for taking a breather before next week's heavy slate of events (FOMC meeting, nonfarm payrolls, refunding announcement, and of course, the election).

- Dec 10-Yr futures (TY) up 2.5/32 at 138-15.5 (L: 138-13 / H: 138-19.5); w volume on the strong side, ~355k.

- The 2-Yr yield is unchanged at 0.1466%, 5-Yr is down 0.6bps at 0.3638%, 10-Yr is down 0.2bps at 0.8215%, and 30-Yr is down 0.1bps at 1.6006%.

- Dollar has fluctuated but basically trading sideways: despite strong Q3 GDP prints in Europe, the Euro shrugged as more attention on lockdowns to come, and ECB easing.

- Another solid data slate today: 0830ET sees Sep personal income / core PCE prices, with Oct MNI Chicago PMI at 0945ET and Oct UMich sentiment at 1000ET.

- With four days to the election, Pres Trump visits Michigan, Minnesota and Wisconsin, while Biden overlaps, in Minnesota, Wisconsin and Iowa.

- No supply today; NY Fed buys ~$1.225B of 7.5-30Y TIPS.

BOND SUMMARY: EGB/GILT - GDP Surprises And Digesting The ECB

Price action in European govies have been relatively contained thus far.

- There has been no follow-through from yesterday's ECB meeting, which played out largely as expected: no change in policy, but a signal of intent that further stimulus will likely be added in December.

- This morning's euro area preliminary GDP prints for the third quarter came in above expectations (Eurozone 12.7% Q/Q vs 9.6% survey, Germany 8.2% vs 7.3% survey, France 18.2% vs 15.0%, Italy 16.1% 11.1%, Spain 16.7% vs 13.5%) , but come at a time when social restrictions are being tightened across the region which risks undermining economic activity in Q4.

- Bunds traded weaker earlier in the session but have pulled back towards yesterday's close.

- The OAT curve has steepened slightly with the 2s30s spread 1bp wider.

- BTPs have trade weaker with cash yields 1-2bp higher on the day.

- Gilts trade close to unch. Last yields: 2-year -0.0623%, 5-year -0.065%, 10-year 0.2277%, 30-year 0.7666%.

OPTIONS

EGB OPTIONS: Bobl Ratio Put Fly Seller

0EZ0 135.50/135.25/135.00 put fly sold at 3 in 4k x 6k x 1k

EURIBOR OPTIONS: Calendar Call Spread

0RH1 100.625/100.75 call spread v 3RH1 100.625/100.75 call spread, pays 1 for the mid in 2k

TECHS:

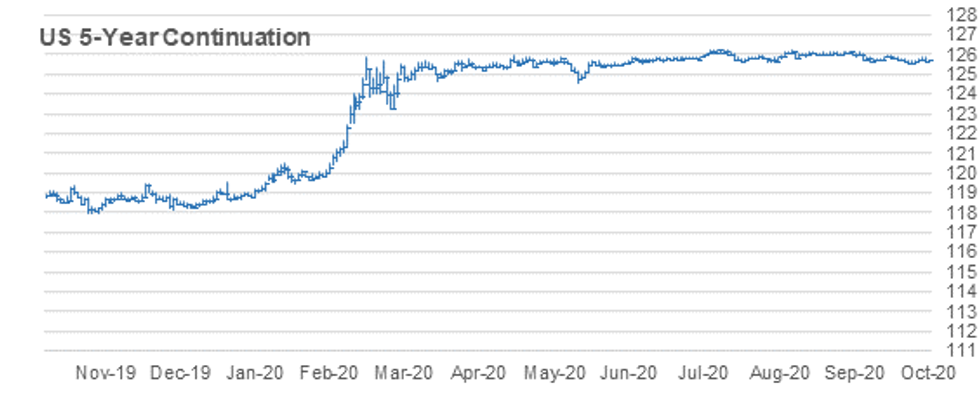

US 5YR FUTURE TECHS: (Z0) Trendline Resistance Capps Gains

- RES 4: 126-00 76.4% retracement of the Sep 30 - Oct 23 sell-off

- RES 3: 125-31 High Oct 15 and a key near-term resistance

- RES 2: 125-29 61.8% retracement of the Sep 30 - Oct 23 sell-off

- RES 1: 125-272 High Oct 28 and the bull trigger

- PRICE: 125-22 @ 10:29 GMT Oct 30

- SUP 1: 125-196 Low Oct 29

- SUP 2: 125-16+ Low Oct 22 and 23 and the bear trigger

- SUP 3: 125-156 1.00 proj of Aug 4 - 28 sell-off from Sep 3 high

- SUP 4: 125-112 Low Jun 10 (cont)

5yr futures stalled at trendline resistance yesterday drawn off the Sep 30 high. The trendline intersects at 125-252. A break, reinforced by a move above Wednesday's 125-272 high would signal a reversal of the recent downleg and pave the way for a climb towards 125-31, Oct 15 high. While the trendline holds, support at 125-16+, Oct 22 and 23 low remains exposed. Clearance of this level would confirm a resumption of bearish activity.

US 10YR FUTURE TECHS: (Z0) Stalls At Trendline Resistance

- RES 4: 139-16 Bear channel resistance drawn off the Aug 4 high

- RES 3: 139-14 High Oct 15 and a key resistance

- RES 2: 139-07+ High Oct 16

- RES 1: 139-03 High Oct 28 and the bull trigger

- PRICE: 138-16 @ 10:42 GMT Oct 30

- SUP 1: 138-11+ Low Oct 29

- SUP 2: 138-05 Low Oct 23

- SUP 3: 138-04+ 1.00 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 4: 137-31+ Bear channel base drawn off the Aug 4 high

Treasuries are lower following yesterday's sell-off. The pullback follows Wednesday's failure at trendline resistance drawn off the Oct 2 high. The trendline intersects at 139-00+. A break of the line, reinforced by a move above 139-03, Oct 28 high would confirm a reversal of the recent downleg and open 139-14, Oct 15 high. While price remains below the trendline though, support at 138-05 remains exposed. A break resumes the downtrend.

US 30YR FUTURE TECHS: (Z0) Support Remains Exposed

- RES 4: 177-00 High Oct 2

- RES 3: 176-10 High Oct 15 and a key resistance

- RES 2: 175-11 50-day EMA

- RES 1: 173-25/29 High Oct 28 / Trendline drawn off the Aug 6 high

- PRICE: 173-08 @ 10:52 GMT Oct 30

- SUP 1: 172-20 Low Oct 29

- SUP 2: 171-22 Low Oct 23 and the bear trigger

- SUP 3: 171-00 Round number support

- SUP 4: 170-16 1.00 proj of Aug 6 - 28 sell-off from Sep 3 high

30yr futures are lower following yesterday's sell-off. The pullback follows an inability this week to clear trendline resistance drawn off the Aug 6 high. The trendline intersects at 174-25. A break, reinforced by a move above 174-29, Oct 28 high would confirm a reversal of the recent downleg and open 176-10, Oct 15 high. While price trades below the trendline, support at 171-22, Oct 23 remains exposed. A break would resume the downtrend.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.