-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Dollar Mixed Despite Solid Signal Into Month-End

HIGHLIGHTS:

- USD mixed despite strong buy signal among month-end models

- UK PM Johnson due to make statement on Gray report this afternoon

- Earnings season remains a focus, with 28% of the S&P500 due this week

US TSYS SUMMARY: Treasuries Bear Flatten On Faster Hiking Risks

- Cash Tsys have held onto the bear flattening seen overnight after Atlanta Fed’s Bostic alluded to the risks of faster rate hikes late Friday along with Goldman increasing its rate hike call to 5 hikes in 2022.

- 2Y yields +4.0bps at 1.203%, 5Y +2bps at 1.632%, 10Y +1.8bps at 1.787% and 30Y +1.9bps at 2.092%.

- TYH2 sits towards the high end of Friday’s range at 127-28+ on soft volumes, roughly equidistant from resistance at 128-16 (20-day EMA) and support at 127-06+ Jan 26 low).

- Fedspeak: SF’s Daly (non-voter, dove) at 1130ET followed by KC’s George (2022, hawk) at 1240ET.

- The main data release today is The Chicago Business Barometer by MNI (0945ET) with consensus for a dip from 63.1 to 61.8 in Jan.

- NY Fed buy-op: Tsy 2.25Y-4.5Y, appr $8.425B vs. $6.325B prior (1030ET)

- Issuance: 1130 US Tsy $60B 13W, $51B 26W bill auctions (1130ET)

EGB/GILT SUMMARY: Trading Lower

European government bonds mainly trade weaker this morning while equities have uniformly pushed higher.

- Having initially opened lower, gilts recovered early losses but subsequently sold off again with yields now holding around the morning's highs and 3-4bp above the Friday close.

- Bund yields are up 3-6bp with the curve bear flattening.

- OATs have traded progressively weaker through the morning with yields broadly 2-5bp higher.

- BTPs opened stronger, but have sold off through the morning, albeit remaining above the Friday close. The curve is 1-2bp flatter.

- On the data front, Eurozone Q4 GDP came in slightly weaker than expected on a Q/Q basis (0.3% vs 0.4%), while the Y/Y figure printed in line with consensus (4.6%). Italian GDP for the same period came in above expectations (0.6% Q/Q vs 0.5% and 6.4% Y/Y vs 6.2%).

- Regional German CPI data for January has been mixed relative to last month's data. The national estimate will be published at 1300GMT. Meanwhile, the preliminary Spanish CPI print for January came in at 6.1% Y/Y vs 5.5% consensus and 6.6% the previous month.

- Focus later today will shift to the MNI Chicago PMI update for January.

EUROPE OPTION FLOW SUMMARY

Eurozone:

DUH2 111.80/111.70 put spread bought for 2.25 in 3k

OEH2 132.00/131.50 put spread bought for 12.5 in 5k

IKJ2 146/143 put spread vs 147.5/148.5 call spread bought for 26 in 5k (bought p/s)

3RH2 99.875/99.625/99.375 put fly sold at 10 in 5.25k

FOREX: USD Mixed-to-Lower Despite Solid Buy Signal Into Month-End

- The dollar trades mixed-to-lower early Monday, running against the bulk of sell-side models for month-end, which continue to signal a strong USD buying need into the January close. This suggests that markets will be on watch for USD rallies through the NY crossover - or alternatively, much of that month-end flow has already worked its way through markets across last week's volatile trade.

- AUD is comfortably the outperformer Monday, with AUD/USD recovering close to 100 pips off the Friday lows. The moves come ahead of Tuesday's rate decision at which the RBA are seen weighing a conclusion to bond purchases, The internal debate at the bank is seen switching to rate hikes, as markets price four full rate hikes by year-end.

- Haven currencies are offered, with JPY and CHF among the poorest performers so far today. Equities sit somewhat stronger, with US futures holding the bulk of the late Friday rally, but indicating a more mixed cash open.

- German national CPI readings for January take focus going forward, with regional turnouts suggesting we may see a higher-than-expected nationwide release later today. The MNI Chicago Business Barometer is also due, with markets expecting activity to decelerate to 61.8 from 63.1 previously.

FX OPTIONS: Expiries for Jan31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1100(E1.3bln), $1.1370-90(E715mln)

- USD/JPY: Y114.00($850mln), Y114.95-05($1.1bln), Y117.00($1.2bln)

- AUD/USD: $0.7300-15(A$587mln)

- USD/CAD: C$1.2550-60($931mln)

Price Signal Summary - Broad USD Uptrend Remains Intact

- In the equity space, S&P E-minis are holding onto recent gains. Price action is likely to remain volatile with the Jan 24 low of 4212.75 intact. Last week’s price action is allowing the recent oversold reading to unwind. Initial resistance to watch is 4446.25, Jan 26 high. The trigger for a resumption of bearish activity is 4212.75 low. The short-term trend direction remains down. EUROSTOXX 50 futures activity is likely to remain volatile. Price continues to trade above last Monday’s low of 3990.50 which is the trigger for a resumption of the recent bearish threat. Resistance to watch is at 4215.50, Jan 24 high.

- In FX, EURUSD traded sharply lower last week and remains vulnerable. The pair has cleared key support at 1.1186/85, the Nov 24 and Jul 1 2020 lows. This confirms a resumption of the broader downtrend since Jan 6, 2021 and paves the way for a move towards 1.1070 next, the May 29, 2020 low. GBPUSD remains vulnerable following the strong sell-off from the Jan 13 high. The pair has cleared a number of support points and this opens 1.3301 next, 76.4% retracement of the Dec 8 - Jan 13 bull phase. Recent USDJPY price action defined a key short-term support last week at 113.47, Jan 24 low. The break reinstates a bullish theme and opens 116.35, the Jan 4 high and key resistance.

- On the commodity front, Gold remains vulnerable. Last week’s sharp sell-off resulted in a break of the bull channel base drawn off the Aug 9 low. The clear breach strengthens the bearish threat and signals scope for weakness towards $1753.6, the Dec 15 low. WTI futures resumed their uptrend last week and the outlook remains bullish. The contract has cleared $87.10, Jan 20 high. This opens the psychological $90.00 handle.

- In the FI space, Bund futures found resistance last week at 171.07 on Jan 24. A clear break of the 171.00/07 zone is required to signal scope for a stronger recovery. The trend remains down and the bear trigger is at 168.95, Jan 19 low. Gilts remain in a downtrend and continue to trade below resistance at 123.79, Jan 13 high. The bear trigger is unchanged at 121.93, Jan 19 low.

EQUITIES: Earnings Season Continues Apace

- Earnings season continues apace this week, with ~28% of the S&P500 by market cap due to report. Highlights this week include Alphabet (Google), Meta (Facebook) and Amazon, with Tuesday the busiest session for the index.

- So far, average report has beaten on EPS expectations by 4.3%, while beating sales forecasts by 1.1%.

- Full schedule here with timings, expectations and earnings-so-far analysis: https://marketnews.com/mni-us-earnings-schedule-sp...

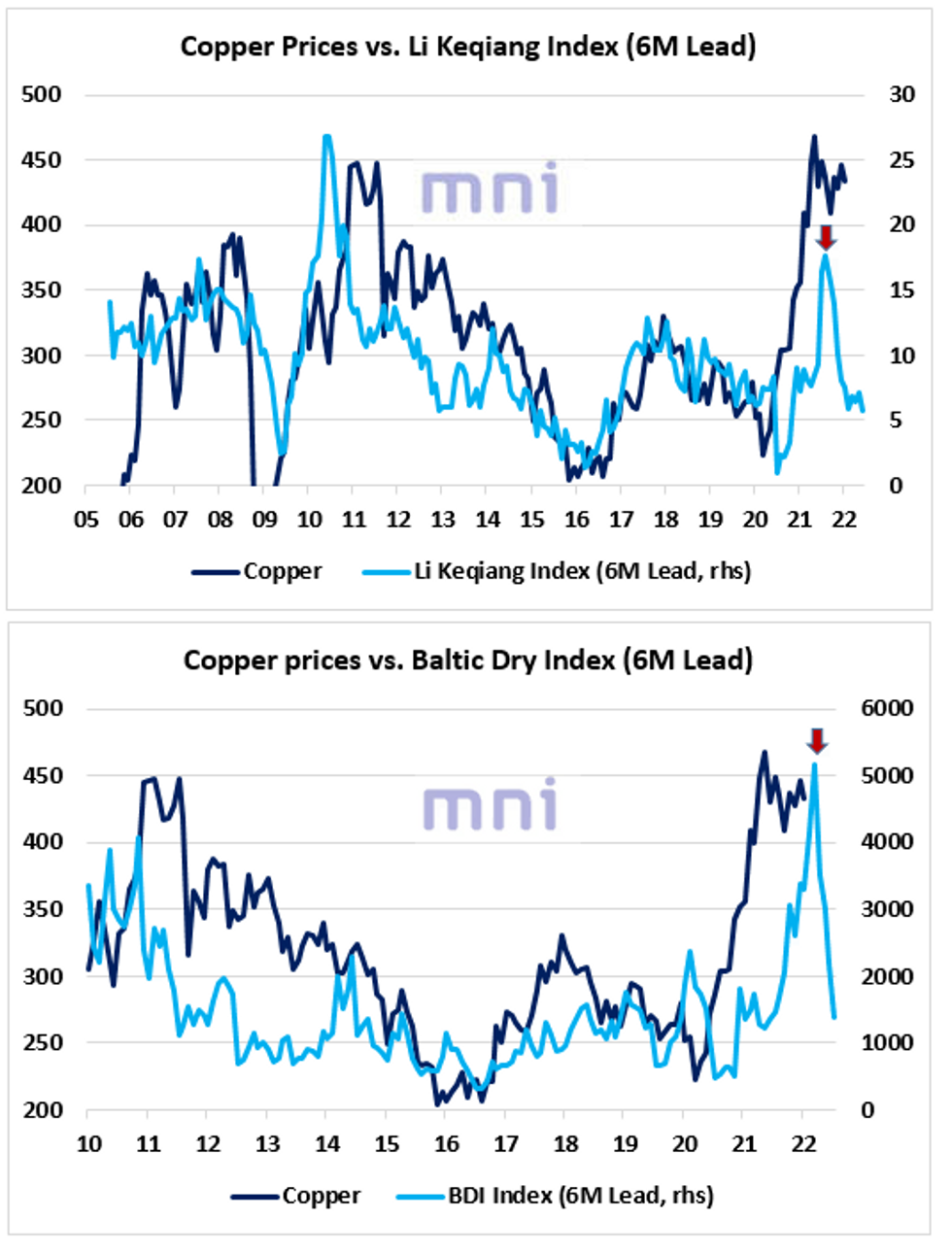

COMMODITIES: Is Copper Set For A Correction In 2022?

- In the past 6 months, copper prices have stabilized around 430 despite the rise in Covid uncertainty this winter and the significant deceleration in Chinese economic activity.

- China Li Keqiang Index, which could be considered as a proxy of the Chinese real economic activity, has been falling in the past year and is still pricing in significantly lower copper prices.

- The top chart shows that the Li Keqiang Index has strongly led copper prices by 6 months in the past 15 years (Index inception).

- In addition, the plunge in the Baltic Dry Index, which is down over 75% since its October high, is also pricing in lower prices in the industrial metal.

- Even though most of the fall was attributed to the winter shipping bottlenecks and the significant deceleration in Chinese economic activity, it has also historically acted as a strong leading indicator (6 months) of copper prices in the past cycle (bottom chart).

- Analysts expect the global refined copper market to move into surplus in 2022, which could also increase the downward pressure on the commodity.

- Will the easing policy from China be enough to maintain copper prices elevated in the medium term?

- Copper broke below its 200DMA at 438.80 last week; next ST support to watch on the downside stands at 422.85, which corresponds to the 23% Fibo retracement of the 205.90 – 489.80 range.

- Key support remains at 400; the industrial metal found support several times at that level last year.

Source: Bloomberg/MNI

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/01/2022 | 1000/1100 | *** |  | EU | GDP preliminary flash est. |

| 31/01/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 31/01/2022 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 31/01/2022 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 31/01/2022 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 31/01/2022 | 1630/1130 |  | US | San Francisco Fed's Mary Daly | |

| 31/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 31/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 31/01/2022 | 1740/1240 |  | US | Kansas City Fed's Esther George | |

| 01/02/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0030/1130 | ** |  | AU | Retail Trade |

| 01/02/2022 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 01/02/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/02/2022 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 01/02/2022 | 0700/0700 | * |  | UK | Nationwide House Price Index |

| 01/02/2022 | 0730/0830 | ** |  | SE | Manufacturing PMI |

| 01/02/2022 | 0730/0830 | ** |  | SE | Services PMI |

| 01/02/2022 | 0730/0830 | ** |  | CH | retail sales |

| 01/02/2022 | 0730/0830 | *** |  | FR | HICP (p) |

| 01/02/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0855/0955 | ** |  | DE | unemployment |

| 01/02/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 01/02/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/02/2022 | 1000/1100 | ** |  | EU | unemployment |

| 01/02/2022 | - | *** |  | US | domestic made vehicle sales |

| 01/02/2022 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 01/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/02/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/02/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/02/2022 | 1500/1000 | * |  | US | construction spending |

| 01/02/2022 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 01/02/2022 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 01/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.