-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKET ANALYSIS - Dip Erased as Stocks Hit Weekly Highs

Highlights:

- Buy-the-dip strategy reigns supreme as e-mini S&P erases Monday decline

- Treasury curve flattens, 10y yield sheds 5bps off Monday high

- Data slate light, with focus on Powell's renomination hearing

US TSYS SUMMARY: Treasuries Twist Flatten Ahead Of Powell Hearing

- Cash Tsys have twist flattened this morning with short-end yields extending to new pandemic era highs whilst the long-end is modestly richer.

- 2Y yields are +2.0bps at 0.915%, 5Y +1.0bps at 1.529%, 10Y -0.5bps at 1.755% and 30Y -1.1bps at 2.078%.

- TYH2 has unwound a recent rally, leaving it up 4 ticks at 128-08+ towards the upper end of yesterday’s range. There have been various supports around these levels, but first support is now seen at 127-30 (1.764 proj of Dec 20-29-31 price swing), tested yesterday, after which it opens 127-18+ (2.00 proj of the Dec 20-29-31 price swing). Initial resistance is seen at 129-00 (Jan 6 high).

- Powell’s nomination hearing at the Senate is at 1500ET, with prepared remarks released late yesterday. Separately, Mester (2022) and George (2022) speak beforehand.

- NY Fed buy-ops: Tsy 4.5Y-7Y, appr $4.525B (1030ET) and Tsy 10Y-22.5Y, appr $1.625B (1120ET).

- Tsy issuance: $52B 3Y Note auction (1300ET).

EGB/GILT SUMMARY: Curves Flatten

European sovereign curves have flattened this morning while equities have broadly pushed higher.

- Gilts have firmed across the curve with the long-end outperforming. The curve has flattened 2-3bp.

- The German curve has similarly flattened, but on the back of the short end trading softer and the longer end gaining. The 2s30s spread has narrowed 3bp on the day.

- It is a similar story for BTPs where the very long end of the curve has flattened 1bp

- Pressure on the UK PM is mounting as the fallout from an alleged Downing St party during a period of tightened Covid restrictions continues to rumble on.

- Tier one data was relatively light this morning. Dutch CPI accelerated sharply in December, with the EU harmonized measure reading 6.4% Y/Y up from 5.9% in November.

- Supply this morning came from the UK (Gilt, GBP3.0bn), Germany (Linker, EUR630mn allotted), Spain (Letras, EUR5.518bn), the Netherlands (DSL, EUR4.705bn), Belgium (TCs, EUR2.186bn), Austria (RAGBs, EUR1.3 allotted) and the ESM (Bills, EUR1.094bn). In addition, Spain is launching a 10-year bond via syndication with volume of EUR10bn and book size in excess of EUR63bn).

STIR UPDATE: Powell’s Prepared Remarks Have Little Impact On Fed Funds Futures

- Released late yesterday, Powell’s prepared remarks for today’s nomination hearing on standing ready to prevent elevated inflation from becoming entrenched have made relatively little impact on Fed Funds futures pricing. The Senate hearing starts at 1000ET/1500GMT.

- The March FOMC meeting still has 22bps priced whilst the Dec meeting has ground higher to a cumulative 89.5bps of hikes.

- Prior to Powell, we also have Mester (1412ET – BBG TV) and George (1430ET – discussion on the economic and policy outlook) speaking, both 2022 voters.

- US CPI for Dec is tomorrow. Core CPI is seen at another 0.5% M/M per BBG consensus, with Goldman seeing some upside surprise potential with an expected 0.58% M/M.

EUROPE ISSUANCE UPDATE: Heavy Day for Auctions & Syndication

UK DMO sells GBP3.0bln 0.375% Oct-26 Gilt, Avg yield 0.988% (Prev. 0.798%), Bid-to-cover 2.37x (Prev. 2.16x), Tail 0.3bp (Prev. 1.0bp)

Netherlands sells E4.705bln 0% Jan-26 DSL, Avg yield -0.329%, Price 101.33

Target E3-5blnGermany allots E630mln 0.10% Apr-33 ILB, Avg yield -1.80% (Prev. -1.86%), Bid-to-cover 1.30x (Prev. 0.85x), Buba cover 1.55x (Prev. 1.24x)

Austria sells 10/30-year RAGBs:

E805mln 0% Feb-31 RAGB, Avg yield 0.143% (Prev -0.156%), Bid-to-cover 2.08x (Prev 2.20x)

E690mln 0.75% Mar-51 RAGB, Avg yield 0.698% (Prev 0.521%), Bid-to-cover 2.12x (Prev 2.08x)

SPAIN SYNDICATION:

Size: E10bln (in line with MNI expectations)

Spread set earlier at 0.50% Oct-31 Obli (mid) + 8 bps (Original guidance was+ 10 bps area)

Books closed in excess of E63bn including E4.75bn of JLM interest

FOREX: Equity Dip Proves Short-Lived, Driving JPY Lower

- The buy-the-dip strategy in US equity markets reigned supreme Monday, with the e-mini S&P rallying sharply off the days lows to put prices at new weekly highs ahead of the Tuesday open. The return to risk has weighed on haven currencies, pressing the JPY, USD and CHF toward the bottom of the pile, while favouring growth proxies and commodity-tied FX including NOK and AUD.

- USD/JPY's Monday weakness put the pair to 115.05, but the recovery alongside global stock markets has prompted a rally toward 113.50. Strength through here opens the Monday highs at 115.85 ahead of 116 and above.

- USD/NOK continues to oscillate either side of the 50-dma, with the relative strength/weakness of oil the primary driver. Weakness through 8.8134 opens losses toward 8.7857 and key support at late December's 8.7597.

- Tier one datapoints are few and far between Tuesday, with just the US NFIB Small Business Optimism data. This keeps focus on the busier CB speaker slate, with the formal handover ceremony for Nagel to take over at the Bundesbank as well as speeches from ECB's Kazaks, Fed's Mester and George as well as the Senate hearing for Powell's renomination as head of the Federal Reserve.

FX OPTIONS: Expiries for Jan11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1255-75(E1.2bln), $1.1305-25(E1.0bln)

- USD/JPY: Y113.60($500mln)

- AUD/USD: $0.7145-53(A$1.0bln), $0.7200(A$786mln)

Price Signal Summary - S&P E-Minis Find Support Below The 50-Day EMA

- In the equity space, S&P E-minis traded below the 50-day EMA but quickly recovered, bouncing off the session low and is currently trading back above this EMA and pivot support level - the EMA intersects at 4648.36 today. The bounce is a bullish development and note that yesterday's price pattern is a hammer - a reversal signal. Watch resistance at 4715.75, Jan 6 high and support at 4572.75, yesterday’s low. Both are potentially important directional triggers. EUROSTOXX 50 futures has also managed to find support at its 50-day EMA. Key short-term support has been defined at 4216.50, yesterday’s low. A stronger recovery would open 4381.5, the Jan 5 high.

- In FX, EURUSD is still stuck in a broad range below resistance at 1.1383/86, the Nov 30 and Dec 31 high. The support to watch is 1.1222, Dec 15 low and the bear trigger remains 1.1185, Jul 1, 2020 low. GBPUSD bullish conditions remain in place and sights are on 1.3676 next, 76.4% of the Oct - Dec sell-off. Support to watch is at 1.3457, the 20-day EMA. EURGBP has resumed its downtrend and is making its way towards major support. 0.8300 marks the base of a multi-year range the cross has been trading within since 2016. There is also support at 0.8282/77 Feb’20 / Dec’19 lows and a key bear trigger. The USDJPY trend outlook remains bullish following last week's break of 115.52, Nov 24 high. This confirmed a resumption of the uptrend and opens 117.08, 2.00 projection of Apr 23 - Jul 2 - Aug 4 price swing. 114.92, the 20-day EMA is seen as a firm support.

- On the commodity front, Gold has managed to remain inside its bull channel drawn from the Aug 9 low - Friday's low of $1782.8 and the recovery from this level means the channel base has provided support. This signals scope for a climb towards key near-term resistance at $1831.9, the Jan 3 high. WTI futures remain in an uptrend and attention is on $81.73, Nov 10 high.

- In the FI space, Bund futures remain in a downtrend and the contract traded lower again yesterday. The focus is on 169.34, Oct 29 low. Gilts remain in a downtrend and futures have recently traded through the 123.00 handle. This opens 122.66 next, 3.764 projection of the Dec 8 - 16 - 20 price swing.

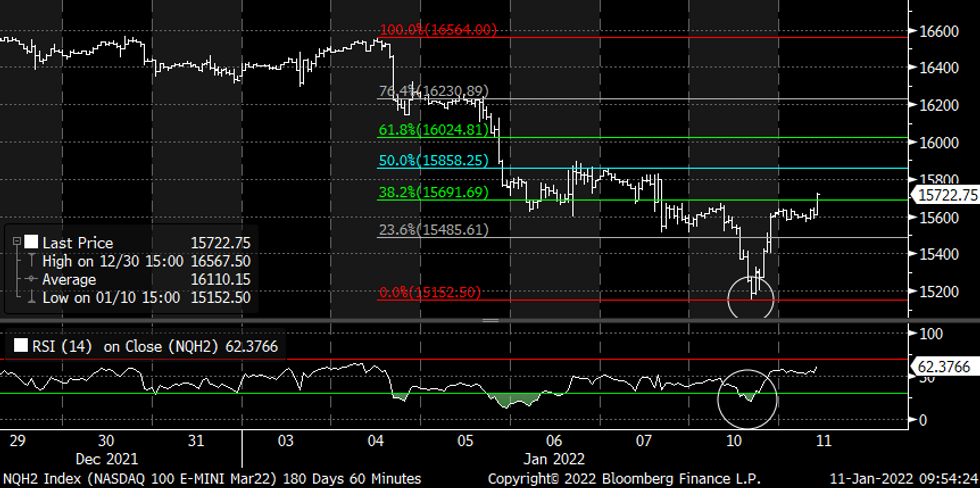

EQUITIES: Tech stocks recover

- Estoxx has now gained 1.73% from yesterday's low, most desks have been fading after all the contracts traded into oversold territory.

- VGH2 has recovered over half of yesterday's sell off.

- Next upside resistance comes at 4298.8, which is the 50% retrace of the January fall, from the 5th January.

- NQA (Nasdaq) is through yesterday's high, and next resistance here, is seen at 15,858.25.

- Tech stocks in Stoxx600 are up 2.53%

Chart source: Bloomberg

COMMODITIES: Metals and oil higher but natgas lower

- WTI Crude up $1.25 or +1.6% at $79.52

- Natural Gas (NYM) down $0.04 or -1.01% at $4.038

- Natural Gas (ICE Dutch TTF) down $1.31 or -1.54% at $83.3

- Gold spot up $4.86 or +0.27% at $1806.38

- Copper up $2.65 or +0.61% at $438.15

- Silver up $0.09 or +0.39% at $22.549

- Platinum up $2.75 or +0.29% at $946.07

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/01/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 11/01/2022 | 1020/1120 |  | EU | ECB Lagarde at Bundesbank Ceremony | |

| 11/01/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 11/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 11/01/2022 | 1430/0930 |  | US | Kansas City Fed's Esther George | |

| 11/01/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 11/01/2022 | 1500/1000 |  | US | Fed Chair Powell's Senate nomination hearing | |

| 11/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 11/01/2022 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 12/01/2022 | 1000/1100 | ** |  | EU | industrial production |

| 12/01/2022 | 1200/0700 | ** |  | US | MBA weekly applications index |

| 12/01/2022 | 1330/0830 | *** |  | US | CPI |

| 12/01/2022 | 1415/1415 |  | UK | BOE Cunliffe at Crypto Fin Conference | |

| 12/01/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 12/01/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/01/2022 | 1700/1200 | ** |  | US | USDA GrainStock - NASS |

| 12/01/2022 | 1700/1200 | *** |  | US | USDA Winter Wheat |

| 12/01/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/01/2022 | 1800/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/01/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 12/01/2022 | 1900/1400 |  | US | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.