-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Yields Up Ahead Of CPI

EXECUTIVE SUMMARY:

- MNI US CPI PREVIEW: CORE SERVICES EYED AS ENERGY RIPS

- GERMAN ZEW SENTIMENT INDICATORS SEE MODERATE APRIL DECLINES

- CHINA WILL SPEED UP LOCAL GOV'T SPECIAL BOND ISSUANCE TO SPUR INVESTMENT

- UK JOBS MARKET BUOYANT AS UNEMPLOYMENT RATE FALLS

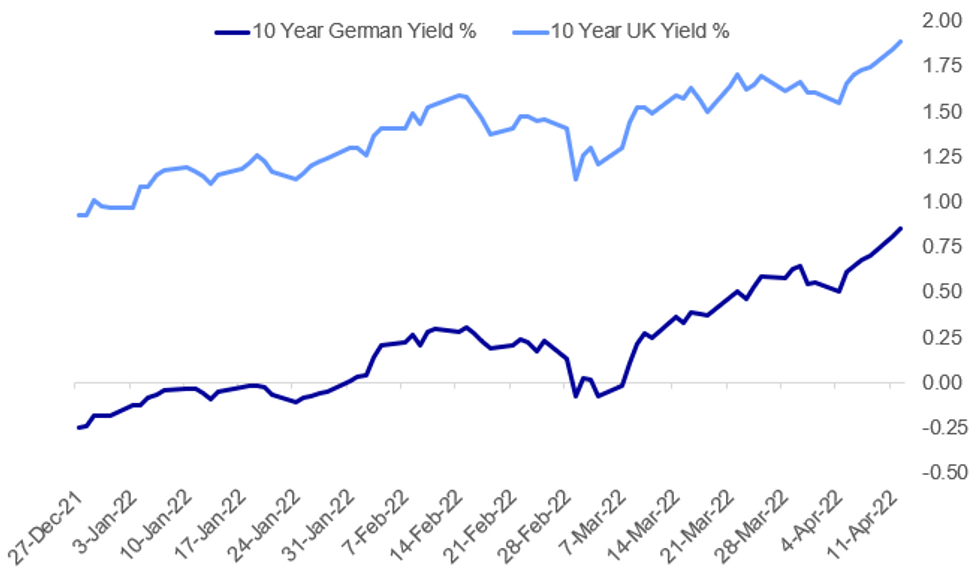

Fig. 1: European Yields Continue To Set New Highs

Source: BBG, MNI

Source: BBG, MNI

NEWS:

MNI US CPI PREVIEW: Consensus has headline CPI surging +1.2% M/M in March on sharp rises in energy (~12% M/M) and less so food (1% M/M). Core inflation is seen at +0.5% M/M from +0.51% M/M in Feb on a larger dip in used car prices, with potential risk to the downside judging by the survey skew. That would see year-ago inflation rise from 6.4% to 6.6% Y/Y, again likely the peak for the cycle. This should come as core goods inflation moderates further but with continued strength in potentially stickier core services after the fastest sequential print since 1992 in Feb. Click for full piece.

- Ifop-Fiducial poll: Presidential run-off election Macron (EC-RE): 52.5% (+0.5), Le Pen (RN-ID): 47.5% (-0.5), +/- vs. 5 - 8 April. Fieldwork: 10 - 11 April 2022. Sample size: 1,003

- One of the deciding factors of the second round election will be how those voters who opted for Melenchon in the first round decide to vote in the second. At present, polls point in a positive direction for Macron. Melenchon secured an outperforming 22% of the vote in the first round. Of these, 39% stated that they would switch their votes to Macron, compared to 20% to Le Pen (41% said they would not vote).

DATA:

MNI: UK MAR CLAIMANT CHG -46900

UK RTI MARCH PAYROLLS +35,000 TO 29.6 MLN: ONS

MNI BRIEF: UK Jobs Market Buoyant As Unemployment Rate Falls

The UK jobless rate fell to 3.8% in the December to February period, matching its lowest level since the fourth quarter of 2019. The rate, in line with analysts expectations, has not been lower since 1974. The decline came despite a smaller-than-forecast 10,000 rise in LFS employment; analysts had been expected a 52,000 increase.

The employment rate actually fell to 75.5% from 75.6% in the November to January period, while the inactivity rate increased to 21.4% from 21.3% previously.

The rising inactivity rate is largely due to increasing long-term sickness and retirement. Vacancies rose by 50,000 in the three months to March over the three months to December, hitting a record-high 1.288 million. That’s the lowest increase since the three months to April 2021.

GERMANY: March Flash CPI Confirmed at +7.3%

MAR FINAL HICP +2.5% M/M, +7.6% Y/Y; FEB +5.5 Y/Y

MAR FINAL CPI +2.5% M/M, +7.3% Y/Y; FEB +5.1% Y/Y

- German inflation was confirmed at +7.3% y/y in March, the highest level since German reunification and similar to 1981 levels. Core inflation rose 3.6% y/y.

- Prices accelerated 2.5% m/m, due to soaring energy prices and persistent supply bottlenecks continuing to inflate input prices.

- Energy prices rose 39.5% y/y in March (Feb: +22.5%), of which heating oil was up 144.0%, followed by motor fuel rising 47.4%.

- Food prices grew by +6.2% y/y.

GERMANY: ZEW Sentiment Indicators See Moderate April Declines

APRIL ZEW CURRENT CONDITIONS -30.8 (FCST -35.0); MAR -21.4

APRIL ZEW EXPECTATIONS -41.0 (FCST -48.5); MAR -39.3

- Germany's ZEW sentiment indicators saw substantially milder declines than anticipated in the April survey.

- The current conditions index fell by 9.4 points, less than the 13.6-point drop expected. The future expectations indicator inched down by 1.7 points, compared to a 9.2-point expected fall.

- This is the second consecutive month of falling confidence since the onset of the Ukraine war, with both indicators hovering around the initial pandemic shock of March 2020.

- We highlight that inflation expectations fell significantly by 43.4 points in April, a reduction of about half the inflation indicator's jump seen in March. Just under half of the surveyed experts saw inflation increasing in the next six months- an optimistic shift for this indicator.

- The ECB has indicated two-way risks of dampened economic growth outlooks against a backdrop of soaring inflation intensified by the Ukraine war. Economic sentiment indicators will be vital in assessing the effects on growth expectations in the upcoming Thursday meeting.

FIXED INCOME: Looking ahead of US CPI

The European morning session hasn't really seen any big market moving headlines per se, but core fixed income has continued to move lower (albeit now off its lows of the day). There have been new cycle highs posted once again for most maturities across UST, gilts and the German curve.

- The highlight of the day will be the US CPI print. Given market pricing, we think a print thats higher than expected could firm up 50bp for May even more, and may even start to bring 75bp into question while a miss is likely to see the 240bp of hikes priced in for this year look a little overbaked.

- TY1 futures are down -0-6+ today at 119-17+ with 10y UST yields up 1.7bp at 2.799% and 2y yields up 3.5bp at 2.537%.

- Bund futures are down -0.46 today at 154.57 with 10y Bund yields up 3.6bp at 0.850% and Schatz yields up 1.7bp at 0.145%.

- Gilt futures are down -0.29 today at 118.75 with 10y yields up 2.6bp at 1.872% and 2y yields up 1.6bp at 1.567%.

FOREX: AUD Bounces Off Overnight Lows as China Stocks Erase Early Weakness

- AUD is the strongest currency on the day across G10, with AUD/USD bouncing off overnight lows of $0.7400 in a move that coincided with a late recovery in Asia-Pacific equities. After sustaining losses of close to 1% at the midday break, the Shanghai Comp rose sharply on the resumption of trade, resulting in a near 2.5% swing for the index - a move that will likely raise questions around potential official involvement via state-run pension funds.

- GBP trades a little softer following jobs data this morning that showed payrolled employees rose by a smaller margin than forecast, with the February release also seeing a negative revision. GBP/USD edged to new lows of 1.2994 following the release, narrowing the gap with the first support of 1.2983 - the Apr 8 low.

- Lastly, the USD Index is very slightly higher - rising around 0.2% into the NY crossover having erased opening weakness. Focus turns to the looming US inflation release as well as the formal beginning of US earnings season, which sees a number of large US bank names report this week.

- Focus turns to the US CPI release, at which markets expect M/M CPI to rise to 1.2% and for the Y/Y release to hit 8.4% - the highest rate since the early 1980's.

EQUITIES: European Stocks Weaker With Non-Cyclicals Lagging (And Tech/Energy Up)

- Asian markets closed mixed: Japan's NIKKEI closed down 486.54 pts or -1.81% at 26334.98 and the TOPIX ended 26.01 pts lower or -1.38% at 1863.63. China's SHANGHAI closed up 46.204 pts or +1.46% at 3213.33 and the HANG SENG ended 110.83 pts higher or +0.52% at 21319.13

- European equities are weaker, with the German Dax down 158.39 pts or -1.12% at 14034.02, FTSE 100 down 31.22 pts or -0.41% at 7585.79, CAC 40 down 60.72 pts or -0.93% at 6494.49 and Euro Stoxx 50 down 32.11 pts or -0.84% at 3807.73.

- U.S. futures are mixed/flat, with the Dow Jones mini down 36 pts or -0.11% at 34183, S&P 500 mini down 3.5 pts or -0.08% at 4405.5, NASDAQ mini up 7 pts or +0.05% at 14007.

COMMODITIES: WTI Rallies 5% From Monday Lows

- WTI Crude up $2.87 or +3.04% at $96.94

- Natural Gas up $0.14 or +2.12% at $6.781

- Gold spot down $1.92 or -0.1% at $1951.41

- Copper up $5.1 or +1.1% at $468.5

- Silver down $0.16 or -0.62% at $24.943

- Platinum down $16.53 or -1.68% at $964.87

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/04/2022 | 1230/0830 | *** |  | US | CPI |

| 12/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/04/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 12/04/2022 | 1610/1210 |  | US | Fed Governor Lael Brainard | |

| 12/04/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/04/2022 | 1700/1300 |  | US | Philadelphia Fed's Patrick Harker | |

| 12/04/2022 | 1800/1400 | ** |  | US | Treasury Budget |

| 12/04/2022 | 2245/1845 |  | US | Richmond Fed's Tom Barkin | |

| 13/04/2022 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 13/04/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 13/04/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 13/04/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/04/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 13/04/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 13/04/2022 | 0900/1100 | ** |  | EU | industrial production |

| 13/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/04/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 13/04/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 13/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 13/04/2022 | 1500/1100 |  | CA | BOC Governor Press Conference | |

| 13/04/2022 | 1630/1230 |  | US | Richmond Fed's Thomas Barkin | |

| 13/04/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.