-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI US Open: Holiday Cheer For British Pound

EXECUTIVE SUMMARY:

- U.K. NOT EXPECTED TO ANNOUNCE POST-CHRISTMAS RESTRICTIONS THIS WEEK: SKY

- RUSSIA BUILDS UP FORCES NEAR UKRAINE AHEAD OF U.S. TALKS

- THREE SINOVAC DOSES FAIL TO PROTECT AGAINST OMICRON IN STUDY

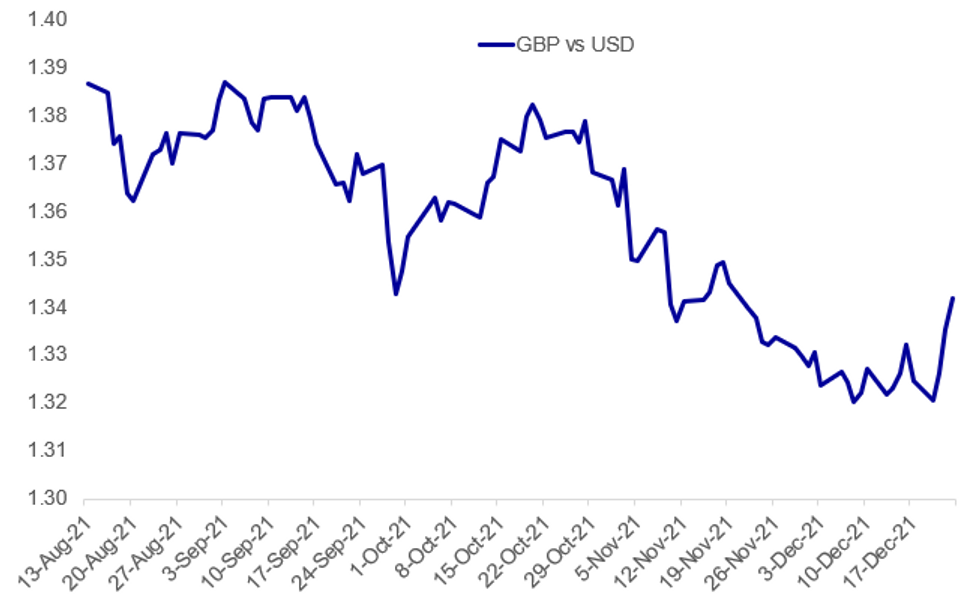

Fig. 1: Pound Gains As Lockdown Fears Ease

Source: BBG, MNI

Source: BBG, MNI

NEWS:

U.K. / COVID (SKY): Boris Johnson is not expected to announce post-Christmas COVID restrictions this week, a senior government source told Sky News. It comes as new data on the severity of Omicron from the UK Health Security Agency (UKHSQ) is set to be published today. Two UK recent studies by scientists at Edinburgh University and Imperial College London showed that it appears to be milder than Delta, raising hopes that people infected with Omicron are less likely to be hospitalised.

RUSSIA/UKRAINE (BBG): Russia is continuing to build up forces close to Ukraine even as it’s preparing for security talks with the U.S., keeping up pressure with a deployment that could turn into a rapid invasion or a long-term threat.Citing “further troop movements on the border,” German Foreign Minister Annalena Baerbock told reporters “my concern is great” and called for dialogue Wednesday. Russia now has 122,000 troops within 200 kilometers (120 miles) of the border, according to Ukraine’s Security and Defense Council. Satellite images show tanks, artillery and air-defense systems have been moved to border regions near Ukraine since November, according to defense-intelligence firm Janes. While the images appear to show limited troop numbers on the ground with the equipment, Russia would be able to reinforce them quickly and covertly with large deployments using trains or aircraft, it said.

SINOVAC (BBG): Two doses and a booster of the Covid-19 vaccine made by China’s Sinovac Biotech Ltd., one of the most widely used in the world, didn’t produce sufficient levels of neutralizing antibodies to protect against the omicron variant, a laboratory study found.

ENERGY / EXXON (BBG): Exxon Mobil Corp. is working to extinguish a fire at its Baytown facility in Texas, the fourth-largest refinery in the U.S. Four people have been injured in the fire that occurred at about 1 a.m. local time, according to Exxon. Gasoline’s premium to West Texas Intermediate crude rose as much as 3.5% in early trading on the New York Mercantile Exchange, erasing losses.

U.S. (BBG): Former Treasury Secretary Lawrence Summers warned of a testing period for the U.S. economy in coming years, with the risk of recession followed by stagnation.In an interview with the Bloomberg Economics “Stephanomics” podcast, Summers said that the Federal Reserve had been late to spot the dangers of inflation and that delayed action to cool prices could potentially tip the economy into a slump. “If I thought we could sustainably run the economy in a red-hot way, that would be a wonderful thing, but the consequence -- and this is the excruciating lesson we learned in the 1970s -- of an overheating economy is not merely elevated inflation, but constantly rising inflation,” Summers said. “That’s why my fear is that we are already reaching a point where it will be challenging to reduce inflation without giving rise to recession.”

RUSSIA (BBG): President Vladimir Putin endorsed the Bank of Russia’s hawkish policies to battle inflation, saying the country could end up facing an economic crisis like Turkey’s if it failed to raise interest rates. “I know that the real sector is unhappy with the rate hikes,” Putin said at his annual year-end press conference Thursday. “But if it wasn’t done, we could end up like Turkey, with the same problem.”

ITALY ISSUANCE (BBG): Italy plans issue a new BTP short maturing 2023 with minimum final outstanding amount of EU9b in 1Q, Ministry of Economy said in statement on 1Q issuance program. To also issue BTP 5 years maturing 2027 with min. final outstanding of EU10b.

DATA:

FIXED INCOME: Weaker Ahead Of The Holidays

Global fixed income is trading decisively weaker Thursday, on the last pre-holiday trading session for US fixed income (early close today too) and most European bonds.

- Gilts are leading the way lower alongside a stronger GBP, with the UK gov't set to avoid announcing lockdown restrictions ahead of Christmas.

- Elsewhere, in Bunds and Treasuries, a bit of bear steepening. BTPs bucking the risk-on trend, underperforming both Bunds and the rest of the periphery.

- Not much in the way of market-moving headlines in the morning, but a fairly heavy US data slate ahead of Friday's holiday: jobless claims, durable goods and PCE among them.

Latest levels:

- Mar 10-Yr US futures (TY) down 3.5/32 at 130-20 (L: 130-19.5/ H: 130-26)

- Mar Bund futures (RX) down 44 ticks at 172.7 (L: 172.7 / H: 173.19)

- Mar Gilt futures (G) down 41 ticks at 125.24 (L: 125.23 / H: 125.56)

- Mar BTP futures (IK) down 90 ticks at 147.6 (L: 147.6 / H: 148.45)

- Mar OAT futures (OA) down 48 ticks at 164.47 (L: 164.46 / H: 165)

FOREX: Pound outperforms

- Most of the action has been in FX this morning, albeit in lower turnovers, and mainly in the Pound.

- Cable traded through the December high and now look to test next resistance at at 1.3414 50-day EMA.

- The British Pound has been underpinned as Boris is set to save Christmas from any restrictions, and will wait until next week for further hospitalisation data to give a clearer picture.

- Elsewhere it has been a more subdued, range bound session across FX pairs.

- USD is mixed in G10, down 0.37% against the GBP, and up 0.35% versus the SEK.

- EURUSD remains in a 31 pips range with some focus on large option expiry at 1.1300 for today in the tone of 1.41bn.

- Looking ahead, last set of data in focus come from the US, with PCE core deflator and prelim Durable goods,

- Note for the US exchange markets close today is at 13.00ET/18.00GMT and US are closed tomorrow.

EQUITIES: Broad Gains

- Asian stocks closed higher: Japan's NIKKEI closed up 236.16 pts or +0.83% at 28798.37 and the TOPIX ended 17.92 pts higher or +0.91% at 1989.43. China's SHANGHAI closed up 20.721 pts or +0.57% at 3643.339 and the HANG SENG ended 91.31 pts higher or +0.4% at 23193.64

- European equities are a little stronger, with the German Dax up 69.14 pts or +0.44% at 15661.72, FTSE 100 up 17.52 pts or +0.24% at 7357.79, CAC 40 up 15.8 pts or +0.22% at 7064.52 and Euro Stoxx 50 up 21.12 pts or +0.5% at 4238.3.

- U.S. futures are pointing higher, with the Dow Jones mini up 68 pts or +0.19% at 35700, S&P 500 mini up 7.5 pts or +0.16% at 4693.5, NASDAQ mini up 11 pts or +0.07% at 16180.75.

COMMODITIES: Industrial Commodities Dip; Precious Metals Edge Higher

- WTI Crude down $0.08 or -0.11% at $72.69

- Natural Gas down $0.08 or -1.96% at $3.898

- Gold spot up $3.05 or +0.17% at $1806.77

- Copper down $2.45 or -0.56% at $436.65

- Silver up $0.04 or +0.16% at $22.85

- Platinum up $5.1 or +0.53% at $973.33

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/12/2021 | 1330/0830 | ** |  | US | Jobless Claims |

| 23/12/2021 | 1330/0830 | ** |  | US | durable goods new orders |

| 23/12/2021 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 23/12/2021 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 23/12/2021 | 1330/0830 | * |  | CA | Payroll employment |

| 23/12/2021 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/12/2021 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 23/12/2021 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 23/12/2021 | 1500/1000 | *** |  | US | new home sales |

| 23/12/2021 | 1500/1000 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/12/2021 | 1500/1000 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/12/2021 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 23/12/2021 | 2130/1630 | ** |  | US | Fed Weekly Money Supply Data |

| 24/12/2021 | 1600/1100 | ** |  | US | St. Louis Fed Real GDP Nowcast |

| 24/12/2021 | 1600/1100 | ** |  | US | NY Fed GDP Nowcast |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.