-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: FI Ending The Week On A Soft Note Amid Heightened Inflation Concerns

MNI US Open: FI Ending The Week On A Soft Note Amid Heightened Inflation Concerns

EXECUTIVE SUMMARY

- Sovereign FI broadly weaker following a weak of heightened inflation concern

- Biden and Jinping scheduled to address leaders of the Pacific Rim

- Western leaders issue stark condemnation of Belarus over migrant crisis

NEWS

US-CHINA (REUTERS): U.S. President Joe Biden and Chinese leader Xi Jinping are expected to address leaders of the Pacific Rim late on Friday amid heightened regional trade and geopolitical tensions. China set the tone for the 21 member Asia Pacific Economic Cooperation (APEC) meeting this week, with Xi warning in a video recording on Thursday that the region must not return to the tensions of the Cold War era. The comment was seen as a reference to efforts by the United States and its regional allies to blunt what they see as China's growing coercive economic and military influence. Biden is expected to address the gathering that begins midnight New Zealand time, the White House confirmed in a statement, adding he will discuss ongoing efforts to address the COVID-19 pandemic and support global economic recovery.

UK (GUARDIAN): Ireland's minister for European Affairs has said that a "tough guy approach" when it comes to Northern Ireland will lead to disaster, adding that threats to suspend the Northern Ireland protocol represented the first time the UK government has been out of step with the international consensus on preserving peace and stability in Northern Ireland in 25 years. Speaking to BBC Radio 4, Thomas Byrne said there was "a serious danger of complete instability in Northern Ireland" if the UK government continues its "tough guy approach" through threats to trigger article 16, which would suspend post-Brexit trade arrangements.

EU-BELARUS (REUTERS): Russia traded barbs with Western members of the U.N. Security Council on Thursday over a crisis on the border between Belarus and Poland, with Russia's deputy U.N. envoy suggesting his European colleagues have "masochist inclinations." Estonia, France, Ireland, Norway, the United States and Britain raised the migrant crisis during a closed-door meeting of the 15-member body. "We condemn the orchestrated instrumentalisation of human beings whose lives and wellbeing have been put in danger for political purposes by Belarus, with the objective of destabilizing neighboring countries and the European Union's external border and diverting attention away from its own increasing human rights violations," they said in a statement.

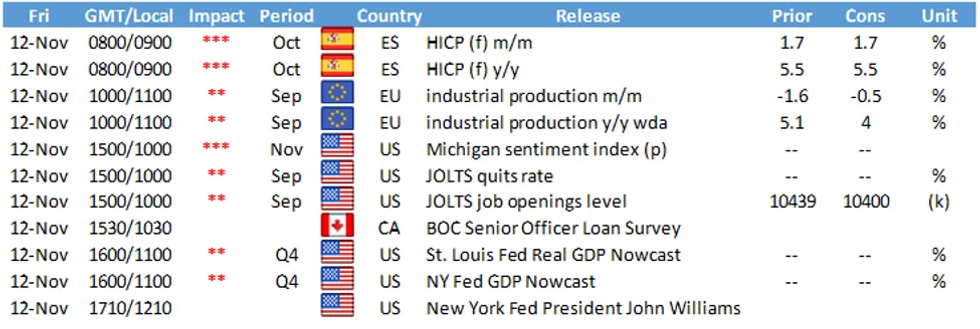

DATA:

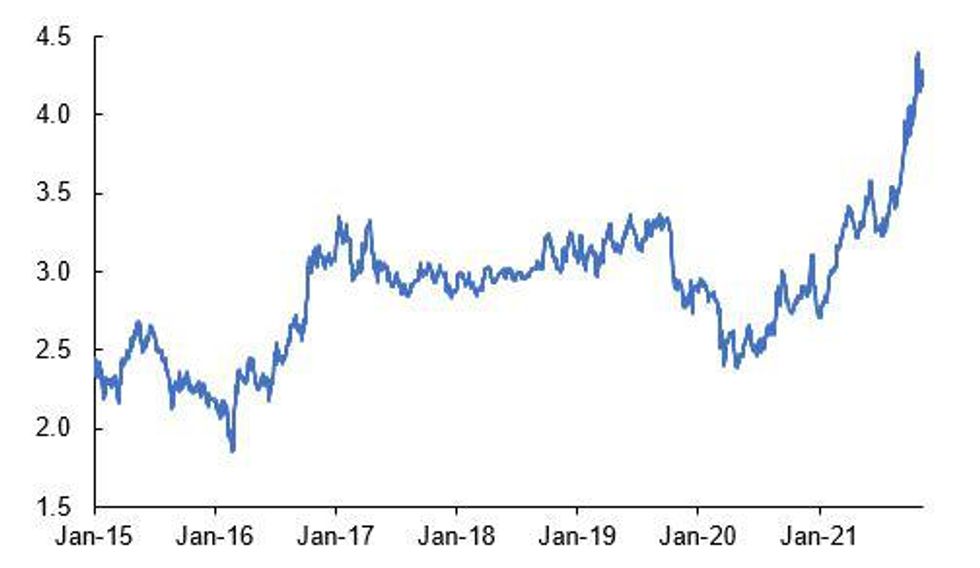

FIXED INCOME: Inflation focus moving European markets today

- As has been the case on most morning's this week, core fixed income continues to trade within yesterday's ranges.

- The most interesting moves this morning have been for peripheral spreads which have widened notably. Italian and Greek 10-year spreads are over 3bp wider on the day to Bunds while the Euribor strip has underperformed both the short sterling and Eurodollar strips as inflation concerns are hitting European markets more today (after having seen larger moves in short sterling and Eurodollar futures earlier this week, these moves can largely be seen as a catch up).

- Looking ahead the only notable speakers are ECB's Lane, BOE's Haskel and Fed's Williams.

- In the US we will receive Michigan confidence and JOLTS data.

- TY1 futures are up 0-1+ today at 130-12 with 10y UST yields up 2.6bp at 1.578% and 2y yields up 2.7bp at 0.543%.

- Bund futures are up 0.07 today at 170.49 with 10y Bund yields down -0.1bp at -0.234% and Schatz yields down -0.2bp at -0.780%.

- Gilt futures are down -0.14 today at 126.19 with 10y yields up 0.9bp at 0.928% and 2y yields down -1.5bp at 0.538%.

FOREX: GBP Leads Bounce to Drag DXY Off Cycle High

- The greenback traded solidly across Asian hours, helping the USD Index print a fresh YTD high for a third consecutive session. Markets have moderated since, with the bounce led by the beleaguered GBP, which has snapped a four session losing streak ahead of Friday's NY crossover.

- SEK is the poorest performing currency so far, helping EUR/SEK climb toward the highest levels of the week, prompting a test of the 76.4% retracement level at 8.7516.

- USD/CHF has quietly printed a new weekly this morning at 0.9231, with CHF continuing to trade poorly against most others. A recovery and close above 0.9229 opens gains toward 0.9262, the 61.8% retracement of the October-November downtick.

- Prelim UMich sentiment numbers take focus Friday, with markets expecting an improvement in the expectations component, but weakness in current conditions. ECB's Lane, BoE's Haskel and Fed's Williams are all due to speak.

COMMODITIES: Under pressure this morning, led by oil

- WTI Crude down $1.40 or -1.72% at $80.15

- Natural Gas down $0.06 or -1.22% at $5.089

- Gold spot down $8.42 or -0.45% at $1853.36

- Copper down $1.55 or -0.35% at $437.8

- Silver down $0.27 or -1.08% at $24.9827

- Platinum down $15.64 or -1.44% at $1072.89

EQUITIES: Asian stocks higher, but European indices more mixed

- Japan's NIKKEI up 332.11 pts or +1.13% at 29609.97 and the TOPIX up 26.3 pts or +1.31% at 2040.6

- China's SHANGHAI closed up 6.314 pts or +0.18% at 3539.1 and the HANG SENG ended 79.98 pts higher or +0.32% at 25327.97

- German Dax up 10 pts or +0.06% at 16094.34, FTSE 100 down 31.24 pts or -0.42% at 7352.42, CAC 40 up 8.18 pts or +0.12% at 7067.79 and Euro Stoxx 50 down 0.66 pts or -0.02% at 4357.56.

- Dow Jones mini up 35 pts or +0.1% at 35863, S&P 500 mini up 4.25 pts or +0.09% at 4646.75, NASDAQ mini up 25.25 pts or +0.16% at 16048.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.