-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Kuroda Plays Down Fed Risk for JPY

Highlights:

- JPY on top as Kuroda doesn't see Fed risk for FX

- Fed hike pricing continues to soften - albeit moderately

- Second reading for US GDP, weekly jobs data due

US TSYS SUMMARY: Treasuries Bull Steepen As Hike Expectations Ease

- Cash Tsys rally, first modestly overnight and then at an accelerated pace through the European session.

- With E-minis also edging higher on the day, the move instead looks led by a further dip in Fed hike expectations following yesterday’s minutes, possibly on the potential for a pause later this year even though Powell has since said that neutral rates aren’t “stopping or looking-around point”.

- 2YY -3.8bps at 2.454%, 5YY -3.5bps at 2.680%, 10YY -2.7bps at 2.718% and 30YY -1.2bps at 2.957%.

- TYM2 sits 9 ticks higher at 120-28, off an earlier of 120-31 that comfortably clears yesterday’s range. It currently sits at the 50-day EMA and next eyes resistance at 121-25+(38.2% retracement of the Mar 7 – May 9 bear leg). Volumes are below average whilst the roll update stands at circa 80%.

- Fedspeak: VC Brainard discusses digital assets at 1200ET and Daly (’24 voter) is interviewed on CNBC at 1300ET

- Data: GDP 2nd reading for Q2 and initial jobless claims (0830ET), followed by pending home sales and Kansas Fed mfg survey.

- Bond issuance: US Tsy $42B 7Y note auction (91282CES6) at 1300ET

- Bill issuance: US Tsy $25B 4W, $30B 8W bill auctions at 1130ET

STIR FUTURES: Further Softening In Fed Hike Expectations

- As seen yesterday, implied Fed hikes have softened in the European session after holding steady through Asian hours.

- FOMC-dated Fed Funds point to 51bp for June but slip to a cumulative 97bps for Jul, the low end of the post-May FOMC range at levels last seen two weeks ago prior to Mester not ruling out a 75bp hike forever and the CPI beat.

- The larger relative declines come further out, with 130bp for Sep and 177bp to year-end both at post-May FOMC lows.

- Fedspeak: VC Brainard discusses digital assets at 1200ET and Daly (’24 voter) is interviewed on CNBC at 1300ET.

Cumulative hikes implied by FOMC-dated Fed Funds futuresSource: Bloomberg

Cumulative hikes implied by FOMC-dated Fed Funds futuresSource: Bloomberg

EGB/GILT SUMMARY: BTPs Lead EGB Rally

European government bonds have broadly rallied this morning with the periphery, and BTPs in particular, leading the charge. Equities have posted modest gains, FX is mixed and oil is incrementally higher.

- The gilt curve has continued to twist steepen, with the long-end driving most of the move. The 2s30s spread has widened 4bp.

- Bunds have firmed across much of the curve, although the very long end is close to flat on the day. Yields below 10-year maturity are down 2-4bp.

- The OAT curve has bull steepened with the 2s30s spread trading up 5bp.

- BTP's have rallied strongly with the belly of the curve outperforming. Cash yields are now down 4-11bp.

- UK Chancellor of the Exchequer Rishi Sunak is today expected to unveil a package of support measures for households to counter the rise in energy prices. There is speculation that this could include a windfall tax on energy companies, which would face stiff resistance from some in the party.

- Supply this morning came from Italy (BTP-ST/BTPei, EUR3.5bn)

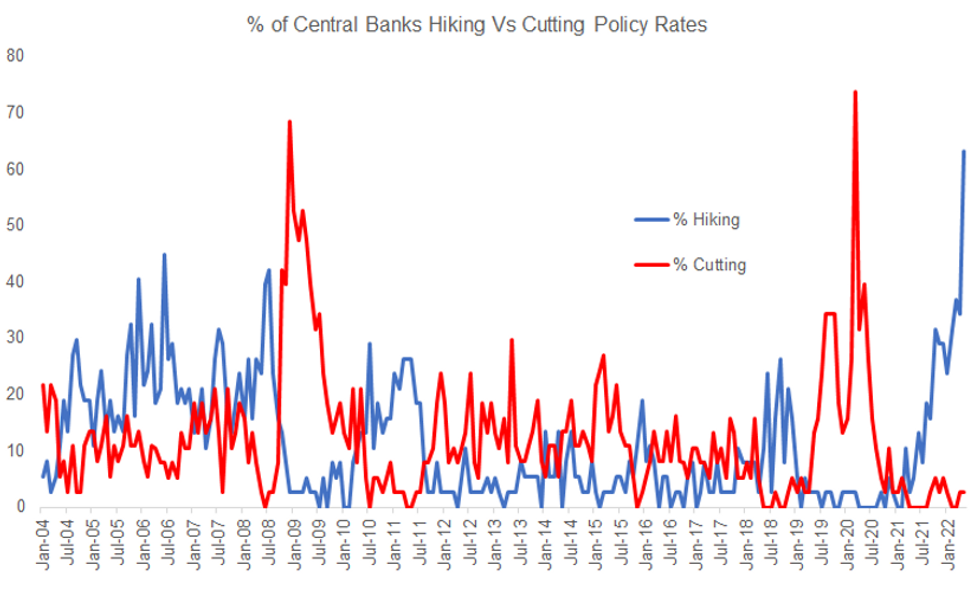

CENTRAL BANKS: Russia Stands Alone Amid Record Global Policy Rate Hiking

With today's rate cut, Russia has the only major central bank (of 38 tracked by the BiS) cutting their benchmark rate this month. 24 of those have hiked this month, the highest proportion of any month in at least 18 years.

Based on 38 central banks changing policy rates in a given monthSource: BiS Data, MNI Calculations

Based on 38 central banks changing policy rates in a given monthSource: BiS Data, MNI Calculations

FOREX: Kuroda Doesn't See Risk to JPY From Fed Policy

- JPY takes the early lead in G10 currencies after a generally subdued overnight session, after comments from BoJ governor Kuroda livened up the currency. Kuroda opined that a tightening Federal Reserve would not necessarily translate into a weaker JPY, with a number of other global factors also a determinate in FX rates. The governor defended the bank's exit strategy, stating that the bank would manage the course effectively - possibly surprising markets that aren't considering an exit from easy policy in Japan any time soon.

- In response, markets sold USD/JPY through the Y127.00 handle, putting the pair at 126.55 and nearer key support of the 50-dma at 126.39 as well as the May 24 low at 126.36.

- Elsewhere, trading is far more muted, with the greenback and EUR posting furtive early gains, but respecting recent ranges more broadly. Focus remains on recent tumult in equity markets, with front-end implied vols across DM and EM currencies still elevated.

- Weekly jobless claims data alongside the secondary reading for US Q1 GDP is the data highlight Thursday, with Canadian retail sales also due. Fed's Brainard, Daly and ECB's Centeno make up the central bank speaker slate.

Price Signal Summary - S&P E-Minis Trend Needle Still Points South

- In the equity space, S&P E-Minis are unchanged and remain below key short-term resistance at 4099.00, May 9 high. The outlook is bearish following a fresh trend low last Friday. Attention is on 3801.97, 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont). 3807.50, Friday’s low is the bear trigger. A break of resistance at 4099.00 is required to signal a base. The primary trend direction in EUROSTOXX 50 futures is down. A corrective cycle is still in play though following the recovery from 3466.00, May 10 low. Price last week probed the 50-day EMA, today at 3722.00. A clear break of this average would improve a short-term bullish theme. On the downside, key support and the bear trigger is unchanged at 3466.00.

- In FX, EURUSD is consolidating. The pair has this week cleared the 20-day EMA, and 1.0642, the May 5 high. An extension higher would signal scope for a climb towards 1.0839, the base of a bear channel drawn from the Feb 10 high. Initial support is at 1.0533, May 20 low. GBPUSD maintains a firmer short-term tone following this weeks climb above 1.2525, May 19 high and the 20-day EMA at 1.2510. This opens 1.2638, the May 4 high and a key resistance. Initial firm support lies at 1.2438, May 20 low. USDJPY appears vulnerable. The pair has this week traded through support at 126.95, the Apr 27 low and an important short-term pivot level. The breach suggests scope for a continuation lower. A move down is still considered a correction and is allowing a recent overbought trend reading to unwind. Attention is on the 50-day EMA, at 125.95.

- On the commodity front, Gold has this week traded above resistance at $1859.1, the 20-day EMA. This opens the 50-day EMA at $1883.3. The latest move higher is still considered corrective and the trend direction remains down. A resumption of bearish activity would refocus attention on last week’s $1787.0 low (May 16). In the Oil space, WTI futures continue to trade at its recent highs and maintain a firm tone. The contract last week breached resistance at $110.07, Mar 24 high. A resumption of gains would open $116.43, the Mar 7 trend high. Initial support is at $103.24, the May 19 low.

- In the FI space, resistance in Bund futures is at $155.33 May 12 high. The trend direction remains down and an extension lower would open 150.49, the May 9 and the bear trigger. The broader trend condition in Gilts remains down. The contract has recently found resistance at 121.07, May 12 high. The bear trigger is unchanged at 116.87, May 9 low.

EQUITIES: Energy Continues To Lead Gains; Tech Lagging

- Asian markets closed mixed: Japan's NIKKEI closed down 72.96 pts or -0.27% at 26604.84 and the TOPIX ended 1 pts higher or +0.05% at 1877.58. China's SHANGHAI closed up 15.644 pts or +0.5% at 3123.108 and the HANG SENG ended 55.07 pts lower or -0.27% at 20116.2.

- European markets are a little higher, with the German Dax up 52.57 pts or +0.38% at 14088.74, FTSE 100 down 3.7 pts or -0.05% at 7540.83, CAC 40 up 19.87 pts or +0.32% at 6339.16 and Euro Stoxx 50 up 13.81 pts or +0.38% at 3701.35.

- U.S. futures are flat/lower, Dow Jones mini up 2 pts or +0.01% at 32078, S&P 500 mini down 3.5 pts or -0.09% at 3973.25, NASDAQ mini down 46.75 pts or -0.39% at 11895.5.

COMMODITIES: NatGas Prices Continue To Gain

- WTI Crude up $0.68 or +0.62% at $111.02

- Natural Gas up $0.16 or +1.77% at $9.13

- Gold spot down $6.23 or -0.34% at $1847.54

- Copper down $2.65 or -0.62% at $422.8

- Silver down $0.19 or -0.87% at $21.7978

- Platinum down $5.35 or -0.56% at $944.79

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/05/2022 | 1100/1300 | * |  | TR | Turkey Benchmark Rate |

| 26/05/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 26/05/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 26/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 26/05/2022 | 1230/0830 | *** |  | US | GDP (2nd) |

| 26/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 26/05/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 26/05/2022 | 1400/1000 |  | MX | Mexican central Bank policy meet minutes | |

| 26/05/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 26/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 26/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 26/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 26/05/2022 | 1600/1200 |  | US | Fed Vice Chair Lael Brainard | |

| 26/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 27/05/2022 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 27/05/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 27/05/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 27/05/2022 | 0800/1000 | ** |  | EU | M3 |

| 27/05/2022 | 1135/1335 |  | EU | ECB Lane Panelist at BOJ-IMES Conference | |

| 27/05/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 27/05/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/05/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 27/05/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.