-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open

US Executive Summary

- J&J Halts Covid-19 Vaccine Trials After One Patient Falls Ill - Bloomberg

- China Trade Makes Full Rebound In Q3 - MNI

- German Europe Min: EU Well Prepared For Both Brexit Scenarios - MNI

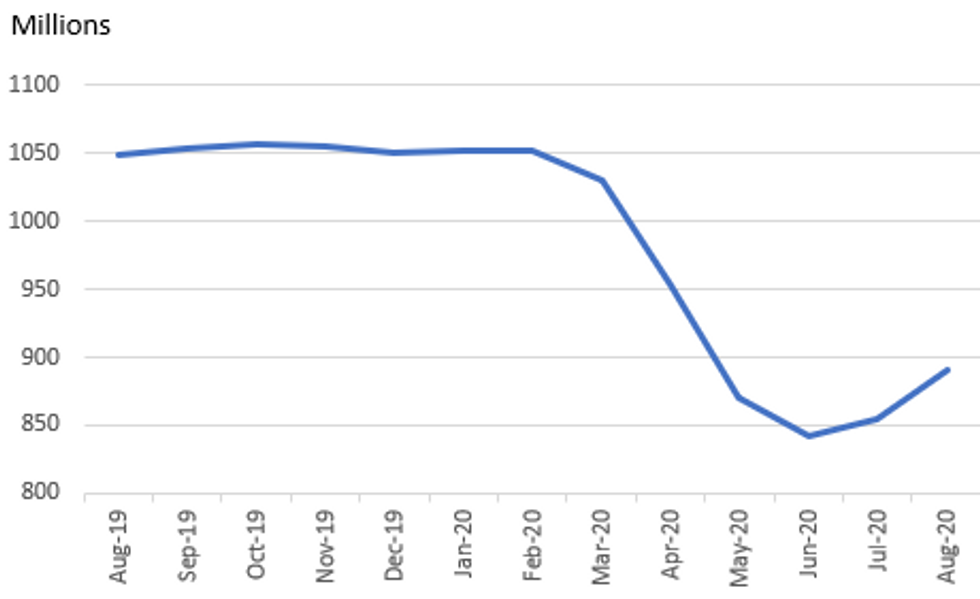

Fig 1. UK Aggregate Hours Still Over 15% Below the Peak Having Only Recovered 25% Of Lost Hours Overall

Source: MNI, ONS

NEWS

J&J Halts Covid-19 Vaccine Trials After One Patient Falls Ill - Bloomberg

Johnson & Johnson halted clinical trials of its Covid-19 vaccine after a participant fell ill, the second time that a front-runner developer has paused testing in the race to create a viable immunization against the virus.

MNI INSIGHT: BOJ Worried But Leaves Negative Gap Alone For Now- Q2 Output Gap Largest In More Than A Decade

Japan's negative output gap in the April-June quarter, the first in nearly four years and the largest in more than a decade, has the central bank increasingly worried that the inflation rate and growth expectations will will remain weak, MNI understands.

MNI POLITICAL RISK: German Europe Min: EU Well Prepared For Both Brexit Scenarios

At the start of the EU General Affairs Council in Luxembourg German Europe Minister Roth states that Brexit talks are at a critical stage and that both the EU and the UK are working hard to get a deal that is acceptable to both sides agreed to as soon as possible.

- Adds that the EU is well prepared for either scenario, whether a deal is reached or the UK going onto WTO trading terms at year-end.

- Says he expects substantial progress from the UK on the three major sticking points: fisheries, LPF, and horizontal governance.

MNI POLICY: China Trade Makes Full Rebound In Q3: Official- Exports Beat Expectations In Jan-Sept Period

China's foreign trade grew 7.5% y/y in Q3, turning positive for the first time in 2020 and achieving "a full rebound," said Li Kuiwen, spokesman of the General Administration of Customs at a data release briefing on Tuesday.

DATA

MNI: UK AUG UNEMPLOYMENT RATE 4.5%

- UK SEP CLAIMANT COUNT +28,000 TO 7.6%

- UK JUN-AUG AVG TOTAL EARNINGS 0.0.% vs -1.0%

- UK JUN-AUG AVG EARNINGS EX-BONUS 0.8% VS 0.2% JUN

July LFS unemp level adjusted higher

The UK LFS unemployment rate at 4.5% was on the ONS's new adjusted basis (see earlier bullet). For compariosn, the adjusted data for the 3 months to July was 4.3%

Aggregate hours still gloomy reading

- UK aggregate hours worked now at 891 million in the Jul-Sep period showing little improvement since last month's report.

- This was 1,052 million in the Dec-Feb period (so we are still over 15% below that level).

- Aggregate hours reached a low of 842 million in Apr-Jun (so we have only made up around a quarter of the hours lost).

Final German CPI Readings Match Prelims

- German Sep, F CPI -0.2% Y/Y; Median -0.2%; Prelim -0.2%

- German Sep, F HICP -0.4% Y/Y; Median -0.4%; Prelim -0.4%

- German Sep, F CPI -0.2% M/M; Median -0.2%; Prelim -0.2%

- German Sep, F HICP -0.4% M/M; Median -0.4%; Prelim -0.4%

GERMANY OCT ZEW ECONOMIC SENTIMENT +56.1; SEP +77.4

GERMANY OCT CURRENT CONDITIONS -59.5; SEP -66.2

BOND SUMMARY: Negative Sentiment But BTP-Bunds Spreads Narrow Further

- Market sentiment has been downbeat this morning following the news that Johnson & Johnson have paused their trials of their Covid-19 vaccine after one of the study participants fell ill. Equities are a little lower and core fixed income higher.

- Despite the generally negative sentiment, peripheral spreads are little changed with the exception of BTPs. BTP futures have continued their move higher to breach the psychologically important 150 level with BTP-Bund spreads narrowing further. Our technical analyst notes that the next resistance is at 150.74, the bull channel top drawn off the Sep 8 low. We also note that Bund futures are at their highest levels since July.

- UK labour market data this morning was disappointing but saw little market reaction.

- US CPI and average earnings are the data highlights for the rest of the day with BOE Governor Bailey testifying before the Lords Economic Affairs Committee.

- TY1 futures are up 0-1+ today at 138-30+ with 10y UST yields down -2.1bp at 0.755% and 2y yields down -0.8bp at 0.148%.

- Bund futures are up 0.11 today at 174.92 with 10y Bund yields down -0.6bp at -0.551% and Schatz yields down -0.4bp at -0.736%.

- Gilt futures are up 0.12 today at 135.60 with 10y yields down -0.7bp at 0.263% and 2y yields down -0.3bp at -0.34%.

FOREX SUMMARY

A touch lower Cash Equity open, pushed the Futures lower this morning, helping the USD retain its overnight bid.

- USD is trading on the front foot a continuation from the Asian session, against most majors.

- Scandies, saw EURSEK jumps 1.5 big figures following the CPI miss, and the pair tested yesterday's high at 10.4162 (printed 10.4128 high).

- SEK has since recovered, as Equities lack clear downside momentum, bringing EURSEK below pre CPI data at 10.3750.

- AUD hovers around the figure at 0.7200, after seeing some selling pressure, following overnight concerns between Australia and China on Coal imports.

- Once again today, worth keeping an eye on FX expiry, which could act as a magnet for today's session, with 1.09bn worth of expiry between 0.7200-0.7220

- GBP has been mixed in early trading, mainly taking its cue from the USD moves, as investors and market participants wait on Brexit, news.

- CEE FX sees CZK losing ground against the Greenback, on Covid concerns for the country.

- USDCZK is up 0.65% at 23.1617.

- Looking ahead, Earning season begins for Q3, with JPM, J&J and Citi expected today.

- On the data front, US CPI is the highlight, while BoE Bailey, ECB de Cos, Riksbank Ingves and Fed Barkin are the scheduled speakers

EQUITIES

- Japan's NIKKEI up 43.09 pts or +0.18% at 23601.78 and the TOPIX up 5.75 pts or +0.35% at 1649.1.

- China's SHANGHAI closed up 1.285 pts or +0.04% at 3359.75

- German Dax down 30.33 pts or -0.23% at 13109.43, FTSE 100 down 18.09 pts or -0.3% at 5982.78, CAC 40 down 15.61 pts or -0.31% at 4963.62 and Euro Stoxx 50 down 3.95 pts or -0.12% at 3294.03.

- Dow Jones mini down 98 pts or -0.34% at 28709, S&P 500 mini down 3.75 pts or -0.11% at 3529.5, NASDAQ mini up 79.75 pts or +0.66% at 12184.

COMMODITIES LEVEL UPDATE

- WTI Crude up $0.53 or +1.34% at $39.97

- Natural Gas down $0.06 or -1.94% at $2.826

- Gold spot up $0.56 or +0.03% at $1923.02

- Copper down $1.55 or -0.51% at $305.05

- Silver down $0.07 or -0.27% at $25.0228

- Platinum down $2.89 or -0.33% at $874.35

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.