-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Tentative Stability

EXECUTIVE SUMMARY:

- EQUITIES PARE SOME OF MONDAY'S LOSSES AS BOND YIELDS PULL BACK

- U.S. RETAIL GASOLINE PRICES HIT RECORD

- QUEEN'S SPEECH TO SET OUT U.K. LEGISLATIVE AGENDA

- GERMAN ZEW EXPECTATIONS INCREASE MODESTLY BUT STILL VERY PESSIMISTIC

- YEN MAY BE NEARING END OF DEPRECIATION: EX-BOJ HAYAKAWA (MNI INTERVIEW)

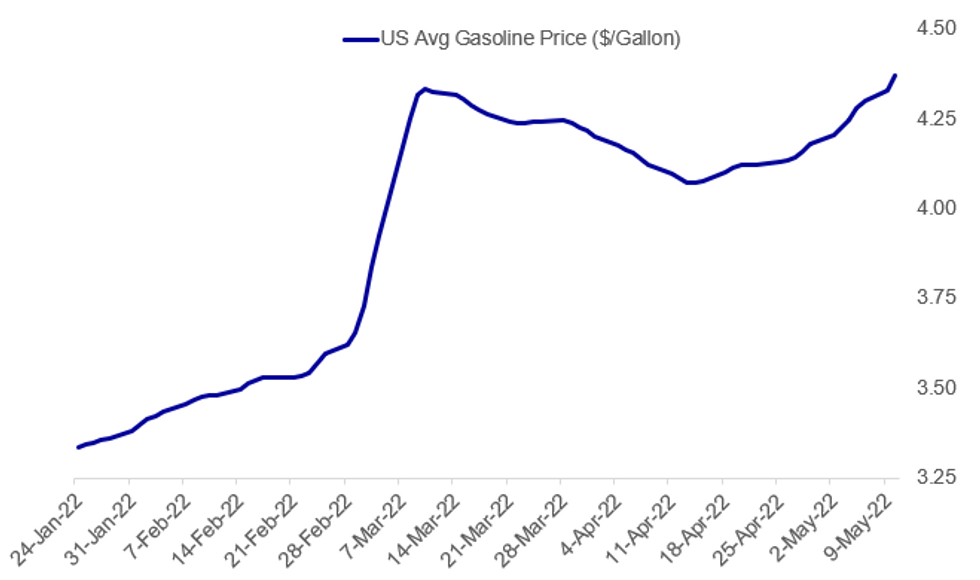

Fig. 1: Record Prices At The Pump Going Into Summer Driving Season

Source: AAA, BBG, MNI

Source: AAA, BBG, MNI

NEWS:

US / GASOLINE (BBG): U.S. retail gasoline and diesel prices rallied to a record just ahead of the nation’s summer driving season, a challenge for President Joe Biden and the Federal Reserve as it combats the fastest inflation in decades. Average gasoline prices hit $4.374 a gallon, according to the American Automobile Association. Diesel also hit a record at $5.50. The surge is set to add to inflationary pressures gripping the world’s biggest economy. The U.S. summer driving season starts in about three weeks.

CHINA / COVID (BBG): China is tightening pandemic restrictions in Shanghai and expanding a mass testing sweep in Beijing as officials chase the elusive goal of wiping out Covid-19 cases in the community. The country reported 3,426 new infections for Monday, the lowest daily tally since March 16. Cases in Shanghai, where the biggest outbreak remains underway, fell to a six week low of 3,014 after peaking at more than 27,000 a day in mid-April. In Beijing, new infections rose to 74, though they have yet to exceed 100-a-day in the current flare-up. Despite the low numbers, authorities are ramping up curbs.

UK: At around 1130BST (0630ET, 1230CET) HRH Prince Charles, the Prince of Wales, will deliver the Queen's speech at the state opening of parliament. The speech will outline the legislative agenda of Prime Minister Boris Johnson's gov't over the coming session. HM Queen Elizabeth II will miss the speech for the first time since 1963, with Buckingham Palace citing 'episodic mobility issues' being experienced by the 96-year old monarch. Market focus will be trained on two likely areas of the speeech. The first, the gov'ts efforts to boost the economy amidst rising inflation. Second is any potential legislation related to the Northern Ireland protocol within the Brexit Withdrawal Agreement.

UK-IRELAND/N IRELAND (BBG): Irish PM Micheal Martin “stressed” the need to “intensify” talks between the EU and U.K. on the Brexit deal’s Northern Ireland protocol in call with U.K. PM Boris Johnson, Martin says in tweet. Says U.K. needs to “avoid any unilateral action” on the protocol itself.

BOJ (MNI): The yen’s recent depreciation may have passed its most acute phase, but the Bank of Japan should act to curtail further weakness or risk setting the stage for a dangerous sudden rise in the currency once the Federal Reserve moves away from its current tightening stance, a former BOJ executive director told MNI. On MNI Policy MainWire now, for more details please contact sales@marketnews.com

FED (BBG): Senate Democrats plan to hold votes to confirm Lisa Cook’s nomination to be a Federal Reserve governor on Tuesday, they announced Monday night.Covid-19 cases among Democrats in the evenly divided chamber have delayed a number of nominations over the past few weeks. A procedural vote failed with some Democrats absent after contracting the coronavirus, sparking a logjam on Federal Reserve and other nominations. Republicans have united in their opposition against Cook, so a procedural vote to advance her nomination as well as a final confirmation vote -- both expected Tuesday -- would likely require a tie-breaking vote from Vice President Kamala Harris in the 50-50 Senate if all senators take part.

FED (BBG): The President understands that the Federal Reserve is “the institution that plays a primary role in fighting inflation,” White House says in fact sheet on Biden-Harris Inflation Plan. “The President has nominated highly qualified individuals to lead the Fed, and is urging the Senate to confirm all these individuals without delay”

DATA:

GERMANY MAY ZEW CURRENT CONDITIONS -36.5

GERMANY MAY ECONOMIC SENTIMENT INDEX -34.3

ZEW Expectations Increase Modestly, However Still Very Pessimistic

GERMANY MAY ZEW CURRENT CONDITIONS -36.5 (APR -30.8)

GERMANY MAY ECONOMIC SENTIMENT -34.3 (APR -41)

- The Germany ZEW survey saw economic sentiment increase 6.7 points to -34.3 in May. The key development since April is the continued expectation of a deterioration of the German economy, however, to a lesser degree than previously assumed.

- The current conditions index slumped a further 5.7 points in the third consecutive month of decrease following the onset of the Ukraine war.

- The enforcement of strict lockdowns in China and associated exasperation of supply chain issues generated more downwards growth pressure in May, worsening economic outlooks in manufacturing industries.

- Inflation rates are expected to ease following the ECB's hawkish shift in recent months.

FIXED INCOME: Gilts driving core FI higher

- Since yesterday's close, core fixed income continued higher in early Asian trading before reversing some of these gains ahead of and in early European trading. However, since the gilt open, gilts have ground higher and outperformed USTs and Bunds, but helped to pull them higher (although at the time of writing still off the Asian highs).

- There is no real headline reason for gilts to have moved higher today. We set out some of our thoughts on gilts here. Today sees the opening of parliament (with the Queen's Speech) in which there is expected to be at least some discussion on the NI Protocol - bringing Brexit risks back to UK markets. And MPC member Saunders' speech yesterday indicated that the neutral Bank Rate was between 1.25-2.50% (the lower bound just 25bp away), which suggested that we might start to see even the hawks slow down in terms of their votes for more hikes (or at least pull into question whether we will see any more 50bp votes). We think these reasons could be dragging gilts higher today.

- Focus later today will remain on CB-talk. We are due to hear from Fed's Williams, Barkin, Waller, Kashkari and Mester as well as the ECB's Nagel, Villeroy and de Guindos.

- TY1 futures are up 0-12+ today at 118-18+ with 10y UST yields down -1.3bp at 3.024% and 2y yields up 1.3bp at 2.608%.

- Bund futures are up 0.40 today at 152.14 with 10y Bund yields down -3.0bp at 1.063% and Schatz yields down -2.2bp at 0.202%.

- Gilt futures are up 0.56 today at 118.67 with 10y yields down -6.0bp at 1.894% and 2y yields down -6.2bp at 1.316%.

FOREX: Markets More Sanguine as Equities Recover Off Lows

- Price action is more sanguine early Tuesday, with most major pairs inside the weekly range headed into the NY crossover. Risk off persisted in early Asia hours, with US futures markets sinking further alongside US yields - this prompted a spell of further USD strength and put AUD/USD at new cycle lows of 0.6911, before markets stabilised through early European hours.

- Scandi currencies trade more solidly, with NOK leading markets higher following the more solid than expected April CPI release from Norway. Y/Y underlying CPI beat median by 0.2ppts to touch 2.6% - the highest since early 2021. This prompted a reversal of EUR/NOK off the multi-month highs, and now sits below 10.20.

- GBP is the poorest performer of the day, with EUR/GBP testing last week's highs of 0.8591 ahead of the formal opening of parliament and the setting out of the government's policy agenda. Market focus will be trained on two likely areas of the speech. The first,the gov'ts efforts to boost the economy amidst rising inflation. Second is any potential legislation related to the Northern Ireland protocol within the Brexit Withdrawal Agreement.

- Tier one data releases are few and far between Tuesday, keeping focus on the central bank speaker slate. Fed's Williams, Barkin, Waller, Kashkari and Mester as well as ECB's de Cos, Nagel, Villeroy and de Guindos are due.

EQUITIES: Tech Rebounds, But Still Down Sharply On The Week

- Asian markets closed mixed: Japan's NIKKEI closed down 152.24 pts or -0.58% at 26167.1 and the TOPIX ended 16.01 pts lower or -0.85% at 1862.38. China's SHANGHAI closed up 31.703 pts or +1.06% at 3035.844 and the HANG SENG ended 368.27 pts lower or -1.84% at 19633.69.

- European stocks are higher, with the German Dax up 191.74 pts or +1.43% at 13380.67, FTSE 100 up 60.99 pts or +0.85% at 7216.58, CAC 40 up 88.64 pts or +1.46% at 6086.02 and Euro Stoxx 50 up 45.43 pts or +1.29% at 3526.86.

- U.S. futures are rebounding, led by tech (after tech led losses Monday), with the Dow Jones mini up 274 pts or +0.85% at 32437, S&P 500 mini up 40.75 pts or +1.02% at 4028.25, NASDAQ mini up 191 pts or +1.57% at 12384.25.

COMMODITIES: Precious Metals Higher As Dollar Trades Sideways

- WTI Crude up $0.55 or +0.53% at $102.19

- Natural Gas up $0 or +0.01% at $7.135

- Gold spot up $8.65 or +0.47% at $1861.43

- Copper up $0.55 or +0.13% at $422.5

- Silver up $0.13 or +0.59% at $22.0106

- Platinum up $20.48 or +2.14% at $973.13

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/05/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 10/05/2022 | 1140/0740 |  | US | New York Fed's John Williams | |

| 10/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 10/05/2022 | 1315/0915 |  | US | Richmond Fed's Tom Barkin | |

| 10/05/2022 | 1345/0945 |  | US | Treasury Secretary Janet Yellen | |

| 10/05/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 10/05/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 10/05/2022 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari and Governor Christopher Waller | |

| 10/05/2022 | 1720/1920 |  | EU | ECB de Guindos at IESE Banking Industry Meeting | |

| 10/05/2022 | 1900/1500 |  | US | Cleveland Fed's Loretta Mester | |

| 10/05/2022 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic | |

| 11/05/2022 | 0030/1030 |  | AU | Westpac-MI Consumer Sentiment | |

| 11/05/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 11/05/2022 | 0600/0800 |  | EU | ECB Elderson Fireside Chat with Sonja Gibbs | |

| 11/05/2022 | 0800/1000 |  | EU | ECB Lagarde Speech at 30th anniversary of Banka Slovenije | |

| 11/05/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 11/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 11/05/2022 | 1220/1420 |  | EU | ECB Schnabel Keynote Speech at Austrian National Bank | |

| 11/05/2022 | 1230/0830 | *** |  | US | CPI |

| 11/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 11/05/2022 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 11/05/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 11/05/2022 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.