-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - UK Yield Rally Hits Reverse as BoE Step In

Highlights:

- UK yield curve shifts materially lower as BoE wade in to steady market

- Bank of England to conduct extraordinary Gilt purchases to address market tumult

- Fed speakers on deck, with Powell up at 1515BST/1015ET

Gilt Prices Surge as BoE Announce Bond Purchases to Restore Stability

- Gilt futures rally sharply as the Bank of England announce they are to hold a temporary purchase programme for Gilts from today, in an attempt to address market functioning.

- Full Bank statement here: https://www.bankofengland.co.uk/news/2022/septembe...

- "These purchases will be strictly time limited. They are intended to tackle a specific problem in the long-dated government bond market. Auctions will take place from today until 14 October. The purchases will be unwound in a smooth and orderly fashion once risks to market functioning are judged to have subsided."

- Gilt futures rally sharply, touching 95.60, GBP also briefly spikes, putting GBP/USD at 1.0837 before the price action swiftly reverses.

BoE Key Parts of Bank's Statement Concerning Balance Sheet:

- "These purchases will be strictly time limited. They are intended to tackle a specific problem in the long-dated government bond market. Auctions will take place from today until 14 October. The purchases will be unwound in a smooth and orderly fashion once risks to market functioning are judged to have subsided."

- "The MPC’s annual target of an £80bn stock reduction is unaffected and unchanged."

- "Bank’s Executive has postponed the beginning of gilt sale operations that were due to commence next week. The first gilt sale operations will take place on 31 October and proceed thereafter."

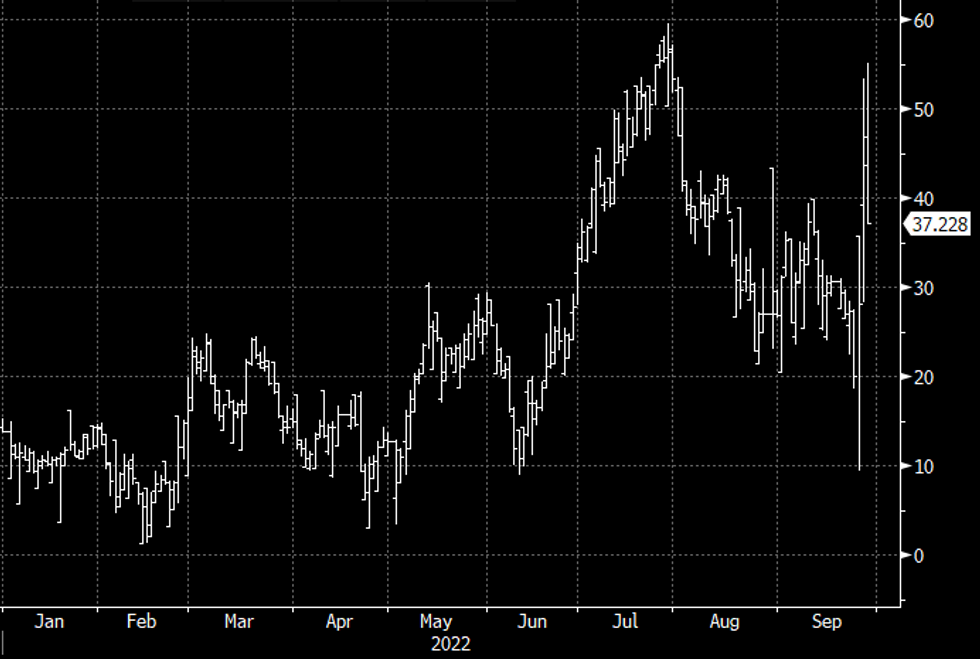

GILT FUTURES: Curve Resolves In Flattening Direction Post-BoE Announcement

Despite the headlines of temporary BoE long-end Gilt purchases to calm the market, the curve basically moved in parallel on the BoE announcement, with yields dropping as much as 34bp from 2s through 30s, with a bit of a steepening initially and now flattening.

- It may have taken a few minutes for traders to digest the news. The curve is now decisively flattening though. 10s30s - after hitting post-1998 high earlier in the session above 55bp; - last 40.7bp, 9+bp flatter since prior to the announcement. See daily chart below.

UK 10s30s spreadSource: BBG

UK 10s30s spreadSource: BBG

US TSYS: Treasuries Jump With BoE Purchases, Fedspeak and Issuance Ahead

- What started off as a twist steepening for cash Tsys with 10Y yields clearing 4% has swung to an outright bull flattening in spillover from the BoE announcing bond purchases to restore stability.

- 2YY -9.9bps at 4.184%, 5YY -8.7bps at 4.097%, 10YY -5.3bps at 3.892%, and 30YY -2.2bps at 3.804%.

- TYZ2 trades 19 ticks higher at 111-15+ (snap high of 111-18) with a spike in volumes but keeps to yesterday’s wide range with its high of 112-01+. Prior to the BoE announcement it saw a new recent low of 110-19.

- Fedspeak: Daly, Bostic, Bullard, Powell, Bowman, Barkin all scheduled although some including Powell just opening remarks.

- Data: Second tier with preliminary wholesale inventories, advanced trade balance, pending home sales (of more note than usual after yesterday’s new home sale surge) and weekly MBA mortgage applications/rate.

- Bond issuance: $22B 2Y FRN Note auctions (91282CFD8) at 1130ET, $36B 7Y Note auction (91282CFL0) at 1300ET after tails for 2Y and 5Y auctions in the past two days.

- Bill issuance: $30B 119D CMB

Price Signal Summary - Gilts Swing Wildly But Remain Below Resistance - For Now

- In the equity space, S&P E-Minis trend conditions remain bearish following last week’s extension lower and this week’s follow through. This strengthens bearish conditions and note that a key support at 3657.00, Jun 17 low and an important medium-term bear trigger, has been cleared. The break confirms a resumption of the broader downtrend. The focus is 3600.00 next. EUROSTOXX 50 futures remain soft following the reversal on Sep 13, from 3678.00, the Jun 13 high and this week’s follow through. Key short-term support at 3423.00, the Sep 5 low has been cleared, the break strengthens bearish conditions and has led to a breach of 3341.00, the Jul 5 low. The focus is on 3229.00 next, the Nov 9 2020 low (cont).

- In FX, the EURUSD remains vulnerable. The break lower last week and this week, confirms a resumption of the primary downtrend - reinforced too by last week’s breach of 0.9864, the Sep 6 low. The move lower maintains the bearish price sequence of lower lows and lower highs. Price is also trending down inside a bear channel drawn from the Feb 10 high. The channel base intersects at 0.9504. Bearish trend conditions in GBPUSD remain intact. An important short-term support has been defined at 1.0350, Monday’s low. The trend is down and a break of this support would confirm a resumption of bearish activity. Monday’s close also highlights an important candle pattern - a hammer and potential reversal signal. A break above Monday’s 1.0931 high is required to strengthen this signal and highlight a potential short-term base. USDJPY is holding on to the recovery from last Thursday’s low of 140.36 - a key short-term support - where a break is required to highlight a top and the potential for a deeper retracement. The uptrend remains intact and attention is on the bull trigger at 145.90, the Sep 22 high. A break would confirm a resumption of the uptrend and open 146.03, 2.764 projection of the Aug 2 - 8 - 11 price swing.

- On the commodity front, Gold traded lower Friday, breaking out of its recent range and in the process confirmed the bear flag formation evident on the daily chart. The yellow metal remains soft. The break low this week confirms a resumption of the downtrend and opens $1610.5, the 1.00 projection of the Jun 13 - Jul 21 - Aug 10 swing. In the Oil space, a bearish threat in WTI futures remains present. The recent break of support at $84.25, the Jul 14 low, confirmed a resumption of the downtrend that started Jun 8 and marks the end of a broad sideways move that has been in place since mid-July. Yesterday’s move lower reinforces current conditions. Attention is on $76.11, 1.618 projection of the Jul 29 - Aug 16 - 30 price swing.

- In the FI space, Bund futures remain in a clear downtrend and the extension lower last week and this week, confirms a resumption of the bear leg that started early August. The focus is on 135.27, the Mar 2012 low (cont). Gilts are trading in an extremely volatile manner, however, trend signals remain bearish. The break recently of a number of support levels signals scope for weakness towards 90.57 next, the 2.618 projection of the May 12 - Jun 16 - Aug 2 swing (cont). Initial resistance is seen at 97.43, Tuesday’s high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/09/2022 | 0815/0915 |  | UK | BOE Cunliffe Keynote at AFME Conference | |

| 28/09/2022 | 0900/1100 | * |  | IT | Industrial Orders |

| 28/09/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 28/09/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/09/2022 | 1235/0835 |  | US | Atlanta Fed's Raphael Bostic | |

| 28/09/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 28/09/2022 | 1410/1010 |  | US | St. Louis Fed's James Bullard | |

| 28/09/2022 | 1415/1015 |  | US | Fed Chair Jerome Powell | |

| 28/09/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 28/09/2022 | 1500/1700 |  | EU | ECB Elderson Intro at Greens/EFA Event | |

| 28/09/2022 | 1500/1100 |  | US | Fed Governor Michelle Bowman | |

| 28/09/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 28/09/2022 | 1530/1130 |  | US | Richmond Fed's Tom Barkin | |

| 28/09/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 28/09/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/09/2022 | 1800/1400 |  | US | Chicago Fed's Charles Evans | |

| 28/09/2022 | 1800/1900 |  | UK | BOE Dhingra Chairs Panel at LSE | |

| 29/09/2022 | 0700/0900 |  | EU | ECB Panetta Intro at ECOFIN Hearing | |

| 29/09/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 29/09/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 29/09/2022 | 0800/1000 |  | EU | ECB de Guindos Speech at BIS/Bank of Lithuania | |

| 29/09/2022 | 0800/1000 |  | IT | PPI | |

| 29/09/2022 | 0815/1015 |  | EU | ECB Elderson Speech at Nederlandsche Bank & OMFIF | |

| 29/09/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/09/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/09/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 29/09/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 29/09/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 29/09/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 29/09/2022 | 0930/1130 |  | EU | ECB de Guindos Opens ECB Research Workshop | |

| 29/09/2022 | 1130/1230 |  | UK | BOE Ramsden Panels Lithuania CB/BIS Conference | |

| 29/09/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 29/09/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/09/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 29/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 29/09/2022 | 1230/0830 | *** |  | US | GDP (3rd) |

| 29/09/2022 | 1330/0930 |  | US | St. Louis Fed's James Bullard | |

| 29/09/2022 | 1400/1000 | ** |  | US | WASDE Weekly Import/Export |

| 29/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 29/09/2022 | 1500/1600 |  | UK | BOE Tenreyro Panellist at Centre for Economic Policy Research | |

| 29/09/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 29/09/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 29/09/2022 | 1700/1300 |  | US | Cleveland Fed's Loretta Mester | |

| 29/09/2022 | 1700/1900 |  | EU | ECB Lane Panels ECB/Cleveland Fed Conference | |

| 29/09/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

| 29/09/2022 | 2045/1645 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.