-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - BoJ Open Door to New USDJPY Highs

Highlights:

- RUB gas payments remain a focus amid signs of division in Europe

- JPY weakness countered by MoF caution

- USD Index propelled to new cycle high

US TSYS SUMMARY: Treasuries See A Modest Rally Ahead Of US GDP

- After some sizeable swings in recent days, cash Tsys are slowly giving back some of yesterday’s sell-off, modestly outperforming core Europe with German inflation potentially coming in higher judging by state releases.

- With moves broadly across the curve, 2s10s keeps to 25bps, the higher end of this week after steepening yesterday.

- 2YY -2.8bps at 2.563%, 5YY -2.5bps at 2.799%, 10YY -2.3bps at 2.809%, 30YY -1.9bps at 2.902%.

- TYM2 is 4 ticks at 119-29+ on average volumes. Recent gains are still viewed as corrective with a primary trend remaining downward, with next support at the bear trigger of 118-08 (Apr 22 low). Resistance sits closer, the 20-day EMA of 120-17.

- Data: The pick is the first estimate of Q1 GDP (consensus +1% annualised after surging +6.9% in Q4) including core PCE - 0830ET

- Bill issuance: US Tsy $35B 4W, $30B 8W bill auctions – 1130ET

- Bond issuance: US Tsy $44B 7Y Note auction (91282CEM9) – 1300ET

STIR FUTURES: Fed Funds Hike Expectations Looking For Drivers

- Hikes implied by Fed Funds futures sit little changed from late yesterday levels, i.e. locking in a 50bp hike next week with a cumulative 106bps for June and 237bps to year-end.

- The 106bps for June is close to where it’s averaged since Mester pushed back against a 75bp hike last week, keeping within +/-2bps ever since.

- We’re still not sure what caused the particularly large lurch higher in OIS-derived June pricing overnight, but it is now back in line with the 106bps from FF futures (a miss print looks most likely).

Fed Funds and OIS implied cumulative Fed hikes for June meetingSource: Bloomberg

Fed Funds and OIS implied cumulative Fed hikes for June meetingSource: Bloomberg

EGB/GILT SUMMARY: Mixed Trading

European government bonds have traded mixed this morning while equities have pushed higher and the US dollar has posted broad gains against G10 FX.

- Gilts have traded weaker this morning with yields up 1-3bp.

- The bund curve has slightly bear flattened with the 2s30s spread narrowing 2bp.

- The OAT curve has marginally twist flattened with the 2s30s spreading trading down 1bp.

- BTPs have lacked clear direction while trading broadly firmer on the day.

- The ECB's Ignazio Visco has stated that a rate adjustment could come in Q3 or by end-year.

- German regional CPI data for April has been mixed with some states reporting an acceleration from the previous month and others a deceleration. The national estimate will be published at 1300GMT.

- Elsewhere, the preliminary April estimate for Spanish inflation came in below expectations (8.3% Y/Y vs 9.0% expected).

- Focus shifts to the first estimate of US Q1 GDP later today.

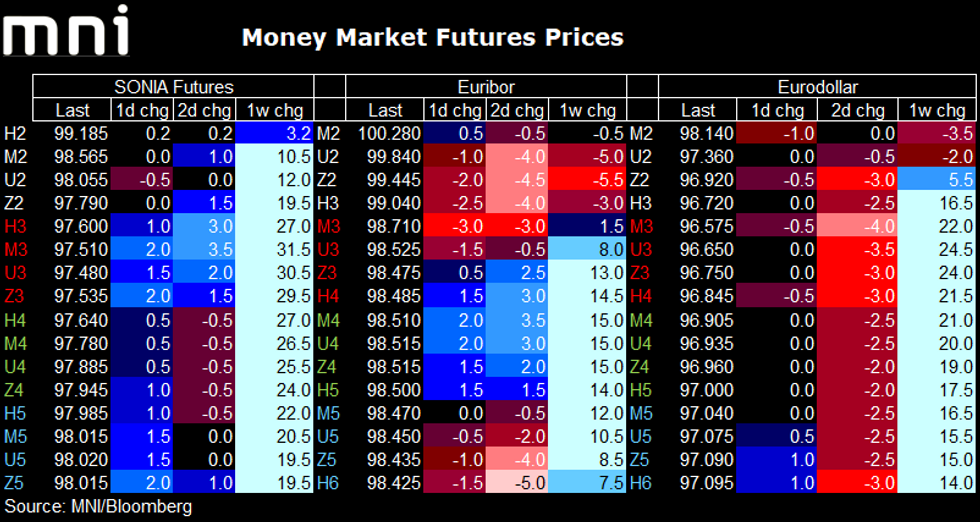

EUROPEAN STIRS: Waiting for German inflation and US GDP

- Outside of a relatively short-lived rally (and relatively small in size relative to recent moves) for both Euribor and Eurodollar futures which followed the release of the softer-than-expected Spanish inflation print this morning, Euribor and Eurodollar futures are only a couple of ticks away from yesterday's close (although there has been some movement lower in Euribor Whites and higher in Blues, so a little bit of a curve shift.

- SONIA futures are also largely unchanged versus yesterday's close but there has been a little more volatility this morning (with little in the way of major headline triggers).

- Looking ahead, the release of the national print of German inflation (if it sees a surprise more than a tenth or 2 higher) and US Q1 GDP will be the main triggers for big STIR moves through the rest of the day.

CHINA: To Cut Stock Transaction Clearing Fee By Half To Boost Equities

- China announced earlier that it will cut the A-share stock transaction fee to 0.01% (of total amount) in Shanghai and Shenzhen stock exchanges (from 0.02%) to boost equities, which have remained vulnerable despite rate cuts and rising ‘liquidity’.

- The cut will be effective on April 29.

- The sharp deceleration in the Chinese economic activity in the past year due to the strict ‘zero-Covid’ policy has been weighing on domestic asset prices, particularly equities.

- Hang Seng Index is down 35% from its high reached in February 2021 (which corresponds to the peak in the Chinese economy), and risky assets have not been able to bounce back despite China officials’ efforts (easing policy, measures to crack down on ‘malicious short sellers’, rising TSF…).

- HSI found support slightly below the 20,000 level on Wednesday; a break below that level would have opened the door for a move down to 18,235.50 (March 15 low).

- On the topside, resistance to watch stands at 21.287.60, which corresponds to the 23.6% Fibo retracement of the 18,235.50 - 31,168.30 range.

Source: Bloomberg/MNI

EUROPE OPTION FLOW SUMMARY:

Eurozone:

UBM2 179/177/176p fly sold at 72 in 1.75k

UBU2 185/183/181p fly, bought for 10 in 4k

OEM2 127/126.5/126.25p fly, bought for 8 in 2.5k

2RU2 9900/9937/9962 broken c fly, bought for 5 in 2k

FOREX: USD/JPY Through Y130 as BoJ Give The All Clear

- The Bank of Japan overnight gave the greenlight for further JPY weakness, as the board reinforced their message that yield curve control will be in place until the economy enters a sustainable recovery. This keeps the BoJ committed to easing policy going forward - running a starker contrast with Fed ahead of next week's FOMC decision.

- The market response was to run USD/JPY through Y130.00 and to new cycle highs of Y130.96. The next upside level to watch in the pair crosses at the 131.96 mark - the 1.00 projection of the Feb 24 - Mar 28 - 31 price swing. Needless to say, JPY is comfortably the poorest performer in G10.

- At the other end of the table, SEK is rallying as the Riksbank went against consensus and lifted interest rates to 0.25%. Furthermore, the repo rate projections outline a bank that now looks certain to hike further in June, with strong possibilities of further hikes in September, November as well as February next year. EUR/SEK extended its two-day decline, taking out the 200-dma support at 10.2793 in the process.

- The Fed and Bank of England remain in their pre-rate decision blackout periods, meaning Thursday will likely be a quiet session for central bank speak - keeping focus on the recent market volatility and - in particular - the run higher in the dollar.

- National German CPI data follows later today, as well as weekly jobless claims from the US and the advanced reading of Q1 GDP.

FX OPTIONS: Expiries for Apr27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E1.2bln), $1.0700-10(E1.0bln), $1.0800(E1.5bln), $1.0900(E1.4bln)

- USD/JPY: Y126.75($540mln)

- GBP/USD: $1.2900(Gbp1.1bln)

- AUD/USD: $0.7450(A$1.9bln)

- NZD/USD: $0.6735(N$1.4bln), $0.6835(N$1.8bln)

- USD/CNY: Cny6.5000($700mln)

Price Signal Summary - USDJPY Cracks 130.00

- In the equity space, S&P E-Minis remain vulnerable and the recovery from 4136.75, Tuesday’s low, is considered corrective. A resumption of weakness would refocus attention on; 4129.50, Mar 15 low and 4094.25, Feb 24 and a bear trigger. A break of the latter support would represent an important technical break and strengthen bearish conditions. Initial resistance to watch is at 4303.50, Apr 26 high. The outlook in EUROSTOXX 50 futures remains bearish despite the recovery from yesterday’s low. Moving average studies continue to highlight a bearish trend condition. The focus is on 3551.60, the 61.8% retracement of the Mar 7 - 29 rally. The 20-day EMA at 3756.00, is the first resistance.

- In FX, EURUSD remains in a clear downtrend and has traded lower again today. The focus is on 1.0454 next, the Jan 1 2017 low. GBPUSD remains under pressure following the recent impulsive move lower. The focus is on 1.2495 next, 61.8% retracement of the Mar 2020 - Jan 21 bull leg. This has been probed, a clear break would open 1.2423, the 2.236 projection of the Mar 23 - Apr 13 - 14 price swing. USDJPY has resumed its uptrend, following the breach of 129.40, Apr 20 high. Importantly, the pair has also cleared the psychological 130.00 handle, strengthening a bullish theme. This signal scope for a climb towards 131.96, the 1.00 projection of the Feb 24 - Mar 28 - 31 price swing. DXY remains in a clear uptrend and suggests the USD is likely to appreciate further in the near-term. The next major resistance is at 103.82, the Jan 3 2017 high.

- On the commodity front, Gold remains vulnerable. The yellow metal has recently cleared support at the 50-day EMA. Furthermore, the pullback from last week’s high of $1998.4 (Apr 18), continues to highlight a bearish threat. This has been reinforced by the break yesterday of support at $1890.2, the Mar 29 low. This opens $1848.8, 76.4% of the Jan 28 - Mar 8 rally. In the Oil space, WTI futures are consolidating and remain above Monday’s low of $95.28. A bearish threat remains present despite recent gains and a resumption of weakness would open $92.60, the Apr 11 low.

- The broader trend condition in the FI space remains bearish. Bund futures are eyeing the 153.00 handle next. Recent gains are considered corrective. Resistance to watch is at 156.21 the 20-day EMA. Gilts traded higher on Tuesday. This suggests scope for a stronger recovery near-term. Futures have traded above the 20-day EMA and breached a trendline resistance drawn from the Mar 1 high. An extension higher would open the 120.00 handle and 121.05, the 50-day EMA. Initial support is at 118.27, Apr 25 low.

EQUITIES: Tech Leading US Gains

- Asian markets closed higher: Japan's NIKKEI closed up 461.27 pts or +1.75% at 26847.9 and the TOPIX ended 38.86 pts higher or +2.09% at 1899.62. China's SHANGHAI closed up 17.203 pts or +0.58% at 2975.485 and the HANG SENG ended 329.81 pts higher or +1.65% at 20276.17.

- European equities are rebounding, with the German Dax up 270.31 pts or +1.96% at 14063.81, FTSE 100 up 60.56 pts or +0.82% at 7486.77, CAC 40 up 121.67 pts or +1.89% at 6568.25 and Euro Stoxx 50 up 70.77 pts or +1.9% at 3805.39.

- U.S. futures are higher, led by tech (amid a busy tech earnings schedule), with the Dow Jones mini up 368 pts or +1.11% at 33594, S&P 500 mini up 72 pts or +1.72% at 4252.25, NASDAQ mini up 302 pts or +2.32% at 13310.75.

COMMODITIES: Oil Inches Higher

- WTI Crude up $0.81 or +0.79% at $102.81

- Natural Gas up $0.01 or +0.08% at $7.342

- Gold spot up $1.51 or +0.08% at $1887.52

- Copper up $0.25 or +0.06% at $447.5

- Silver down $0.04 or -0.18% at $23.257

- Platinum up $10.35 or +1.12% at $930.59

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/04/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/04/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 28/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 28/04/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 28/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 28/04/2022 | 1400/1600 |  | EU | ECB Elderson Panels ECOSOC UN Forum | |

| 28/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 28/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 28/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 28/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 28/04/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 29/04/2022 | 0530/0730 | ** |  | FR | Consumer Spending |

| 29/04/2022 | 0530/0730 | *** |  | FR | GDP (p) |

| 29/04/2022 | 0600/0700 | * |  | UK | Nationwide House Price Index |

| 29/04/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 29/04/2022 | 0645/0845 | ** |  | FR | PPI |

| 29/04/2022 | 0700/0900 | *** |  | ES | GDP (p) |

| 29/04/2022 | 0800/1000 | *** |  | DE | GDP (p) |

| 29/04/2022 | 0800/1000 | *** |  | IT | GDP (p) |

| 29/04/2022 | 0800/1000 | ** |  | EU | M3 |

| 29/04/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 29/04/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 29/04/2022 | 0900/1100 | *** |  | EU | GDP preliminary flash est. |

| 29/04/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/04/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 29/04/2022 | 1230/0830 | ** |  | US | Employment Cost Index |

| 29/04/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 29/04/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 29/04/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.