-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Durable Goods And Jobless Claims In Focus

EXECUTIVE SUMMARY:

- ITALIAN BUSINESS AND CONSUMER SENTIMENT UP IN MAY

- RIKSBANK HAS STARTED CAUTIOUSLY APPROACHING EXIT: SKINGSLEY

- CHINA SAID TO EASE OFFSHORE FUNDING LIMIT FOR FOREIGN BANKS

- BANK OF JAPAN SEES BANKS' DOLLAR FUNDING STAYING STABLE

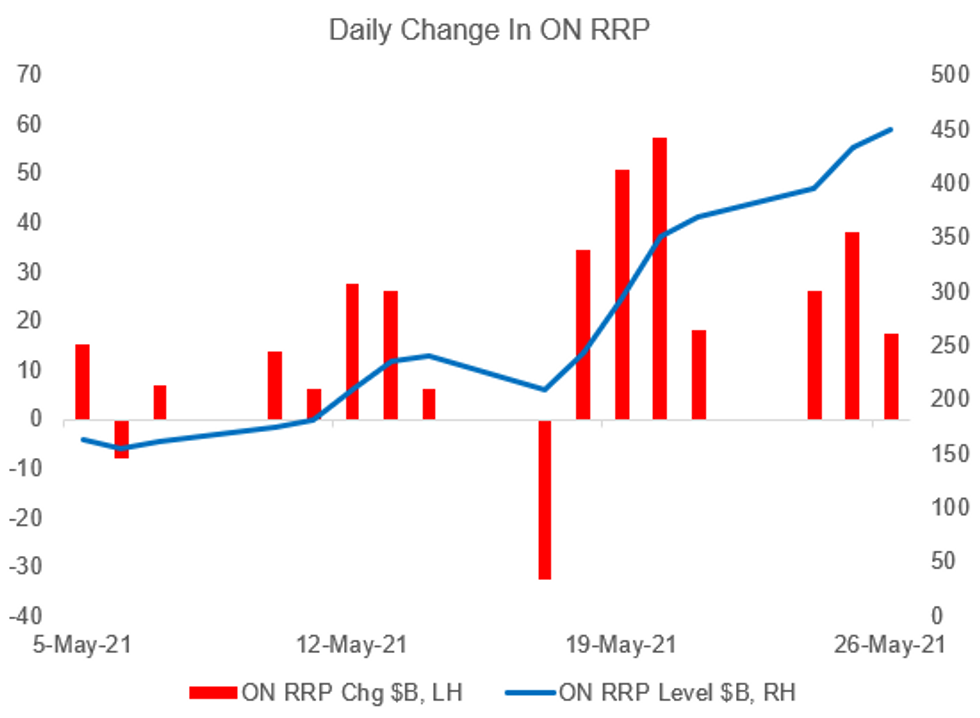

Fig. 1: Rising Usage Of Fed Overnight Reverse Repos

Source: NY Fed, MNI

Source: NY Fed, MNI

NEWS:

RIKSBANK (BBG): Riksbank's asset purchases that are declining quarter by quarter is evidence that the central bank has already started taking cautious steps toward the exit even as inflation pressure is still "too low," First Deputy Governor Cecilia Skingsley says at online seminar arranged by Dagens Industri. Says "it's a hard trade-off" between short-term support measures that support the recovery and unwinding measures to avoid increasing vulnerabilities and stability risks.

CHINA (BBG): China's central bank raised the limit on how much smaller lenders and foreign banks operating in the country can borrow offshore, a move that will ease a funding shortfall and give a push to expansion plans for firms such as HSBC Holdings Plc.Their ability to borrow outside of China was expanded this week after the People's Bank of China raised the leverage ratio for such funding to 2 from 0.8 for institutions with capital of less than 100 billion yuan ($15.6 billion), said people familiar with the decision, who asked not to be identified as the matter is private. Qualified banks will be given a 10 billion yuan initial quota, said the people.

B.O.J. (MNI): Bank of Japan officials see just a slight risk that the huge fiscal spending by the U.S. government will make it more difficult for commercial banks there to raise dollar funds unless demand for the greenback spikes due to unstable financial markets, MNI understands. For full article contact sales@marketnews.com

B.O.J. (MNI): The balance of ETF (exchange-traded fund) held by the Bank of Japan rose to JPY35.9 trillion at the end of March from JPY29.7 trillion a year earlier, the central bank said Thursday, with unrealized profits at a record high JPY15.44 trillion, up sharply up from JPY308.1 billion.

E.U. (BBG): German Foreign Minister Heiko Maas says EU won't be satisfied with "small sanctions steps" and will target "economic structures and payments traffic" in Belarus and make sure they have a substantial effect. "We will monitor what impact this has in Belarus, whether Lukashenko backs down in any way": Maas to reporters before talks with EU counterparts in Lisbon. "If that's not the case then it's to be expected that this is just the beginning of an extensive and lengthy spiral of sanctions"

E.U.: Following the approval of the 'Own Resources' decision of the EU's Recovery and Resilience Fund by the National Assembly of Hungary and the Romanian Senate yesterday, there are only two member states yet to approve the plan that would allow for the disbursement of EUR750bn for COVID-19 relief: Austria and Poland. On 25 May, Paola Tamma at Politico tweeted the following: "Recovery fund update: Netherlands senate adopts Own Resources Decision w 45 yays, 23 nays. Romania & Hungary vote on it tomorrow (RO needs 2/3 majority=support of opposition PSD); Austria & Poland upper chambers vote on it Thursday. If they all pass it, Commission can start borrowing € in June=1mo ahead of sked"

FRANCE (BBG): French Finance Minister Bruno Le Maire says the budget deficit will be more than 9% of economic output in 2021 as the government plans another 15 billion euros ($18.3 billion) of spending to avoid a cliff-edge in support for businesses"We will have a deficit above 9% because we are only gradually withdrawing aid. If we have strong growth that will allow us to quickly reduce the deficit in coming years," Le Maire says on France Inter radio.

GERMANY: Prospects of the economy reopening and vaccinations gaining momentum are having a positive effect on the labour market, the Munich-based Ifo institute said Thursday. German firms plan to increase their staff levels further, the Ifo Employment barometer suggested, as it rose to 100.2 in May, its highest level since June 2019. Companies hiring intentions rose steadily in the manufacturing sector over the last year, while the electrical and electronics industries have a particularly high need for new staff. Service sector employee needs increased sharply with logistic firms and IT service providers leading the way. In trade, companies were more optimistic towards hiring new staff, due to the planned easing of restrictions.

BANK OF KOREA: The Bank of Korea held the base rate at the historical low of 0.5% citing uncertainties around covid and modest price pressures from demand even as it raised its growth and inflation forecasts for the year. While the domestic recovery is expected to strengthen and inflation would remain high for some time, the board will maintain its accommodative stance as "there are underlying uncertainties surrounding the path of COVID-19 and inflationary pressures on the demand side are forecast to be modest," the bank said in its statement following the decision.

DATA:

Italy Business Sentiment Up Again in May

- ITALY May SA manufacturing morale 110.2 vs Apr 106.0, surpassing market forecasts (BBG: 106.0)

- May composite business sentiment indicator 106.7 vs Apr 97.9

- May SA business sentiment index highest since Feb2018-Istat says

- May SA bus. sentiment rose for 6th consecutive month--Istat says

- May m/m intermed., capital, consumer gds all rose--Istat

- Manufacturing current orders -0.8 in May vs -6.0 in Apr

- 3-month manuf. output outlook +13.1 vs +9.4 in Apr

- Current manufacturing inventory levels -1.9 vs. Apr +1.0

Italy Consumer Sentiment Rose Sharply in May

- May SA consumer confidence 110.6 vs Apr 102.3, beating expectations (BBG: 104.0)

- Italy May consumer conf. index back to pre-crisis Feb 20 level--Istat says

- Consumers' sentiment on economy rose to 116.2 from Apr 91.6

- Confidence in future outlook up to 122.6 from Apr 109.6

- Sentiment on their personal climate climbed to 108.7 vs Apr 105.9

- Sentiment on the current climate rose to 102.6 from Apr 97.4

FIXED INCOME: Gilts lead the retracement lower

Core bond markets have been retracing some of yesterday's gains despite some mixed moves in equity markets.

- Gilts have seen the biggest moves on the day in what has been a light morning for headlines.

- Focus in Europe today is on the votes today from the upper chambers of Austria and Poland regarding the approval of the EU own resources which is the bedrock of the NextGenerationEU plans.

- There are also a couple of scheduled ECB speakers (de Guindos, Schnabel) while BOE's Vlieghe is due make a speech "What government bond yields can tell us about future growth and inflation"

- TY1 futures are down -0-2 today at 132-27 with 10y UST yields up 0.8bp at 1.585% and 2y yields down -0.3bp at 0.146%.

- Bund futures are down -0.07 today at 170.22 with 10y Bund yields up 0.5bp at -0.202% and Schatz yields up 0.3bp at -0.668%.

- Gilt futures are down -0.16 today at 127.52 with 10y yields up 1.5bp at 0.766% and 2y yields up 0.2bp at 0.020%.

FOREX: China FX Firms Further, USD/CNY at Fresh Multi-Year Low

- Currencies markets are steady early Thursday, with most major pairs respecting recent ranges and not troubling any nearby support/resistance levels.

- Strength in China FX remains a focus, with both CNY and CNH pressing higher in European hours to trade at the best levels against the USD since mid-2018. The strength in Chinese currencies come despite repeated reports throughout the week of state-run banks looking to buy USD in order to curb the rally in the Chinese currency.

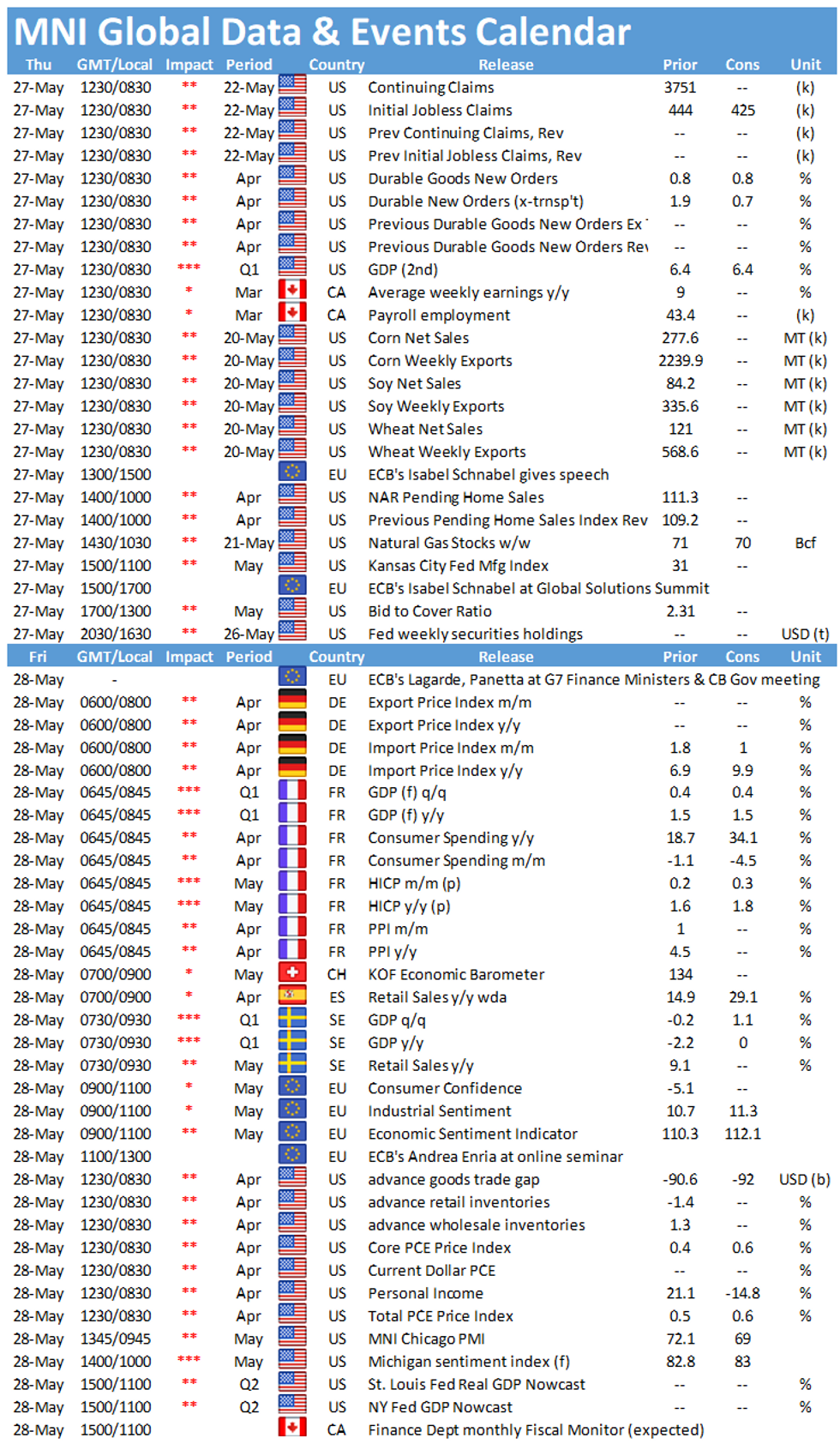

- Data picks up Thursday, with weekly US jobless claims, prelim durable goods orders numbers and the secondary reading for Q1 US GDP. Pending home sales data could also take some focus given the miss on expectations for new home sales earlier in the week.

- Central bank speak picks up further, with BoE's Vlieghe and ECB's de Guindos, Weidmann & Schnabel all scheduled.

EQUITIES: European Stocks Off Session Lows, As U.S. Futures Sag

- Asian markets closed mixed, with Japan's NIKKEI down 93.18 pts or -0.33% at 28549.01 and the TOPIX down 9.65 pts or -0.5% at 1911.02. China's SHANGHAI closed up 15.494 pts or +0.43% at 3608.851 and the HANG SENG ended 52.81 pts lower or -0.18% at 29113.2.

- European equities are mixed though generally off session lows, with the German Dax down 60.48 pts or -0.39% at 15450.72, FTSE 100 up 0.23 pts or +0% at 7026.93, CAC 40 up 21.48 pts or +0.34% at 6391.6 and Euro Stoxx 50 down 2.46 pts or -0.06% at 4023.92.

- U.S. futures are a little weaker, led to the downside by Tech stocks, with the Dow Jones mini down 24 pts or -0.07% at 34256, S&P 500 mini down 9.75 pts or -0.23% at 4183.25, NASDAQ mini down 63.5 pts or -0.46% at 13636.25.

COMMODITIES: Oil Slides; Copper Outperforms

- WTI Crude down $0.55 or -0.83% at $65.89

- Natural Gas down $0.02 or -0.56% at $3.014

- Gold spot down $1.44 or -0.08% at $1901.65

- Copper up $2.6 or +0.57% at $455.4

- Silver down $0.06 or -0.22% at $27.7196

- Platinum down $4.12 or -0.34% at $1198.37

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.