-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EUR Eyes August Low After Soft ZEW

Highlights:

- Germany's ZEW survey sees expectations drop to lowest since GFC

- Canadian CPI expected to edge off multi-decade high posted in June

- USD firming toward August high

US TSYS SUMMARY: Modest Twist Flattening With Data In Focus Ahead

- After a subdued Asia session, cash Tsys have seen a modest cheapening through European hours before the pace slowed after a miss for both German and Eurozone ZEW analyst expectations in August. The front end leads the way for a small twist flattening with the pivot beyond the 10Y, pushing 2s10s back below -40bps but still above lows of just off -50bps prior to US CPI.

- 2YY +1.9bps at 3.201%, 5YY +1.2bps at 2.912%, 10YY +0.2bps at 2.790% and 30YY -1.5bps 3.087%.

- TYU2 sits unchanged at 119-22+, well within recent ranges on typically soft seasonal volumes. Recent moves lower are considered corrective with resistance seen at 120-22 (Aug 10 high), but having recently breached trendline support at 119-16, there could be a deeper near-term retracement with support seen at 118-30+ (Aug 12 low).

- Data: Further declines expected for housing starts/building permits (0830ET) with perhaps particular attention on IP for July (0945ET) for realised implications from softer business activity surveys.

- No Fedspeak or issuance scheduled today.

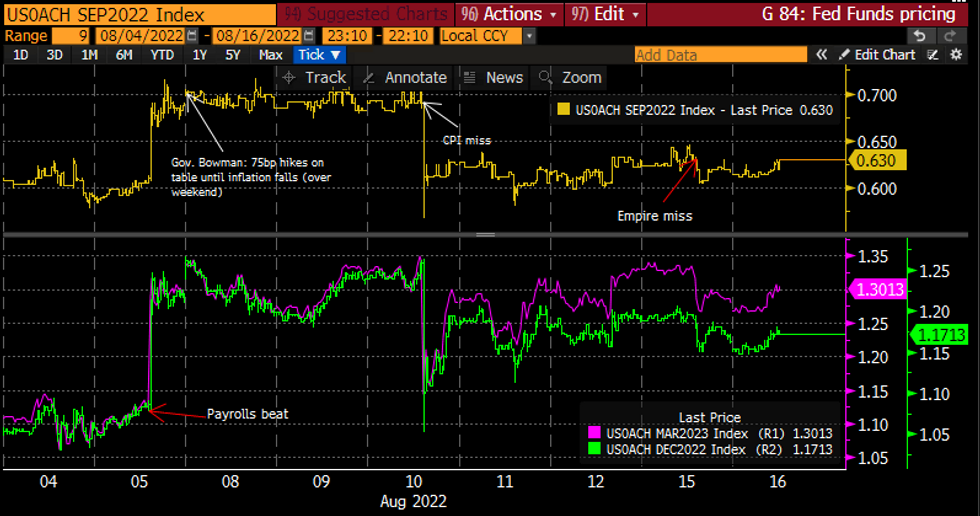

STIR FUTURES: Fed Hikes Recovering From Empire Miss

- Fed Funds implied hikes sit towards the middle of yesterday’s range having ground higher through the European session to continue recovering from the Empire miss before pausing after a dip in ZEW analyst expectations for both Germany and the Eurozone.

- Pricing 62-63bp for the Sep FOMC with a cumulative 117bp to Dec and 130bp to a peak of 3.63% in Mar’23. Inversion hovers at its recently narrowed 45bps of cuts to Dec’23.

- No Fedspeak scheduled for today ahead of the FOMC minutes and Governor Bowman tomorrow.

Cumulative hikes implied by FOMC-dated Fed Funds futuresSource: Bloomberg

Cumulative hikes implied by FOMC-dated Fed Funds futuresSource: Bloomberg

EGB/GILT SUMMARY: UK Wages Show Limited Second-Round Effects

European government bonds have edged lower this morning while equities have made gains G10 currencies have weakened against the dollar.

- UK employment data was somewhat mixed this morning. The 3m/3m employment gain data for June was lower than expected (160k vs 268k consensus), while the more timely change in payrolled employees was higher than expected in July (73k vs 25k survey). Average earnings surprised higher in June (5.1% Y/Y vs 4.5%), but continue to be outstripped by inflation.

- Gilts have recovered some of the earlier losses while continuing to trade below yesterday's close. Cash yields are now 1-2bp higher across the curve.

- The bund curve has steepened on the back of the longer end selling off with 2s30s widening 3bp.

- OATs have traced out a similar path with the 2s30s spread trading up 3bp.

- BTPs have underperformed core EGBs. Yields are 4-7bp higher on the day with the curve bear flattening.

- Supply this morning came from the UK (Gilts, GBP2.75bn), Germany (Bobl, EUR3.242bn), Spain (Letras, EUR1.703bn), Finland (RFTBs, EUR1.496bn) and the ESM (Bills, EUR1.1bn).

EUROPE ISSUANCE UPDATE:

- Germany allots E3.242bln 1.30% Oct-27 Bobl, Avg yield 0.71% (Prev. 0.96%), Bid-to-cover 1.46x (Prev. 0.74x), Buba cover 1.80x (Prev. 1.11x)

- UK DMO sells GBP2.75bln 0.50% Jan-29 Gilt, Avg yield 1.955% (Prev. 1.636%), Bid-to-cover 2.65x (Prev. 2.48x), Tail 0.5bp (Prev. 1.2bps)

EUROPE OPTION FLOW SUMMARY

Eurozone:- Euribor midcurve: 0RU2 98.50/98.25 put spread vs 2RU2 98.375/98.125 put spread, sold at 3 in 5k (-0R, +2R)

- RXU2 152/153/154 call fly sold at 6 in 4k. Hearing this is an unwind

- Selling 5.5k RXU2 156.00 puts, buying 5.5k RXV2 151.00/147.50 ps, receiving net 30 (roll Sep into Oct)

- RXV2 150.00/146.00/145.00 put ladder bought for 33.5/34 in 6k

- SX7E (16th Dec) 90/80ps vs 90/100cs, trades 2.25 in 10k

FOREX: EUR Sinks as ZEW Points to Lowest Expectations Since GFC

- The greenback makes modest progress early Tuesday, putting the USD Index north of the Monday highs and nearing the August highs of 106.93.

- EUR trades under pressure against most others, with EUR/USD printing a new intraday low of 1.0125 following another dire read for the German ZEW survey. The expectations component was a particular source of weakness, dropping to -55.3 from -53.8, the lowest level for the index since the Global Financial Crisis. Today's -55.3 read came in just above the -63.0 from Oct'08. A break below 1.0123 for EUR/USD would be fresh August lows, opening 1.0097 as the next support.

- USD/JPY is making solid gains on the day, breaking back above the Y134 handle for the first time since the US CPI release last week. JPY is weaker against all others in G10 so far Tuesday. CAD/JPY eyes the 50-dma at 104.98 for direction, a break above which could see the cross break out of the tight August range.

- US building permits data for July cross later today, as well as Canadian and US housing starts and the July Canadian CPI release. Prices are expected to have risen 0.1% on the month, and 7.6% on the year. US industrial production follows a little later in the session. There are no central bank speakers of note.

FX OPTIONS: Expiries for Aug16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0000(E1.3bln), $1.0048-50((E563mln), $1.0070-75(E1.3bln), $1.0100-10(E1.0bln) , $1.0125-40(E1.3bln), $1.0250(E932mln), $1.0300(E949mln)

- USD/CNY: Cny6.89-90($859mln)

Price Signal Summary – AUD Uptrend Intact Despite Monday Weakness

- S&P E-Minis traded higher once again Monday and the contract maintains a bullish tone. The climb extends the positive price sequence of higher highs and higher lows. Recent gains in EUROSTOXX 50 have confirmed a resumption of the current uptrend. The move higher maintains the bullish price sequence of higher highs and higher lows and attention is on resistance at 3840.00, the Jun 6 high.

- EURUSD started the week on a bearish note and has extended the move lower from last week’s 1.0368 high (Aug 10). The move down appears to be a short-term reversal and means that the pair has failed to clear channel resistance. EURGBP traded lower Monday and has remained below Friday’s high. The broader outlook is bearish and the recent move higher is likely a correction. Price action since mid-June has established a sequence of lower lows and lower highs. AUDUSD traded lower Monday but despite the pullback, remains closer to its recent highs. The recent breach of 0.7047, Aug 1 high, confirmed a resumption of the uptrend that started Jul 14 and signals scope for a continuation higher.

- Gold maintains a bullish tone despite Monday’s retracement. Recent gains have resulted in a print above trendline resistance at $1784.7. The trendline is drawn from the Mar 8 high and the break represents an important technical breach. WTI futures traded lower Monday and this resulted in a brief print below support at $87.01, the Aug 5 low. The move lower reinforces bearish conditions and a clear break of $87.01 would confirm a resumption of the trend.

- Bund futures started the week on a firmer note. The recent retracement is still considered corrective and the short-term trend direction is up. Moving average studies are in a bull mode condition. Last week’s extension lower in Gilt futures resulted in a break of trendline support drawn from the Jun 16 low. The pullback this month is still considered corrective and the trend outlook remains bullish.

EQUITIES: European Stocks Continue To Edge Higher

- Asian markets closed flat/lower: Japan's NIKKEI closed down 2.87 pts or -0.01% at 28868.91 and the TOPIX ended 3 pts lower or -0.15% at 1981.96. China's SHANGHAI closed up 1.798 pts or +0.05% at 3277.885 and the HANG SENG ended 210.34 pts lower or -1.05% at 19830.52.

- European stocks continue to gain, with Utilities, Communications, Energy and Financials stocks leading: German Dax up 92.49 pts or +0.67% at 13797.86, FTSE 100 up 27.58 pts or +0.37% at 7492.74, CAC 40 up 33.11 pts or +0.5% at 6552.29 and Euro Stoxx 50 up 19.01 pts or +0.5% at 3781.1.

- U.S. futures are off just a touch, with the Dow Jones mini down 11 pts or -0.03% at 33861, S&P 500 mini down 6 pts or -0.14% at 4292.25, NASDAQ mini down 18.25 pts or -0.13% at 13663.

COMMODITIES: Oil Extends Decline Amid Broader Weakness

- WTI Crude down $0.84 or -0.94% at $88.54

- Natural Gas up $0.23 or +2.59% at $8.687

- Gold spot down $4.14 or -0.23% at $1776.99

- Copper down $1.15 or -0.32% at $361.5

- Silver down $0.16 or -0.78% at $20.3164

- Platinum down $7.7 or -0.82% at $938.94

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/08/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/08/2022 | 1230/0830 | *** |  | CA | CPI |

| 16/08/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 16/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/08/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 17/08/2022 | 0130/1130 | *** |  | AU | Quarterly wage price index |

| 17/08/2022 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 17/08/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 17/08/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 17/08/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 17/08/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 17/08/2022 | 0900/1100 | * |  | EU | Employment |

| 17/08/2022 | 0900/1100 | *** |  | EU | GDP (p) |

| 17/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 17/08/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 17/08/2022 | 1330/0930 |  | US | Fed Governor Michelle Bowman | |

| 17/08/2022 | 1400/1000 | * |  | US | Business Inventories |

| 17/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 17/08/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 17/08/2022 | 1820/1420 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.