-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US OPEN: Stocks Regain Some Stability

EXECUTIVE SUMMARY:

- CHINESE CREDIT DEMAND WEAKENS SHARPLY IN APRIL AMID COVID LOCKDOWNS

- SAMSUNG IS SAID IN TALKS TO HIKE CHIPMAKING PRICES BY UP TO 20%

- BOJ SHOULD REVIEW 2% TARGET: EX-SENIOR OFFICIAL (MNI INTERVIEW)

- EUROZONE INDUSTRIAL PRODUCTION SLUMPS IN MARCH

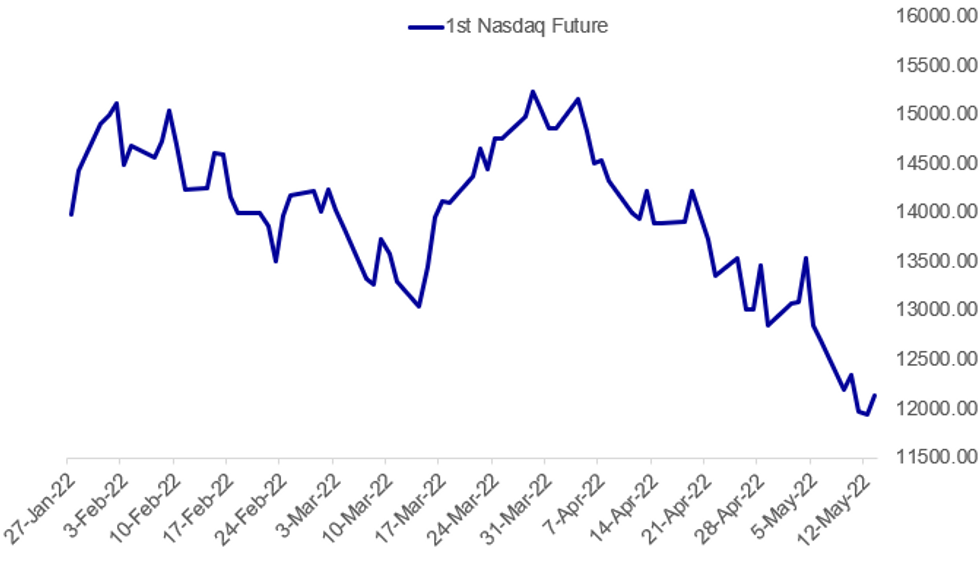

Fig. 1: Stocks Show Some Stability Overnight

Source: BBG, MNI

Source: BBG, MNI

NEWS:

SAMSUNG / CHIPMAKERS (BBG): Samsung Electronics Co. is talking with foundry clients about charging as much as 20% more for making semiconductors this year, joining an industry-wide push to hike prices to cover rising costs of materials and logistics. Contract-based chip prices are likely to rise around 15% to 20%, depending upon the level of sophistication, according to people familiar with the matter, who asked not to be identified due to the sensitivity of the issue. Chips produced on legacy nodes would face bigger price hikes, they said. New pricing would be applied from the second half of this year, and Samsung has finished negotiating with some clients, while it is still in discussions with others, the people said. Samsung’s decision is a shift from its relatively stable pricing policy last year, when the industry rushed to raise prices in the wake of a global chip shortage.

BOJ (MNI INTERVIEW): The Bank of Japan should review its unrealistic inflation target, as the excessively easy monetary policy it requires lowers productivity and erodes government fiscal discipline, a former BOJ executive director told MNI. For full article contact sales@marketnews.com

DATA:

CHINA END-APR M2 +10.5% Y/Y VS MEDIAN +9.9% Y/Y

* CHINA APR NEW LOANS CNY645.4 BLN VS MEDIAN CNY1.53 TLN

* CHINA END-APR M1 +5.1% Y/Y VS +4.7% Y/Y END-MAR

* CHINA END-APR M0 +11.4% Y/Y VS +9.9% Y/Y END-MAR

* CHINA END-APR OUTSTANDING CNY LOANS +10.9%; END-MAR+11.4%

* CHINA END-APR OUTSTANDING CNY DEPOSITS +10.4%; END-MAR +10%

* CHINA APR TSF CNY910.2 BLN VS MEDIAN CNY2.2 TRLN

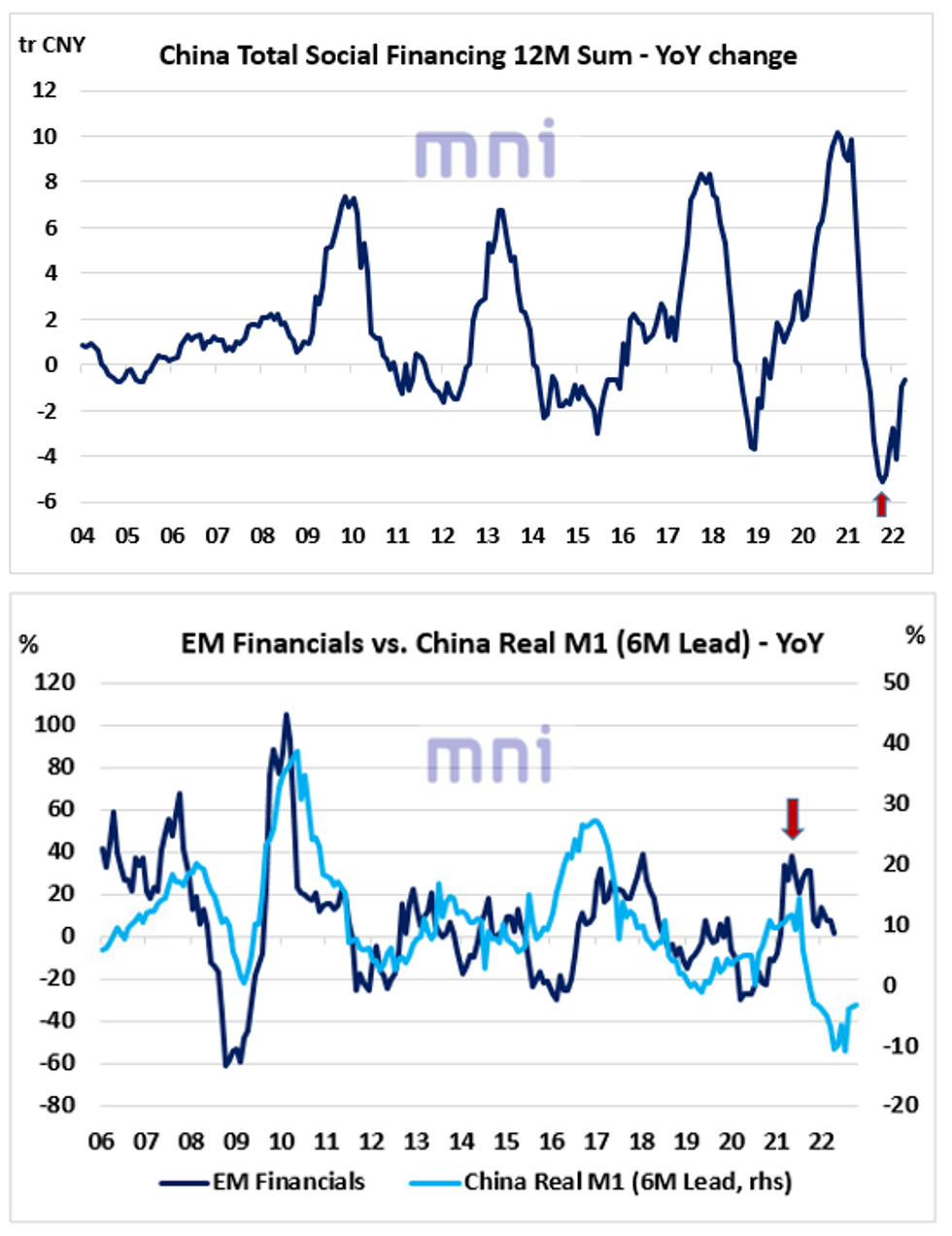

Credit Demand Weakens Sharply in April Amid Covid Lockdowns

- PBoC reported on Friday that credit demand weakened sharply in April amid Covid lockdowns significantly disrupting the economic activity.

- Aggregate financing rose by 910.2bn CNY, significantly below expectations of 2.2tr CNY with new yuan loans rising by 645bn CNY (vs. 1.53bn CNY exp.).

- Even though the annual change in China Total Social Financing (TSF) 12M sum continues to rise (top chart), the disappointing ‘liquidity’ data could challenge domestic risky assets in the near term.

- The global risk off environment triggered by the renewed geopolitical tensions and surging stagflation risks have been weighing on Chinese equities in recent weeks.

- The Hang Seng index has been trading below the 20,000 level this week and is down over 20% since its early February high.

- China M1 money supply accelerated to 5.1% YoY in April (vs. 5% exp.), up from 4.7% the previous month.

- However, China real M1, which has historically acted as a strong leading indicator for cyclical equities (i.e. financials), is still standing at low levels historically and is currently pricing in further weakness in EM financial equities (bottom chart).

Source: Bloomberg/MNI

EZ Industrial Production Slumps in March, Ukraine Effects Feeding Through

EUROZONE MAR IP -1.8% M/M, -0.8% Y/Y; FEB +0.5%r M/M

FEB M/M IP REVISED DOWN 0.2PP, Y/Y IP REVISED DOWN 0.3PP

- Industrial production contracted by -1.8% m/m, the largest month-on-month decline since February 2021. Compared to March 2021. IP slumped by -0.8%.

- Forecasts were anticipating marginally stronger contractions of -2.0% m/m and -1.0% m/m.

- Capital good production drove the decline (-2.7% m/m), followed by durable consumer goods (-2.3% m/m), immediate goods (-2.0% m/m) and energy (-1.7% m/m). Only durable consumer goods saw expansion (+0.8% m/m).

- Within the Eurozone aggregate, German industrial production fell by 5.0% m/m.

- The March print highlights the initial effects of the onset of the Ukraine war. Worsened supply chain disruptions, energy price growth and reduced propensity to invest in capital goods are key downside drivers.

FIXED INCOME: Core FI off the lows but still down on the day

- Core fixed income has moved off of its lows of the day, but has still trended downwards for most of the European session. There are no real headline drivers for the moves, but the move lower seems to be the market taking a bit of a breather after the rally which started shortly after the US CPI data was released on Wednesday. Curves have been bear steepening in general (although the gilt curve has been seeing more of a parallel shift).

- Economic data is a bit on the thin side today with the highlight being the release of Michigan confidence data later today (including the inflation expectations component).

- Speakers so far this morning have done little to move the needle. Forthcoming speakers include Fed's Kashkari and Mester as well as the ECB's Nagel and Schnabel.

- TY1 futures are down -0-20+ today at 119-11+ with 10y UST yields up 5.5bp at 2.906% and 2y yields up 3.2bp at 2.594%.

- Bund futures are down -0.06 today at 154.70 with 10y Bund yields up 4.6bp at 0.883% and Schatz yields up 1.4bp at 0.055%.

- Gilt futures are down -0.17 today at 120.51 with 10y yields up 5.5bp at 1.714% and 2y yields up 5.0bp at 1.209%.

FOREX: EUR/JPY Steadies, Providing Some Relief

- Thursday's volatile and decisive trading has given way to relief rallies across a number of crosses early Friday - primarily EUR/JPY - which broke through considerable support yesterday to print the lowest levels since mid-March in a wide-ranging session. The cross has steadied, but holds well toward the lower-end of the week's range, with 132.66 undercutting as key support while the 50-dma at 134.59 provides first resistance.

- With the cross on more even footing, relief rallies are noted elsewhere, with EUR/USD off the Thursday low and AUD/USD oscillating either side of the 0.69 handle.

- Resultingly, the JPY is the worst performer in G10, while SEK, AUD and NOK trade more favourably. Oil prices have stabilised between $106-108/bbl, helping commodity-tied currencies find some footing while a pause in the equity sell-off is soothing recent concerns.

- Nonetheless, markets remain wary, with heightened implied volatility across G10 signalling that traders are well aware of the risk of another turn lower for risk sentiment, as a number of central bank speakers are still due: Fed's Kashkari and Mester are due to speak, while ECB's Nagel and Schnabel add to recent ECB commentary.

- Data focus turns to import/export price indices data from the US as well as the prelim read for May UMich confidence. Markets expected sentiment to moderate from April's 65.2 to 64.0. Attention again will be paid to inflation expectations, particularly in light of the hotter-than-expected CPI earlier in the week.

EQUITIES: Stocks Regain Some Stability Overnight

- Asian markets closed stronger: Japan's NIKKEI closed up 678.93 pts or +2.64% at 26427.65 and the TOPIX ended 35.02 pts higher or +1.91% at 1864.2. China's SHANGHAI closed up 29.29 pts or +0.96% at 3084.284 and the HANG SENG ended 518.43 pts higher or +2.68% at 19898.77.

- European equities are gaining, with the German Dax up 168.21 pts or +1.22% at 13804.13, FTSE 100 up 92.52 pts or +1.28% at 7288.71, CAC 40 up 71.41 pts or +1.15% at 6247.86 and Euro Stoxx 50 up 47.42 pts or +1.31% at 3632.19.

- U.S. futures are bouncing a little, led by tech, with the Dow Jones mini up 253 pts or +0.8% at 31905, S&P 500 mini up 43.75 pts or +1.11% at 3971, NASDAQ mini up 206.25 pts or +1.73% at 12152.75.

COMMODITIES: Oil Off Session Highs, But Holding Previous 2 Days' Gains

- WTI Crude up $0.79 or +0.74% at $106.87

- Natural Gas up $0.08 or +1.06% at $7.738

- Gold spot up $0.95 or +0.05% at $1824.6

- Copper down $1.3 or -0.32% at $411.15

- Silver up $0.15 or +0.72% at $20.8225

- Platinum up $9.32 or +0.98% at $958.92

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/05/2022 | 0900/1100 | ** |  | EU | industrial production |

| 13/05/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 13/05/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 13/05/2022 | 1500/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 13/05/2022 | 1600/1800 |  | EU | ECB Schnabel Panelist at IRFMP | |

| 13/05/2022 | 1600/1200 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.