-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Dollar On Back Foot As Tech Stocks Bounce

EXECUTIVE SUMMARY:

- UK'S JOHNSON SAYS NO POINT NEGOTIATING WITH A 'CROCODILE' LIKE PUTIN

- CHINA SPEEDS UP SPECIAL BOND SALES

- ECB'S DE COS: DON'T HAVE PREDETERMINED NORMALIZATION GUIDELINE

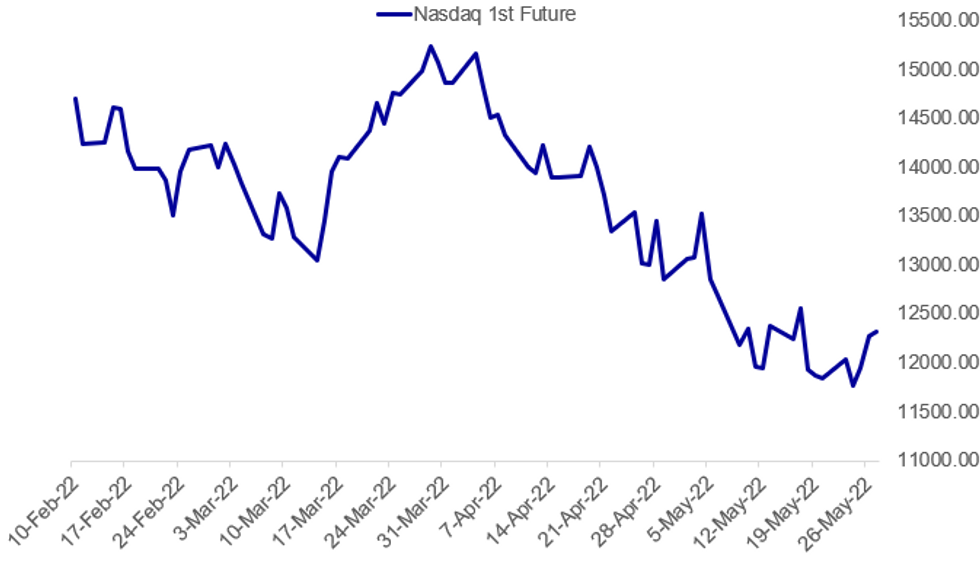

Fig. 1: Tech Stocks Edging Higher From Recent Lows

Source: BBG, MNI

Source: BBG, MNI

NEWS:

UK/RUSSIA/UKRAINE (BBG): Boris Johnson urged further military support for Ukraine as it continues to battle Russian forces, including sending it more offensive weapons such as Multiple Launch Rocket Systems that can strike targets from much further away. “How can you deal with a crocodile when it’s in the middle of eating your left leg?” the British prime minister said in an interview on Friday, when asked about how the prospect of negotiating with Russian President Vladimir Putin. “The guy’s completely not to be trusted.” The MLRS “would enable [Ukraine] to defend themselves against this very brutal Russian artillery, and that’s where the world needs to go down,” Johnson said.

CHINA: China is accelerating the sale of local government special bonds to help boost infrastructure investment to turn around an economic slowdown, aiming to issue most of the annual quota of CNY3.65 trillion by the end of June, according to analysts. Special bonds, to be repaid using income generated by the projects are seen as an important tool to drive investment and stabilise growth. Sales in May will exceed CNY600 billion to hit a new high this year, while that in June could reach as much as CNY1.42 trillion, according to a research note by China Industrial Secs. It is reported that regulators in early May had urged localities to further speed up the bond sales and complete the annual issuance by end-June.

ECB (BBG): “The process of increasing interest rates should be gradual,” European Central Bank Governing Council member Pablo Hernandez de Cos comments in op-ed in Expansion. “The aim is to avoid abrupt movements, which could be particularly damaging in a context of high uncertainty such as the current one.” “We do not have a predetermined normalization guideline,” all decisions will be data dependent.

CHINA STOCKS (BBG): State-owned automaker China FAW Group Co. is considering acquiring a significant stake in the troubled ride-hailing giant Didi Global Inc., according to people familiar with the matter.The Chinese carmaker has reached out to Didi’s top executives and expressed its interest in becoming a major shareholder in the firm, said the people, who asked not to be identified as the information is private. FAW pledged to help Didi resolve issues related to data security, paving the way for a Hong Kong listing, the people said.

UK /OIL (BBG): BP Plc said it will look again at its plans in the UK, raising questions about whether a £5 billion windfall tax on oil and gas profits announced by the government included enough incentives to preserve investment. The statement raises the possibility of reversal by the London-based oil major, which has previously said that planned investments of £18 billion ($23 billion) in the country by 2030 weren’t contingent on whether or not the government raised taxes. “Today’s announcement is not for a one-off tax -– it is a multiyear proposal,” BP said in an emailed statement. “We will now need to look at the impact of both the new levy and the tax relief on our North Sea investment plans.”

BOJ: The balance of ETF (exchange-traded fund) held by the Bank of Japan rose to JPY36.6 trillion at the end of March from JPY36.1 trillion a year earlier, the BOJ said on Friday.

DATA:

FIXED INCOME: A more steady start

- A very light session for Govies and across assets this morning.

- Most markets trade within ranges, with the only notable moves seen in Risk, with Equities underpinned.

- Peripheral spread are mixed, Greece is 2.6bps tighter, while Spain sits 0.8bp wider.

- Gilt outperforms Bund a touch, pushing the Gilt/Bund spread 1bp tighter.

- Most of the volume for Gilt is concentrated in finishing the roll, with the pace running at 82%.

- Similar price action for Treasuries with the September now front Month, and the rolls all but done.

- Tnotes trades circa flat on the day, and well within yesterday's ranges.

- Looking ahead, US Wholesale inventories and PCE deflator, while Michigan will be final reading.

- Jun Bund futures (RX) up 11 ticks at 153.37 (L: 153.22 / H: 153.71)

- Germany: The 2-Yr yield is up 0.6bps at 0.362%, 5-Yr is up 0.7bps at 0.689%, 10-Yr is down 0.5bps at 0.993%, and 30-Yr is down 2.1bps at 1.26%.

- Sep Gilt futures (G) up 22 ticks at 117.52 (L: 117.38 / H: 117.71)

- UK: The 2-Yr yield is down 0.7bps at 1.446%, 5-Yr is down 0.9bps at 1.59%, 10-Yr is down 1.5bps at 1.953%, and 30-Yr is down 2.4bps at 2.205%.

- Jun BTP futures (IK) up 5 ticks at 129.14 (L: 129.04 / H: 129.79)

- Jun OAT futures (OA) up 11 ticks at 145.74 (L: 145.63 / H: 146.03)

- Italian BTP spread up 2.9bps at 192.7bps

- Spanish bond spread up 0.6bps at 106.6bps

- Portuguese PGB spread down 0.2bps at 110.4bps

- Greek bond spread down 1.8bps at 252.6bps

FOREX: Greenback Eyes 50-dma Support - Last Crossed in February

- The greenback traded lower into the Asia close, helping give most major pairs a boost across early European hours. EUR/USD traded a new monthly high of 1.0764 while extends the recent recovery to hit 1.2667 - narrowing the gap with key resistance at the 50-dma of 1.2775. The equivalent level for the USD Index rests at 101.326.

- As a result, the USD's the poorest performing currency so far, although price action and volumes have thinned across the European morning. AUD and NZD sit at the other end of the table, firming against all others in G10 as global equity futures inch toward the best levels of the week.

- AUD/NZD is more rangebound, with the cross seeing some support earlier in the week from the 50-dma crossing at 1.0925.

- US personal income/spending data for April crosses later today, alongside PCE and the final UMich report for May. Central bank speakers are few and far between Friday, with no major speeches on the docket.

EQUITIES: Tech Rebound Continues

- Asian markets closed higher on tech gains: Japan's NIKKEI closed up 176.84 pts or +0.66% at 26781.68 and the TOPIX ended 9.72 pts higher or +0.52% at 1887.3. China's SHANGHAI closed up 7.132 pts or +0.23% at 3130.24 and the HANG SENG ended 581.16 pts higher or +2.89% at 20697.36.

- European equities are gaining, with tech and consumer discretionary stocks leading the way: the German Dax up 81.39 pts or +0.57% at 14314.89, FTSE 100 up 10.42 pts or +0.14% at 7573.74, CAC 40 up 57.81 pts or +0.9% at 6470.85 and Euro Stoxx 50 up 26.08 pts or +0.7% at 3766.74.

- U.S. futures are higher, with the Dow Jones mini up 20 pts or +0.06% at 32620, S&P 500 mini up 8.5 pts or +0.21% at 4064.25, NASDAQ mini up 38 pts or +0.31% at 12317.25.

COMMODITIES: Copper Leads Gains Following A String Of Down Days

- WTI Crude up $0.24 or +0.21% at $114.46

- Natural Gas down $0.08 or -0.9% at $8.814

- Gold spot up $7.58 or +0.41% at $1857.99

- Copper up $4.5 or +1.06% at $430.45

- Silver up $0.18 or +0.82% at $22.2042

- Platinum up $1.95 or +0.2% at $954.41

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/05/2022 | 1135/1335 |  | EU | ECB Lane Panelist at BOJ-IMES Conference | |

| 27/05/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 27/05/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/05/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 27/05/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.