-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Quarter-End Dip In Eurozone Inflation (And Stocks)

EXECUTIVE SUMMARY:

- EUROZONE INFLATION TICKED LOWER IN JUNE

- RUSSIA CONDUCTED CYBER ATTACK ON GERMAN BANKING SYSTEM: BILD

- BOJ'S NAKAGAWA: APPROPRIATE TO CONTINUE WITH CURRENT EASING

- DELTA VARIANT WORRIES R.B.A. AHEAD OF KEY MEETING (MNI INSIGHT)

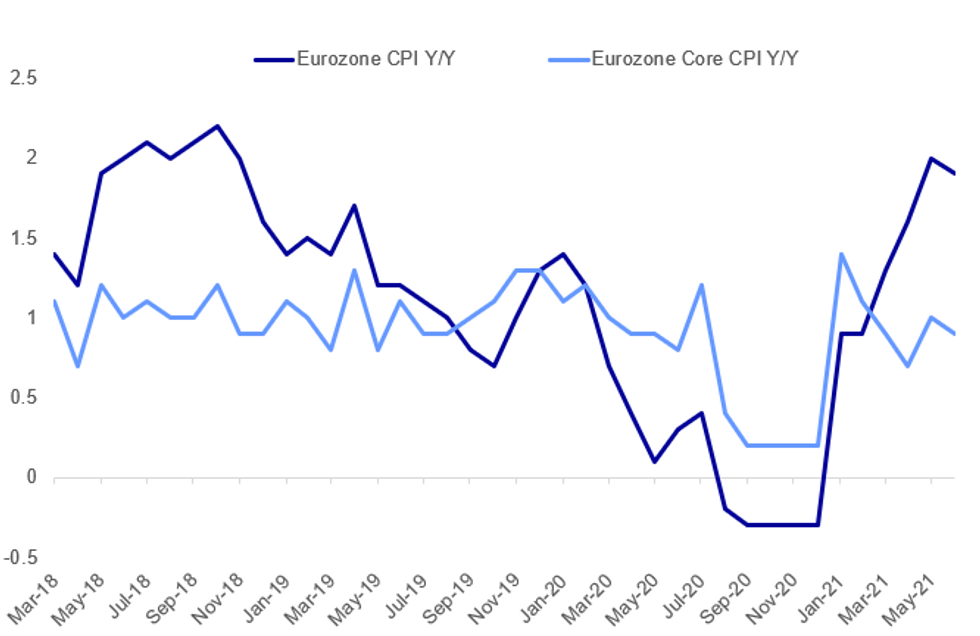

Fig.1: Eurozone Y/Y Inflation Slips

Source: Eurostat, MNI

Source: Eurostat, MNI

NEWS:

GERMANY (BILD): According to BILD information, Russia has massively attacked critical infrastructure and the banking system in Germany in the past few days. According to BILD information from western intelligence sources, the state-run Russian hackers from the "Fancy Bear" group were behind the attack. The Federal Office for Information Security (BSI) confirmed the attack against BILD on Wednesday morning.

BOJ (BBG): New Bank of Japan board member Junko Nakagawa says it's appropriate to continue with the bank's current monetary stimulus. Monetary policy needs to be flexible to shifts in economic and market conditions, Nakagawa says at her inaugural press conferenceMust watch downside risks for economy and inflation amid pandemic.

R.B.A. (MNI INSIGHT): Fresh Covid-19 outbreaks and the slow pace of Australia's vaccine rollout are having more of an impact on the economy than the Reserve Bank of Australia expected when it made its most recent forecasts in May, weighing on its calculations as it considers an extension of its yield guidance, MNI understands. For full article contact sales@marketnews.com

JAPAN: Wires and social media reporting comments from Japanese Prime Minister Yoshihide Suga stating that Japan's vaccination programme will assist in the country's economy rebounding from the pandemic, and that tax collection receipts during the previous year are expected to reach a new high. Suga also confirmed that the government would take more 'proactive' measures to combat the rise in COVID-19 cases with the Tokyo Olympic Games less than one month away.

ITALY POLITICS: Italy's anti-establishment 5-Star Movement (M5S) seems to be risking a major split as founder Beppe Grillo apparently seeks to block the appointment of former Prime Minister Giuseppe Conte as party leader. Politico reported earlier today a blog post by Grillo - the comedian who has few powers within the party but is seen as one of the movement's founding fathers - stating that Conte "has neither political vision nor managerial skills. He has no experience of organizations and no capacity for innovation."

MONEY MARKET REFORMS: The Financial Stability Board Wednesday released a consultation offering a menu of money market fund reform proposals for G20 member countries that is intended to help inform their considerations, but stopped short of recommending a single set of policy changes that all jurisdictions must adopt. "The consultation report that we're publishing today sets out policy proposals to enhance money market fund resilience, including with respect to the appropriate structure of the sector, and underlying short term funding markets," FSB Chair and Fed official Randal Quarles told reporters.

ECB / DIGITAL EURO (BBG): The ECB will decide whether or not to start the process that could lead to the digital euro in mid-July, Executive Board member Fabio Panetta says on Italy's Class-CNBC television. If the ECB decides to undertake this process it will take at least 5 years

DATA:

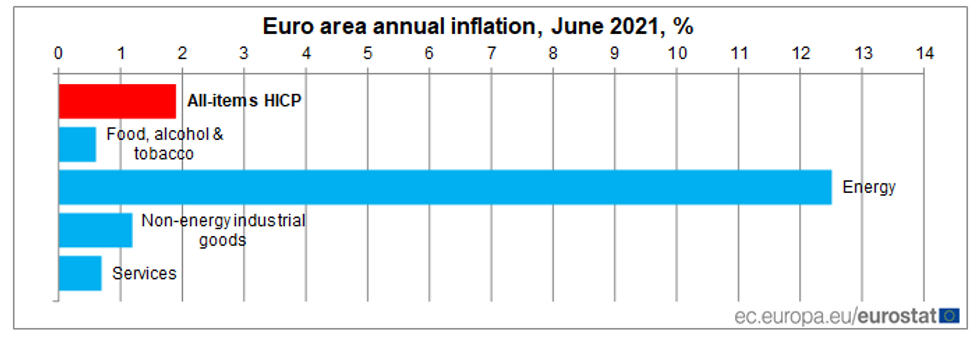

EZ Flash Inflation Ticked Down in Jun

EZ JUN FLASH HICP +0.3% M/M; +1.9% Y/Y; MAY +2.0% Y/Y

EZ JUN FLASH CORE HICP +0.3% M/M; +0.9% Y/Y; MAY +1.0% Y/Y

EZ inflation eased to 1.9% in Jun, confirming market expectations (BBG: +1.9%).

Similarly, core inflation edged down to 0.9% in Jun, following May's uptick to 1.0%.

Jun's downtick was led by a deceleration of energy inflation to 12.5%, down from 13.1%, and of service inflation which slowed to 0.7% after rising to 1.1% in May.

On the other hand, prices for non-energy industrial goods increased to a five-month high of 1.2%, while food inflation accelerated to 0.6%.

Among the member states, Estonia (3.7%), Lithuania (3.5%) and Luxembourg (3.4%) recorded the largest rates, while Portugal (-0.6%) was the only country to post a decline of consumer prices.

Source: Eurostat

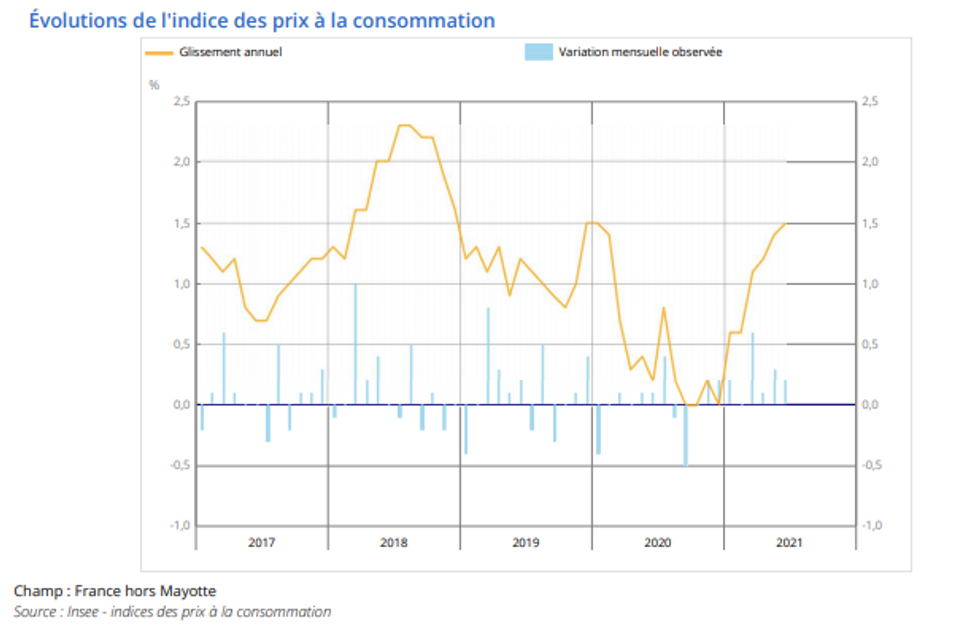

French Flash Inflation At 1.9%

JUN FLASH HICP +0.2% M/M, +1.9% Y/Y; MAY +1.8% Y/Y

JUN FLASH CPI +0.2% M/M, +1.5% Y/Y; MAY +1.4% Y/Y

- Annual inflation rose to 1.9% in Jun, up from 1.8% seen in May, hitting the highest level since Dec 2018 where the index also stood at 1.9%.

- The headline HICP was in line with market forecasts (median 1.9%)

- While energy and service inflation decelerated to 10.9% and 0.9%, respectively, prices for manufactured products rebound to 0.9% in June, up from -0.1% seen in May.

- Tobacco prices remained at May's level of 5.3% in Jun, the lowest level since Feb 2018.

- Food inflation fell 0.3% in Jun, the third decline in a row and driven by a decrease of fresh food prices, down 3.4%.

Source: Insee

Italian Inflation Edged Higher in Jun

- Prel Jun HICP +0.2% m/m, +1.3% y/y (May +1.2% y/y), slightly below expectations (BBG: +1.4%)

- Main domestic index (NIC) Jun +0.1% m/m, +1.3% y/y (May +1.3% y/y)

- Jun Prelim y/y HIC and HICP tick up for 6th consecutive month-Istat says

- Jun core HICP inflation +0.3% y/y vs May +0.1% y/y.

- Net-of-energy Jun HICP index +0.1% y/y vs May 0.0% y/y

- Flash Jun HICP data provides +1.6% "acquired" inflation.

MNI BRIEF: UK Q1 GDP Revised Lower As Services, Industry Hit

The UK economy shrunk by more than initially reported over the opening months of the year, contracting by 1.6%, compared to the 1.5% decline initially released May, the Office for National Statistics said Wednesday. All of the output components fell by more than initial estimates. Services declined by 2.1% (vs 2.0% previously), shaving 1.65 percentage points from GDP.

Manufacturing declined by 1.0% (vs -0.7% previously) while construction rose by 2.3% (vs 2.6% previously). The decline, which takes output 8.8% below pre-pandemic levels, sets the UK further behind other developed economies. The U.S. expanded by 1.6% in Q1 (-0.9% below pre-pandemic levels), while the EU contracted by 0.3% over the opening months of the year, taking output 5.1% below Q4 2019. However, there were upward revisions to the UK expenditure categories.

MNI DATA BRIEF: UK Q1 Consumer Spending Below 1st Estimate

UK consumer spending declined by 4.6% in the first quarter, much worse than the initially-reported 3.9% decline, with most of the revision stemming from more complete data from restaurants and hotels, according to the Office for National Statistics. Consumption exerted the biggest drag on Q1 output, shaving 2.46 percentage points from GDP.

The savings rate jumped to 19.9% from 16.1% in Q4, the second-highest on record (after 25.9% in Q2). Government spending rose by 1.5%, down from the originally-reported 2.6%, due to updated data on public administration and downward revisions to education. However, business investment fell by 10.7%, shallower than the originally-reported 11.9% decline. Net trade added 2.31 percentage points to GDP, as exports fell by less than reported back in May. There were no revisions to aggregate GDP data over previous quarters.

UK household spending

Source: Bloomberg

FIXED INCOME: Above yesterday's highs

It's the last day of the quarter and core fixed income markets have begun the day in a positive mood, with Treasuries, Bunds and gilts all above yesterday's highs. Some of this has been put down to being on stories of potential Russian attempts to hack German critical infrastructure and the banking system. Others have dismissed this and pointed instead to month-end rebalancing flows.

- Eurozone inflation data has been the highlight of the morning, coming in in line with expectations. Core Y/Y fell from 1.0% to 0.9% and headline from 2.0% to 1.9%.

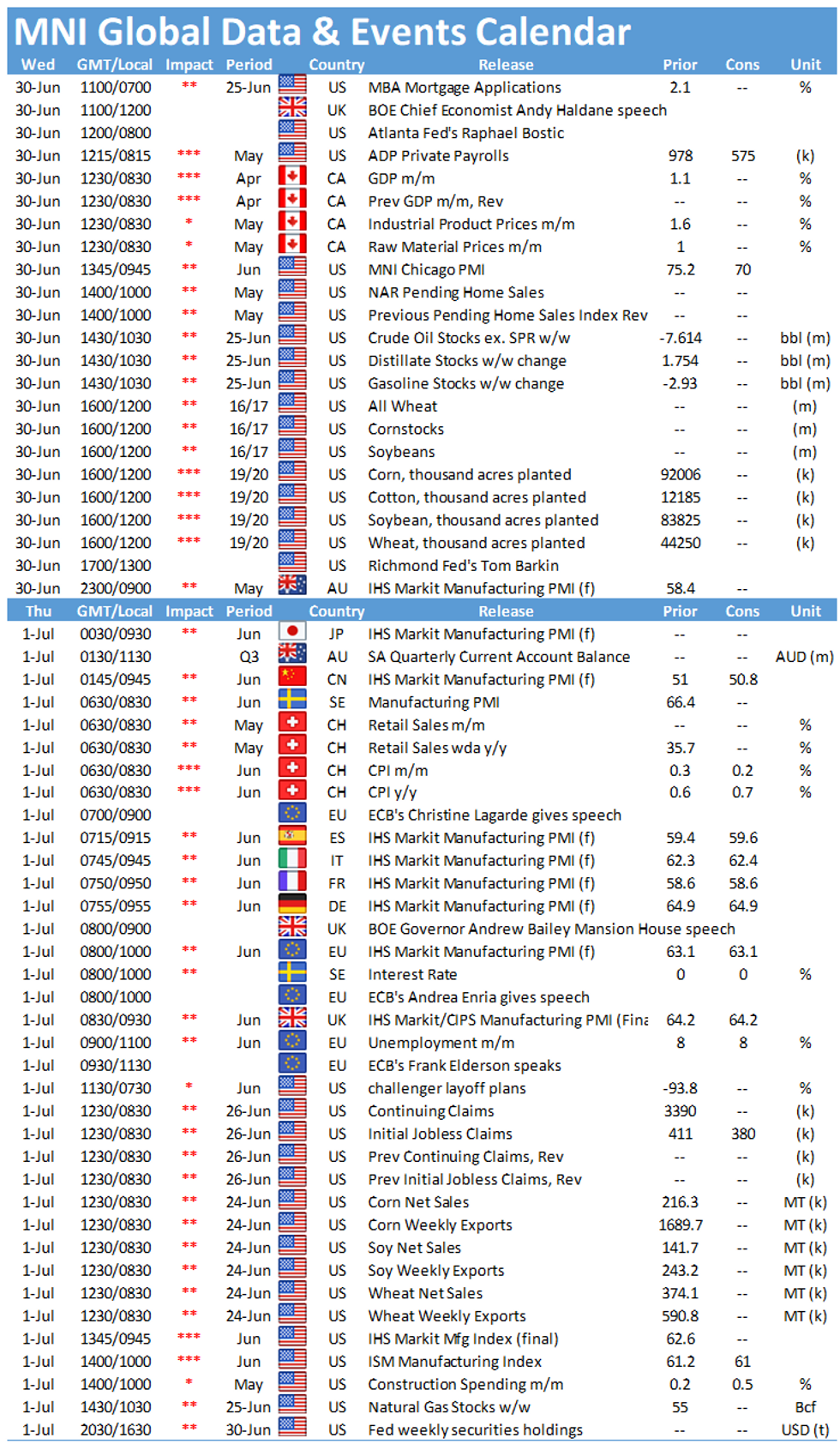

- Looking ahead to later today, US ADP payrolls and the MNI Chicago Business Barometer will both be released. These will set the tone for tomorrow's ISM print and Friday's employment report.

- TY1 futures are up 0-3 today at 132-11+ with 10y UST yields down -0.8bp at 1.463% and 2y yields down -0.3bp at 0.248%.

- Bund futures are up 0.26 today at 172.33 with 10y Bund yields down -1.8bp at -0.189% and Schatz yields down -0.5bp at -0.662%.

- Gilt futures are up 0.12 today at 128.08 with 10y yields down -1.5bp at 0.722% and 2y yields down -0.8bp at 0.049%.

FOREX: USD Index Firmer Despite Softer Yield Curve

- The USD index is on the front foot, building on the late progress made on Tuesday, although the week's best levels are out of reach for now at 92.194. The more solid greenback comes despite an ebb lower in US 10y yields this morning, which have slipped to new weekly lows of 1.460% as equity markets edge further off session highs.

- Haven currencies are trading well, with JPY among the best performers of the day as European and US equity markets slipped on headlines that Russia had conducted a cyber attack on the German banking system, according to reports in Bild.

- Antipodean currencies are faring poorly, with AUD and NZD among the largest decliners ahead of the NY crossover. AUD/USD eyes the mid-June lows of 0.7476. A break below here would mark the lowest rate since December.

- MNI Chicago PMI data is the calendar highlight Wednesday, with activity expected to slow to 70.0 from 75.2 previously. ADP employment change also crosses, which markets will be watching for any clues ahead of Friday's NFP release.

- Outgoing MPC member Andy Haldane speaks on monetary policy at 1200BST, with Fed's Bostic and Barkin also due.

EQUITIES: Futures Tilting Weaker Into Month-/Qtr-End

- Asian stocks closed mixed, with Japan's NIKKEI down 21.08 pts or -0.07% at 28791.53 and the TOPIX down 5.91 pts or -0.3% at 1943.57. China's SHANGHAI closed up 18.019 pts or +0.5% at 3591.197 and the HANG SENG ended 166.15 pts lower or -0.57% at 28827.95.

- European equities are lower, with the German Dax down 223.49 pts or -1.42% at 15669.37, FTSE 100 down 56.88 pts or -0.8% at 7078.84, CAC 40 down 70.17 pts or -1.07% at 6555.92 and Euro Stoxx 50 down 58.51 pts or -1.42% at 4101.5.

- U.S. futures are weakening, with the Dow Jones mini down 146 pts or -0.43% at 34024, S&P 500 mini down 11.5 pts or -0.27% at 4270.5, NASDAQ mini down 22 pts or -0.15% at 14541.25.

COMMODITIES: Metals Slip Amid Broader Risk Aversion

- WTI Crude up $0.12 or +0.16% at $73.37

- Natural Gas up $0.07 or +1.98% at $3.71

- Gold spot down $4.88 or -0.28% at $1758.42

- Copper up $0.65 or +0.15% at $428.35

- Silver down $0.03 or -0.11% at $25.8035

- Platinum down $17.19 or -1.6% at $1065.46

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.