-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Europe's Energy Crunch Continues

EXECUTIVE SUMMARY:

- U.S. TO DISTRIBUTE 500M FREE COVID TESTS AS OMICRON SPREADS

- ECB'S KAZIMIR SEES RISK EUROZONE INFLATION SAYS HIGH FOR LONGER

- ENERGY CRUNCH SEES EUROPE ELECTRICITY AND GAS PRICES SOAR TO NEW RECORDS

- BOC MUST COOL INFLATION BEFORE BOOSTING JOBS: EX-ADVISERS (MNI EXCLUSIVE)

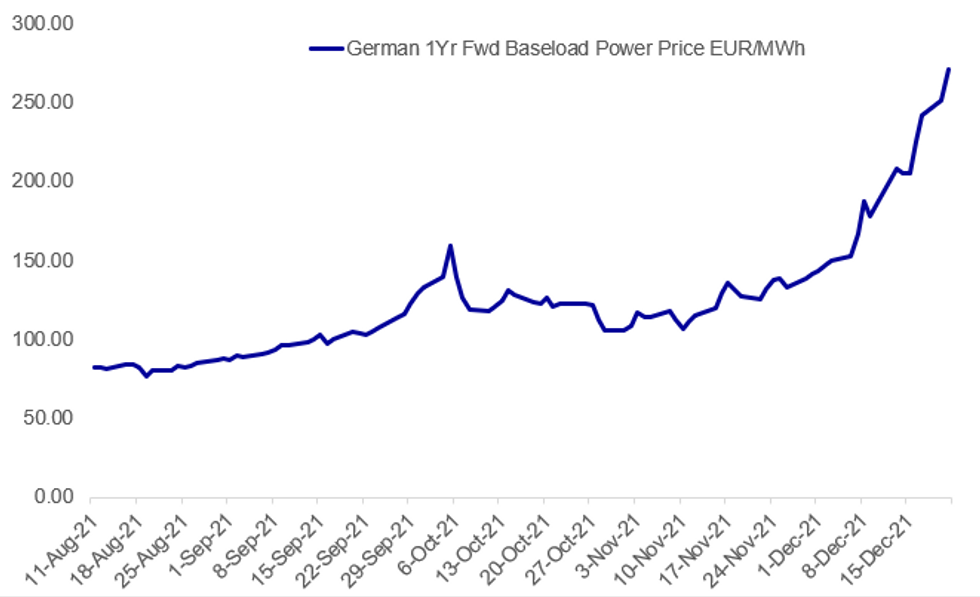

Fig. 1: Another Set Of Record High European Energy And Power Prices

Source: BBG, MNI

Source: BBG, MNI

NEWS:

U.S. / COVID (BBG): President Joe Biden will send 500 million free coronavirus tests to Americans’ homes beginning next month and dispatch the military to shore up overwhelmed hospitals as the U.S. confronts a resurgent pandemic. Biden will announce new measures to try to curb the virus on Tuesday, the day after the CDC said the omicron variant first identified in southern Africa now accounts for most new U.S. cases. He aims to boost testing, hospital care and vaccinations without any new lockdowns or closings. He’ll also deliver a stark warning to the unvaccinated, a senior administration official said, telling them that they risk serious disease or death while assuring Americans who’ve gotten their shots that they can safely gather with their families over the holidays.

ECB (RTRS): Euro zone inflation could stay elevated for even longer than the European Central Bank now expects, ECB policymaker Peter Kazimir said on Tuesday, just days after the bank extended stimulus measures on hopes of a drop in inflation. "What is true about Slovakia, is also true for the euro zone as a whole: there is a risk, and this risk is not small, that elevated inflation will stay with us for longer," Kazimir, Slovakia's central bank chief, told a news conference.

EUROPE ENERGY (BBG): European electricity prices jumped to a record as a shortage of natural gas strained power grids already coping with nuclear outages and freezing temperatures. German power for delivery next year surged as much as 6.4% to 269 euros a megawatt-hour. Nuclear outages in France are forcing Europe to rely more on gas just as shipments from Russia via a key pipeline reversed direction, with gas flowing eastward towards Poland instead.

EUROPE ENERGY (BBG): European gas prices jumped to a record high after Russian flows via a key route reversed direction. Futures surged as much as 11% as Russian gas was flowing eastward from Germany to Poland, according to network operator Gascade. The change in flows probably reflects lower orders from German buyers due to the holiday season, said Katja Yafimava, a senior research fellow at the Oxford Institute for Energy Studies. Lower supplies into Germany will force Europe to keep withdrawing gas at high rates from its already depleted storages. As freezing temperatures spread across the continent this week, more gas will be needed to keep the lights on as Europe’s vast network of renewable sources also can’t fill the gap, with German wind output at the lowest in five weeks.

BANK OF CANADA (MNI EXCLUSIVE): The Bank of Canada faces a protracted fight to slow inflation to the 2% midpoint of its target range before policymakers will be able to turn their attention to a new duty to seek full employment when their primary mandate to control prices permits them to do so, former advisers told MNI. For full article contact sales@marketnews.com

U.S. EQUITIES (BBG): Shares in chip stocks rally in U.S. premarket trading after Micron, the biggest U.S. maker of memory chips, gives an upbeat forecast for the current quarter, with company predicting record revenue for fiscal 2022.Micron +6.7% premarket; Nvidia +2.6%, AMD +1.8%, Intel +0.9%

THAILAND/COVID/TOURISM (RTRS): Thailand will reinstate its mandatory COVID-19 quarantine for foreign visitors and scrap a quarantine waiver from Tuesday due to concerns over the spread of the Omicron variant of the coronavirus. The decision to halt Thailand's "Test and Go" waiver means visitors will have to undergo hotel quarantine, which ranges between 7 to 10 days. Meanwhile, a so-called "sandbox" programme, which requires visitors to remain in a specific location but allows them free movement outside of their accommodation, will also be suspended in all places except for the tourist resort island of Phuket.

ASTRAZENECA / COVID (BBG): Protection from severe illness following two shots of AstraZeneca Plc’s Covid-19 vaccine starts declining about three months after the second dose, according to a study that reinforces the need for boosters. The researchers analyzed data for 2 million people in Scotland and 42 million people in Brazil and assessed the risk of severe Covid outcomes, including hospitalizations and deaths, three months after the second dose. They didn’t analyze Astra’s shot against the fast-spreading omicron variant, which wasn’t circulating at the time.

DATA:

MNI BRIEF: UK November Borrowing Tops Expectations

UK public sector borrowing hit GBP17.384 billion in November, exceeding expectations of GBP16.0 billion, the Office for National Statistics said Tuesday. That’s below the the outturn of GBP22.249 billion of November 2020, but well above the borrowing of GBP12.391 billion in October (revised downward from GBP18.799 billion). That takes borrowing to 96.1% of GDP, the highest ratio since March of 1963, compared to 95.5% in November of 2020. November borrowing also exceeded the OBR monthly estimate by GBP 3.2 billion.

Debt interest payments hit GBP4.5 billion, while corporate tax receipts declined by 1.0 billion over the same period a year earlier. VAT receipts rose by 1.8% over the same period a year earlier to GBP12.8 billion.

Over the year to date, borrowing hit GBP136 billion, down 46% from the same period of last year. That’s GBP47 billion below the full-year OBR forecast of GPB183 billion.

FIXED INCOME: Bunds and gilts at their lows of the day

It's been a mixed morning in core fixed income. After markets were in risk-on mode overnight, European equities came off their highs in the early European morning session. This saw Bunds and Treasuries retrace some of their losses. However, despite equities giving up more of their gains, Bund and gilt futures are at their lows of the day while TY1 is still off its lows and now largely flat on the day. As we publish, headlines that European gas prices are surging to fresh records are putting some downward pressure on Bunds.

- TY1 futures are down -0-1 today at 131-04 with 10y UST yields up 1.0bp at 1.435% and 2y yields unch at 0.634%.

- Bund futures are down -0.42 today at 174.00 with 10y Bund yields up 2.2bp at -0.349% and Schatz yields up 0.9bp at -0.734%.

- Gilt futures are down -0.35 today at 126.47 with 10y yields up 3.4bp at 0.804% and 2y yields up 3.1bp at 0.561%.

FOREX: Equity Bounce Works Against USD

- Equities have recovered off the Monday lows, but the bounce has been somewhat shallow so far, with the e-mini S&P struggling to make headway above the 4600 level. Treasury yields have followed suit, with the 10y yield back above 1.42%. The greenback has subsequently softened, boosting EUR/USD and GBP/USD back to Monday NY highs.

- NZD is the strongest performing currency so far Tuesday, prompting AUD/NZD to correct off the 200-dma at 1.0594, which marks the key upside level going forward.

- Outside of developed markets, TRY remains the volatile currency, having rallied sharply Monday on the back of Erdogan's policy announcements looking to reverse the recent course of dollarisation. Markets expect further details at 1100GMT/0600ET. USD/TRY has traded as low as 11.099 having touching record high of 18.36 yesterday.

- Canadian retail sales data marks the sole tier one release Tuesday, with markets expecting October sales to rise around 1.0% on the month. There are no notable central bank speakers, but markets may watch for comments from President Biden, who speaks on the US' COVID approach at 1430ET/1930GMT.

EQUITIES: Europe Gaining, But Off Early Highs

- Asian markets closed higher: Japan's NIKKEI closed up 579.78 pts or +2.08% at 28517.59 and the TOPIX ended 28.46 pts higher or +1.47% at 1969.79. China's SHANGHAI closed up 31.523 pts or +0.88% at 3625.125 and the HANG SENG ended 226.47 pts higher or +1% at 22971.33.

- European stocks are gaining but off morning's best levels, with the German Dax up 83.92 pts or +0.55% at 15326.18, FTSE 100 up 61.27 pts or +0.85% at 7266.6, CAC 40 up 34.16 pts or +0.5% at 6912.21 and Euro Stoxx 50 up 25.75 pts or +0.63% at 4133.69.

- U.S. futures are up, led by the Nasdaq, with the Dow Jones mini up 178 pts or +0.51% at 34991, S&P 500 mini up 25.75 pts or +0.56% at 4584.25, NASDAQ mini up 116 pts or +0.74% at 15737.25.

COMMODITIES: Precious Metals Gain As USD Slips

- WTI Crude up $0.18 or +0.26% at $68.94

- Natural Gas down $0.1 or -2.69% at $3.741

- Gold spot up $6.55 or +0.37% at $1798.02

- Copper up $4.55 or +1.06% at $434.2

- Silver up $0.38 or +1.72% at $22.659

- Platinum up $10.19 or +1.09% at $945.71

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/12/2021 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 21/12/2021 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/12/2021 | 1330/0830 | * |  | US | current account balance |

| 21/12/2021 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/12/2021 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/12/2021 | 1500/1600 | ** |  | EU | consumer confidence indicator (p) |

| 21/12/2021 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 21/12/2021 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 22/12/2021 | 0700/0700 | * |  | UK | Quarterly current account balance |

| 22/12/2021 | 0700/0700 | *** |  | UK | GDP Second Estimate |

| 22/12/2021 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 22/12/2021 | 0745/0845 | ** |  | FR | PPI |

| 22/12/2021 | 0800/0900 | ** |  | ES | PPI |

| 22/12/2021 | 0830/0930 | ** |  | SE | PPI |

| 22/12/2021 | 0830/0930 | ** |  | SE | Retail Sales |

| 22/12/2021 | 1200/0700 | ** |  | US | MBA weekly applications index |

| 22/12/2021 | 1330/0830 | *** |  | US | GDP (3rd) |

| 22/12/2021 | 1500/1000 | *** |  | US | NAR existing home sales |

| 22/12/2021 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 22/12/2021 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.