-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Eyeing Omicron Optimism

EXECUTIVE SUMMARY:

- U.K. TO SAY OMICRON CAUSES MILDER DISEASE THAN DELTA: POLITICO

- U.S. AND U.K. PLAN MILLIONS OF COVID TREATMENTS

- EUROPEAN GAS PRICES DROP AFTER SURGING ON CONSTRAINED RUSSIAN FLOWS

- MNI CHINA LIQUIDITY INDEX: DEC CONDITIONS, POLICY SEEN STEADY

- ECB'S HOLZMANN: RATES CAN BE RAISED NEXT YEAR IN EXTREME CASE

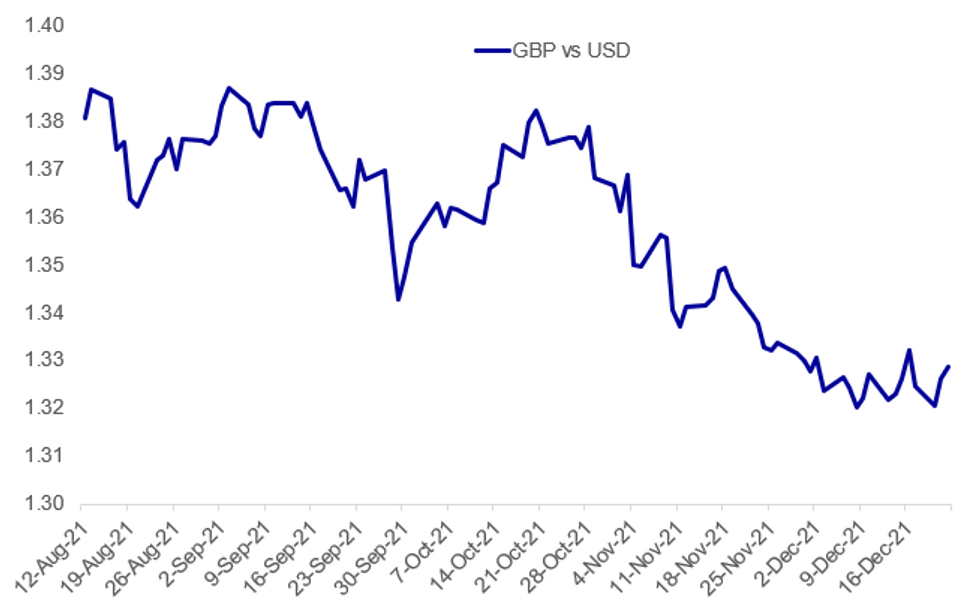

Fig. 1: Pound Edges Higher

Source: BBG, MNI

Source: BBG, MNI

NEWS:

COVID / UK (BBG/POLITICO): U.K. government scientists are set to conclude that those who become sick with the omicron variant are less likely to become severely ill than from the delta strain, but that it’s not necessarily mild enough to avoid large numbers of hospitalizations, Politico’s Playbook reports, without saying where it got the information. U.K. Health Security Agency is due to publish its early real-world data on the severity of the disease before Christmas. More people are likely to have mild illness, probably due to the U.K.’s large number of vaccinated and previously infected people, as well as because omicron might be intrinsically milder, according to the report.

COVID / UK (BBG): The U.K. government will buy millions more Covid-19 antiviral pills from Pfizer Inc. and Merck & Co. as it seeks to combat the surge in omicron infections and reduce rising pressure on the country’s hospitals. Britain has secured an additional 1.75 million courses of Merck’s drug, molnupiravir, and an additional 2.5 million courses of Pfizer’s paxlovid, according to a statement Wednesday. Previously the U.K. had sourced 480,000 courses of molnupiravir and 250,000 courses of paxlovid.

COVID/ U.S. (BBG): The Biden administration expects to take delivery of 4 million courses of Covid-19 treatments by the end of January, according to officials familiar with the matter, sharply ramping up therapies for the disease as the omicron variant spreads.The treatments include a monoclonal antibody product, pre-exposure preventive drugs for immunocompromised people, and new antiviral pills awaiting Food and Drug Administration authorization, the officials said. That authorization is expected as soon as Wednesday.

EUROPE ENERGY (BBG): European gas prices eased after surging to a fresh record on Tuesday as Russia keeps shipments to Europe capped. Russian gas flows into Germany’s Mallnow compressor station remained halted this morning and the key Yamal-Europe pipeline was instead flowing gas eastward to Poland for a second day, according to network operator Gascade. The so-called reverse flows are likely the result of lower requests from buyers in Europe.

MNI CHINA LIQUIDITY INDEX: Liquidity conditions across China's interbank market were little changed into the end of the calendar year, with markets seeing stable policy in coming weeks, the latest MNI Liquidity Conditions Index shows. For access to full release, contact sales@marketnews.com

ECB (BBG): The European Central Bank can cut or phase out asset purchases next year if inflation doesn’t slow in line with forecasts, with a subsequent interest-rate increase in 2022 also a possibility in an extreme scenario, Governing Council member Robert Holzmann tells online briefing. Holzmann says his suggestion that the ECB could raise rates before ending asset purchases if inflation accelerates in an extreme way didn’t find much support in the Governing Council and therefore isn’t very likely to happen.

ECB (BBG)/LE MONDE): “We are well aware of the uncertainty around our inflation projections. There is a risk to the upside,” European Central Bank Executive Board member Isabel Schnabel says in interview with Le Monde.

ITALY(BBG): “Italy has fulfilled all its 51 Recovery Plan targets for this year,” which will allow the country to receive planned funds from the EU, Premier Mario Draghi tells reporters at year-end press conference in Rome.Italy’s debt-to-GDP ratio to start falling next year: Draghi.

EU-UK (BBG): The Council of the EU approved an agreement between the bloc and the U.K. on fishing opportunities for 2022, it said in a statement on Wednesday. “Paves the way” for EU fisherman and women to exercise their fishing rights in the Atlantic and the North SeaThe decision determines fishing rights for around 100 shared fish stocks in EU and U.K. waters, including the total allowable catch limit for each species.

BANK OF THAILAND (MNI STATE OF PLAY): Thailand's central bank has cited uncertainty on the impact of the Omicron variant on the economic recovery in its decision on Wednesday to leave its policy rate unchanged. While upping its forecast for growth in 2021, the Bank of Thailand has revised its 2022 estimate marginally lower to 3.4%, while forecasting 2023 growth rebounding at 4.7%.

ISRAEL/COVID (BBG - FROM OVERNIGHT): Israel will administer a fourth dose of coronavirus vaccine to people over the age of 60 and medical personnel, becoming the first nation in the world to do so on such a widespread basis as the omicron variant barrels across the world. “The citizens of Israel were the first to get the third vaccine and we are continuing to lead with the fourth vaccine,” Prime Minister Naftali Bennett said in a statement late Tuesday. He’s ordered authorities to prepare for a nationwide inoculation drive.

DATA:

MNI: UK Q3 GDP +1.1%r Q/Q; + 6.8% Y/Y

MNI BRIEF: UK Q3 GDP Revised Downward

The UK economy grew by less than initially reported over the third quarter, rising by 1.1%, down from 1.3%. That leaves the economy 1.5% below its pre-pandemic level, down from the previously-reported 2.1% shortfall, after growth for 2019 was revised upward to a 9.4% decline, from previously-reported 2.1% gap.

However, Q2 output was revised downward to 5.4% from 5.5%, while Q1 growth was upgraded to -1.3% from -1.4% previously. Business investment fell by 2.5% in Q3 from the initially-reported 0.4% gain, while household spending was revised up to 2.7% from 2.0%. The savings rate declined to 8.6% from 10.7% in Q2.

Meanwhile, the current account deficit widened sharply to GBP24.4 billion from an upwardly revised GBP13.462 billion (originally reported as a shortfall of GBP8.6 billion). The takes the deficit to 4.2% of GDP from 2.3%in Q3.

FIXED INCOME: Risk-on and inflation expectations driving core FI

A combination of risk-on sentiment (on hopes of Omicron developments) and higher inflation expectations (with European gas prices still close to yesterdays highs - despite being lower intraday) have helped core fixed income lower.

- Gilts are the biggest movers, with the curve moving in a fairly parallel fashion as yields rise around 4bp. SONIA futures have seen Whites move up to 4 ticks lower on the day (up to 10 tick 2-day move), Reds move 4.5-5.5 ticks lower on the day (11.5-15.0 tick 2-day move) and Greens/Reds 5.5-6.5 ticks lower on the day (16.5-19.5 tick 2-day move).

- The German curve has bear steepened, with Euribor futures a little lower on the day (Greens/Blues down 8-10 ticks over 2 days now). 10-year yields are up 2.7bp while BTP-Bund 10-year spreads are 2.9bp wider on the day.

- TY1 futures are little changed on yesterday's lows, having reversed some of the overnight move higher to not sit close to their lows of the day. The UST curve has bear steepened a little.

- European gas prices will remain in focus, alongside any Omicron developments.

- TY1 futures are up 0-1 today at 130-19 with 10y UST yields up 1.7bp at 1.480% and 2y yields up 0.9bp at 0.678%.

- Bund futures are down -0.26 today at 173.05 with 10y Bund yields up 2.1bp at -0.288% and Schatz yields up 0.7bp at -0.714%.

- Gilt futures are down -0.29 today at 125.53 with 10y yields up 3.4bp at 0.905% and 2y yields up 3.5bp at 0.639%.

FOREX: NOK leads in G10s

USD is mixed so far today, during our early European morning trading session.

Early mover was the GBP, with a small bid emerging.

Cable tested session high, albeit well within the last few session's ranges, and by just a few pips.

Cable sees small resistance moving down to 1.3289 initially, printed 1.3289 high, at the time of typing.

The Pound trades in the green against all G10s, besides the NOK.

NOK has extended gains, with a broader base bid going through.

The currency is up against all the majors and test session high against USD, EUR, JPY.USDNOK eye the December low and lowest level since mid November at 8.8624 next.

Looking ahead, sees US 3rd GDP reading

EQUITIES: U.S. Futures A Little Softer Overnight

- Asian stocks closed mostly higher: Japan's NIKKEI closed up 44.62 pts or +0.16% at 28562.21 and the TOPIX ended 1.72 pts higher or +0.09% at 1971.51. China's SHANGHAI closed down 2.507 pts or -0.07% at 3622.618 and the HANG SENG ended 131 pts higher or +0.57% at 23102.33

- European futures are flat/mixed, with the German Dax up 0.35 pts or +0% at 15446.74, FTSE 100 down 11.16 pts or -0.15% at 7286.26, CAC 40 up 11.44 pts or +0.16% at 6976.03 and Euro Stoxx 50 up 0.54 pts or +0.01% at 4175.39.

- U.S. futures are a little weaker, with the Dow Jones mini down 47 pts or -0.13% at 35334, S&P 500 mini down 11.25 pts or -0.24% at 4629.5, NASDAQ mini down 66.5 pts or -0.42% at 15913.5.

COMMODITIES: Energy Leads

- WTI Crude up $0.49 or +0.69% at $71.62

- Natural Gas up $0.04 or +0.98% at $3.907

- Gold spot down $1.02 or -0.06% at $1788.22

- Copper up $1.95 or +0.45% at $436.55

- Silver up $0.04 or +0.18% at $22.558

- Platinum up $3.3 or +0.35% at $941.22

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/12/2021 | 1200/0700 | ** |  | US | MBA weekly applications index |

| 22/12/2021 | 1330/0830 | *** |  | US | GDP (3rd) |

| 22/12/2021 | 1500/1000 | *** |  | US | NAR existing home sales |

| 22/12/2021 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 22/12/2021 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 22/12/2021 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 23/12/2021 | 0800/0900 | *** |  | ES | GDP (f) |

| 23/12/2021 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 23/12/2021 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 23/12/2021 | 1330/0830 | ** |  | US | Jobless Claims |

| 23/12/2021 | 1330/0830 | ** |  | US | durable goods new orders |

| 23/12/2021 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 23/12/2021 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 23/12/2021 | 1330/0830 | * |  | CA | Payroll employment |

| 23/12/2021 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/12/2021 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 23/12/2021 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 23/12/2021 | 1500/1000 | *** |  | US | new home sales |

| 23/12/2021 | 1500/1000 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/12/2021 | 1500/1000 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/12/2021 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 23/12/2021 | 2130/1630 | ** |  | US | Fed Weekly Money Supply Data |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.