-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRiEF: Riksbank Puts Neutral Rate In 1.5 To 3.0% Range

MNI: Japan Govt Keeps Economic Assessment, Ups Imports

MNI US Morning FI Analysis: Focus On European PMIs

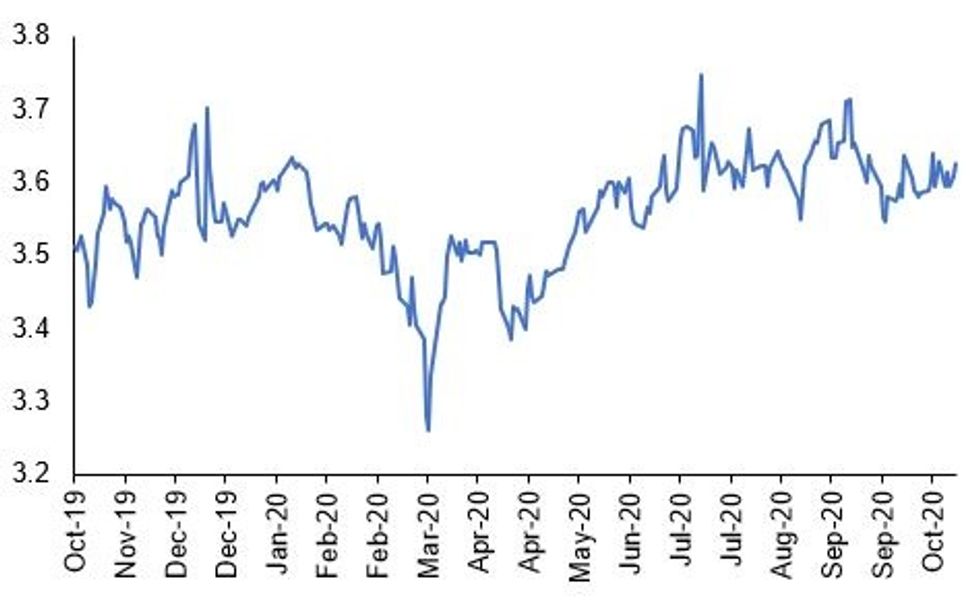

Fig 1.GBP 5y5y Forward Inflation Swap

Source: MNI/Bloomberg

US TSYS SUMMARY: Time Ticking On Stimulus Talks

Little movement in Tsys overnight, with range trading amid equities consolidating Thursday's gains.

- Dec 10-Yr futures (TY) down 1/32 at 138-9.5 (L: 138-06.5 / H: 138-13), higher-than-avg volumes overnight (333k). The 2-Yr yield is down 0.2bps at 0.1514%, 5-Yr is up 0bps at 0.3749%, 10-Yr is down 0.2bps at 0.8547%, and 30-Yr is down 0.3bps at 1.6722%.

- Last night's presidential debate was a much more civil affair than the previous edition, but bookmakers' odds suggest little impact on the direction of the race (arguably modestly higher % chance of Trump win, last at 34% vs 32% pre-debate, per Betfair).

- Today on the campaign trail, Trump's holding rallies in Florida, while Biden's delivering remarks on COVID-19 and the economy in Delaware.

- As for stimulus, we're pretty much where we left off Thursday, though with more time having elapsed. Unclear whether Pelosi and Mnuchin spoke Thursday (a call was scheduled but appears not to have taken place), and/or whether they'll talk today.

- Attention turns to flash PMIs at 0945ET. Svcs expected unch vs Sep at 54.6, but Manuf seen ticking slightly higher to 53.5 vs 53.2 prior.

- The Fed speaking schedule has wound down ahead of pre-FOMC blackout beginning this weekend. We hear from NY Fed's Logan on a panel on mkt liquidity at 0905ET.

- No supply today. NY Fed buys ~$8.825B of 2.25-4.5Y Tsys.

BOND SUMMARY: EGB/Gilt - PMIs Paint Mixed Picture

European govies trade mixed this morning alongside broad equity gains, modest upside for oil and G10 FX strength vs the USD.

- The gilt curve has bear steepened with the 2s30s spread 2bp wider.

- Bunds started the session on a strong footing and have gradually traded weaker and back to unch on the day. Last yields: 2-year -0.7680%, 5-year -0.7714%, 10-year -0.5651%, 30-year -0.1454%.

- OATs have similarly given up some of the early gains while continuing to trade above yesterday's close.

- BTPs have rallied with cash yields 2-4bp lower on the day.

- French preliminary PMI data for October was a touch weaker than expected while the German composite surprised higher on the back of a strong outturn for manufacturing (58.0 vs 55.0 survey). There was a marginal improvement in the Eurozone composite, which remains in contraction territory. The UK PMIs remain healthy, with only a slight deterioration in the services estimate (52.3 vs 53.0). UK retail sales were also stronger than expected in September (Ex auto: 1.6% M/M vs 0.5% survey)

- The DMO earlier sold GBP1.75bn of 1-/3-/6-month T-bills.

DEBT SUPPLY

DMO sold GBP1.75bln in 1-/3-/6-month T-bills

- GBP500mln Nov 23 T-bill, avg yield -0.0077% (-0.0053%), cover 4.99x (5.40x)

- GBP500mln Jan 25 T-bill, avg yield -0.0454% (-0.0388%), cover 3.39x (9.12x)

- GBP750mln Apr 26 T-bill, avg yield -0.0416% (-0.0310%), cover 2.12x (6.95x)

Next week's bill auctions (unch size):

- GBP0.50bln 1-month

- GBP0.50bln 3-month

- GBP0.75bln 6-month

OPTIONS

EGB OPTIONS: Bund outright call

RXZ0 178c, bought for 9 in 5k

EGB OPTIONS: Bund upside CS

RXZ0 177/178cs 1x2 bought for 3 in 1.25k

SHORT STERLING OPTIONS: Upside buyer

0LH1 100.00/100.12/100.25c fly, bought for 1.5 in another 2k (4k total)

EGB OPTIONS: Bund downside

RXZ0 174.00/173.00ps 1x1.5, bought for 10 in 2.8k

EURIBOR OPTIONS: Longer dated Call

ERU1 100.625c, bought for 4 in 3k (ref 100.55)

TECHS:

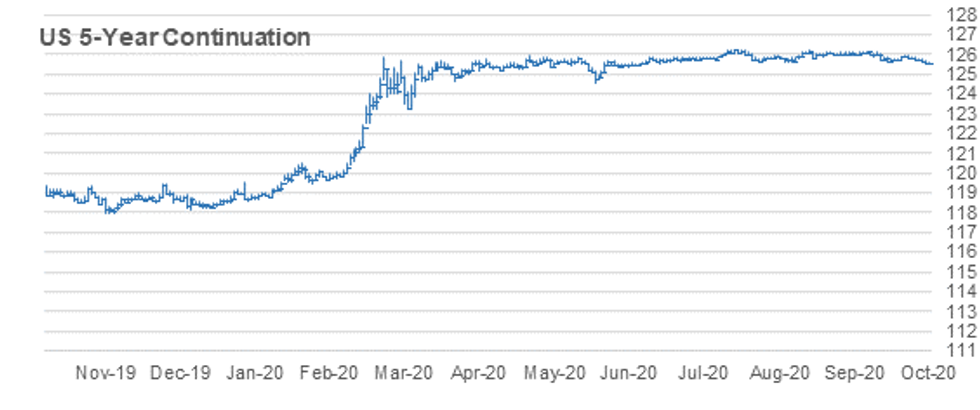

US 5YR FUTURE TECHS: (Z0) Needle Pointing South

- RES 4: 125-31 High Oct 15

- RES 3: 125-276 50-day EMA

- RES 2: 125-26 20-day EMA

- RES 1: 125-22+ High Oct 22

- PRICE: 125-18 @ 11:31 BST Oct 23

- SUP 1: 125-16+ 1.00 proj of Aug 4 - 13 sell-off from Sep 3 high

- SUP 2: 125-112 Low Jun 10 (cont)

- SUP 3: 125-08 1.382 proj of Aug 4 - 13 sell-off from Sep 3 high

- SUP 4: 125-06+ Low Jun 6

5yr futures maintain a weaker tone. Futures traded lower again yesterday extending this week's slide. The breach Wednesday of support at 125-202, Oct 7 low, confirmed a resumption of the downtrend that has been in place since early August. This paves the way for weakness towards 125-16+ next (tested yesterday), a Fibonacci projection and 125-112, Jun 10 low (cont). Initial resistance is at 125-22+.

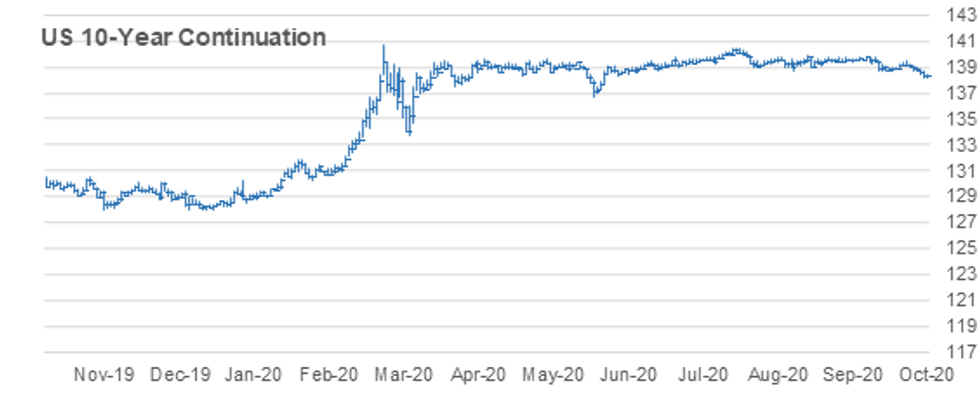

US 10YR FUTURE TECHS: (Z0) Heading South

- RES 4: 139-14 High Oct 15

- RES 3: 139-05+ 50-day EMA

- RES 2: 139-00 20-day EMA

- RES 1: 138-20+ Low Oct 7 and this week's breakout level

- PRICE: 138-08+ @ 11:42 BST Oct 23

- SUP 1: 138-05+ Low Oct 23

- SUP 2: 138-04+ 1.00 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 3: 137-29 76.4% retracement of the Jun - Aug rally (cont)

- SUP 4: 137-16 200-dma

Treasuries weakened further yesterday, extending this week's sell-off. A bearish theme was reinforced Wednesday following the break of 138-20+, Oct 7 low. The move lower confirmed a resumption of the broader reversal that occurred on Aug 4 and clears the way for a continued move lower. This has opened 138-04+ next, a Fibonacci projection ahead of 138-00. Initial resistance is seen at 138-20+.

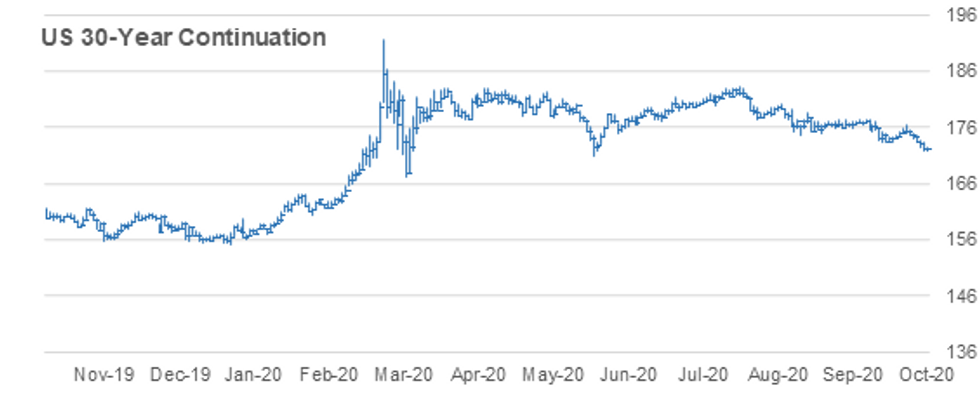

US 30YR FUTURE TECHS: (Z0) Bearish Trend Sequence Intact

- RES 4: 176-10 High Oct 15

- RES 3: 175-11 Trendline resistance drawn off the Aug 6 high

- RES 2: 174-22 20-day EMA

- RES 1: 173-10 Low Oct 7 and this week's breakout level

- PRICE: 171-13 @ 11:52 BST Oct 23

- SUP 1: 171-25 Low Oct 22

- SUP 2: 171-00 Round number support

- SUP 3: 170-16 1.00 proj of Aug 6 - 28 sell-off from Sep 3 high

- SUP 4: 170-00 Psychological round number

30yr futures maintain a bearish tone and traded lower yesterday. Price cleared key support at 173-10, Oct 7 low on Wednesday. The break negates recent bullish developments and instead confirms a resumption of the downtrend that has been in place since the Aug 6 reversal. A number of price objectives have already been achieved. Attention is on 170-16 next, a Fibonacci projection. Firm resistance resides at 173-10.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.