-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: European Rate Repricing Continues Pre-NFPs

EXECUTIVE SUMMARY:

- JAN U.S. PAYROLLS SEEN +70K IN MNI DEALER MEDIAN

- ECB MAY REVIEW HOW QUICKLY TO END BOND-BUYING, MULLER SAYS

- GERMAN FACTORY ORDERS REBOUND

- NATO'S STOLTENBERG CONFIRMED AS NEXT NORGES BANK GOVERNOR

- ECB SURVEY SHOWS HIGHER EXPECTATIONS FOR INFLATION, GDP, JOBS

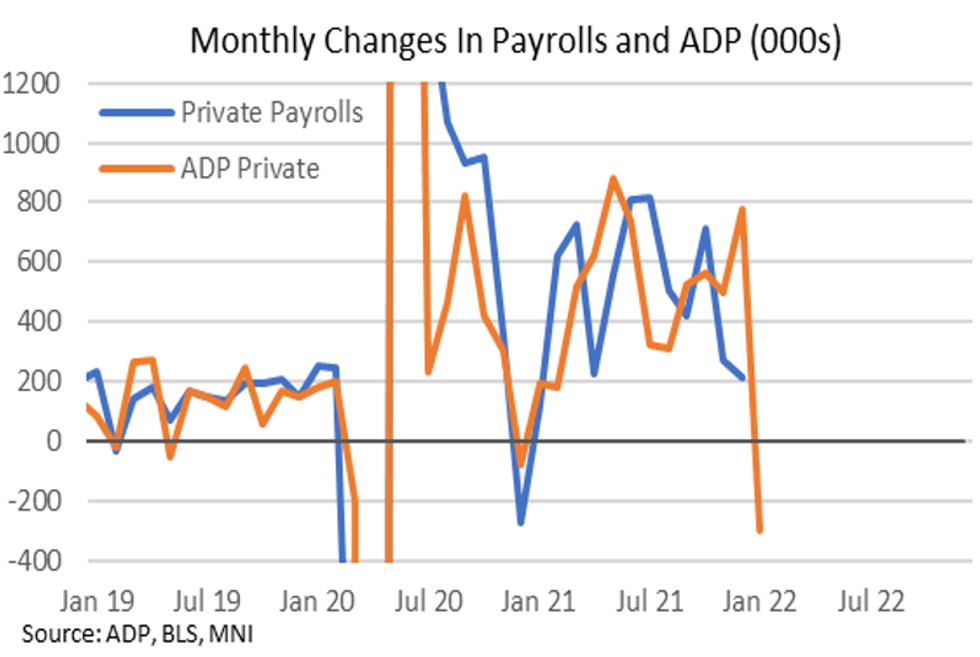

Fig. 1: Weak ADPs A Signal For Jan Payrolls?

NEWS:

US NONFARM PAYROLLS: January nonfarm payrolls are expected to have risen by +70K in the MNI Dealer Median, and +125k in the Bloomberg survey median, after the surprisingly low +199k in December. Risks are seen to the downside after a large miss in ADP at -301k(consensus has slowly nudged lower), and many wouldn’t be surprised by a negative print. The BBG survey range is again wide at -400k to +250k, with an average of just 51k and a very large standard deviation of 165k.

ECB (BBG): ECB “is ready to adjust its plans for the near future if necessary,” due to increasing price pressures in the euro area, Governing Council member Madis Muller says in blog post. ECB “may review how quickly we complete bond purchases” “All indications are that it’s time to move in a clear direction to reduce the European Central Bank’s support for the economic recovery”

ECB (RTRS): Inflation in Slovakia should peak in the spring, and then decline gradually during the rest of the year before dropping more significantly at the start of 2023, Slovak central bank Governor Peter Kazimir said on Friday. The central bank has said in its outlook that the price growth should peak at around 7% in the beginning of 2022.

NORGES BANK: As suspected by local press reports overnight, wires confirm the appointment of NATO Chief Stoltenberg as the next Norges Bank governor, replaced Oystein Olsen who departs at the end of February. Announcement wasn't due for another hour or so, so a little ahead of schedule but not too much of a surprise. Stoltenberg was considered one of the front-runners and is the current NATO Secretary General and former Prime Minister of Norway. Had previously been an economics lecturer and worked at Statistics Norway. Policy stance difficult to gauge, but is expected to retain pragmatic approach of prior committee. His candidacy has proved controversial as he would retain his NATO position for a further seven months and has close ties to the current government. Current Deputy Governor Ida Wolden Bache will assume the governor duties until Stoltenberg replaces her after concluding his term at NATO.

ECB SPF SURVEY: Headline inflation expectations for 2022 have been revised up to 3.0%, up to 1.8% (+0.1%) for 2023 and 1.9% for 2024 (not previously surveyed), according to the ECB's Q1 Survey of Professional Forecasters released Friday, with expectations for 2026 up to 2.0% from 1.9% in the previous round. If correct, that still leaves inflation below target in the medium term, a key pillar in the ECB's policy strategy. GDP growth expectations were revised down from 4.5% to 4.2% in 2022, up from 2.2% to 2.7% for 2023, and were unchanged at 1.5% longer-term. Expected unemployment was revised down by between 0.2% and 0.3% for all horizons, standing at 7.2% for 2022, 6.9% for 2023, 6.8% for 2024 and 6.7% longer-term. Uncertainty remained elevated compared with pre-pandemic levels.

BOJ (MNI BRIEF): The Bank of Japan may consider conducting an extraordinary outright purchase of Japanese Government Bonds (JGBs) and buying at a fixed-rate to curb higher yields if the 10-year yield continues rising next week, MNI understands. BOJ outright purchases of JGBs are not scheduled on Monday and Tuesday, and the BOJ plans to conduct operations on Wednesday. The 10-year JGB yield closed at 0.200% on Friday for the highest level since Jan. 29, 2016, when the BOJ announced the introduction of the negative interest rate policy

RUSSIA-CHINA: Reuters reporting that Russia has agreed a long-term gas supply deal with China. Guy Faulconbridge tweets: "Russian President Vladimir Putin toldChinese President Xi Jinping in Beijing on Friday that Russia has prepared anew deal to supply China with 10 billion cubic metres of natural gas from its Far East.." Some key comments from statement below:* "Russia and China oppose the actions of external forces to underminesecurity and stability in common adjacent regions, intend to resist theinterference of external forces under any pretext in the internal affairsof sovereign countries, oppose "color revolutions" and will increasecooperation in the above-mentioned areas."

DATA:

US: Primary Dealer NFP Estimates

| Primary Dealer | Estimate | Primary Dealer | Estimate |

|---|---|---|---|

| HSBC | +225K | Credit Suisse | +200K |

| Daiwa | +200K | Mizuho | +200K |

| Amherst Pierpoint | +170K | Societe Generale | +155K |

| BNP Paribas | +150K | Deutsche Bank | +150K |

| J.P.Morgan | +150K | RBC | +150K |

| BMO | +100K | Citi | +70K |

| Barclays | +50K | UBS | +50K |

| Nomura | -50K | Scotiabank | -100K |

| Wells Fargo | -100K | Bank of America | -150K |

| Jefferies | -200K | TD Securities | -200K |

| Morgan Stanley | -215K | Goldman Sachs | -250K |

| NatWest | -350K | -- | -- |

| Dealer Median | +70K | BBG Whisper Number | +5K |

MNI: GERMANY DEC FACTORY ORDERS +2.8%M/M, 5.5% Y/Y; NOV +2.3r% Y/Y

German factory orders rebound

DEC FACTORY ORDERS +2.8% M/M, +5.5% Y/Y; NOV +2.3r% Y/Y

- German factory orders beat forecasts, expanding +2.8% M/M in December. This is down from 3.6r% M/M in November, but significantly beating the forecast +0.3% M/M.

- Domestic orders were a key driver of this growth, increasing +11.7% M/M in December.

- In the annualised reading, factory order growth jumped to +5.5%, 2.5 points above the consensus forecast and significantly stronger than +2.3% Y/Y in November.

- In 2021, total German factory orders was 17.8% higher than 2020.

- Profits remain below pre-pandemic levels.

MNI BRIEF: NFC's Upbeat, Modest Wage Growth Seen: ECB Survey

Non-financial companies reported strong or growing demand across most sectors, but continuing supply constraints mean their ability to meet that demand is limited, the ECB’s latest Economic Bulletin released Friday reports, with electronic chips still in short supply.

Travel and tourism continue to recover, while service sector contacts were relatively upbeat despite the spread of Covid-19s omicon variant since November 2021. Low footfall in shops is being offset by an increase in online activity, retailers said.

Most contacts expressed optimism about the outlook for 2022, but higher and/or more persistent inflation, especially energy costs, was a concern - especially their capacity to reduce real disposable income and dampen demand. The survey also suggested that labour markets remain tight, with some shortages, albeit with geographical and sectoral variations, and the increased prevalence of home working. Wage growth is expected to pick up from around 2% to around 3% or more this year.

EZ DEC RETAIL SALES -3.0% M/M, +2.0% Y/Y; NOV +8.2%r Y/Y

Eurozone Retail weaker than expected

DEC RETAIL SALES -3.0% M/M, +2.0% Y/Y; NOV +8.2%r Y/Y

- Retail sales across the Eurozone slumped in December, falling almost two points further than the forecast to -3.0% m/m.

- The annual reading was also significantly weaker than consensus predicted, coming in at +2.0% y/y, three points lower than the forecast.

- Non-food product sales counted for the bulk of the slump, decreasing by 5.2% on the month.

- In November retail sales were strong for the region, implying that consumers pulled forward the Christmas shopping rush due to concerns over rising covid cases and supply chain disruptions impacting the festive season.

FIXED INCOME: Large volumes on the European open

- An incredibly busy open for Rates and Govies in early trade.

- All of the action was in rates, with massive selling of Bund and short term 3 months rate (Euribor), all in big volume sizes.

- Markets have now reversed and have unwound some of the opening price action, and the dust seems to be settling at the time of typing.

- Peripheral spreads sits wider, with Greece in the lead by 4.3bps.

- Greek/Bund spreads is widest since 28/05/20.

- Next upside resistance in the spread is seen at 201.03bps.

- Gilts have held onto gains this morning on position squaring, and the contract trades at the upper end of the range, up 13 ticks at the time of typing.

- Gilt/Bund is 2.5bps tighter, but within the 2022 ranges.

- Looking ahead, there is a few data on the calendar, but the street has already brushed aside the German factory order's beat, and it is very likely that investors will look through the US NFP, with ALL EYES turning to the US CPI on the 10th February.

- Near term attention is also on Central Bank speakers, given the latest hawkish rhetoric.

FOREX: EUR Extending Post-ECB Rally, Nearing Congestion Resistance

- EUR strength has persisted into a second session, with EUR/USD making further progress after topping the 100-dma of 1.1429 after yesterday's hawkish ECB press conference. This puts the pair just shy of congestion resistance layered between 1.1483 up to 1.1500, which could slow progress from here. EUR/GBP is similarly higher, extending the recovery off the multi-year low printed yesterday at 0.8285. This puts markets on track to test 0.8480 - the 61.8% retracement of the December - February downleg.

- Commodity-tied currencies are trading more poorly, with AUD and CAD among the session's worst performers. This retains the 50-dma in AUD/USD at 0.7164 as key resistance, which has contained rallies so far. The keeps the trend condition bearish and the recent bounce is considered corrective. The recent breach of key support at 0.6993/91, the Dec 3 2021 and Nov 2 2020 lows reinforced a bearish theme and confirmed a resumption of the downtrend and has opened 0.6963/21, the Jul 16 and Jul 14 2020 lows.

- Nonfarm payrolls takes focus going forward, with markets expecting job gains to slow to +125k in January vs. December's +199k. Nonetheless, there remains a wide range of estimates with a considerable tail skewed toward a negative reading, with a number of analysts looking for a reading as low as -250k.

- Canadian jobs data is also due, with the unemployment rate seen rising to 6.3% from 6.0% previously. A number of central bank speakers are also due, with BoE's Pill and Broadbent due as well as ECB's Villeroy.

EQUITIES: Tech Leading After Strong Amazon Earnings

- Japanese equities closed higher (China still closed for holidays): Japan's NIKKEI closed up 198.68 pts or +0.73% at 27439.99 and the TOPIX ended 10.64 pts higher or +0.55% at 1930.56.

- European stocks are mostly weaker, with the German Dax down 153.88 pts or -1% at 15209.12, FTSE 100 up 29.52 pts or +0.39% at 7558.27, CAC 40 down 25.54 pts or -0.36% at 6983.8 and Euro Stoxx 50 down 31.25 pts or -0.75% at 4109.59.

- U.S. futures are mostly higher, with the Dow Jones mini up 1 pts or +0% at 34972, S&P 500 mini up 17 pts or +0.38% at 4486, NASDAQ mini up 133.75 pts or +0.92% at 14626.

COMMODITIES: Precious Metals Continue To Bounce

- WTI Crude up $1.42 or +1.57% at $91.66

- Natural Gas up $0.13 or +2.56% at $5.017

- Gold spot up $8.48 or +0.47% at $1813.31

- Copper up $1.6 or +0.36% at $448.65

- Silver up $0.19 or +0.83% at $22.6186

- Platinum down $7.3 or -0.7% at $1029.08

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/02/2022 | 1215/1215 |  | UK | BOE Broadbent & Pill Monetary Policy Briefing | |

| 04/02/2022 | 1330/0830 | *** |  | US | Employment Report |

| 04/02/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 04/02/2022 | 1500/1000 | * |  | CA | Ivey PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.