-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Broad Retracement (But Not For The Dollar)

EXECUTIVE SUMMARY:

- KISHIDA WINS LDP LEADERSHIP, SET TO BECOME JAPAN P.M.

- LITTLE EVERGRANDE IMPACT ON CHINA LIQUIDITY: MNI SURVEY

- CHINA'S REGULATORS TIGHTEN SCRUTINY OF FX DEALERS (RTRS)

- E.U. UNITES BEHIND NARROWER TRADE OBJECTIVES FOR U.S. MEETING

- MAKHLOUF SAYS ECB MUST BE READY TO ACT IF INFLATION ENTRENCHED

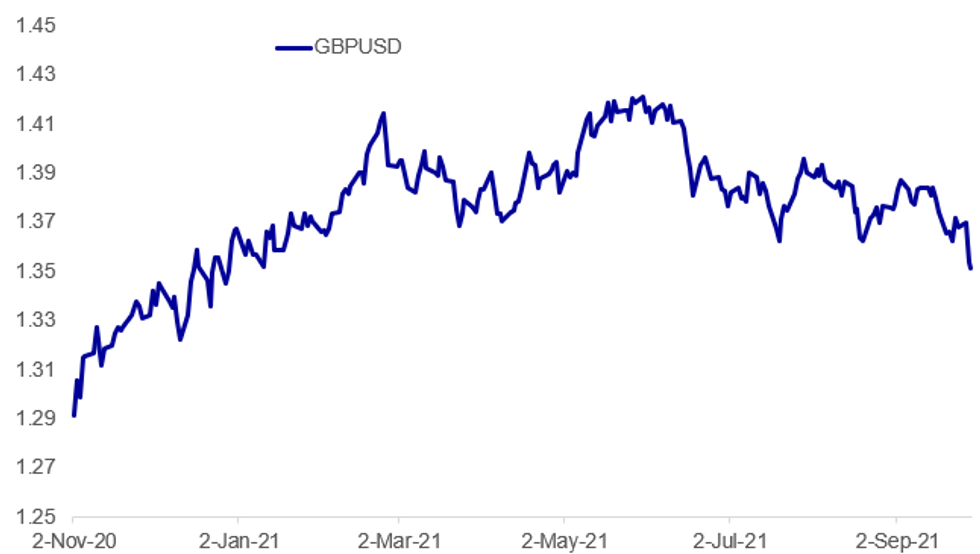

Fig. 1: Cable Remains Under Pressure

Source: BBG, MNI

Source: BBG, MNI

NEWS:

JAPAN: Fumio Kishida, former Liberal Democratic Party policy chief, on Wednesday won a runoff for the ruling LDP leadership race, capturing 257 of the 427 votes from 380 lawmakers and 47 voters representing each of Japan's prefectures. His challenger Taro Kono got 170 of the 427 voters. All four candidates are onboard with large-scale fiscal spending to support an economy facing downside risks caused by a prolonged coronavirus pandemic and general support for current monetary policies. Kishida will be elected prime minister in a special parliamentary session Oct. 4, and a new cabinet is expected to be put in place that day based on the LDP-led coalition's majority in the powerful lower house. He will take the party into a general election in November.

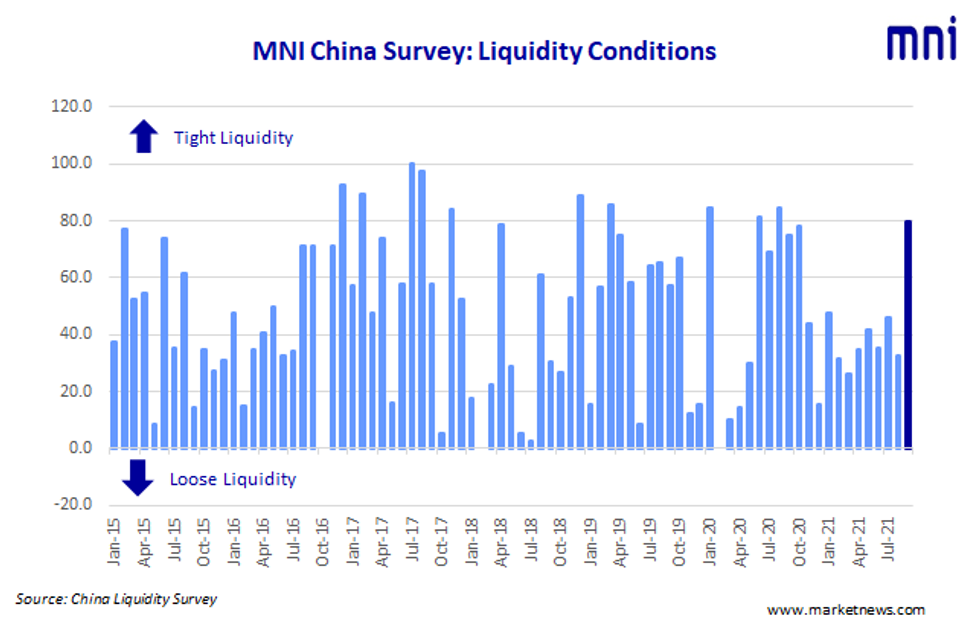

MNI CHINA LIQUIDITY INDEX: The fallout from Evergrande has had little impact on short-term liquidity conditions across China's interbank market, but there is certainly a continued degree of uncertainty across the wider financial markets, respondents to MNI's Liquidity Conditions survey said. For full article see Data section below.

CHINA / FX (RTRS): China's regulators are tightening control over the inner workings of its currency market, pressuring banks to trade less and in smaller ranges, two banking sources told Reuters, as part of a sweeping push to curb speculation. The moves follow recent efforts at curtailing financial risks that include dampening commodity price rises, banning cryptocurrency transactions and restricting property speculation. And they bring the campaign deeper into day-to-day operations on the dealing desks of a $30 trillion market.It is also the latest example of scrutiny focused on foreign exchange, which analysts said might be aimed at tightening the leash on the yuan at a sensitive time when U.S. policymakers prepare to withdraw monetary stimulus and China seems poised to add more.

E.U./ U.S./GLOBAL TRADE (BBG): European Union countries agreed on a joint statement for its pivotal trade meeting with the U.S. scheduled for later Wednesday, with France successfully watering down aspects of it, including on semiconductors. The draft was endorsed by all 27 member states just hours before the start of the meeting, according to officials familiar with the decision, who asked not to be identified because the procedure was private. The conclusions for the Trade and Technology Council, seen by Bloomberg, aim to deliver guiding principles on screening investments, export controls, artificial intelligence and semiconductor supply chains. And while China isn't mentioned by name, numerous issues appear to be directed at Beijing, such as a discussion on non-market policies that distort trade.

LIBOR (BBG): U.K. regulators may allow firms to continue using Libor for some contracts in limited circumstances after its planned end date, an effort to ensure the transition of trillions of dollars of contracts goes smoothly. The Financial Conduct Authority said Wednesday that it could allow dollar Libor to be used in new contracts beyond year-end for circumstances that include market making and hedging. Firms can also to use "synthetic Libor," created without banks' trading data, for all legacy contracts except cleared derivatives in the yen and sterling markets for a further year.

ECB (BBG): European Central Bank Governing Council member Gabriel Makhlouf said policy makers must be ready to respond to persistently higher inflation that could result from lasting supply bottlenecks."We must be very vigilant of the risks out there," the governor of the Irish central bank said in a Bloomberg TV interview. Price pressures observed at the moment are largely transitory, he added."Right now I don't believe there's a risk of excessive inflation," he said.

CHINA / PROPERTY (MNI): China may soon extend a pilot property tax to more cities despite fears over a weakening real estate market, targeting high-income centres such as Shenzhen as authorities cap speculation and excessive borrowing in line with President Xi Jinping's drive to reduce inequality, policy advisors told MNI. For full article contact sales@marketnews.com

DATA:

MNI China Liquidity Index™ – Jumps to 79.6 in September

Liquidity across China's interbank money market tightened significantly in September, the latest MNI Liquidity Conditions Index shows.

The Liquidity Condition Index stood at 79.6 in September, up from the 32.7 recorded in August.

- The Economy Condition Index stood at 5.6, the lowest time since dropping to 0 in February 2020, the economy's pandemic-era low point.

- The PBOC Policy Bias Index edged higher, but still sitting below the 50 mark.

- The Guidance Clarity Index also edged higher, although was overall little changed on the August level.

- With the economy seen slowing, long-term bond yields are seen lower over the next 3 months.

The MNI survey collected the opinions of traders with financial institutions operating in China's interbank market, the country's main platform for trading fixedincome and currency instruments, and the main funding source for financial institutions.

Interviews were conducted Sept 13 – July 24.

Click below for the full press release:

MNI_China_Liquidity_Index_Aug_2021.pdf

For full database history and full report on the MNI China Liquidity Index™, please contact:sales@marketnews.com

MNI BRIEF: Spain Inflation At Highest Since 2008

Spanish CPI rose by 0.8% between August and September, taking the annual rate of 4.0% in September, the highest level since September of 2008, according to data released by INe on Wednesday. Core inflation was more subdued, rising by an annual rate of just 1.0%, creating the biggest gap between the two measures since August of 1986.

HICP rose by 1.1% between August and September, taking the index 4.0% above its level of 2020. Eurozone September HICP data are due on Friday at 1000BST.

Source: INe

MNI BRIEF: Little Evergrande Impact On Liquidity: MNI Survey

One Shanghai-based trader noted the tighter financing conditions faced by real estate companies, which could trigger a round of defaults in the sector – which could then roll out into other sectors.

China Evergrande Debts has attracted global financial market attention in recent month, as more financial risk concerns arising, MNI added a special question of "Whether the Evergrande case has caused big influence on short term liquidity market" in September's survey. Another trader at a big four bank said the authorities handling of risk events in recent years, including Baoshang and Yongmei would help them deal with any Evergrande fall out.

FIXED INCOME: The retracement game

- Today's moves in bond markets have largely been reversals of yesterday's moves. Chinese equities were better bid overnight, initially halting the selloff in Treasuries and a move higher in European/US equities has coincided with moves in fixed income markets. At first glance it may seem strange that core fixed income has been moving in the same direction as equities but a lot of the moves are being driven by expectations of rate hikes. So higher rates has been bearish for both fixed income and equities in recent days. Today is seeing a retracement of that.

- Looking ahead there are plenty of ECB speakers today at the ECB Forum with Powell, Bailey and Kuroda joining Lagarde for a panel event later. We are also due to hear from Fed's Bostic, Daily and Harker.

- TY1 futures are up 0-8+ today at 131-23+ with 10y UST yields down -3.2bp at 1.507% and 2y yields down -0.5bp at 0.298%.

- Bund futures are up 0.26 today at 170.12 with 10y Bund yields down -1.6bp at -0.216% and Schatz yields down -0.5bp at -0.700%.

- Gilt futures are up 0.18 today at 125.75 with 10y yields down -2.1bp at 0.972% and 2y yields down -1.7bp at 0.386%.

FOREX: GBP Weakness Pervades as Cable Shows Through Tuesday Low

- For a second session, GBP is the poorest performer in G10, with GBP/USD through the Tuesday low of 1.3521. Explanations are broad and varied, with some positing the images of fuel shortages and supply chain woes are raising the spectre of stagflation, however a number of sell-side analysts are pinning price action on month/quarter-end rebalancing, an effect that may persist into the Thursday fix.

- The broader risk-off themes present in Tuesday trade have faded slightly, with the spike in US Treasury yields abating and European stock markets recovering. Nonetheless, JPY is making solid headway as USD/JPY reverses off the 2021 highs printed overnight at 111.68.

- Lastly, the USD Index showed through the mid-August highs of 93.729 high, improving the near-term outlook further. This opens gains toward levels not seen since early November last year at 94.302.

- Tier one data releases are few and far between Wednesday, keeping focus on the ongoing ECB Sintra forum. Highlights today include ECB's Centeno, Stournaras, Makhlouf & Lane, Fed's Harker, Daly & Bostic and the headline appearances from Powell, Lagarde, Bailey and Kuroda at a joint panel.

EQUITIES: Tech Leads Rebound, With Energy Stocks Lagging

- Asian stocks closed weaker, with Japan's NIKKEI down 639.67 pts or -2.12% at 29544.29 and the TOPIX down 43.48 pts or -2.09% at 2038.29. China's SHANGHAI closed down 65.925 pts or -1.83% at 3536.294 and the HANG SENG ended 163.11 pts higher or +0.67% at 24663.5

- European equities are a little higher, with the German Dax up 139.05 pts or +0.91% at 15381.32, FTSE 100 up 54.19 pts or +0.77% at 7080.36, CAC 40 up 57.86 pts or +0.89% at 6561.91 and Euro Stoxx 50 up 39.29 pts or +0.97% at 4097.21.

- U.S. futures are gaining, led by tech, with the Dow Jones mini up 191 pts or +0.56% at 34366, S&P 500 mini up 30.5 pts or +0.7% at 4374, NASDAQ mini up 130.75 pts or +0.89% at 14895.5.

COMMODITIES: Energy Prices Pause For Breath

- WTI Crude down $0.62 or -0.82% at $74.65

- Natural Gas down $0.05 or -0.83% at $5.821

- Gold spot up $7.94 or +0.46% at $1742.1

- Copper down $2.05 or -0.48% at $422.65

- Silver down $0.13 or -0.6% at $22.3258

- Platinum up $0.33 or +0.03% at $968.24

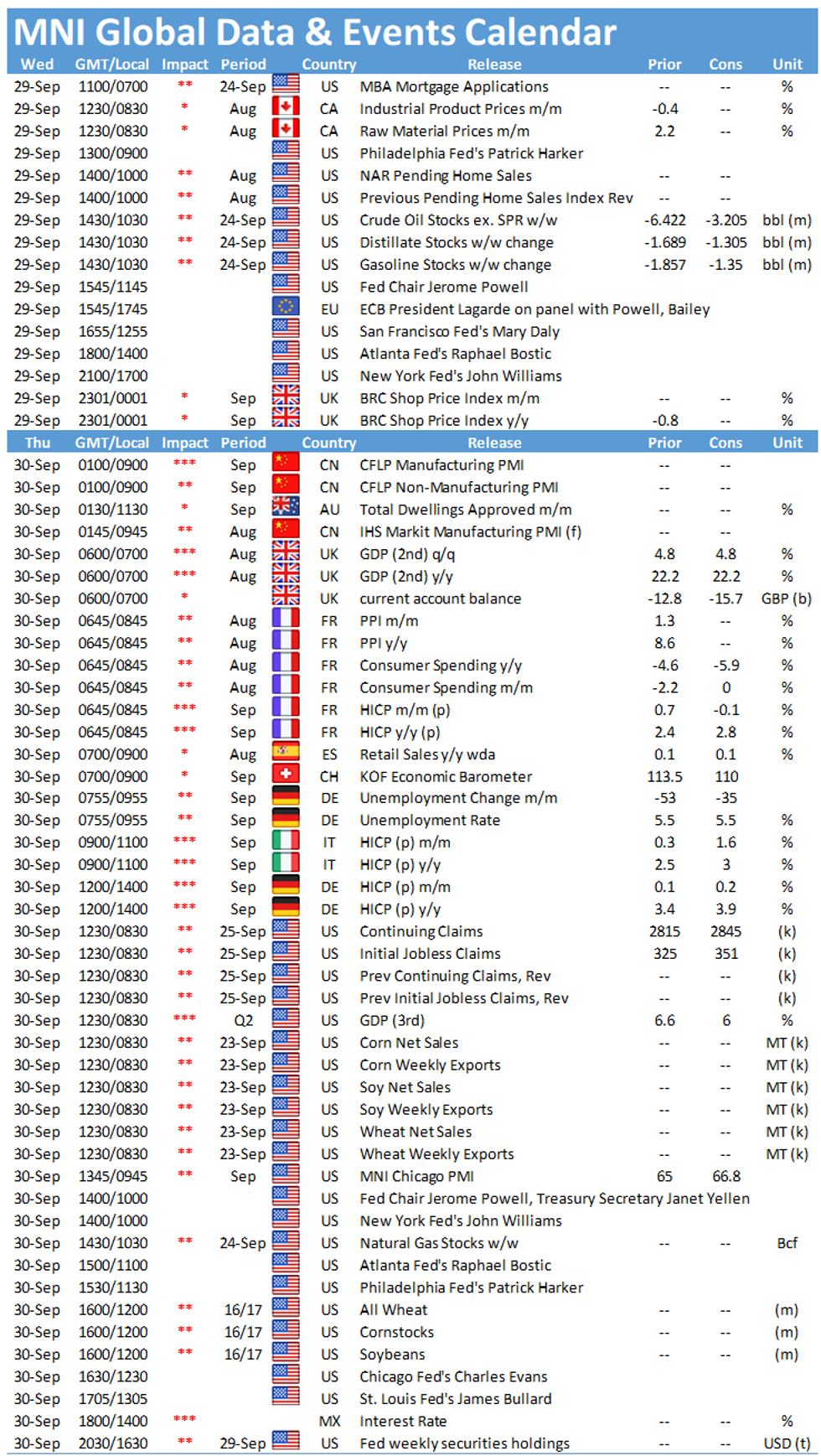

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.