-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Countdown Is On For Quarter-End And Gov't Shutdown

EXECUTIVE SUMMARY:

- BUSY DAY AHEAD IN U.S. CONGRESS AS GOV'T SHUTDOWN, INFRA VOTES POSSIBLE

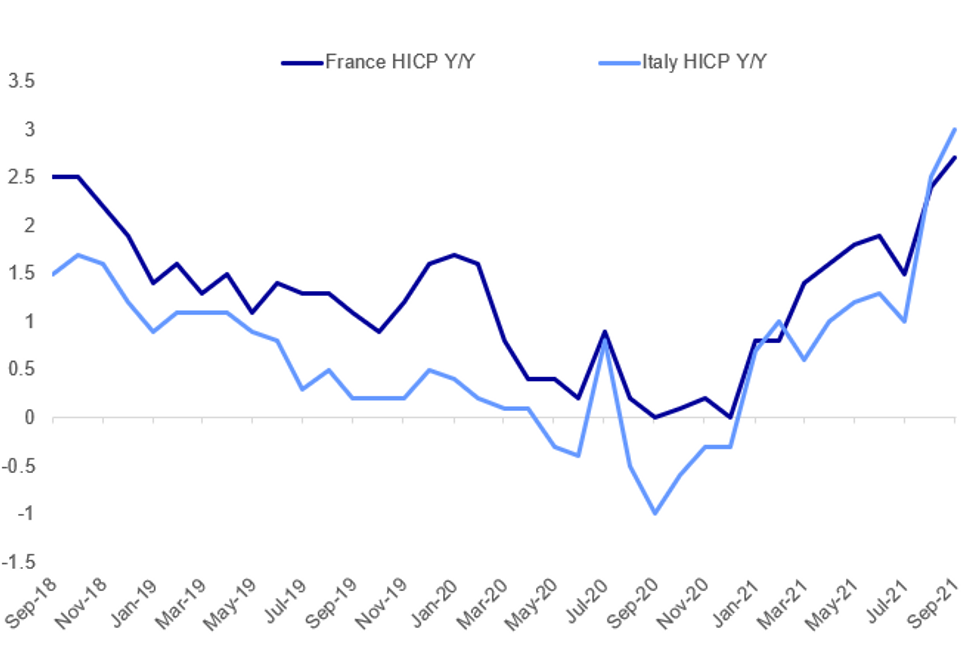

- FRENCH AND ITALIAN INFLATION UP SHARPLY IN SEPT ON ENERGY PRICES

- SOME AT SWEDISH RIKSBANK SAW RATE HIKE CASE IN NEXT 3 YEARS

- BOJ KURODA: VIRTUOUS CYCLE STILL BACKS JAPAN ECONOMY

- BRITAIN PLANS GBP500MLN OF GRANTS AS COVID AID PULLED BACK

Fig. 1: Eurozone Inflation Continued To Pick Up In September

Source: Eurostat, MNI

Source: Eurostat, MNI

NEWS:

U.S.: Chad Pergram at FOX News lays out the jam-packed day ahead in Congress:

- "Pelosi says House is scheduled to vote on bipartisan infrastructure bill today. But unclear if it has the votes if liberals pull their support. Some GOPers will vote yes. But moderates could then yank their support for the social spending plan if infrastructure fails/is delayed"

- "Senate poised to vote on temporary gov't funding bill today to avert a shutdown. House will follow. Gov't funding expires tonight. Debt limit issue now placed on back burner"

- The separation of the debt ceiling vote from that on continued gov't funding looks set to allow broad bipartisan support for a continuing resolution that will see the federal gov't funded through until early December. Senate likely to vote on this first before it goes to the House, deadline is 2359ET for this to be signed off by the president.

- With debt ceiling suspension/raising not set to become a crunch issue until mid-October (unless markets dictate otherwise), Congress is more likely to focus on the contentious infrastructure packages.

- Still a stalemate on which one the House votes on first. Leftist Dems demanding the UD3.5trn package is essentially written up before the UD1.2trn bipartisan package is voted on. Centrist Dems demanding bipartisan bill is passed (ideally today) before the larger package can be approved.

U.S. (CNN): Beginning at 10:30 a.m. ET on Thursday, the Senate is slated to hold several amendment votes before voting on the continuing resolution. The House is expected to take up the measure later Thursday once it is approved by the Senate.

RIKSBANK: The Riksbank Executive Board's collective rate path at its September meeting showed the policy rate hike left at zero for the next three years, but the minutes of the meeting revealed that some members saw a case for including a hike. Henry Ohlsson said that "If the good economic development in Sweden and abroad continues one .. possibility would be to raise the repo rate." Anna Breman said that she "could have envisaged a repo-rate path that indicates a rate rise at the end of the forecast period." The members did not issue any formal dissents and the view of Deputy Governor Ceclia Skingsley, that after a long period of inflation undershooting a period of overshooting is acceptable without tightening policy, remains the dominant one.

BOJ: Bank of Japan Governor Haruhiko Kuroda on Thursday said that a virtuous cycle in the corporate sector continues to support the improvement of the overall economy, although the household sector is weak. "As for the outlook for Japan's economy, a recovery is expected to become clearer as the impact of coronavirus will wane gradually," Kuroda said at the general meeting of Japan Securities Dealers Association.

UK (BBG): The U.K. government announced a 500 million-pound ($672 million) program of hardship grants to help consumers who are struggling with the rising cost of living over the winter.The announcement coincides with the expiration of two larger benefit programs that funneled almost 80 billion pounds to consumers during the height of the coronavirus crisis. Prime Minister Boris Johnson's Conservative government has come under increasing pressure from the party's own rank-and-file lawmakers and opposition parties to help the poorest people as the demands on household budgets grow.

CHINA EVERGRANDE (BBG): Evergrande pays first instalment for wealth management products due September in accordance to previously announced repayment plan, according to statement on its website. Payments have been deposited into investors' accounts.

UK DATA: UK GDP expanded by 5.5% in the second quarter, a significant upward revision from the 4.8% pace reported in August. That leaves output 3.3% below pre-pandemic levels, a smaller gap than the initially-published 4.4%. According to the ONS, updated and improved data from the health and entertainments sector were drivers of the revision. Household spending accounted for 3 percentage points of growth, expanding by 7.9% in Q2, up from the initial estimate of 7.3%.

FRANCE DATA: French HICP rose to an annual rate of 2.7% in September, the highest level since the final month of 2011, from 2.4% in August. CPI rose less dramatically, to 2.1% from 1.9% in August, the fastest pace of growth since October of 2018. Both measures declined by 0.2% between August and September. Producer prices rose by 1.0% in August, taking the annual rate to 10.0%, also a multi-decade high.

FRANCE (RTRS): Former French President Nicolas Sarkozy was found guilty of illegal campaign financing over his failed 2012 re-election bid by a Paris court on Thursday.It was the second guilty verdict this year for Sarkozy, who led France from 2007 to 2012 and retains influence among conservatives despite falling from grace over his legal woes.The court was yet to say what sentence he would receive. Prosecutors were seeking a one-year prison sentence, half of it suspended, for the 66-year old former president. He is in any case unlikely to go to jail immediately as he would be expected to appeal the sentence.His conservative party, the prosecutors said, spent nearly double the 22.5 million euros (currently $19.2 million) allowed under electoral law on extravagant campaign rallies and then hired a friendly public relations agency to hide the cost.

BOJ: The Bank of Japan said Thursday it will keep the frequency of government bond buying operations and the scale of each bond buying operation for the fourth quarter unchanged from the third quarter. The BOJ will offer to buy JPY450 billion of JGBs with a remaining life of 1 to 3 years (four times), JPY450 billion of JGBs with a remaining life of 3 to 5 years (four times), JPY425 billion of JGBs with a remaining life of 5 to 10 years (four times), JPY150 billion of JGBs with a remaining life of 10 to 25 years (one time) and JPY50 billion of JGBs with a remaining life of more than 25 years (one time).

DATA:

MNI: BAVARIA SEP CPI +0.0% M/M, +4.2% Y/Y; AUG +3.9% Y/Y

MNI: BADEN-W SEP CPI +0.0% M/M, +3.8% Y/Y; AUG +3.6% Y/Y

MNI: SAXONY SEP CPI +0.0% M/M, +4.1% Y/Y; AUG +4.0% Y/Y

MNI: FRANCE SEP FLASH HICP -0.2% M/M, +2.7% Y/Y; AUG +2.4% Y/Y

MNI: ITALY SEP FLASH HICP +1.4% M/M, +3.0% Y/Y; AUG +2.5%Y/Y

FIXED INCOME: Core FI off intraday lows but inside yesterday's range

Core fixed income is off of its intraday lows which were seen shortly after the European cash open. However, the moves are unremarkable compared to recent day's price action and Treasuries, Bunds and gilts all remain within yesterday's trading range. Month end extensions remain a talking point in the market.

- This morning has seen CPI data in focus across the Eurozone with data generally in line or marginally below consensus expectations (in contrast to yesterday's Spanish print that was 0.5ppt higher than expected).

- We have also seen UK Q2 GDP revised up from 4.8%Q/Q to 5.5%. Later today we will receive the third print of US Q2 GDP.

- TY1 futures are up 0-5 today at 131-20 with 10y UST yields up 0.1bp at 1.519% and 2y yields up 0.3bp at 0.294%.

- Bund futures are up 0.02 today at 170.17 with 10y Bund yields down -0.4bp at -0.218% and Schatz yields down -0.2bp at -0.700%.

- Gilt futures are down -0.17 today at 125.49 with 10y yields up 0.9bp at 0.999% and 2y yields up 0.6bp at 0.405%.

FOREX: USD Index in Holding Pattern Below 2021 High

- The USD Index holds close to Wednesday's multi-month high, with prices in a holding pattern just below 94.432. The slight slowdown in the USD's rise has worked in favour of the currencies hardest hit during the Wednesday rout, with GBP, AUD and SEK today trading slightly firmer.

- Month-end flows are in focus, with most sell-side models pointing toward USD strength into the month- and quarter-end fix. How much of this flow has already been completed across the past few sessions is unclear, but the WMR fix will be carefully watched.

- Elsewhere, NOK is extending this week's underperformance, extending the losing streak against the USD to five consecutive sessions. The roll off the highs for WTI and Brent crude oil prices as well as shakier risk sentiment across global equity markets are undermining the currency.

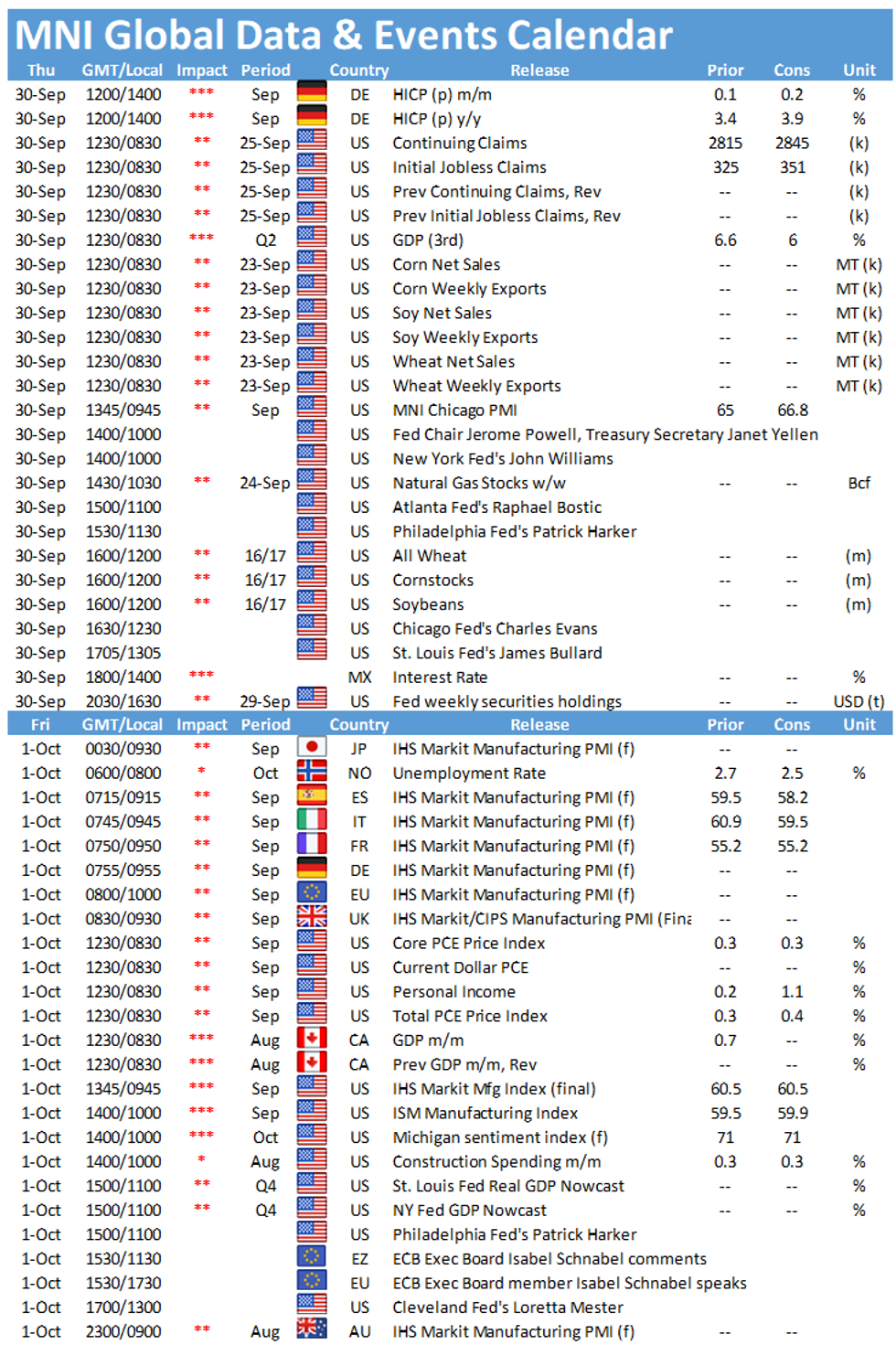

- The US MNI Chicago Business Barometer takes focus going forward alongside prelim German CPI data and the weekly US jobless claims data. Central bank speak also takes focus, with appearances from Fed's Powell, Williams, Bostic, Harker and others alongside ECB's de Cos and Visco.

EQUITIES: Positive Start To Thursday Trade

- Asian markets closed mixed, withJapan's NIKKEI down 91.63 pts or -0.31% at 29452.66 and the TOPIX down 8.13 pts or -0.4% at 2030.16. China's SHANGHAI closed up 31.873 pts or +0.9% at 3568.167 and the HANG SENG ended 87.86 pts lower or -0.36% at 24575.64.

- European equities are a little higher, with the German Dax up 33.61 pts or +0.22% at 15426.79, FTSE 100 up 44.86 pts or +0.63% at 7150.98, CAC 40 up 34.37 pts or +0.52% at 6605.82 and Euro Stoxx 50 up 22.12 pts or +0.54% at 4111.76.

- U.S. futures are gaining, with the Dow Jones mini up 241 pts or +0.7% at 34506, S&P 500 mini up 30.75 pts or +0.71% at 4380.5, NASDAQ mini up 103.75 pts or +0.7% at 14843.5.

COMMODITIES: Precious Metals Claw Back Some Losses

- WTI Crude up $0.28 or +0.37% at $74.94

- Natural Gas up $0.11 or +1.95% at $5.546

- Gold spot up $4.26 or +0.25% at $1731.19

- Copper down $3.2 or -0.76% at $417.85

- Silver up $0.13 or +0.62% at $21.6078

- Platinum up $4.82 or +0.51% at $960.93

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.