-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Fiscal Failure And Covid Concerns

EXECUTIVE SUMMARY

- GLOBAL EQUITIES / OIL DROP AMID U.S. BBB PLAN COLLAPSE AND OMICRON CONCERNS

- GERMANY PROPOSES JOACHIM NAGEL AS HEAD OF BUNDESBANK

- MODERNA BOOSTER INCREASES ANTIBODIES 37-FOLD AGAINST OMICRON

- ECB POLICYMAKERS SOUGHT GREATER ACKNOWLEDGEMENT OF UPSIDE INFLATION RISKS (RTRS SOURCES)

- CHINA GDP NEEDS A FISCAL-MONETARY BOOST: ADVISOR (MNI INTERVIEW)

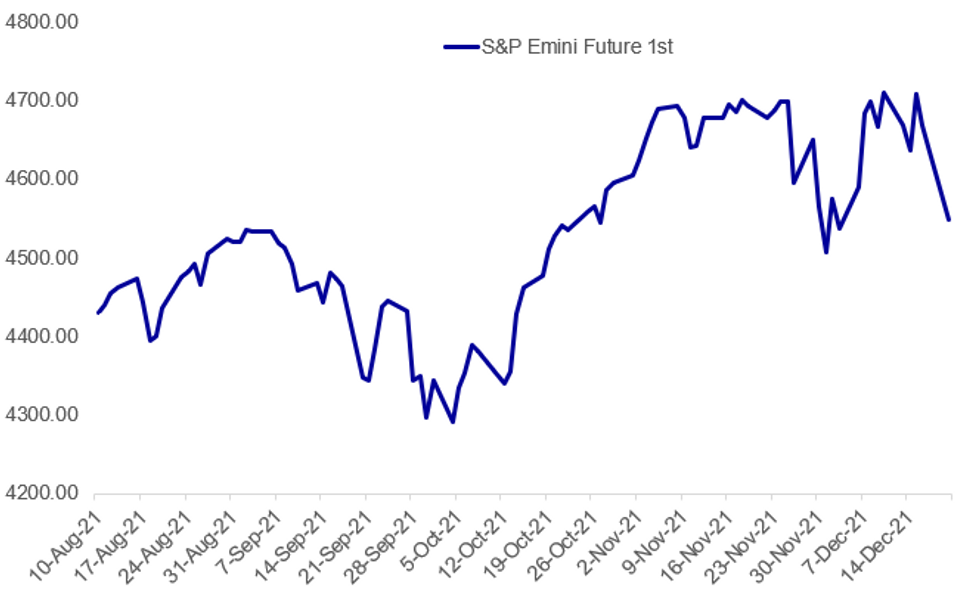

Fig. 1: S&P Futs Back Below 50-Day EMA At 4590.64

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB / BUNDESBANK (RTRS): German Chancellor Olaf Scholz and Finance Minister Christian Lindner are proposing Joachim Nagel to be new president of the country's central bank, Lindner said on Twitter on Monday. "In view of inflation risks, the importance of a stability-oriented monetary policy is growing. Nagel is an experienced figure who ensures the continuity of the Bundesbank," Lindner said in a tweet.

MODERNA BOOSTER / COVID (BBG): Moderna Inc. said a third dose of its Covid-19 vaccine increased antibody levels against the omicron variant, results the company said are reassuring even as it works on a version of its shot tailored to the new strain. A 50 microgram booster dose - the authorized amount - saw a 37-fold increase in neutralizing antibodies, the company said in a statement Monday. The company also tested a 100 microgram dose, which increased antibody levels 83-fold compared with the primary two-dose course.The results are a good sign for the shot as companies race to understand how well their vaccines hold-up against the new variant and assess whether new shots will be required to contain it. Pfizer Inc. and BioNTech SE said earlier this month initial lab studies showed a third dose of their Covid-19 vaccine may be needed to fight the omicron variant after a 25-fold reduction in neutralizing antibodies against the variant was observed in people who got just two shots.

ECB (RTRS): European Central Bank policymakers meeting last week sought a greater acknowledgement of inflation risks but were rebuffed by the bank's chief economist Philip Lane in an unusually robust debate, sources close to the debate told Reuters. In what was described as a robust and tense meeting, a significant number of policymakers questioned the quality of the ECB's projections, pointing to their checkered track record, and argued that inflation was at risk of ending next year higher than the ECB's expectation.

CHINA (MNI INTERVIEW): China needs to expand fiscal and monetary policy options into next year to stimulate credit demand in a bid to boost GDP growth above 5%, a former senior advisor to the People's Bank of China told MNI. For full article contact sales@marketnews.com

U.S. FISCAL (BBG - FROM OVERNIGHT): President Joe Biden faces the unexpected task of quickly rewriting his policy agenda in a crucial election year after a key Senate Democrat abruptly rejected his signature $1.75 trillion economic plan. Senator Joe Manchin stunned the White House and fellow Democrats Sunday by announcing his opposition to a tax-and-spending package tailored to win his support after months of courtship by Biden and other administration officials. The move effectively torpedoes Biden’s campaign promises to address climate change, health-care costs and child-care needs.Losing support from Manchin, a moderate from West Virginia, is essentially fatal in a 50-50 Senate where Republicans uniformly oppose the plan, known as Build Back Better. Biden and top congressional Democrats must now regroup at once on those priorities, with little more than 10 months before midterm races that will decide control of Congress.

US BANKS / BMO / BNP (BBG): Bank of Montreal agreed to buy BNP Paribas SA’s Bank of the West unit for $16.3 billion, extending its presence in key U.S. growth markets and giving the French lender a windfall before its new strategic plan.BMO will fund the transaction, which should add 1.8 million customers upon closing next year, in cash and mainly with excess capital, according to a statement on Monday. Bloomberg had previously reported the Canadian bank’s interest.

DATA:

No key data in the European morning.

FIXED INCOME: BBB and potential further UK/European Covid restrictions lead FI higher

Risk-off due to the failure of Biden's BBB plan and continued elevated concerns of further government-imposed Covid-19 restrictions across the UK and Europe (and the announcement of the Dutch lockdown) have all pulled core fixed income higher.

- The UST curve has steepened, with larger moves having been seen at the short-end. Eurodollar Reds/Greens are up 4.5-5.0 ticks on the day as some future Fed hikes are pushed further out in expectation of a lower level of government spending.

- A similar steepening has been seen in the gilt curve, but more due to rate hike expectations being pushed back due to concerns about a post-Christmas lockdown, with a number of newspapers talking up the options ministers are said to be discussing this morning.

- The German curve has bull flattened a little, in contrast. 10-year Bunds have moved in line with 10-year gilts but with little expected in terms of near-term hikes, Schatz yields have moved less. Peripheral spreads, particularly BTP-Bund spreads, have widened a little.

- TY1 futures are up 0-8 today at 131-13+ with 10y UST yields down -2.3bp at 1.381% and 2y yields down -3.5bp at 0.605%.

- Bund futures are up 0.16 today at 174.59 with 10y Bund yields down -0.5bp at -0.386% and Schatz yields down -1.2bp at -0.738%.

- Gilt futures are up 0.34 today at 127.22 with 10y yields down -2.2bp at 0.734% and 2y yields down -0.7bp at 0.491%.

FOREX: Risk Proxies Slide as Manchin Tanks BBB

- Vague risk-off pervades currency markets early Monday, with the greenback making gains against losses for growth proxies and commodity-tied FX. Stock futures trade higher on both sides of the pond, with the e-mini S&P dropping over 60 points and European indices joining the slide.

- Senator Manchin's one-handed tanking of Biden's Build Back Better bill has prompted a number of sell-side outfits to lower GDP forecasts for the coming year, adding to the near-term pressures as cases from the omicron variant continue to swell across developed markets.

- GBP/USD has revisited sub-1.32 levels, narrowing the gap with key support at 1.3163. A break below here opens losses toward 1.3135 and levels not seen since late 2020.

- The single currency fares better, with EUR higher against all others in G10. EUR/USD is recouping a very minor portion of the losses suffered late last week, with EUR/USD now either side of the 1.1250 level. Nonetheless, the near-term outlook remains weak below 1.1349.

- The data calendar is understandably light headed into the holiday season, with no central bank speakers of note either.

EQUITIES: Stocks Slide With Energy Leading Downside

- Asian markets closed weaker: Japan's NIKKEI closed down 607.87 pts or -2.13% at 27937.81 and the TOPIX ended 43.14 pts lower or -2.17% at 1941.33. China's SHANGHAI closed down 38.762 pts or -1.07% at 3593.602 and the HANG SENG ended 447.77 pts lower or -1.93% at 22744.86.

- European equities are sharply lower, with the German Dax down 328.53 pts or -2.12% at 15206.59, FTSE 100 down 111.01 pts or -1.53% at 7146.52, CAC 40 down 109.26 pts or -1.58% at 6796.55 and Euro Stoxx 50 down 69 pts or -1.66% at 4092.74.

- U.S. futures continue to slide, with the Dow Jones mini down 448 pts or -1.27% at 34804, S&P 500 mini down 63 pts or -1.37% at 4547, NASDAQ mini down 241.5 pts or -1.53% at 15546.5.

COMMODITIES: Oil Tanks As Omicron Concerns Weigh

- WTI Crude down $2.79 or -3.94% at $67.94

- Natural Gas up $0.07 or +2.01% at $3.751

- Gold spot up $0.55 or +0.03% at $1799.02

- Copper down $2.85 or -0.66% at $426.3

- Silver down $0.01 or -0.03% at $22.369

- Platinum down $7.69 or -0.82% at $927.98

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/12/2021 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 20/12/2021 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/12/2021 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/12/2021 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 21/12/2021 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/12/2021 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 21/12/2021 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/12/2021 | 1330/0830 | * |  | US | current account balance |

| 21/12/2021 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/12/2021 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/12/2021 | 1500/1600 | ** |  | EU | consumer confidence indicator (p) |

| 21/12/2021 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 21/12/2021 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.