-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Supply Chain Woes Dent German Confidence

EXECUTIVE SUMMARY:

- GERMAN BUSINESS CONFIDENCE TUMBLES TO SIX-MONTH LOW ON SUPPLIES

- TURKISH LIRA DROPS TO RECORD LOW AFTER ERDOGAN'S THREAT AGAINST ENVOYS

- N.A.B.E. SURVEY SHOWS U.S. LABOR SHORTAGES TO PERSIST INTO 2022

- JAPAN NIPPON LIFE TO BOOST YEN BOND HOLDINGS IN FY2021 2H

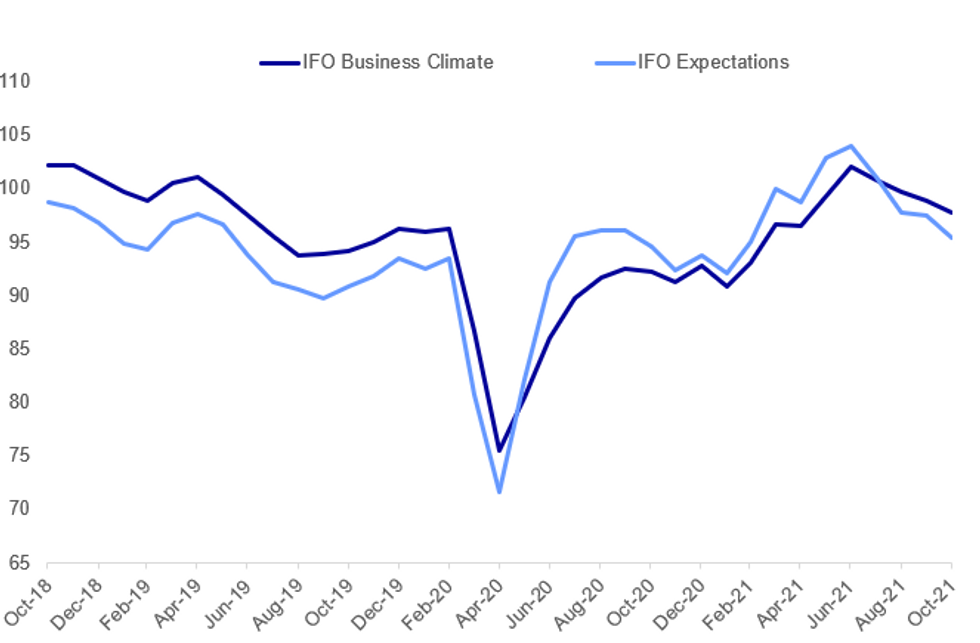

Fig. 1: German IFO Business Confidence

Source: IFO, BBG

Source: IFO, BBG

NEWS:

GERMAN IFO (BBG): German business confidence took another hit in October as global supply logjams damp momentum in the manufacturing-heavy economy. A gauge compiled by the Munich-based Ifo Institute dropped for a fourth time in a row and more than economists predicted. At 97.7, it's now at the lowest level in six months, with expectations also on the decline. The figures point to the mounting challenges facing German businesses, who are particularly exposed to supply disruptions given the nation's reliance on industry. Recent company surveys suggest the weakness is also spilling into services as consumers turn wary of quickly rising prices.

US LABOR MARKET (BBG): U.S. labor shortages will persist into 2022 and contribute to a permanent increase in business costs, according to a survey by the National Association for Business Economics.Some 36% of respondents currently experiencing worker shortages said they expect them to end at some point next year. None see that happening before 2021 draws to a close and 14% see shortages abating in 2023 or later, the Oct. 6-14 survey of NABE members working at private-sector firms or industry trade associations showed.

TURKEY (BBG): Turkey's lira fell to a record as the country's latest diplomatic spat with the U.S. and other foreign governments gave traders another reason to sell the struggling currency. The lira retreated as much as 2.5% in early Asian trading amid thin liquidity on Monday, touching a new low for a third day. It was 1.5% weaker at 9.7509 per dollar at 10:48 am. in Istanbul. Already under pressure following a larger-than-expected rate cut last week, the currency encountered fresh selling after President Recep Tayyip Erdogansaid on Saturday that the ambassadors of 10 nations were no longer welcome after they demanded the release of a prominent government critic. Investors are watching for the Turkish Foreign Ministry to make the move official.

JAPAN / NIPPON LIFE: Japan's Nippon Life Insurance Company plans to increase domestic bond holdings, such as hedged foreign corporate bonds and yen corporate bonds and Japanese government bonds, for the second half of this fiscal year to March 31, 2022, the company's chief fund manager said on Monday. Nippon Life, the largest life insurer in terms of assets in Japan, increased its domestic bond holdings, mainly hedged foreign corporate bonds, by JPY1.41 trillion for the April-September period, Shinichi Okamoto, executive officer of finance and investment planning department, told reporters.

CHINA / COVID (BBG) - PUBLISHED OVERNIGHT: China locked down a county that has seen the most Covid-19 cases in the nation's latest delta outbreak, as an initial flareup in the northwest quickly spirals into a nationwide surge.Ejin, a county in China's Inner Mongolia region, asked its 35,700 residents to stay home from Monday and warned of civil and criminal liabilities should anyone disobey the order, state broadcaster CCTV reported, citing a local government statement. The small county bordering Mongolia is the current outbreak's hotspot, home to nearly one-third of the more than 150 infections found over the past week in the mainland.

TECH STOCKS (BBG): PayPal Holdings Inc. said it isn't pursuing an acquisition of Pinterest Inc., ending days of speculation over a potential $45 billion deal.San Jose, California-based PayPal had approached Pinterest about a potential deal, Bloomberg News reported last week. The companies discussed a potential price of around $70 a share, people with knowledge of the matter said, a price that would have valued Pinterest at about $45 billion.

DATA:

GERMANY OCT IFO BUSINESS CLIMATE +97.7

MNI: GERMANY OCT IFO CURRENT CONDITIONS 100.1; SEP 100.4* GERMANY OCT IFO EXPECTATIONS 95.4; SEP 97.3

FIXED INCOME: Fade off their lows

- A more subdued start, as we begin a new week. Early price action, on the Bund cash open, was to fade, some of the Friday sell off.

- After the initial small bid in Bund, early price action was to the downside, but mostly US driven.

- Bund now trades at mid range 168.27.

- Peripheral spreads are all tighter against the German 10yr. Italy is in the lead by 1.6bps, but we watch Portugal versus Bund this morning, with the spread making another attempt at sub 50bps, and nearing tightest levels since 2009.

- Gilts are faring a little better and trade in green territory, pushing the Gilt/Bund spread a touch wider, but just by 0.4bp.

- Treasuries were the early leader, initially testing lower, dragging EGBs.

- But we have since faded off the lows and trade closer to mid range, as we await for the US to come in.

- We have no real market moving data to start the week.

- Notable speaker left for the session, is BoE Tenreyro.

- While Earning season continues for Europe and the US, including Amazon, Apple, Alphabet, Facebook , Microsoft, Spotify, Twitter, to name a few. for this week.

FOREX: EUR/CHF Recovers Off 2021 Lows

- The AUD trades favourably, prompting a recovery in AUD/USD back above $0.75 and toward Friday's highs of $0.7512. Decent gains are also noted against the JPY, with the AUD/JPY cross recovering off Friday's 84.61, eyeing initial resistance at 85.546 ahead of last week's high of 86.26.

- Haven currencies including CHF and JPY trade poorly, with CHF slipping against most others. This has prompted EUR/CHF to recover off YTD lows printed Friday at 1.0659 - which may raise some speculation over the SNB's willingness to intervene at current levels or lower.

- The USD Index is holding the middle ground, sitting in very minor negative territory and comfortably above the 50-dma support of 93.3088.

- The data slate is light Monday, with just the Chicago Fed National Activity Index for September on the docket. The Fed have entered their pre-decision media blackout, so no speeches due outside of an appearance from BoE's Tenreyro at 1400BST/0900ET. She speaks on supply chains and monetary policy.

EQUITIES: S&P Eminis Off Overnight Lows, Nearing Record High

- Asian equities closed mixed, with Japan's NIKKEI down 204.44 pts or -0.71% at 28600.41 and the TOPIX down 6.81 pts or -0.34% at 1995.42. China's SHANGHAI closed up 27.259 pts or +0.76% at 3609.863 and the HANG SENG ended 5.1 pts higher or +0.02% at 26132.03.

- European stocks are mostly higher, with the German Dax up 22.84 pts or +0.15% at 15564.16, FTSE 100 up 36.26 pts or +0.5% at 7220.26, CAC 40 down 6.45 pts or -0.1% at 6759.97 and Euro Stoxx 50 up 1.39 pts or +0.03% at 4197.15.

- U.S. futures are slightly positive, with the Dow Jones mini up 12 pts or +0.03% at 35569, S&P 500 mini up 5.25 pts or +0.12% at 4541.75, NASDAQ mini up 31.5 pts or +0.21% at 15372.5.

COMMODITIES: NatGas Resumes Its Climb

- WTI Crude up $0.9 or +1.07% at $82.95

- Natural Gas up $0.27 or +5.19% at $5.198

- Gold spot up $10.83 or +0.6% at $1791.83

- Copper up $4.2 or +0.93% at $447.8

- Silver up $0.17 or +0.69% at $24.319

- Platinum up $2.51 or +0.24% at $1046.66

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.