-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Gilts Underperform As UK GDP Beats Expectations

EXECUTIVE SUMMARY:

- UK GDP CONTRACTS IN Q2, BUT BEATS FORECASTS

- ROBUST JUNE EUROZONE INDUSTRIAL PRODUCTION, GAS SUPPLY CONCERNS GOING FORWARD

- GLOBAL RISKS MEAN BOJ MUST STAY EASY - SEKINE (MNI INTERVIEW)

- SWEDEN HEADLINE SLOWS, CONTINUED ACCELERATION IN CPIF EX-ENERGY

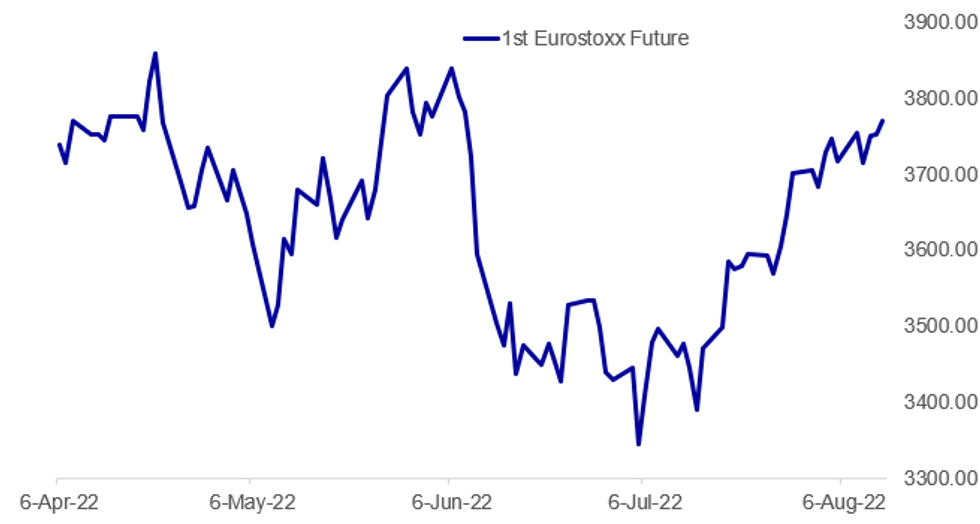

Fig. 1: Eurostoxx Testing Resistance

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BOJ (MNI INTERVIEW): The increased risk of a global slowdown as the Federal Reserve hikes rates and the absence of sustained wage growth mean the Bank of Japan has no option but to maintain its current easy policy stance, its former chief economist Toshitaka Sekine told MNI.

WEEKLY FUND FLOW (BofA/MNI): Citing EPFR data, BofA's analysis shows:

- Equity funds saw a $7.1bln inflow in the week to Wednesday

- US stocks saw $11bln inflow, the largest in 8 weeks, while US growth stocks recorded the largest inflow since December

- For Europe, equity funds saw their 26th straight week of outflows, reaching $4.8bln this week

- The report sees investors 'fading' inflation, with TIPS seeing the 5th straight week of outflows - the longest streak since April 2020

GERMAN POLITICS (MNI): Chancellor Olaf Scholz's centre-left Social Democratic Party (SPD) has recorded its lowest level of support in a poll by outlet FGW since the September 2021 federal election. The environmentalist Greens, which sit as a junior coalition partner to Scholz's SPD, record their highest level of support with FGW since the election in the same poll, drawing level with the main opposition centre-right Christian Democratic Union (CDU/CSU). FSW: CDU/CSU: 26% (=), Greens: 26% (+1), SPD: 19% (-2), AfD: 12% (+1), FDP:7% (+1), Die Linke: 4% (-1). Fieldwork 9-11 Aug, chgs 12-14 July, sample:1,389

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Moody's on Germany (current rating: Aaa; Outlook Stable)

- S&P on Switzerland (current rating AAA; Outlook Stable) and Hungary (currentrating: BBB; Outlook Stable)

- DBRS Morningstar on Belgium (current rating AA (high); Negative Trend)

DATA:

MNI BRIEF: UK GDP Contracts in Q2, But Beats Forecasts

- UK JUN GDP -0.6% M/M, -0.1% 3MM, +2.9% 3M Y/Y

- MNI: UK JUN SERVICES INDEX -0.5% M/M, -0.4% 3MM

- MNI: UK JUN IND PROD -0.9% M/M, +2.3% Y/Y

- MNI: UK JUN CONSTRUCTION OUTPUT -1.4% MM, +2.3% 3M3M, +4.1% YY

- MNI: UK JUN TRADE BALANCE GBP -11.39BN

The UK economy slipped into contraction in the three months to June, declining 0.1% on the quarter, albeit slightly better than expected by the financial markets, where consensus estimates were for a decline of 0.2%.

On the month, June saw the economy decline 0.6%, a reversal of the 0.5% growth seen in May. The two month reading for May and June was largely a wash, with the bank holiday adjustments in each month cancelling themselves out.

According to the ONS, there were positive contributions from consumer-facing services, including accommodation and food service activities , and arts, entertainment and recreation activities. There was a 0.2% decrease in real household consumption.

Source: ONS

SWEDEN: Headline Inflation Slows, Continued Acceleration in CPIF ex Energy

SWEDEN JUL CPI +0.1% M/M, +8.5% Y/Y (FCST +8.7%); JUN +8.7% Y/Y

SWEDEN JUL CPIF -0.2% M/M, +8.0% Y/Y (FCST 8.3%); JUN +8.5% Y/Y

- Swedish CPI was softer than anticipated across the board, with headline inflation slowing to +0.1% m/m and +8.5% y/y, down 1.3pp and 0.2pp respectively.

- The Riksbank-watched CPIF underlying inflation print slowed for the first time since January, by 0.5pp to +8.0% y/y (8.3% expected), whilst the month-on-month reading saw a contraction of -0.2% m/m (+0.1% forecasted).

- Electricity and fuel prices accounted to the deceleration in CPIF, which was largely offset by the +3.2% m/m jump in food prices which is only partly seasonal. CPIF excluding energy saw another 0.5pp jump to +6.6% y/y in July, underlining the continued building of widespread price pressures despite some minimal reduction in month-on-month clothing and furnishing costs.

- This data provides mixed messages for the RIksbank ahead of the September 19 meeting, as the targeted CPIF rate saw some easing, however excluding energy inflation pressures continue to mount in the Swedish economy. The August inflation print is due on September 14 and is likely to generate more reaction as markets look for another 50bp hike.

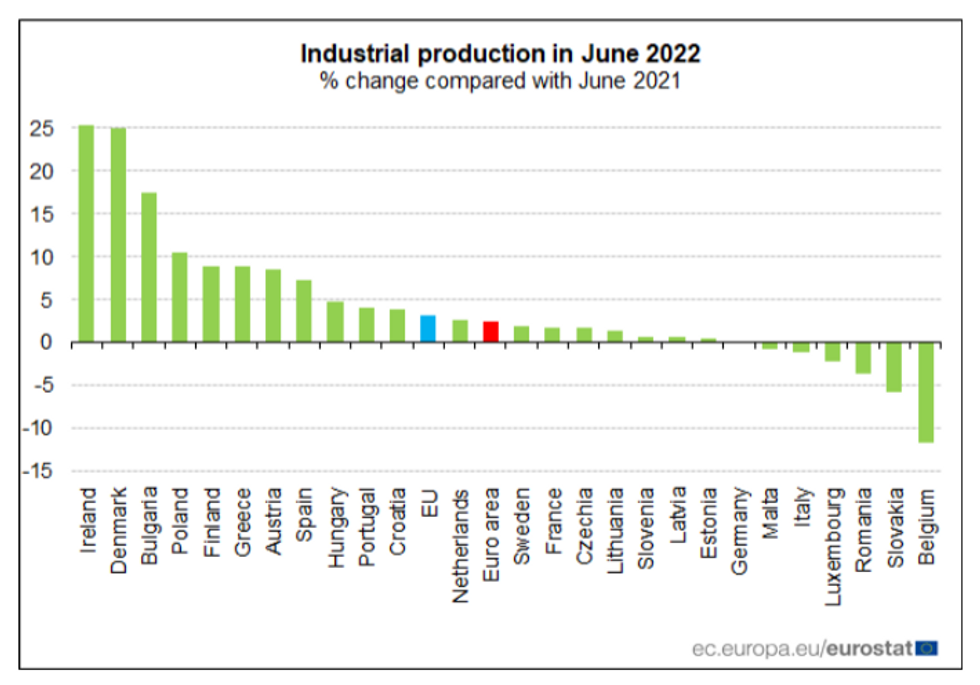

EUROZONE: Robust June Industrial Production, Gas Supply Concerns Going Forward

EUROZONE JUN INDUSTRIAL PRODUCTION +0.7% M/M (FCST +0.2%), MAY +2.1%r M/M

EUROZONE JUN INDUSTRIAL PRODUCTION +2.4% Y/Y (FCST +1.0%); MAY +1.6% Y/Y

- Industrial production saw a robust June expansion in the eurozone, up 2.4% y/y (up 0.8pp from May). The month-on-month expansion was 0.7% m/m, following the substantial upwards revision in the May data, from +0.8% m/m to +2.1% m/m.

- The June data is all above expectations, at a 0.5pp beat month-on-month and 1.4pp beat for the annual print.

- Expansions were registered in the production of capital goods (+7.6% y/y) and durable g=consumer goods (+4.0%), whilst energy stabilised (+0.0%). Soft contractions were seen for intermediate goods (-0.5% y/y) and non-durables (-1.1%), hinting at slowdowns in demand.

- Substantial discrepancies are seen across national IP numbers (see graph below).

- More recent developments in the gas supply through Russia are cause for concern regarding euro area industry going forward, leading some sell-side analysts to shift forecast a German industry contraction for Q3 and Q4.

- The ECB will be closely monitoring signs of contraction across the bloc ahead of the September 8 meeting, with a front-load-and-pause tactic remaining the most likely.

**MNI: FRANCE JUL HICP +0.3% M/M, +6.8% Y/Y

**MNI: SPAIN JUL HICP -0.6% M/M, +10.7% Y/Y

FIXED INCOME: Gilts the biggest movers after better-than-expected GDP data

- Gilts have been the underperformers this morning after monthly GDP data beat expectations and saw Q2 GDP fall 0.1%Q/Q rather than the -0.2% fall pencilled in. This data remains very noisy due to the extra Jubilee holidays but clearly beat expectations - the question now turns to whether July data can also hold up better than expected with the next release coming on Monday 12 September (the week of the next MPC meeting).

- The German and US curves are both broadly in line with where they were at yesterday's close.

- The Michigan survey is the main remaining release of the week, with the inflation expectations components the highlight. Ahead of that we will receive US import / export price indices while the Fed's Barkin is due to appear on CNBC at 15:00BST / 10:00ET.

- TY1 futures are up 0-1 today at 119-04 with 10y UST yields down -0.4bp at 2.885% and 2y yields down -0.9bp at 3.212%.

- Bund futures are down -0.26 today at 155.25 with 10y Bund yields up 3.1bp at 1.000% and Schatz yields up 2.1bp at 0.572%.

- Gilt futures are down -0.33 today at 116.09 with 10y yields up 4.2bp at 2.099% and 2y yields up 4.3bp at 2.025%.

FOREX: SEK Spirals as Markets Price Out Odds of Imminent Riksbank Action

- The greenback is directionless early Friday, contrasting with the general theme of the week where the dollar has drifted lower across early European hours. The notable volatility following Wednesday's CPI may have flushed positioning somewhat, with markets now looking ahead to the UMich release as well as Fedspeak, with Barkin appearing on CNBC following the Wall Street opening bell.

- GBP is another source of weakness, with EUR/GBP inching to a new August high this morning following signs of a further deterioration for the economy in this morning's GDP report. Both private consumption and government spending came in below forecast, putting EUR/GBP above the 100-dma at 0.8472.

- SEK is underperforming, slipping against all others in G10 after the softer-than-expected inflation release this morning. CPI slowed to 0.1% on the month (vs. Exp. 0.3%) and 8.5% on the year (vs. Exp. 8.7%). The softer report has prompted markets to price out the outside chance of an inter-meeting rate hike from the Riksbank (something that many on the sell-side had seen a material risk of).

- NOK/SEK has rallied to the best levels since late April in response, topping 1.06 as well as the 50% retracement of the Mar - May downleg at 1.0621.

- US import and export price index data crosses later today, with the prelim University of Michigan survey for August also on the docket. Focus will turn to the inflation expectations answers, which are expecting to slow to 5.1% and 2.8% for the 1-yr and 5-10yr forecast horizons respectively.

EQUITIES: Eurostoxx Retesting August's Highs

- Asian stocks closed higher: Japan's NIKKEI closed up 727.65 pts or +2.62% at 28546.98 and the TOPIX ended 39.53 pts higher or +2.04% at 1973.18. China's SHANGHAI closed down 4.777 pts or -0.15% at 3276.888 and the HANG SENG ended 93.19 pts higher or +0.46% at 20175.62.

- European futures are stronger, with energy stocks continuing to lead gains: German Dax up 55.23 pts or +0.4% at 13694.51, FTSE 100 up 45.24 pts or +0.61% at 7465.91, CAC 40 up 31.12 pts or +0.48% at 6544.67 and Euro Stoxx 50 up 11.74 pts or +0.31% at 3757.05.

- U.S. futures are higher as well, with the Dow Jones mini up 148 pts or +0.44% at 33452, S&P 500 mini up 20.75 pts or +0.49% at 4230.5, NASDAQ mini up 71.25 pts or +0.54% at 13382.5.

COMMODITIES: Holding Ground

- WTI Crude down $0.2 or -0.21% at $94.09

- Natural Gas down $0.17 or -1.94% at $8.494

- Gold spot down $2.49 or -0.14% at $1790.94

- Copper down $0.5 or -0.13% at $369.85

- Silver up $0.02 or +0.09% at $20.3762

- Platinum down $2.02 or -0.21% at $969.29

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/08/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 12/08/2022 | 1400/1000 |  | US | Richmond Fed Pres Barkin on CNBC | |

| 12/08/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 12/08/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.