-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Euro Slips On "Gradual" ECB Talk

EXECUTIVE SUMMARY:

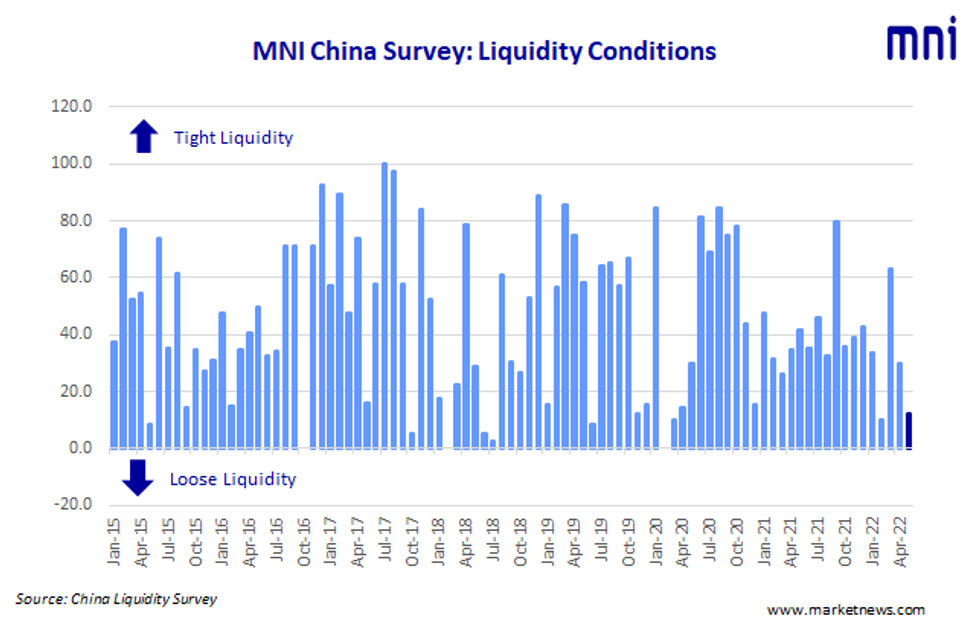

- MNI CHINA LIQUIDITY INDEX: CONDITIONS EASE IN MAY

- GRADUAL END TO APP, NEGATIVE RATES JUSTIFIED: ECB PANETTA

- ECB SHOULD RAISE RATE BY QUARTER POINT IN JULY, REHN SAYS

- BOE NEEDS TO DO MORE BUT SHOULD BE WARY OF RECESSION, PILL SAYS

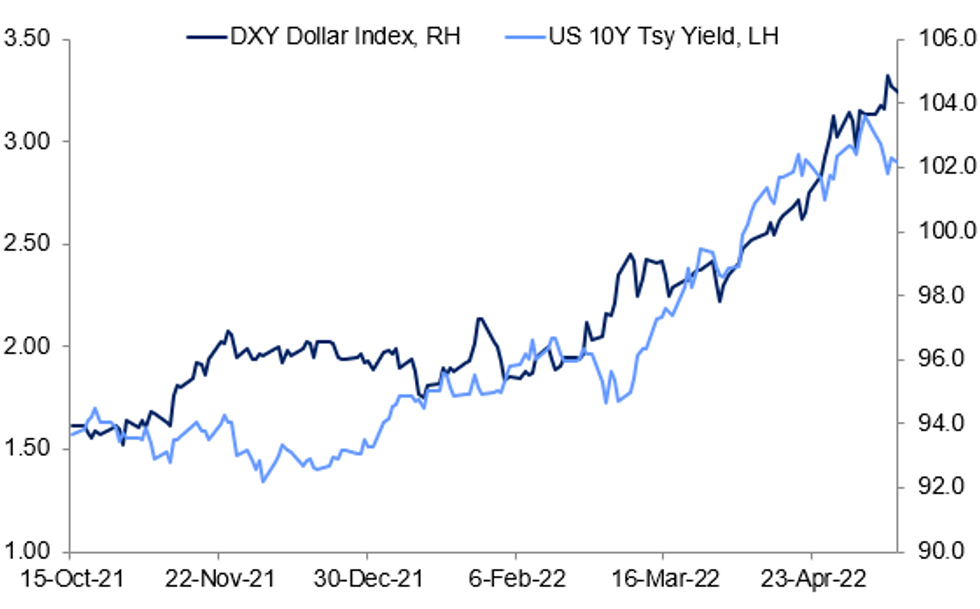

Fig. 1: Dollar Regains Some Ground

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB (BBG): The European Central Bank should raise its rate by 0.25 percentage points in its July meeting to -0.25% and again to zero “as the autumn comes,” Bank of Finland governor Olli Rehn says.

ECB: An end to asset purchases and a gradual exit from negative interest rates by the European Central Bank in coming months would be justified at the present time, Executive Board member Fabio Panetta said Tuesday, allowing policymakers to continue normalising policy by 'removing part of our monetary policy that is no longer needed today.' Panetta's comments comes less than 48 hours after President Christine Lagarde suggested purchases would end early in July, with a first hike later that month, followed by a second in September (MNI SOURCES1: ECB Seen Two To Three 25-BP Hikes In 2022). However, Panetta was careful to stress that given 'exceptional levels of uncertainty,' any normalisation of policy should be done 'gradually and be data dependent -- and he pointed to clear signs of weaker leading indicators and 'signs of economic stress.'

BOE (BBG): The Bank of England needs to tighten policy further to fight rising inflation, but it’s also wary of acting to quickly and risking pushing the UK into recession, according to Chief Economist Huw Pill. Pill, who has voted with the majority to hike rates at each of the BOE’s previous four meeting, told the Western Mail newspaper that he expects “over the coming months some further moves in the direction we have been seeing.” “I personally think there is more that needs to be done in this transition from what has been a very supportive monetary policy for the economy really going back to the financial crisis, through the fallout from Brexit and the pandemic,” he said, according to the newspaper. “And we need to go not necessarily to a super restrictive stance, but to a stance that takes some of that support away and is more reflective of the fact inflation is higher and labor markets tighter.”

ECB (BBG): “We are open to analyze new instruments” to contain bond-market fragmentation within the euro area, but “we have not discussed any concrete instrument in detail in the Governing Council,” European Central Bank Vice President Luis de Guindos says in press briefing. “If we have fragmentation in the sovereign market, immediately that will be extended to the credit market and broader fixed-income markets” “This is something that we have to look at carefully”

ECB (BBG): Some companies in the euro area risk being overstretched by the combination of surging commodity prices and lower economic growth caused by Russia’s invasion of Ukraine, the European Central Bank warned. The region’s financial system also needs to brace for the possibility of another correction on asset markets as the conflict continues and monetary stimulus is withdrawn to combat record inflation, officials said in their bi-annual Financial Stability Review published on Wednesday. “The terrible war in Ukraine has brought immense human suffering,” ECB Vice President Luis de Guindos said in a statement. “It has also increased financial stability risks through its impact on virtually all aspects of economic activity and financing conditions.”

CHINA: The Chinese yuan is returning to a two-way range against the U.S dollar as market sentiment bets on improved fundamentals after the central bank further moved to bolster the economy, and as an end to two months of strict lockdowns in Shanghai is in sight, market analysts said. For further details contact sales@marketnews.com

DATA:

MNI China Liquidity Index™– Falls To 12.5 in May

With further lockdowns and Covid-related restrictions across the economy, demand for credit has slowed, leaving an abundance of liquidity in the system, which, along with central bank operations, has pushed short-term money market rates lower, the latest MNI Liquidity Conditions Index shows.

The Liquidity Condition Index slipped to 12.5 in May, down from 30.0 in April, touching the second lowest reading since the breakout of the Covid in early 2020. As many as three-quarters of traders reporting conditions improved on April.

The higher the index reading, the tighter liquidity appears to survey participants.

- The Economy Condition Index stood at 18.8, slowing from April's rise to 26.7,partly on fresh Covid concerns.

- The PBOC Policy Bias Index remained below 50 for an 11th consecutive month.

- The Guidance Clarity Index was little changed, as respondents again claim to understand the signals from the PBOC.

The MNI survey collected the opinions of 32 traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed income and currency instruments, and the main funding source for financial institutions.

Interviews were conducted May 9 – May 20.

Click below for the full press release:

MNI China Liquidity Index May 2022.pdf

For full database history and full report on the MNI China Liquidity Index™, please contact:sales@marketnews.com

SPAIN: Factory-Gate Inflation Sees First Slowing Since Feb 2021

SPAIN APR PPI +1.6% M/M, +45.0% Y/Y, MAR +47.0%r Y/Y

- Spanish PPI slowed by two points to a near-record high of +45.0% y/y in April. This is the first deceleration in year-on-year PPI since February 2021, where levels were back around 0.6% y/y.

- Energy prices accounted for the bulk of the slowdown, softening 17.5pp in April to +119.0% y/y and down -0.6% m/m.

- Intermediate and non-durable goods' prices continued to climb, causing core factory-gate inflation to rise 1.9 points to +15.6% y/y in April. This is a fresh post-April 1980 high.

Source: INE

FRANCE: Consumer Sentiment Inches Lower

FRANCE MAY CONSUMER SENTIMENT 86 (FCST 89); APR 87r

- Consumer confidence weakened by a further point in May, well below the long-term average of 100.

- Soaring inflation chipping at disposable incomes and economic uncertainty surrounding the Ukraine war constinue to weigh on sentiment.

- Future financial expectations remained unchanged, whilst propensity to make major purchases saw a slight increase. The expected living standards fell further. For the second month running, a rising number of French consumers see prices slowing 12 months out.

- German and UK consumer confidence also remain very weak, with Friday's UK GfK index at a record low, whilst Germany saw a minimal uptick this morning. Italian confidence is due tomorrow.

Source: Insee

*MNI: SWEDEN MAY ECONOMIC TENDENCY SURVEY 110.5; APR 109.4R

FIXED INCOME: Looking ahead to the Fed Minutes

- By recent standards, core fixed income markets have been rather un-volatile this morning and has taken a bit of a breather following yesterday's big moves.

- Treasuries are up a little on the day while gilts and Bunds are a little lower.

- Data this morning has not been too market moving, nor have a slew of ECB speakers.

- Attention will turn later to US durable good and the FOMC Minutes.

- The Fed Minutes later will be watched for any further views on the terminal rates, the likelihood of any 75bp hikes and the triggers for slowdown to 25bp hikes.

- TY1 futures are up 0-6+ today at 120-18+ with 10y UST yields down -1.2bp at 2.741% and 2y yields down -1.6bp at 2.501%.

- Bund futures are down -0.03 today at 153.91 with 10y Bund yields down -2.2bp at 0.943% and Schatz yields down -1.3bp at 0.353%.

- Gilt futures are down -0.26 today at 118.86 with 10y yields down -0.4bp at 1.882% and 2y yields down -0.8bp at 1.431%.

FOREX: USD bid is the early story of the day

- Early story in FX, during the morning European session, has been the bid in USD, taking its cue from Risk once again tilted to the downside.

- The Dollar is up against the majority of the majors, and versus all G10.

- Even the Kiwi, which was the best performer overnight, post the RNBZ rate hike, is now back a touch in the red (0.09%) against the Greenback.

- The worst performer is the SEK, down 1.18% versus the USD.

- Although most pairs still trade within past ranges.

- EURUSD sees support at 1.0642, now at 1.0666 at the time of typing as initial support.

- But market participant will have an eye on 1.0647, with 1.4bn worth of Option expiry for today.

- Looking ahead, US, Prelim Durable goods is the notable data, but likely more attention on the FOMC later.

- Speakers are also in focus with a packed day, which includes ECB de Cos, Lane, Knot, BOJ Kuroda, BoE Tenreyro, and Fed Brainard

EQUITIES: Off Overnight Highs, Energy Stocks Leading

- Asian markets closed mixed: Japan's NIKKEI closed down 70.34 pts or -0.26% at 26677.8 and the TOPIX ended 1.68 pts lower or -0.09% at 1876.58. China's SHANGHAI closed up 36.537 pts or +1.19% at 3107.464 and the HANG SENG ended 59.17 pts higher or +0.29% at 20171.27.

- European equities are a little higher, with energy stocks leading the way higher: German Dax up 47.92 pts or +0.34% at 13919.75, FTSE 100 up 26.62 pts or +0.36% at 7484.35, CAC 40 up 7.46 pts or +0.12% at 6253.14 and Euro Stoxx 50 up 12.45 pts or +0.34% at 3647.56.

- U.S. futures are a little stronger, though off overnight highs (and still well up from the week's lows) Dow Jones mini up 20 pts or +0.06% at 31900, S&P 500 mini up 5 pts or +0.13% at 3945.5, NASDAQ mini up 27 pts or +0.23% at 11798.

COMMODITIES: Oil Defies Broader Weakness

- WTI Crude up $1.08 or +0.98% at $110.83

- Natural Gas down $0.01 or -0.07% at $8.79

- Gold spot down $9.03 or -0.48% at $1858.56

- Copper down $5.4 or -1.25% at $425.1

- Silver down $0.22 or -0.98% at $21.8995

- Platinum down $7.68 or -0.8% at $948.68

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/05/2022 | 0945/1145 |  | EU | ECB Lane Speaks at German Bernacer Prize | |

| 25/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 25/05/2022 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 25/05/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 25/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 25/05/2022 | 1515/1615 |  | UK | BOE Tenreyro Panels Discussion | |

| 25/05/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 25/05/2022 | 1615/1215 |  | US | Fed Vice Chair Lael Brainard | |

| 25/05/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 25/05/2022 | 0045/2045 |  | SK | Bank of Korea policy decision | |

| 26/05/2022 | 0130/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 26/05/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 26/05/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 26/05/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 26/05/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 26/05/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 26/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 26/05/2022 | 1230/0830 | *** |  | US | GDP (2nd) |

| 26/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 26/05/2022 | 1400/1000 |  | MX | Mexican central Bank policy meet minutes | |

| 26/05/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 26/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 26/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 26/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 26/05/2022 | 1600/1200 |  | US | Fed Vice Chair Lael Brainard | |

| 26/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.