-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI US OPEN: Latest Fed Hawkish Turn Getting Priced In

EXECUTIVE SUMMARY:

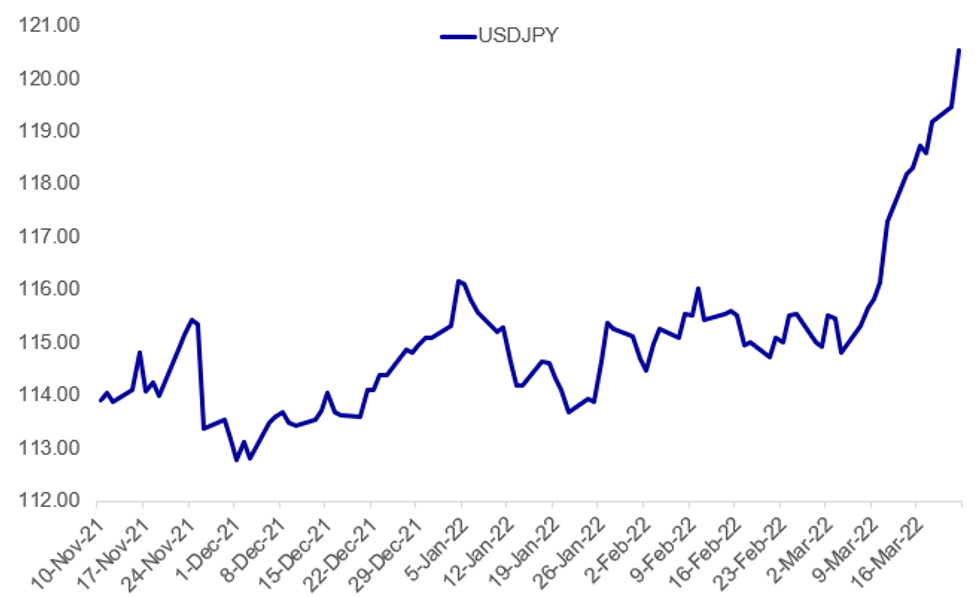

- JAPAN'S FINANCE MINISTER SAYS RAPID YEN MOVES ARE UNDESIRABLE

- UK FEB GOVERNMENT BORROWING EXCEEDS EXPECTATIONS

- GERMAN FINANCE MINISTER: GOV'T WILL DEPLOY FISCAL POLICY TO AVOID STAGFLATION

Fig. 1: Yen Weakens Further To 6-Yr Lows Vs USD

Source: BBG, MNI

Source: BBG, MNI

NEWS:

JAPAN / YEN (RTRS): Japanese Finance Minister Shunichi Suzuki said on Tuesday he was closely watching exchange-rate developments, warning that rapid moves in the yen were undesirable. He also told reporters a weak yen had both pros and cons for Japan's economy.

OIL (DJ): Oil prices erase earlier gains as doubts linger about the European Union's willingness to ban Russian oil imports. Brent crude oil is down 0.6% at $114.96 a barrel. Signs that the EU is getting close to banning Russian oil imports--as the U.S. and U.K. have said they will--have supported prices. But continued signs of discord in the 27 member bloc remain. Both Germany and the Netherlands have said that the bloc can't cut itself off Russian supplies right now.

NORGES BANK (MNI STATE OF PLAY): Norges Bank looks nearly certain to deliver its well-trailed 25-basis-point hike on Thursday following its March meeting, and could steepen its collective rate path to show four or even five rate hikes this year.

JAPAN (AP): Japan’s government alerted people of potential blackouts in the Tokyo region Tuesday because power supplies were low after several coal-fired plants temporarily stopped generating electricity following last week's earthquake. The rare alert, calling on households and companies to conserve power, comes as the Tokyo region is facing snow and unusually cold weather for early spring, prompting the use of heaters.

ECB (RTRS): The European Central Bank should consider Greece's economic progress when it decides whether to keep granting it funding despite its 'junk' credit rating in the coming days, the ECB's vice-president Luis de Guindos said on Tuesday. The ECB has been accepting Greek government bonds as collateral and even bought them under its latest emergency stimulus scheme, providing vital support to one of the euro zone's weakest economies. This so called waiver is due to expire in June but the ECB has already indicated it will keep buying Greek bonds as it invests proceeds from its Pandemic Emergency Purchase Programme (PEPP) and is expected to continue accepting them as collateral too.

ITALY: The economic flow-through of the war in Ukraine will have a deep impact in the Italian economy and growth is now forecast to be "around 3%" this year, undersecretary to the economy Maria Cecilia Guerra said Tuesday. That is more than one percentage point lower from the "above 4%" that the government forecast in late January.

DATA:

MNI: UK FEB PSNCR GBP2.478 BN

MNI: UK FEB PSNCR GBP2.48 BN

MNI BRIEF: UK Feb Government Borrowing Exceeds Expectations

UK public sector borrowing vastly exceeded expectations in February, hitting GBP13.112 billion, well above the GBP8.1 billion forecast by City economists and the Office for Budget Responsibility, data released Tuesday showed. The outcome is below the GBP15.479 billion recorded in February 2021.

Updated OBR forecasts are due on Wednesday, when Chancellor of the Exchequer Rishi Sunak delivers his spring statement.

As a percentage of GDP, debt rose to 94.7% of GDP from 94.4% a year earlier. Debt interest payments rose by GBP2.8 billion over the same month of 2021, to GBP8.2 billion, with GBP5.2 billion of that due to the rise in RPI, according to an ONS official. CGNR, excluding exceptional items fell to GBP1.553 billion from GBP6.363 billion in February of 2021. Over the year to date, borrowing fell to GBP138.4 billion from GBP290.9 billion a year earlier. The January repayment was revised sharply higher to GBP7.069 billion from GBP2.886 billion reported a month earlier, even though self-assessment receipts were revised down by GBP1.6 billion.

FIXED INCOME: Continuing sell-off after Powell's comments yesterday

After Powell's hawkish comments yesterday the fixed income sell-off continues as markets continue to price both more and quicker hikes for the Fed (and as a spillover to other markets like the UK, even where it seems much less likely we will see 50bp hikes given recent policymaker comments).

- USTs underperform across the curve with a slight bear flattening. Gilts also bear flattening with SONIA futures underperforming both Euribor and Eurodollar futures this morning. The German curve has bear steepened by 0.3bp.

- 10-year yields for Treasuries, Bunds and gilts are now all at cycle highs.

- Looking ahead to today, the data calendar is releatively light but there are a number of central bank speakers including ECB's Villeroy, Panetta, Lagarde and Lane, Fed's Wuerffel, William, Daly and Mester. There are a number of other senior central bankers due to speak at the BIS Innovation Summit (whichmay not have any near-term monpol implications).

- TY1 futures are down -0-11+ today at 122-26+ with 10y UST yields up 5.6bp at 2.348% and 2y yields up 6.7bp at 2.185%.

- Bund futures are down -0.94 today at 159.36 with 10y Bund yields up 4.0bp at 0.507% and Schatz yields up 4.0bp at -0.253%.

- Gilt futures are down -0.69 today at 120.66 with 10y yields up 3.9bp at 1.676% and 2y yields up 5.8bp at 1.371%.

FOREX: JPY Extends Downleg on Hawkish Fed

- The JPY is comfortably the poorest performer in G10 again Tuesday, with the USD/JPY uptrend accelerating on the break of the top of the bull channel, drawn from the Jun 1 2021 high. More importantly though, the USD has also cleared the psychological 120.00 handle. This confirms a resumption of the uptrend and strengthens bullish conditions for the pair.

- The move, initially triggered by Powell's particularly hawkish appearance at the NABE yesterday, looks to have legs, with options markets continuing to price out the likelihood of a meaningful move lower in USD/JPY that had been baked in during the early weeks of the Ukraine crisis. Reflecting this, USD/JPY risk reversals have risen for 11 of the past 12 sessions.

- European equities are picking up this morning, shrugging off the negative Wall Street close, and helping boost growth proxy currencies. AUD, NZD and SEK are among the stronger performers, while a pullback in the oil price works against NOK and CAD.

- Data releases take a backseat Tuesday, with little on the docket to divert attention away from the stacked central bank speaker schedule. There are four ECB speeches to digest, with the highlight being Lagarde at 1315GMT / 0915ET as well as Fed's Williams, Daly and Mester. BoE's Cunliffe also crosses.

EQUITIES: S&P Futures Test Monday's High

- Asian markets closed higher: Japan's NIKKEI closed up 396.68 pts or +1.48% at 27224.11 and the TOPIX ended 24.47 pts higher or +1.28% at 1933.74. China's SHANGHAI closed up 6.176 pts or +0.19% at 3259.862 and the HANG SENG ended 667.94 pts higher or +3.15% at 21889.28.

- European equities are heading higher, with financials leading: the German Dax up 143.12 pts or +1% at 14470.9, FTSE 100 up 38.03 pts or +0.51% at 7480.69, CAC 40 up 36.65 pts or +0.56% at 6619.44 and Euro Stoxx 50 up 35.85 pts or +0.92% at 3917.87.

- U.S. futures are a little higher, with S&P eminis testing Monday's high (4473): Dow Jones mini up 155 pts or +0.45% at 34591, S&P 500 mini up 18.75 pts or +0.42% at 4471, NASDAQ mini up 68 pts or +0.47% at 14438.

COMMODITIES: Oil Gives Back Overnight Gains

- WTI Crude down $0.82 or -0.73% at $111.3

- Natural Gas flat at $4.9

- Gold spot down $11.87 or -0.61% at $1924.34

- Copper down $1.15 or -0.24% at $469.85

- Silver down $0.15 or -0.58% at $25.0709

- Platinum down $11.11 or -1.07% at $1029.84

MNI: UK FEB PSNCR GBP2.478 BN

MNI: UK FEB PSNCR GBP2.48 BN

MNI BRIEF: UK Feb Government Borrowing Exceeds Expectations

UK public sector borrowing vastly exceeded expectations in February, hitting GBP13.112 billion, well above the GBP8.1 billion forecast by City economists and the Office for Budget Responsibility, data released Tuesday showed. The outcome is below the GBP15.479 billion recorded in February 2021.

Updated OBR forecasts are due on Wednesday, when Chancellor of the Exchequer Rishi Sunak delivers his spring statement.

As a percentage of GDP, debt rose to 94.7% of GDP from 94.4% a year earlier. Debt interest payments rose by GBP2.8 billion over the same month of 2021, to GBP8.2 billion, with GBP5.2 billion of that due to the rise in RPI, according to an ONS official. CGNR, excluding exceptional items fell to GBP1.553 billion from GBP6.363 billion in February of 2021. Over the year to date, borrowing fell to GBP138.4 billion from GBP290.9 billion a year earlier. The January repayment was revised sharply higher to GBP7.069 billion from GBP2.886 billion reported a month earlier, even though self-assessment receipts were revised down by GBP1.6 billion.

FIXED INCOME: Continuing sell-off after Powell's comments yesterday

After Powell's hawkish comments yesterday the fixed income sell-off continues as markets continue to price both more and quicker hikes for the Fed (and as a spillover to other markets like the UK, even where it seems much less likely we will see 50bp hikes given recent policymaker comments).

- USTs underperform across the curve with a slight bear flattening. Gilts also bear flattening with SONIA futures underperforming both Euribor and Eurodollar futures this morning. The German curve has bear steepened by 0.3bp.

- 10-year yields for Treasuries, Bunds and gilts are now all at cycle highs.

- Looking ahead to today, the data calendar is releatively light but there are a number of central bank speakers including ECB's Villeroy, Panetta, Lagarde and Lane, Fed's Wuerffel, William, Daly and Mester. There are a number of other senior central bankers due to speak at the BIS Innovation Summit (whichmay not have any near-term monpol implications).

- TY1 futures are down -0-11+ today at 122-26+ with 10y UST yields up 5.6bp at 2.348% and 2y yields up 6.7bp at 2.185%.

- Bund futures are down -0.94 today at 159.36 with 10y Bund yields up 4.0bp at 0.507% and Schatz yields up 4.0bp at -0.253%.

- Gilt futures are down -0.69 today at 120.66 with 10y yields up 3.9bp at 1.676% and 2y yields up 5.8bp at 1.371%.

FOREX: JPY Extends Downleg on Hawkish Fed

- The JPY is comfortably the poorest performer in G10 again Tuesday, with the USD/JPY uptrend accelerating on the break of the top of the bull channel, drawn from the Jun 1 2021 high. More importantly though, the USD has also cleared the psychological 120.00 handle. This confirms a resumption of the uptrend and strengthens bullish conditions for the pair.

- The move, initially triggered by Powell's particularly hawkish appearance at the NABE yesterday, looks to have legs, with options markets continuing to price out the likelihood of a meaningful move lower in USD/JPY that had been baked in during the early weeks of the Ukraine crisis. Reflecting this, USD/JPY risk reversals have risen for 11 of the past 12 sessions.

- European equities are picking up this morning, shrugging off the negative Wall Street close, and helping boost growth proxy currencies. AUD, NZD and SEK are among the stronger performers, while a pullback in the oil price works against NOK and CAD.

- Data releases take a backseat Tuesday, with little on the docket to divert attention away from the stacked central bank speaker schedule. There are four ECB speeches to digest, with the highlight being Lagarde at 1315GMT / 0915ET as well as Fed's Williams, Daly and Mester. BoE's Cunliffe also crosses.

EQUITIES: S&P Futures Test Monday's High

- Asian markets closed higher: Japan's NIKKEI closed up 396.68 pts or +1.48% at 27224.11 and the TOPIX ended 24.47 pts higher or +1.28% at 1933.74. China's SHANGHAI closed up 6.176 pts or +0.19% at 3259.862 and the HANG SENG ended 667.94 pts higher or +3.15% at 21889.28.

- European equities are heading higher, with financials leading: the German Dax up 143.12 pts or +1% at 14470.9, FTSE 100 up 38.03 pts or +0.51% at 7480.69, CAC 40 up 36.65 pts or +0.56% at 6619.44 and Euro Stoxx 50 up 35.85 pts or +0.92% at 3917.87.

- U.S. futures are a little higher, with S&P eminis testing Monday's high (4473): Dow Jones mini up 155 pts or +0.45% at 34591, S&P 500 mini up 18.75 pts or +0.42% at 4471, NASDAQ mini up 68 pts or +0.47% at 14438.

COMMODITIES: Oil Gives Back Overnight Gains

- WTI Crude down $0.82 or -0.73% at $111.3

- Natural Gas flat at $4.9

- Gold spot down $11.87 or -0.61% at $1924.34

- Copper down $1.15 or -0.24% at $469.85

- Silver down $0.15 or -0.58% at $25.0709

- Platinum down $11.11 or -1.07% at $1029.84

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/03/2022 | 1000/1100 | ** |  | EU | Construction Production |

| 22/03/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/03/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/03/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/03/2022 | 1300/0900 |  | HU | Hungarian National Bank policy decision | |

| 22/03/2022 | 1310/1410 |  | EU | ECB Panetta Opening CCP Risk Management Conference | |

| 22/03/2022 | 1315/1415 |  | EU | ECB Lagarde Speech at BIS Innovation Summit | |

| 22/03/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 22/03/2022 | 1515/1515 |  | UK | BOE Cunliffe Panels BIS Innovation Summit | |

| 22/03/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 22/03/2022 | 1700/1800 |  | EU | ECB Lane Panels Discussion on Flexible Exchange Rates | |

| 22/03/2022 | 1800/1400 |  | US | San Francisco Fed's Mary Daly | |

| 22/03/2022 | 2100/1700 |  | US | Cleveland Fed's Loretta Mester | |

| 23/03/2022 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 23/03/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 23/03/2022 | 0700/0700 | *** |  | UK | Producer Prices |

| 23/03/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 23/03/2022 | - |  | UK | OBR Economic and Fiscal Forecast | |

| 23/03/2022 | - |  | UK | DMO 2022-23 Financing Remit | |

| 23/03/2022 | 1200/1200 |  | UK | BOE Bailey Panels BIS Innovation Summit | |

| 23/03/2022 | 1200/0800 |  | US | Fed Chair Jerome Powell | |

| 23/03/2022 | 1230/1230 |  | UK | FY 2022/23 Budget statement | |

| 23/03/2022 | 1315/1415 |  | EU | ECB Lagarde Speech at BIS Innovation Summit | |

| 23/03/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 23/03/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 23/03/2022 | 1435/1035 |  | US | New York Fed's John Williams | |

| 23/03/2022 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/03/2022 | 1530/1530 |  | UK | DMO Quarterly Consultation Meetings Agenda | |

| 23/03/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 23/03/2022 | 1545/1145 |  | US | San Francisco Fed's Mary Daly | |

| 23/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 23/03/2022 | 1900/1500 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2022 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.