-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI US MARKETS ANALYSIS - USDJPY Touches Y125, First Time Since 2015

Highlights:

- JPY falls fast as Mr Yen opens tolerance band of Y130

- Equities on more solid footing as Ukraine-Russia meetings due tomorrow

- 10y Treasury yields touch new cycle best of 2.55%

US TSYS SUMMARY: First Inversion In 5s30s Since 2006

- Cash Tsy yields are off earlier highs but have still seen a sizeable bear flattening, driving the curve to new recent flats and in the case of 5s30s, the first inversion since 2006.

- A two-stage lockdown in Shanghai and the further inflationary pressure this could have helped drive the overnight sell-off, only partially reversed by Russia downplaying the chances of Putin and Zelensky meeting, noting a lack of progress in talks and noting Biden’s statements on Putin as being alarming.

- 2YY +7.1bps at 2.340%, 5YY +5.1bps at 2.596%, 10YY +1.5bps at 2.488%, 30YY +0.3bps at 2.588%.

- TYM2 sits 4 ticks lower on the day at 121-13+, but off an earlier low of 120-30+ which now forms first support just above 120-28, the continuation of the Dec 26, 2018 low. Volumes are solid for the day as a whole but have slowed down in recent trading.

- Data: Second tier data releases with wholesale & retail inventories, the advance goods trade balance and Dallas Fed manufacturing activity.

- Bond issuance: US Tsy $50B 2Y Note auction (1130ET) and US Tsy $51B 5Y Note auction (1300ET)

- Bill issuance: US Tsy $57B 13W, $48B 26W bill auctions (1130ET)

US 2s10s and 5s30s Tsy curvesSource: Bloomberg

US 2s10s and 5s30s Tsy curvesSource: Bloomberg

STIR FUTURES: Fed Priced For A Further 8.5 Hikes This Year

- Further supply side disruption fears from a two-stage lockdown in Shanghai have helped push Fed hike expectations even higher.

- This follows from an increasing number of analysts calling for multiple 50bp hikes on Friday, the pick being Citi looking for four consecutive 50bp hikes.

- Today’s adjustment has been in 2H22, struggling to price much more over immediate meetings.

- FOMC-dated Fed Funds futures for May and June meetings are unchanged from late Fri with 44bps for May and 88bps for June. The latter implies a 21% chance of 75bps, 57% of 100bps and 22% of 125bps over the two meetings.

- Further out, cumulative hikes for Dec are up another 10bps to a new high of 216bps.

Source: Bloomberg

Source: Bloomberg

EGB/GILT SUMMARY - A busy start for the week

- A busier start for the week for EGBs and Bund, and the latter has once again traded in a wide ranger, 102 ticks so far overnight and this morning.

- The contract traded 93 ticks with under 10k overnight, but liquidity has picked up, as Europe came in, and Yield testing another multi year high.

- This has been a continuation from the Friday's session, after more Banks upped their calls for 50bps hike for the US, with Citi joining on Friday and calling for four 50bps hikes (at each meeting).

- Similar story for Europe, as traders look to price four 25bps hike from the ECB this year, with inflation not abating.

- Peripheral spreads are all wider versus the German 10yr,, Greece is in the lead by 4.6bps.

- Gilts are also down, with Global Bonds, but outperform Germany a touch, translating in a 2.2bps wider spread.

- Looking ahead, BoE Bailey speaks on the Economy, while Rishi Sunak testifies to Parliament.

- Gilt futures are down 57 ticks at 120.07

- Bund futures are down -0.64 today at 158.01 with 10y Bund yields up 1.6bp at 0.600% and Schatz yields up 3.7bp at -0.107%.

- BTP futures are down -0.72 today at 137.38 with 10y yields up 4.1bp at 2.121% and 2y yields up 5.0bp at 0.243%.

- OAT futures are down -0.55 today at 150.83 with 10y yields up 1.2bp at 1.024% and 2y yields up 2.5bp at -0.84%.

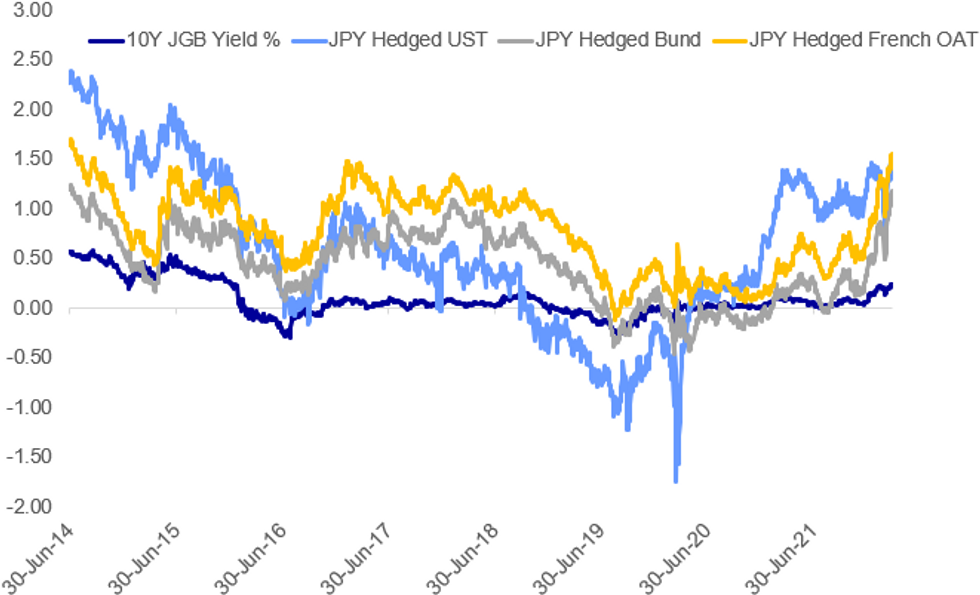

German And French JPY-Hedged Yields Increasingly Attractive

A quick look at 3-month JPY-hedged 10Y yields (ie from the perspective of Japanese investors) vs the 0.25% on offer for JGBs.

- Foreign instruments are becoming increasingly attractive from this perspective.

- The US nominal move vs JGBs is getting much of the attention but the hedged yield (1.43%) is not much higher than it was a year ago.

- However German (1.18%) and French (1.61%) 10Y hedged yields are the highest since 2014 and up 100+bp since a year ago.

Source: MNI, BBG

Source: MNI, BBG

EUROPE ISSUANCE UPDATE

Eurozone issuance: 0% Oct-28 EU NGEU:

The is the weakest demand we have seen for an EU bond since the EU ramped up its issuance programmes (initially through SURE then NGEU). However, today's market moves probably didn't help demand going into the auction.

- E2.498bln 0% Oct-28 EU NGEU, Avg yield 0.804% (Prev. -0.117%), Bid-to-cover 1.05x (Prev. 1.58x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXK2 157/156ps, sold at 34 in 3.4k

OEM2 128.50/127.50/126.50p fly bought for 14 and 14.5 in 40k

OEK2 129.50/130.50cs, bought for 22 in 5.2k

ERU2 99.625/99.875/100.00/100.25 1x1x1x0.5 call condor, bought for 6 in 15k

SX7E 16th Dec 100c, bought for 4.40 in 24k

US:

FVK2 114.25/113.0ps, sold at 33.5 in 20k (suggest rolling down strikes)

FOREX: JPY Plummets as Markets Opens Door to Y130

- JPY weakness was evident throughout the Asia-Pac session as well as the early European morning, but gains for USD/JPY and EUR/JPY really accelerated following the publication of an interview with former top currency chief Sakakibara (also known as Mr Yen), who stated that Japanese authorities do not need to take any action against current FX weakness, but should begin to intervene should USD/JPY cross Y130.00. This is considerably higher than the market's perceived tolerance band of Y125.00 for the pair, and helped spur fast money sales of the JPY vs. both the USD and EUR.

- The market moves open the door to the next key psychological level at Y130.00 - a level last crossed in 2002. Technical signals all point to a slowdown in gains for the pair in the near-term, with the RSI indicator now flashing at its most overbought level since 2001.

- As such, no surprise to see JPY at the bottom end of the G10 pile, with the greenback and EUR among the strongest. Markets continue to reshuffle monetary policy expectations, with Eurozone money markets now pricing over 50bps of rate hikes from the ECB by the December rate decision.

- Focus turns to US wholesale and retail inventories data as well as an appearance from the BoE governor Bailey, who speaks on the economy just a few hours after S&P downgraded their UK growth view, with accelerating inflation crimping on disposable income.

FX OPTIONS: Expiries for Mar28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0950-60(E1.0bln), $1.1000(E532mln)

- USD/JPY: Y120.50-70($649mln)

- USD/CAD: C$1.2535-50($1.0bln)

Price Signal Summary - USDJPY Rally Accelerates, 125.00 Beckons

- In the equity space, S&P E-Minis remain in a short-term uptrend. The contract continues to trade at levels above the 50-day EMA that intersects at 44166.83 today. Scope is seen for a climb towards 4578.50, the Feb 9 high. Initial support is at the 20-day EMA, at 4390.96. EUROSTOXX 50 futures continue to trade inside its current range and the recent consolidation still appears to be a bull flag - a continuation pattern that reinforces current bullish conditions. Attention is on the 50-day EMA at 3863.20. This average represents an important resistance. If cleared, it would further strengthen a bullish S/T theme and open 3965.50., the Feb 23 high.

- In FX, EURUSD breached support at 1.0961 earlier, the Mar 22 low. The break lower reinforces short-term bearish conditions following the recent pullback from 1.1137, Mar 17 high. An extension lower would open 1.0890, the Mar 9 low and 1.0806, the Mar 7 low and bear trigger. Key short-term resistance is at 1.1137, Mar 17 high. GBPUSD has failed to hold on to recent highs. The pullback means key resistance at 1.3331, the 50-day EMA, remains intact. Watch support at 1.3120, the Mar 22 low. A break would be bearish. USDJPY has started the week on a bullish note as today’s impulsive rally extends. The pair is through 124.00 and in the process has also cleared a number of short-term resistance levels. Current momentum suggests the USD still has the potential to extend this bull cycle, although it is worth noting that the pair is extremely overbought on the daily frequency. The focus is on the 125.00 psychological handle.

- On the commodity front, Gold remains bearish following the recent sharp pullback from the Mar 8 high of $2070.4. The move lower is allowing a recent overbought condition to unwind. Key support is seen at the 50-day EMA that intersects at $1901.9 - just ahead of the recent low of $1895.3 on Mar 15. Oil markets remain bullish despite the recent pullback. The next objective in WTI is $118.34, 76.4% of the Mar 7 - 15 downleg. Support to watch is at $104.70, the 20-day EMA.

- In the FI space, Bund futures remain bearish and have traded to a fresh cycle low today. The focus is on 157.33, the Oct 10 2018 low (cont). Gilts have also traded lower and the contract is through last week’s low 120.26 (Mar 24). The psychological 120.00 handle has been probed. This opens 119.75 next, the 123.6% retracement of the Feb 15 - Mar 1 climb.

EQUITIES: Europe Higher, With Financials Leading And Tech Lagging

- Asian markets closed mixed: Japan's NIKKEI closed down 205.95 pts or -0.73% at 27943.89 and the TOPIX ended 8.1 pts lower or -0.41% at 1973.37. China's SHANGHAI closed up 2.263 pts or +0.07% at 3214.503 and the HANG SENG ended 280.09 pts higher or +1.31% at 21684.97.

- European stocks are higher, with the German Dax up 212.98 pts or +1.49% at 14515.15, FTSE 100 up 23.77 pts or +0.32% at 7506.26, CAC 40 up 71.84 pts or +1.1% at 6624.58 and Euro Stoxx 50 up 55.06 pts or +1.42% at 3922.13.

- U.S. futures are flat/lower, with the Dow Jones mini up 26 pts or +0.07% at 34785, S&P 500 mini down 0.5 pts or -0.01% at 4536, NASDAQ mini down 30.75 pts or -0.21% at 14725.75.

COMMODITIES: Oil Softer - WTI Either Side of $110

- Brent Option Expiry Today: 186k calls expiring today and 179k puts with 115$/bbl the nearest strike price of interest for calls and puts

- Largest put interest at 110$/bbl and call interest 125$/bbl and above

- Total call open interest 1.758m calls vs 1.472m puts shows more positions still in place to cover upside risk.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/03/2022 | 1100/1200 |  | UK | BOE Bailey in Conversation w. Guntram Wolff | |

| 28/03/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/03/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 28/03/2022 | 1430/1530 |  | UK | DMO Consultation Gilt Issuance 2022/23 | |

| 28/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 28/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 28/03/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 28/03/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 29/03/2022 | 0030/1130 | ** |  | AU | Retail Trade |

| 29/03/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/03/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 29/03/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 29/03/2022 | 0700/0900 |  | ES | Spain Retail Sales | |

| 29/03/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/03/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/03/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 29/03/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 29/03/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 29/03/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 29/03/2022 | 1300/0900 |  | US | New York Fed's John Williams | |

| 29/03/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 29/03/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 29/03/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 29/03/2022 | 1445/1045 |  | US | Philadelphia Fed's Patrick Harker | |

| 29/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.