-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Euro/Dollar Nears Parity Pre-Payrolls

EXECUTIVE SUMMARY:

- MNI DEALER MEDIAN FOR U.S. JUN NONFARM PAYROLLS: +282.5K

- EX-JAPAN PM ABE DIES AFTER SHOOTING AT LDP RALLY

- RUSSIA GAS CUTOFF WOULD MEAN RECESSION IN ITALY: VISCO

- COVID COMPLICATES BOJ CALCULUS ON BUSINESS SUPPORT (MNI INSIGHT)

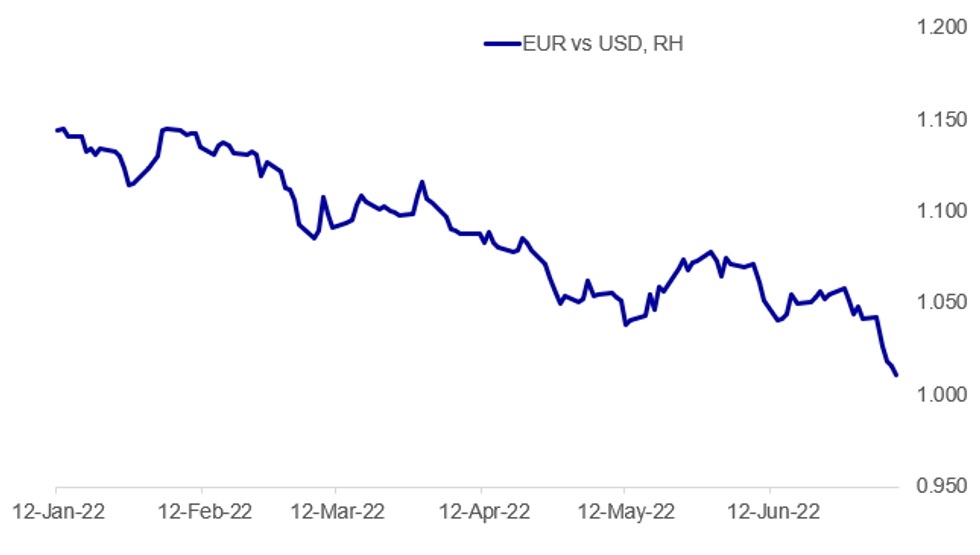

Fig. 1: Euro Tests Parity With Dollar Ahead Of Nonfarm Payrolls

Source: BBG, MNI

Source: BBG, MNI

NEWS:

MNI US EMPLOYMENT REPORT PREVIEW (Click for full report):Nonfarm payrolls are seen rising 268k in June as the pace eases further from the 390k in May but remains well above average growth of 164k through 2019, with wage growth and the u/e rate unchanged from May. Rising growth concerns could see focus on the composition of payrolls growth, adding to the familiar focus on labour market tightness. Potentially small downside risk to July pricing (currently 71bp) but it would likely take a very weak report to materially change those expectations.

JAPAN: Former Japanese Prime Minister Shinzo Abe has died in hospital after being fatally shot at a political rally earlier today the governing Liberal Democratic Party has confirmed.

- Abe was Japan's longest-serving prime minister, having led the gov't from 2006-2007 and from 2012-2020.

- He was viewed as a transformative PM, with his efforts to draw Japan more closely into the western security alliance viewed as a major step in transforming the security outlook in the Indo-Pacific. Abe strongly campaigned for a change to the constitution to allow Japan to construct a standing army, as opposed to its current Self-Defense Forces.

- Also well-known for his 'Abenomics' plan with its 'three arrows' focused on utilising monetary policy, fiscal policy, and structural reform to boost the Japanese economy.

- Abe's assassination is likely to have a major political impact in Japan. Despite having stepped down in 2020, he remained a major political figure in the country, having a significant influence on the Japanese policy debate and on the direction of the LDP.

ITALY / RUSSIA / EUROPE ENERGY (BBG): A halt in Russian natural gas flows to Italy this quarter would trigger a contraction in Italy’s economy, according to the country’s central bank chief. In such a scenario, gross domestic product would “shrink on average in 2022-2023 and return to growth in 2024,” Bank of Italy Governor Ignazio Visco said Friday in a speech in Rome. The outlook is already deteriorating because of rising energy and raw materials costs, weaker trade and growing uncertainty, he cited.

ITALY (MNI BRIEF): Sound fiscal policy will be a key element in avoiding market fragmentation in the eurozone in a shared effort with the European Central Bank using its existing instruments or "new ones" if borrowing costs increase in individual jurisdictions to levels "not justified by fundamentals," Bank of Italy governor Ignazio Visco said.

BOJ / JAPAN (MNI INSIGHT): A jump in Covid cases has made it more difficult for the Bank of Japan to avoid extending its special financing programme for smaller firms, but is unlikely to take a decision at its July 20-21 meeting as it waits to see whether the government will withdraw its own small business support, MNI understands.

ECB / BANKS (BBG): The European Central Bank’s first major climate stress test shows banks facing a hit of 70 billion euros ($71 billion) if the transition to a lower-carbon economy is disorderly. The figure includes credit and market losses, while droughts, heat and floods alone could mean a hit of 17 billion euros, the ECB said on Friday in Frankfurt. It cautioned that the result “significantly understates” actual risks related to global warming, partly because climate shocks weren’t accompanied by a broader economic downturns and limited to specific portfolios.

UK (MNI POLITICS): Support for the governing Conservative party has fallen to its lowest level since September 2019 in the latest opinion poll carried out by Techne. With all fieldwork carried out on the day PM Boris Johnson announced his resignation as leader of the Conservatives, the party's support fell to 29%, while the main opposition Labour party's support stood at 41%.

BOE (BBG): A top Bank of England official downplayed speculation the government could seek to overrule UK regulators’ decisions, saying he expected their independence would be protected in forthcoming legislation. Sam Woods, chief executive officer of the Prudential Regulation Authority, said on Friday that he was aware of press reports about the impending Financial Services and Markets Bill. The Telegraph newspaper reported on July 2 that BOE Governor Andrew Bailey was set to clash with then-Chancellor Rishi Sunakover a “call-in” power that would allow ministers to reverse regulators’ decisions.

DATA:

US DATA PREVIEW: Primary Dealer NFP Estimates

| Primary Dealer | Estimate | Primary Dealer | Estimate |

|---|---|---|---|

| Amherst Pierpoint | +375K | TD Securities | +350K |

| Bank of America | +325K | Morgan Stanley | +325K |

| Jefferies | +320K | Societe Generale | +310K |

| Daiwa | +300K | NatWest | +300K |

| Scotiabank | +300K | Citi | +290K |

| Nomura | +290K | Barclays | +275K |

| Credit Suisse | +275K | J.P.Morgan | +275K |

| Goldman Sachs | +250K | HSBC | +250K |

| Wells Fargo | +240K | BNP Paribas | +230K |

| Deutsche Bank | +225K | UBS | +225K |

| BMO | +200K | Mizuho | +200K |

| Dealer Median | +282.5K | BBG Whisper | +245K |

**MNI: ITALY MAY IP -1.1% M/M, +3.4% Y/Y

FIXED INCOME: Bunds outperform

- Bunds are the outperformers in core fixed income space this morning. There are no specific headlines driving the moves, but markets are looking at fundamentals and concerned that the outlook for the eurozone looks particularly precarious at present.

- Gilts on the other hand are actually a bit lower on the day, with some of the adjustments following PM Johnson's resignation continuing to reverberate around sterling markets. There is focus today on a slightly more expansionary fiscal policy outlook (which would to some extent lead to a tighter monetary policy outlook).

- US Treasuries have seen the smallest moves, as the market looks ahead to today's employment report. We expect there to be only small changes to expectations for the July meeting (unless there is a very large surprise), but expectations further out the curve are two-way given recent market moves.

- TY1 futures are up 0-7 today at 118-15+ with 10y UST yields down -0.6bp at 2.991% and 2y yields up 0.4bp at 3.021%.

- Bund futures are up 0.27 today at 150.82 with 10y Bund yields down -3.8bp at 1.276% and Schatz yields down -6.6bp at 0.472%.

- Gilt futures are down -0.34 today at 115.14 with 10y yields up 1.6bp at 2.142% and 2y yields up 2.1bp at 1.819%.

FOREX: EUR Dips Further, But Oversold Condition Could Slow Progress to Parity

- The greenback has resumed its deep-seated uptrend early Friday, putting the index at fresh multi-decade highs and touching 107.786. The primary driver remains EUR weakness, with the pair extending the week's losses to near parity and put prices off by over 3.5% since this time last week.

- There are few signs of a slowdown in the downside momentum for EUR/USD - with the market focus remaining on the downtrend channel drawn off the February high. Nonetheless, the EUR/USD RSI has now dipped into oversold territory for the first time since March - which could slow downside progress, but is unlikely to stop the primary downtrend.

- JPY is the sole currency to be outperforming the greenback ahead of the NY crossover, with negative global equity futures pointing to a lower open on Wall Street later today. This reinforces the general risk-off theme, although the e-mini S&P holds the bulk of the week's recovery headed into next week's earnings season. Markets also watch the passing of ex-PM Abe in Japan, who was shot while taking part in election campaigning.

- Focus going forward is on the June nonfarm payrolls report, at which markets expect monthly job gains of somewhere between 250-300k. Earnings growth is expected to moderate, while the participation rate inches higher to 62.4% - equalling the post-pandemic high.

EQUITIES: Soft Start To US Payrolls Day

- Asian markets closed mixed: Japan's NIKKEI closed up 26.66 pts or +0.1% at 26517.19 and the TOPIX ended 5.1 pts higher or +0.27% at 1887.43. China's SHANGHAI closed down 8.32 pts or -0.25% at 3356.078 and the HANG SENG ended 82.2 pts higher or +0.38% at 21725.78.

- European stocks are a little softer, with Materials/Financials weakness weighing most heavily: German Dax down 67.04 pts or -0.52% at 12790.44, FTSE 100 down 9.06 pts or -0.13% at 7177.74, CAC 40 down 29.98 pts or -0.5% at 5974.07 and Euro Stoxx 50 down 33.1 pts or -0.95% at 3458.99.

- U.S. futures are slightly lower, with the Dow Jones mini down 132 pts or -0.42% at 31235, S&P 500 mini down 19.75 pts or -0.51% at 3885.25, NASDAQ mini down 76.25 pts or -0.63% at 12062.25.

COMMODITIES: Metals Pull Back Again As Dollar Firms

- WTI Crude down $0.83 or -0.81% at $102.19

- Natural Gas down $0.17 or -2.65% at $6.139

- Gold spot down $4.71 or -0.27% at $1735.94

- Copper down $9.1 or -2.55% at $348.55

- Silver down $0.12 or -0.65% at $19.1068

- Platinum down $7.35 or -0.84% at $870.68

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/07/2022 | 1155/1355 |  | EU | ECB Lagarde at Les Rencontres Economiques | |

| 08/07/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 08/07/2022 | 1230/0830 | *** |  | US | Employment Report |

| 08/07/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/07/2022 | 1230/0830 |  | US | New York Fed's John Williams | |

| 08/07/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/07/2022 | 1500/1100 |  | US | New York Fed's John Williams | |

| 08/07/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.