-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI US OPEN: March Payroll Gains In Focus

EXECUTIVE SUMMARY:

- MNI NONFARM PAYROLLS DEALER MEDIAN: +520K

- LAVROV: RUSSIA IS PREPARING RESPONSE ON UKRAINE'S PROPOSALS

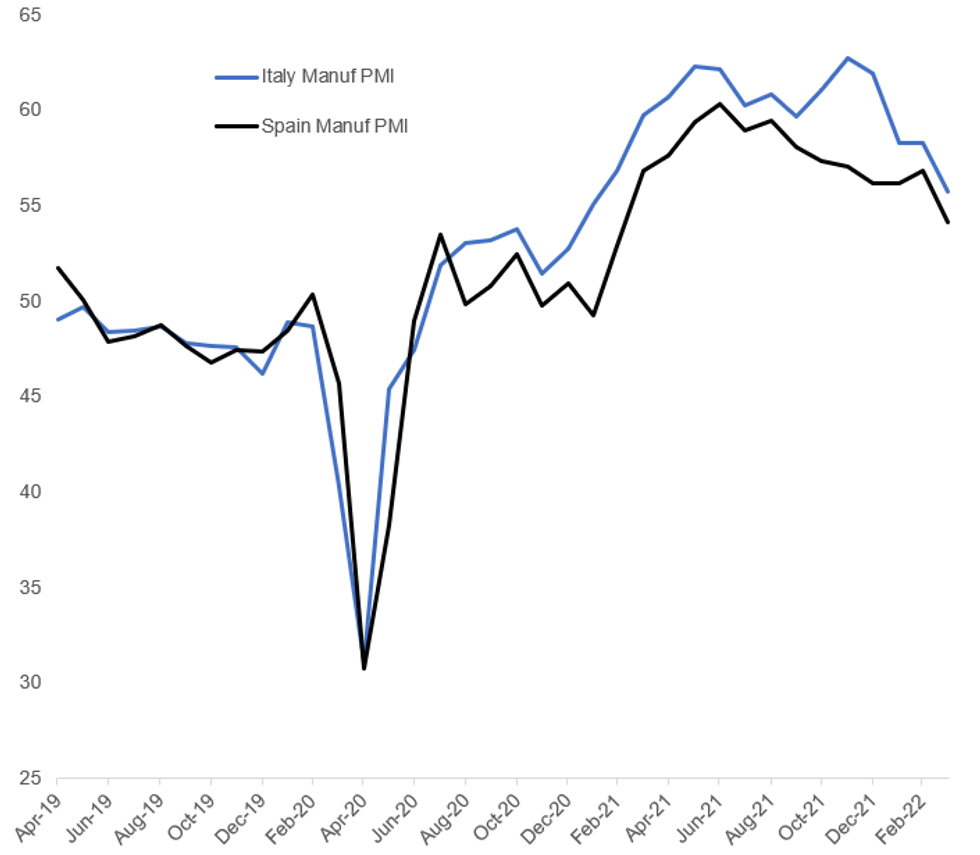

- ITALIAN, SPANISH PMIS WEAKER THAN EXPECTED

- EUROZONE INFLATION SPIKES HIGHER IN MARCH

- PBOC LIKELY TO EASE AS LOCKDOWNS HIT OUTPUT: ADVISORS (MNI)

Fig. 1: European PMIs Continue To Sag

Source: S&P Global

Source: S&P Global

NEWS:

US NONFARM PAYROLLS PREVIEW: March nonfarm payrolls are expected to have risen by 490k according to theBloomberg median. There are a few much softer forecasts although the majorityof views are relatively tightly packed between 450-550k and the primarydealer median sits at 520k. See the full report, including previews from eight sell side analysts plus the St Louis Fed's model, here: https://marketnews.com/mni-us-payrolls-preview-eyes-on-wages-slack

RUSSIA-UKRAINE (BBG): Russia is preparing a response to Ukraine’s proposals on security guarantees and ending war, Foreign Minister Sergei Lavrov says in televised comments at press briefing in New Delhi. Talks with Ukraine must continue. Ukrainian side showed “more understanding” of realities in Crimea, Donbas. Russia is ready to discuss Ukraine’s proposals on non-nuclear, neutral status.

EUROPE ENERGY (BBG): Natural gas prices in Europe fluctuated as traders weighed the potential impact on the market by Russia’s decision to shift payment for its supplies to rubles, with colder weather also set to boost demand. Benchmark gas futures fell after jumping as much as 5.6% earlier on Friday. President Vladimir Putin’s demand to be paid in rubles for the fuel has been looming for days, with traders on edge about how that may affect flows. Foreign buyers will need to open special ruble and foreign currency accounts with Russia’s Gazprombank JSC to handle payments, according to a Kremlin decree on Thursday. Russia said that flows will continue to Europe, but the lack of details on the new mechanism has left buyers scratching their heads amid uncertainties on the impact on contracts. Many consumers are still waiting to unpick the move.

PBOC (MNI): The People's Bank of China is likely to respond to the double blow to the economy from the most serious Covid outbreak since April 2020 and rising raw material costs with a cut to banks' reserve requirements and increased liquidity injections in the second quarter, but Federal Reserve tightening makes benchmark rate cuts less possible, policy advisors and experts told MNI. For full article contact sales@marketnews.com

RUSSIA-UKRAINE (RTRS): Russia is continuing to withdraw some of its forces from Ukraine's northern Kyiv region and they are heading towards Belarus, the local governor said on Friday. "We are observing the movement of joint (Russian) vehicle columns of various quantities," Governor Oleksandr Pavlyuk wrote on the Telegram messaging app. He said Russian forces had left the village of Hostomel, which is next to an important, but was digging in at the town of Bucha. Reuters was unable to verify the information.

RUSSIA (RTRS): Russia's central bank said on Friday it was softening restrictions on foreign fund transfers for individuals for a six-month period. The bank said the measures, which raise an earlier limit on funds that can be transferred abroad, did not apply to residents and non-residents from countries that had imposed sanctions against Russia over Ukraine. "Within a calendar month, individuals have the right to transfer no more than 10,000 U.S. dollars or the equivalent in another currency from the Russian Federation from their account in a Russian bank to their account or to another person abroad," the bank said in a statement.

RUSSIA-INDIA (RTRS): Russian Foreign Minister Sergei Lavrov began meetings with India's leaders in New Delhi on Friday after seeing his Chinese counterpart earlier in the week, as Moscow tries to keep the Asian powers on its side amid Western sanctions. Lavrov's mission to shore up support from a country Moscow has long regarded as a friend comes a day after senior U.S. and British officials held talks in New Delhi to persuade the Indian government to avoid undermining sanctions imposed after Russia invaded Ukraine in late February. U.S. Secretary of State Antony Blinken also spoke by telephone with India's foreign minister, Subrahmanyam Jaishankar, late on Thursday to discuss "the worsening humanitarian situation in Ukraine" and other matters.

DATA:

PREVIEW: Primary Dealer NFP Estimates

| Dealer | Estimate | Dealer | Estimate |

|---|---|---|---|

| Goldman Sachs | +575K | Jefferies | +560K |

| Nomura | +560K | Barclays | +550K |

| Credit Suisse | +550K | J.P.Morgan | +550K |

| Morgan Stanley | +550K | RBC | +550K |

| Bank of America | +525K | Societe Generale | +525K |

| UBS | +525K | Amherst Pierpoint | +520K |

| Daiwa | +500K | BMO | +490K |

| Citi | +490K | HSBC | +475K |

| Scotiabank | +450K | Wells Fargo | +450K |

| Deutsche Bank | +400K | BNP Paribas | +375K |

| Mizuho | +350K | TD Securities | +350K |

| NatWest | +200K | -- | -- |

| Dealer Median | +520K | BBG Whisper | +529K |

MNI: SPAIN MAR MFG PMI 54.2; FEB 56.9

MNI: ITALY MAR MFG PMI 55.8; FEB 58.3

MNI: FRANCE FINAL MAR MFG PMI 54.7; FLASH 54.8; FEB 57.2

GERMANY FINAL MAR MFG PMI 56.9; FLASH 57.6 FEB 58.4

MNI: EUROZONE FINAL MAR MFG PMI 56.5; FLASH 57.0; FEB 58.2

MNI: SWISS MAR CPI +0.6% M/M, +2.4% Y/Y; FEB +2.2% Y/Y

MNI: SWISS FEB RETAIL SALES +0.3% M/M, +12.8% Y/Y

Euro Area Inflation Spikes Higher In March

EZ FLASH HICP MAR +2.5% M/M, +7.5% Y/Y; FEB +5.9% Y/Y

EZ FLASH CORE HICP MAR +1.2% M/M, +3.0% Y/Y; FEB +2.7% Y/Y

- Eurozone March flash headline inflation far exceeded early forecasts, but was largely inline with updated expectations following the release of far stronger than expected national data earlier this week.

- The main components of euro area inflation, energy is expected to have the highest annual rate in March (44.7%, compared with 32.0% in February)

- Core inflation (Ex Energy, Food, Tobaco and Alcohol was also higher, setting a fresh euro era high at 3.0% y/y, but just shy of an expected 3.1% y/y reading

FIXED INCOME: Lower, but some reversal after inflation data

Core fixed income had been trending lower through most of the European morning session but the release of European inflation data at 10:00GMT / 5:00ET has seen the selloff stall with Bunds and gilts retracing a large portion of their moves lower today. This has happened despite the headline data coming in 0.8ppt above the early economic consensus expectations. We had thought that market expectations would be close to the level of the actual release but it appears there may have been some investors positioning for an even higher print.

- Later today the focus will turn to US data with the employment report and ISM manufacturing both due for release. Although less market moving than CPI at present, these are both still potential market movers.

- There is also focus on any further escalation of the Russia-EU escalation over gas payments.

- TY1 futures are down -0-23 today at 122-05 with 10y UST yields up 6.0bp at 2.401% and 2y yields up 4.9bp at 2.386%.

- Bund futures are down -0.22 today at 158.44 with 10y Bund yields up 2.1bp at 0.566% and Schatz yields up 1.7bp at -0.63%.

- Gilt futures are down -0.16 today at 121.07 with 10y yields up 3.0bp at 1.639% and 2y yields up 2.5bp at 1.369%.

FOREX: AUD Nears Key Resistance Ahead of NFP

- JPY is trading weaker as markets partially reverse the recovery off the week's multi-year low, running in contrast with the softer equity market after the risk-off wave pushing stocks lower into Thursday's quarterly close.

- AUD is trading more favourably, with AUD/USD back above $0.7500 and narrowing the gap with the cycle high at 0.7540 printed on Mar28. Progress through here opens 0.7556, the Oct 28 High and a key resistance.

- Markets remain on watch for any further steps toward a ceasefire made at new negotiations between Russian and Ukrainian representatives today. Comments from Lavrov today suggest there has been movement forward between the two sides, and that Russia has seen "much more understanding" from the Ukrainian side.

- Nonfarm payrolls for March takes focus going forward, with markets expecting job gains of 490k - a slightly slower pace of job gains relative to the 678k seen in February. Full MNI preview here: https://marketnews.com/mni-us-payrolls-preview-eye...

- ISM Manufacturing data follows 90 minutes later, with prices paid subcomponent seen rising once again to 80.0. ECB's De Cos, Makhlouf and Fed's Evans are due to speak.

EQUITIES: Energy And Financials Leading Gains, Tech Lagging

- Asian markets closed mixed: Japan's NIKKEI closed down 155.45 pts or -0.56% at 27665.98 and the TOPIX ended 2.13 pts lower or -0.11% at 1944.27. China's SHANGHAI closed up 30.514 pts or +0.94% at 3282.717 and the HANG SENG ended 42.7 pts higher or +0.19% at 22039.55.

- European equities are a little higher, with the German Dax up 13.87 pts or +0.1% at 14427.12, FTSE 100 up 32.95 pts or +0.44% at 7538.68, CAC 40 up 28.55 pts or +0.43% at 6668.36 and Euro Stoxx 50 up 9.23 pts or +0.24% at 3908.15.

- U.S. futures are higher, with the Dow Jones mini up 133 pts or +0.38% at 34751, S&P 500 mini up 16.75 pts or +0.37% at 4547.5, NASDAQ mini up 47.25 pts or +0.32% at 14916.

COMMODITIES: WTI Below $100

- WTI Crude down $0.92 or -0.92% at $99.38

- Natural Gas up $0 or +0.04% at $5.633

- Gold spot down $3.5 or -0.18% at $1931.97

- Copper down $4.75 or -1% at $470.3

- Silver down $0.08 or -0.32% at $24.7052

- Platinum up $3.16 or +0.32% at $988.99

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/04/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/04/2022 | 1230/0830 | *** |  | US | Employment Report |

| 01/04/2022 | 1305/0905 |  | US | Chicago Fed's Charles Evans | |

| 01/04/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/04/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/04/2022 | 1400/1000 | * |  | US | Construction Spending |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.