-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Double-Digit UK CPI Sparks Rate Sell-Off

EXECUTIVE SUMMARY:

- UK CPI IN DOUBLE DIGIT SURPRISE AS FOOD COSTS SOAR

- RBNZ HIKES BY 50BP, REAFFIRMS INFLATION-FIGHTING BIAS

- BOE RATES MAY NEED TO RISE TO 4%, ANDREW SENTANCE SAYS

- EUROZONE ECONOMY GREW LESS THAN INITIALLY ESTIMATED IN Q2

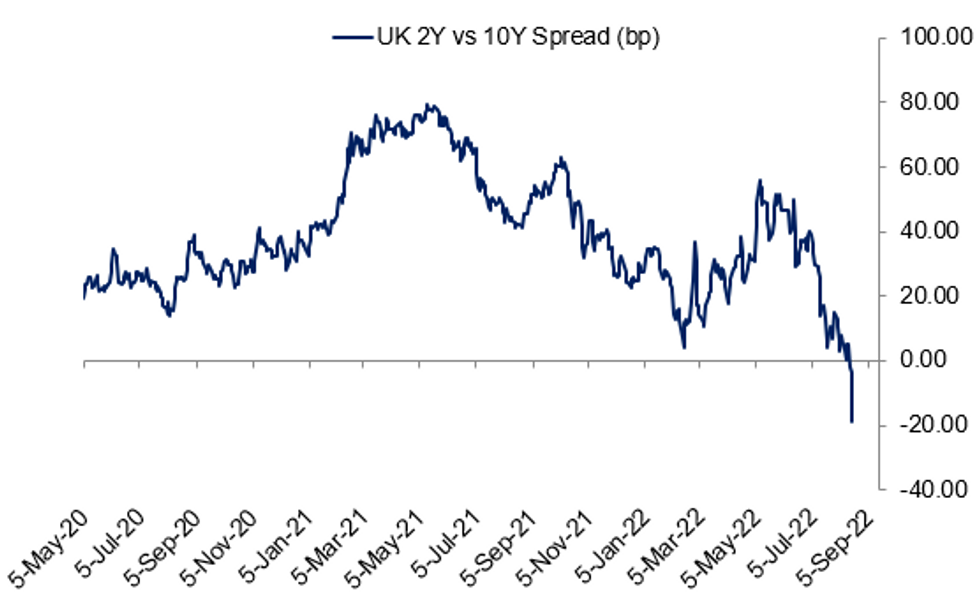

Fig. 1: UK 2s10s Inverts Further

Source: BBG, MNI

Source: BBG, MNI

NEWS:

RBNZ: The Reserve Bank of New Zealand raised the OCR by 50bp to 3.0% as expected by virtually all economists while resetting the terminal level of the OCR track to a higher level.

- The Committee said "it remains appropriate to continue to tighten monetary conditions at pace" to meet the policy objectives, as "core consumer price inflation remains too high and labour resources remain scarce." Members cited evidence of broad-based domestic pricing pressures from a "range of indicators."

- The RBNZ tipped hat to positive developments in its fight against runaway price growth, pointing to the expected easing of headline inflation rate in the near term and a decline in inflation expectations. But it also poured cold water on optimism, noting that core inflation has increased and the risk of a greater change in the wage/price setting behaviour remains.

- While the 50bp OCR hike had been deemed a foregone conclusion well ahead of the meeting, the focus was on the OCR track. The RBNZ raised its peak to 4.10% from 3.95% forecast in the May MPS, effectively setting the stage for a slightly steeper tightening of monetary conditions.

- The Committee showed little concern about the rapid pace of cooling in the housing market. Property prices "are expected to keep falling over the coming year towards more sustainable levels."

- Interestingly, the summary record of the meeting mentioned discussions on the neutral OCR level, previously believed to be around 2%. The Committee took note of an increase in market-based estimates, noting that the Reserve Bank's staff will review their own estimates.

- All in all, the Reserve Bank reaffirmed its bias towards containing price pressures despite weaker global growth outlook and some domestic economic headwinds. While the minutes mentioned discussions "whether more rapid [OCR] increases" were needed, any talk of more gradual tightening was conspicuously absent.

BOE (BBG): The Bank of England may need to more than double interest rates by the end of this year to get inflation under control, said a policy maker who served at the central bank through the last financial crisis. Andrew Sentance, now a senior adviser to Cambridge Econometrics, said the BOE’s key rate may need to rise to 3% or 4% because policy makers have “fallen behind the curve.” The rate is now 1.75%.

UK (BBG): Liz Truss led Rishi Sunak by 32 points in the latest survey of UK Tory members by the ConservativeHome website, suggesting she remains on track to win the race to succeed Boris Johnson as prime minister. Some 60% of the 961 Tory members polled by the influential website said they favored Truss to become the Conservative Party’s new leader, while just 28% backed Sunak, ConservativeHome said on Wednesday. The result is similar to the last ConservativeHome poll of Tory members on Aug. 4, when Truss also enjoyed a 32-point lead.

UK-EU (BBG): The UK government says it has launched formal consultations with the European Union, “in an effort to end persistent delays to the UK’s access to EU scientific research programs, including Horizon Europe.”

OPEC (BBG): Global oil markets face a high risk of a supply squeeze this year as demand remains resilient and spare production capacity dwindles, the new head of OPEC said. Fears over slowing consumption in China and the wider world -- which have pushed crude prices 16% lower this month -- have been exaggerated, OPEC Secretary-General Haitham Al-Ghais said in an interview with Bloomberg Television.

SWITZERLAND / GREEN BONDS (RTRS): Switzerland is to issue its first green bonds from autumn of this year, the government said, after adopting the framework for doing so at a meeting on Wednesday. The targeted issuance volume is several hundred million francs per year, the government said in a statement. "By issuing green Confederation bonds, (the Swiss Federal Council) intends to promote the application of international standards on the Swiss capital market and encourage private sector players to issue their own green bonds," the statement said.

NORTH KOREA (MNI POLITICS): North Korea test-fired two cruise missiles toward the West Sea from South Pyongan province early Wednesday morning, South Korea's military said. South Korea and the U.S. are analysing the details of the incident, such as flight distance.

DATA:

MNI BRIEF: UK CPI In Double Digit Surprise As Food Costs Soar

Inflation continued to outpace expectations in July, with the consumer price index (CPI) rising 10.1% year-on-year to a fresh 40-year high, up from 9.4% in June, the Office for National Statistics reported Wednesday. The rate exceeded analysts consensus forecasts of an increase of 9.8% y/y and was above the Bank of England's outlook for July.

According to Grant Fitzner, the ONS's chief economist, a wide range of price rises drove inflation up again this month. "Food prices rose notably, particularly bakery products, dairy, meat and vegetables, which was also reflected in higher takeaway prices," he said.

The retail price index (RPI), the measure used for rises in many benefits and services, rose 12.3% year-on-year, the highest annual increase since March 1981.

MNI: EUROZONE FLASH Q2 GDP +0.6% Q/Q, +3.9% Y/Y

EUROZONE DATA (BBG): The euro-area economy grew slightly less than initially estimated in the second quarter as signs continue to emerge that momentum is unraveling. Output rose 0.6% from the previous three months between April and June, compared with a preliminary reading of 0.7%, Eurostat said Wednesday. Employment, meanwhile, climbed 0.3% during that period.

MNI BRIEF: BOJ's July Real Export Index Rises 1.7% M/M

The Bank of Japan’s real export index, calculated using Ministry of Finance trade data, rose 1.7% m/m in July for a third monthly straight rise. The figures were calculated by MNI based on BOJ data and confirmed. The July index rose 3.1% when compared on a like for like basis with Q2's 3.2% q/q decline.

BOJ officials saw both exports and production rebounded, helped by an easing in supply-side restrictions. However, they will monitor the impact of planned power outages in China on Japanese manufacturers' factories. Exports of automobiles rose 13.7% in July, accelerating from +0.4% in June, showing the impact of the supply-side restriction on automobile makers is easing.

Japan's exports rose 19.0% y/y in July for the 17th straight rise following +19.3% in June, and imports rose 47.2% y/y for the 18th straight gain following +46.1% in June, data released on Wednesday by the Ministry of Finance showed. The overall trade deficit was JPY1.437 trillion, as higher resource prices saw a12th straight deficit.

The full July real export index data is due on Monday.

FIXED INCOME: A busy start driven by UK inflation

- A very busy morning session for Govies and Rate markets, which was all triggered by the UK CPI beat on the Govie cash open.

- SONIA strip opened with gap down, 6 ticks for the SFIM3 96.61 to 96.55, and plummeted 36 ticks, breaking through the June lows, and at contracts lows.

- This was the story along the strip, as investors and traders priced 200bps worth of hike to May 2023.

- UK 2s/10s tested the most inverted level since 2007.

- All the action was in Govies and rates, and EGBs and Bund got dragged lower by UK.

- At the time of typing, dust has settled in Govies and UK Rates.

- Bund moves off the low, underpinned by the small EU GDP miss.

- Some likely squaring in the SONIA strip, with June and Sep 23, 14 ticks off their lows now.

- The move in futures, pushed the 10yr Yield Gilt/Bund spread by another 1.5bp wider, highest since 22nd March.

- Upside resistance is seen at 120.05bps.

- With the move more pronounced in Europe and the UK, US Treasuries futures outperforms Europe, but are also still trading in the red.

- Tnote/Bund spread is in turn 3.8bps tighter and testing initial support at 179.46bps, now at 179.5bps.

- Looking ahead, US, Retail Sales, and FOMC minutes will also be in focus.

- Fed's Bowman speaks on technology and financial services.

FOREX: GBP Strength Limited as Yield Curve Aggressively Inverts

- GBP is stronger early Wednesday, with GBP/USD rallying to touch a react high of 1.2143 following the July CPI release which came in well ahead of expectations. Y/Y CPI surged to 10.1%, with core similarly rising ahead of forecast to again touch the highest levels since 1992. In response to the release, markets have brought forward their expectations for BoE policy in the coming quarters, and now see another 200bps of rate rises by the midpoint of 2023.

- Somewhat countering this hawkish outturn, however, is the continued curve inversion for the front end of the yield curve, reinforcing expectations for a looming recession in the UK. The 2y5y yield spread is now the most inverted since the Global Financial Crisis, limiting GBP's strength ahead of the NY crossover. The short-term trend outlook is bullish but a break of 1.2293 is required to reinforce this and signal a resumption of the bull cycle. A break would open 1.2406, the Jun 16 high. On the downside, clearance of support at 1.2004 would instead expose 1.1890, the Jul 21 low.

- NZD has entirely reversed initial strength garnered from the RBNZ rate decision overnight, at which the bank steepened their OCR track to bring forward the peak rate of 4% to Q2 next year. Initial NZD/USD strength (touching 0.6383) has unwound, putting the pair lower headed into NY hours.

- Lastly, AUD is the poorest performing currency in G10 as wage price index data fell short of forecast. EUR/AUD is now north of 1.46 and narrowing in on the early August highs at 1.4806.

- The US retail sales release takes focus going forward, with markets expecting the headline advance figure to have improved by 0.1% on the month. The FOMC minutes for their July meeting follow, due at 1900BST/1400ET. Central bank speakers today are limited to Fed's Bowman, who speaks on technology and women's role in the economy.

EQUITIES: Pulling Back On Higher Central Bank Hike Expectations

- Asian markets closed stronger: Japan's NIKKEI closed up 353.86 pts or +1.23% at 29222.77 and the TOPIX ended 25.03 pts higher or +1.26% at 2006.99. China's SHANGHAI closed up 14.641 pts or +0.45% at 3292.526 and the HANG SENG ended 91.93 pts higher or +0.46% at 19922.45.

- European futures are weaker, with the Health Care, Materials, and Industrials dragging down Eurostoxx: German Dax down 61.96 pts or -0.45% at 13847.56, FTSE 100 down 13.96 pts or -0.19% at 7521.73, CAC 40 down 18.73 pts or -0.28% at 6573.53 and Euro Stoxx 50 down 9.51 pts or -0.25% at 3795.33.

- U.S. futures are a little lower, with the Dow Jones mini down 85 pts or -0.25% at 34033, S&P 500 mini down 16.75 pts or -0.39% at 4291, NASDAQ mini down 69.75 pts or -0.51% at 13588.5.

COMMODITIES: Energy Rebounds, Metals Don't

- WTI Crude up $0.37 or +0.43% at $86.85

- Natural Gas up $0.07 or +0.74% at $9.397

- Gold spot down $1.23 or -0.07% at $1774.56

- Copper down $2.5 or -0.69% at $359.85

- Silver down $0.16 or -0.78% at $19.9923

- Platinum down $7.62 or -0.81% at $930.79

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 17/08/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 17/08/2022 | 1330/0930 |  | US | Fed Governor Michelle Bowman | |

| 17/08/2022 | 1400/1000 | * |  | US | Business Inventories |

| 17/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 17/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 17/08/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 17/08/2022 | 1820/1420 |  | US | Fed Governor Michelle Bowman | |

| 18/08/2022 | 0130/1130 | *** |  | AU | Labor force survey |

| 18/08/2022 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 18/08/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 18/08/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 18/08/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 18/08/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 18/08/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 18/08/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 18/08/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 18/08/2022 | 1400/1000 | * |  | US | Services Revenues |

| 18/08/2022 | 1400/1000 | ** |  | US | leading indicators |

| 18/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 18/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 18/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 18/08/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 18/08/2022 | 1715/1915 |  | EU | ECB Schnabel Presentation at IHK Reception | |

| 18/08/2022 | 1720/1320 |  | US | Kansas City Fed's Esther George | |

| 18/08/2022 | 1745/1345 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.