-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Betting Odds Swing in Favour of a EU-UK Deal

EXECUTIVE SUMMARY:

- BETTING ODDS SWING IN FAVOUR OF A DEAL AS EU/UK EXTEND NEGOTIATIONS

- GBP STRONGEST IN G10, GILTS TRADE HEAVY

- NO DATA DUE, FOCUS RESTS ON KEY CENTRAL BANK DECISIONS LATER IN THE WEEK

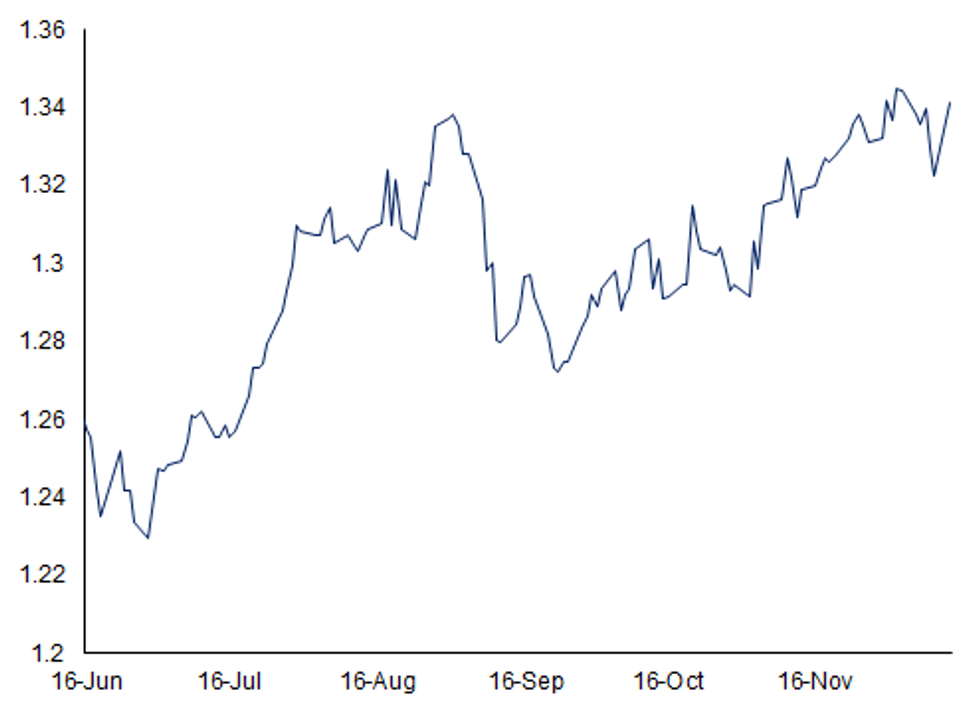

GBP Returns to Recent Highs on Trade Deal Optimism

GBP Returns to Recent Highs on Trade Deal Optimism

NEWS:

EU/UK:

Member States Assume Brexit Talks Could Continue To End Of Week: RTE

Michel Barnier has told EU member states there has been some movement on the level playing field, and on dispute resolution, but that fisheries talks remain "very difficult" @rtenews understands. Sources say this could go through this week and beyond.

BBC: Barnier Says Talks Hard, But Moving in 'Direction Of Agreement'

"EU Chief Negotiator Michel Barnier has indicated there could be a Brexit deal within days if a solution to fishing rights is found, a senior EU source has told the BBC."

US:

Pelosi, Mnuchin Due To Talk Later Today On COVID-19 Relief: Fox

Chad Pergram at Fox News tweets: "Senate bipartisan coalition expected to formalize its $908 billion coronavirus bill this wk. Pelosi/Mnuchin expected to talk later today about COVID deal. Also, talks continue about overall spending pkg to fund gov't"

ASIA:

MNI EXCLUSIVE: China Property Investment To Grow 5%+: Advisors- Land Sales To Pick Up Next Year With New Quotas

Real estate investment in China will grow at least 5% next year as land sales recover and builders, constrained by tighter financing rules, accelerate project launches and home sales to improve their cash flow, policy advisors told MNI.

MNI REALITY CHECK: China Nov Sales Boosted By Online Sales

China's retail sales should see further growth in November, supported by continued strong auto sales and a boost from the e-commerce shopping festival which could take online good sales to a new high, industry insiders and analysts told MNI.

MNI INSIGHT: BOJ Tankan Increases Concern Over Virtuous Cycle

The Bank of Japan's December Tankan business sentiment survey showed that businesses are more cautious about implementing capital investment, increasing concerns over a pause in the virtuous economic cycle, MNI understands.

DATA:

EZ OCT IND PROD +2.1% M/M, -3.8% Y/Y; SEP +0.1%r M/M

BOND SUMMARY: Steady ahead of Brexit, Fed and BoE

A steady start for Bonds ahead of a risk events filled week (Brexit, Fed, BoE)

- Brexit continues to dominate, with trade talks extended and set to continue from today, with no new set deadline.

- Bund are trading in the red, while peripherals outperforms somewhat, and Italy leads 2.3bps tighter against the German 10yr.

- Gilts are down 54 ticks at the time of typing, translating in a wider 3.1bps spread versus Germany.

- The street views the extension of Brexit talks as positive, pushing GBP higher and Gilts lower.

- US Treasuries have traded in line with EGBs, also helped by overnight news, that a bipartisan group will unveil a $908bn relief bill today. Although, there's no guaranty that it will be passed by congress.

- Looking ahead, we have no tier 1 data and speakers are scheduled for today.

- Gilt futures are down -0.35 today at 136.40 with 10y yields up 4.8bp at 0.219% and 2y yields up 3.8bp at -0.84%.

- Bund futures are down -0.23 today at 178.45 with 10y Bund yields up 1.3bp at -0.625% and Schatz yields up 0.8bp at -0.781%.

- BTP futures are up 0.11 today at 152.15 with 10y yields down -1.2bp at 0.545% and 2y yields down -0.9bp at -0.454%

- OAT futures are down -0.12 today at 168.37 with 10y yields up 0.5bp at -0.379% and 2y yields down -0.1bp at -0.733%

- TY1 futures are down -0-5 today at 138-11 with Bund futures down -0.23 at 178.45 and Gilt futures down -0.35 at 136.40.

FOREX: Sterling Firmer as Betting Odds Swing in Favour of a Deal

In typical EU style, an agreement was reached to 'go the extra mile' and extend EU-UK free trade talks beyond Sunday's deadline which juiced GBP both at the open on Sunday evening and throughout the European morning. GBP/USD rallied smartly through the Friday high in early Asia-Pac hours and has continued to progress north of 1.34 ahead of the NY crossover. Unsurprisingly then, GBP is the strongest currency in G10 so far.

At the other end of the table, USD trades poorly, with the USD index making an early attempt on the multi-year lows printed on Dec 4 at 90.476 - a level that could be reached should EUR/USD break north of Friday's 1.2163.

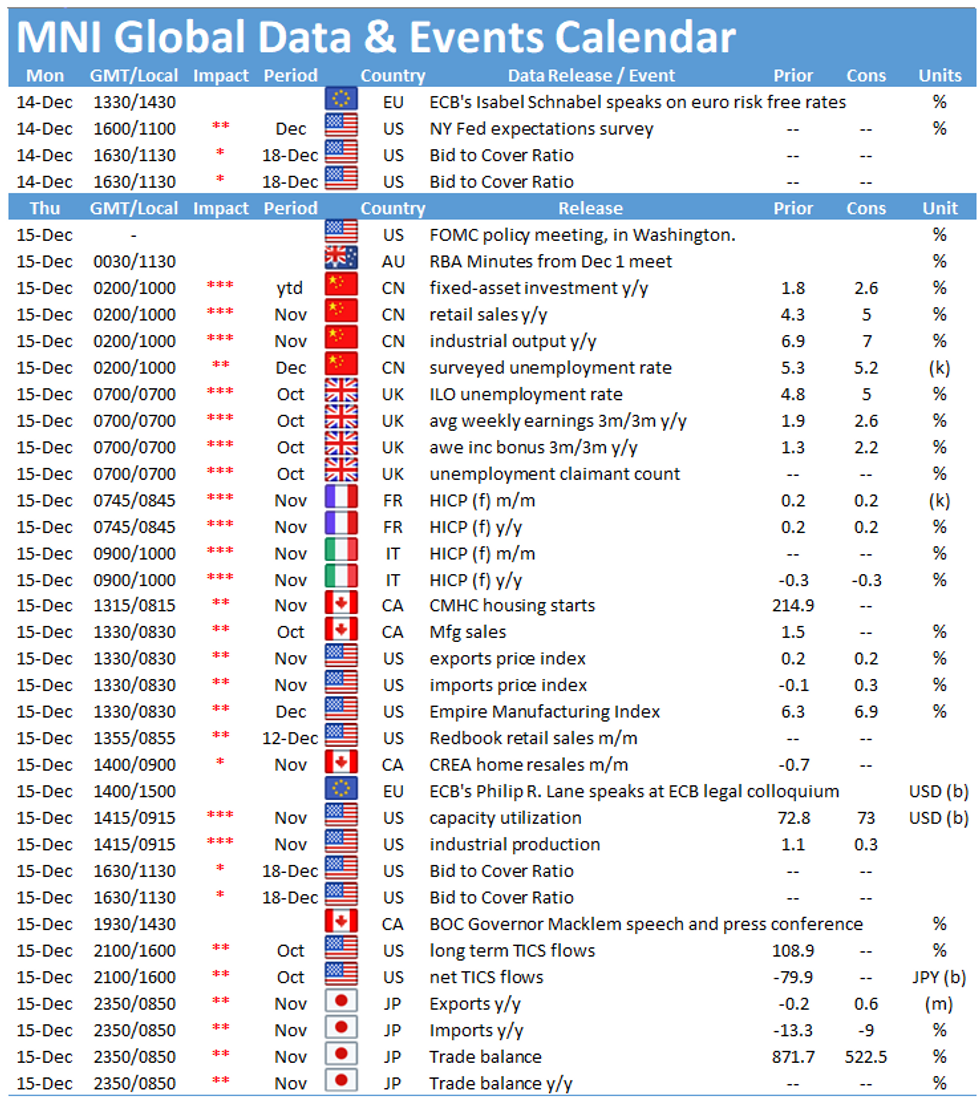

The data calendar is typically empty this Monday, with focus resting on the deluge of central bank rate decisions later in the week, with UK, US, Norway, Switzerland among others releasing policy decisions this week.

EQUITIES: Stocks Solid on Tangible Signs of Brexit Progress

- Japan's NIKKEI up 79.92 pts or +0.3% at 26732.44 and the TOPIX up 8.51 pts or +0.48% at 1790.52

- China's SHANGHAI closed up 21.929 pts or +0.66% at 3369.12 and the HANG SENG ended 116.35 pts lower or -0.44% at 26389.52.

- The German Dax up 143.21 pts or +1.09% at 13257.57, FTSE 100 up 26.89 pts or +0.41% at 6575.83, CAC 40 up 60.11 pts or +1.09% at 5567.83 and Euro Stoxx 50 up 34.73 pts or +1% at 3520.73.

- Dow Jones mini up 220 pts or +0.73% at 30251, S&P 500 mini up 22.75 pts or +0.62% at 3683.75, NASDAQ mini up 51.75 pts or +0.42% at 12422.

COMMODITIES: NatGas Continues to Outperform While Gold Suffers on Firmer Equities

- WTI Crude up $0.48 or +1.03% at $47.07

- Natural Gas up $0.1 or +3.94% at $2.693

- Gold spot down $16.55 or -0.9% at $1823.3

- Copper up $0.3 or +0.09% at $353.2

- Silver down $0.18 or -0.75% at $23.7736

- Platinum up $4.25 or +0.42% at $1017.86

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.