-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Canadian Dollar Rises Ahead Of BoC Decision

EXECUTIVE SUMMARY:

- BANK OF CANADA TAPER SEEN ON COURSE AS GROWTH WOBBLES (MNI STATE OF PLAY)

- U.K. PUSHES FOR FINANCE EXEMPTION FROM GLOBAL TAX DEAL

- E.U. PARLIAMENT APPROVES VACCINE PASSPORTS, EASING TRAVEL

- "GANGBUSTERS" U.K. ECONOMY MAY NEED LESS B.O.E. SUPPORT: HALDANE

- E.C.B. TO REAFFIRM BOND BUYING VIEW (MNI STATE OF PLAY)

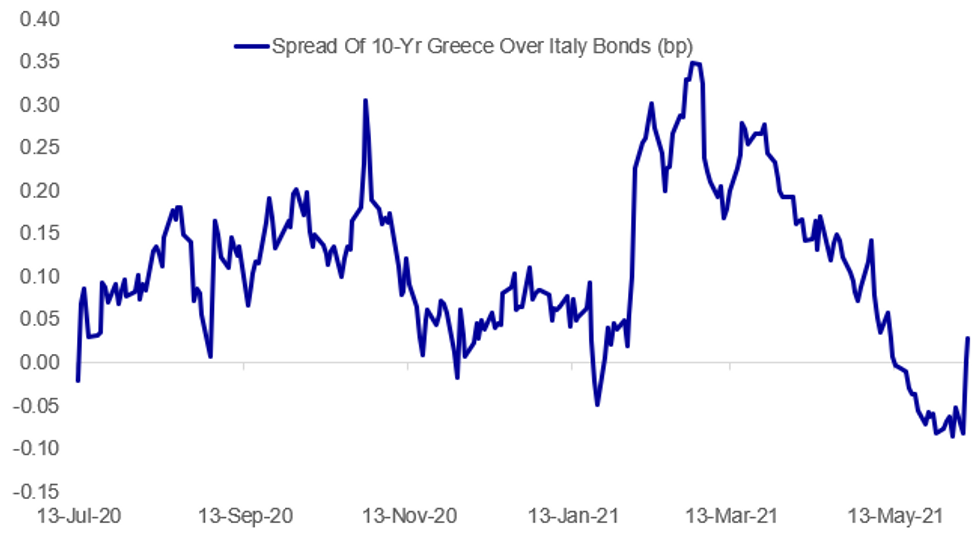

Fig.1: Greek Supply Turns Spread Wider Vs Italy Again

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BANK OF CANADA (MNI STATE OF PLAY): The Bank of Canada on Wednesday may signal it remains on a path to the further tapering that some investors expect in the third quarter, holding its rate and asset purchase settings for now as it juggles a short-term growth slowdown and faster inflation. For full article contact sales@marketnews.com

U.K./G7/GLOBAL TAXES (BBG): U.K. Chancellor of the Exchequer Rishi Sunak is pressing for the City of London to be exempt from a plan by global leaders to make multinationals pay more tax to the countries they operate in. Finance ministers from the Group of Seven advanced economies struck a historic deal last weekend that could force the world's biggest companies to pay a minimum corporate tax rate of 15%. Sunak is expected to make the case that financial services, including global banks with head offices in London, should be exempt from the plan when talks move to the G-20 next month.

U.K.-E.U. (BBG): Officials from Britain and the European Union are meeting on Wednesday to try and defuse a row over Northern Ireland that threatens to spill over into this week's Group of Seven summit.European Commission Vice President Maros Sefcovic is holding talks with the U.K.'s Brexit minister, David Frost, in an effort to resolve the trade dispute -- part of which now revolves around whether British will be allowed to ship sausages to Northern Ireland. Frost will then head to Cornwall, England, to support Prime Minister Boris Johnson, who is set to come under pressure from U.S. President Joe Biden and EU leaders.

UK-EU: A meeting between the UK Cabinet Office minister Lord Frost and VP of the European Commission for Interinstitutional Relations Maros Sefcovic is underway in London, with the intention of de-escalating the heightened tensions surrounding the implementation of the Northern Ireland protocol in the Brexit Withdrawal Agreement. The latest spike in tensions comes as the UK gov't noted that it would likely unilaterally extend the customs check grace period on imports of chilled meat products from GB to NI, for which the EU has threatened to retaliate.

UK-EU: James Crisp of The Daily Telegraph tweets: "Have got some strong pushback from EU sources to Politico story that EU diplomats mulling emergency plan to introduce border checks between Ireland and rest of EU if London and Brussels talks over Northern Ireland Protocol ultimately fail." "Unity above all. Ireland will not be dropped," said one EU diplomat. "Completely nuts," said another. An EU officials said, "Pure unadulterated bollocks". Feeling around Brussels that the story could be a kite flying exercise or a warning shot from tough member state to Ireland not to push too hard for flexibilities on Single Market rules in Northern Ireland. Interesting that this is poss more about intra EU politics than UK-EU."E.U. (BBG): The European Parliament approved the introduction of mutually recognizable certificates that will allow quarantine-free travel within the bloc.As a final step, the certificates need to be approved by the EU governments. They should be operating across all 27 EU member states by July 1 and will offer proof their holders have been inoculated against the coronavirus, have recovered from the illness or have a recent negative test

B.O.E.(BBG): The U.K. economy is "going gangbusters" at the moment and the Bank of England may need to consider turning off the monetary stimulus tap to keep inflation in check, according to Chief Economist Andy Haldane. The pound rose.Haldane, who is leaving the role this month, said it was "hard to find anything whose price isn't going up at the moment" and it was important to stop any temporary blip in inflation from becoming embedded.

E.C.B. (MNI STATE OF PLAY): With an economic rebound and rising inflation emboldening hawks, the European Central Bank could reaffirm its intention to buy bonds at a pace necessary to maintain easy financing conditions after its meeting on Thursday, but steer shy of promising to maintain its current EUR80 billion a month throughout the summer. For full article contact sales@marketnews.com

RIKSBANK (BBG): Swedish inflation "is moving upwards over time" after recent "large swings," Riksbank Governor Stefan Ingves says at a webinar. July CPIF "will be 0.8% if we are right". It's "reasonable to believe inflation will move towards 2% after that".

AIRLINES / COVID (BBG): British Airways and Ryanair Holdings Plc face an investigation into whether they broke U.K. consumer rules by failing to offer refunds to customers for flights they couldn't take.The U.K.'s Competition and Markets Authority said it has opened enforcement cases against both airlines on Wednesday. The watchdog last year opened a probe into the airline sector, following concerns that during the Covid-19 pandemic, customers were denied refunds while unable to fly and instead were offered vouchers or the option to rebook flights.

DATA:

MNI: GERMANY APR SA TRADE BALANCE +EUR15.9BN

*GERMANY APR EXPORTS +0.3% M/M, +47.7% Y/Y

*GERMANY APR IMPORTS -1.7% M/M, +33.2% Y/Y

FIXED INCOME: Pre-positioning ahead of the ECB meeting and US CPI

- Core fixed income is on the front foot this morning with position squaring ahead of the ECB being cited as the reason.

- This theme is consistent with the moves seen in EGB spreads with Italian, Spanish and Portuguese spreads in particular tightening (BTP the biggest mover on the day).

- GGB spreads are barely changed on the day, with Greece holding a 10-year syndicated tap (MNI expects E3bln size).

- There is also focus on today's USD38bln 10-year UST reopening, while the UK has sold GBP1bln of its 10-year linker. Germany looks to sell E1.5bln 30-year Bund and Portugal E0.75-1.00bln of OTs.

- German trade data this morning was a little disappointing but had no market impact with focus remaining on tomorrow's ECB meeting and US inflation print.

- TY1 futures are up 0-4 today at 132-18+ with 10y UST yields down -2.4bp at 1.512% and 2y yields down -0.4bp at 0.150%.

- Bund futures are up 0.26 today at 172.36 with 10y Bund yields down -1.3bp at -0.238% and Schatz yields down -0.5bp at -0.679%.

- Gilt futures are up 0.14 today at 127.62 with 10y yields down -0.8bp at 0.761% and 2y yields down -0.1bp at 0.061%.

FOREX: Greenback Following Yields Lower

- The greenback trades modestly weaker early Wednesday, but the USD Index still holds above the Tuesday lows. Markets are in consolidation mode, with most major pairs trading inside the week's range. Greenback weakness continues to follow the US yield curve, after Tuesday saw the 10yr yield close at its lowest level since March. Losses persist this morning, with yields nearing the 1.50% level.

- CAD is the strongest currency in G10, with USD/CAD reversing Tuesday's gains as oil prices continue to grind higher. Both Brent and WTI crude futures broke above the 2021 highs ahead of yesterday's close, and are hitting new cycle best levels this morning.

- The Bank of Canada decision takes focus going forward. This meeting sees no new Monetary Policy Report, meaning the Bank won't release any fresh growth or inflation projections. As such, markets expect little in terms of policy action, with the BoC seen favouring July's decision as the next opportunity for the Bank to further taper their asset purchase programme.

- Outside of the BoC, US wholesale trade sales and inventories numbers are released, but markets remain focused on US CPI released later in the week.

EQUITIES: Nasdaq Leads U.S. Gains

- Asian stocks closed mostly lower, with Japan's NIKKEI down 102.76 pts or -0.35% at 28860.8 and the TOPIX down 5.51 pts or -0.28% at 1957.14. China's SHANGHAI closed up 11.29 pts or +0.32% at 3591.396 and the HANG SENG ended 38.75 pts lower or -0.13% at 28742.63.

- European equities are mixed, with the German Dax down 5.58 pts or -0.04% at 15659.53, FTSE 100 down 35.54 pts or -0.5% at 7067.19, CAC 40 up 2.36 pts or +0.04% at 6559.65 and Euro Stoxx 50 down 0.53 pts or -0.01% at 4098.54.

- U.S. futures are up slightly, with the Dow Jones mini up 17 pts or +0.05% at 34600, S&P 500 mini up 4.25 pts or +0.1% at 4229.75, NASDAQ mini up 22 pts or +0.16% at 13832.25.

COMMODITIES: WTI Through $70, Copper Weakens

- WTI Crude up $0.5 or +0.71% at $70.38

- Natural Gas down $0 or -0.13% at $3.118

- Gold spot down $4.21 or -0.22% at $1892.11

- Copper down $4.65 or -1.02% at $452.3

- Silver down $0.04 or -0.15% at $27.5638

- Platinum down $6.6 or -0.57% at $1159.36

LOOK AHEAD:

US Data/Speaker Calendar (prior, estimate)- Jun-09 0700 MBA Mortgage Applications Wk Jun 4 (-4.0%, ---)

- Jun-09 1000 Wholesale Inventories Apr Final (+0.8%, +0.8%)

- Jun-09 1000 Wholesale Trade Sales Apr

- Jun-09 1030 NY Fed buys Tsy 22.5Y-30Y, appr $2.025B

- Jun-09 1130 US Tsy $35B 119-Day CMB bill auction

- Jun-09 1300 US Tsy $38B 10Y Note auction

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.