-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: E.U. Mulls Its Vaccine Options

EXECUTIVE SUMMARY:

- E.U. LEADERS MULL VACCINE EXPORT RESTRICTIONS AT SUMMIT

- SWISS NATIONAL BANK HOLDS RATES, SOFTENS FX INTERVENTION LANGUAGE

- MERKEL URGES GERMANS TO LOOK ON THE BRIGHT SIDE TO BEAT COVID

- FRENCH BUSINESS CLIMATE SEES MARCH SURGE

- DOWNSIDE WIGGLE ROOM FOR B.O.J. ON J.G.B. TRADING BAND (MNI INSIGHT)

Fig. 1: French Confidence Improves In March (Albeit Pre-Lockdown)

INSEE, MNI

INSEE, MNI

NEWS:

EU SUMMIT/COVID (BBG): When European Union leaders meet on Thursday afternoon to begin a two-day video conference, they'll underscore the severity of the continent's health situation and the need for member states to continue lockdowns that have roiled the economies of nations trying to curb the spread of Covid.They'll also discuss a controversial new proposal that will allow the EU to block the export of vaccines from pharmaceutical companies that haven't met their commitments to the bloc. The new rules, unveiled Wednesday, would also block shipments to countries that don't send full doses or ingredients back to the EU or that have better health situations or vaccination rates.

EU SUMMIT/COVID (GUARDIAN): EU leaders are likely to shy away from supporting the use of new powers to block Covid vaccine shipments to countries such as the UK with better jab coverage than the bloc, according to a draft statement ahead of a meeting of EU leaders today. The European commission has increased its scope for blocking vaccine exports but disquiet among capitals is set to be reflected in a muted statement at the end of the virtual summit on Thursday evening. The latest draft summit conclusion has leaders underlining "the importance of transparency as well as of the use of export authorisations".

SNB (BBG): The Swiss National Bank softened its language on the need to intervene in currency markets to protect the economy, while insisting the franc is still "highly valued." Officials led by President Thomas Jordan kept both the policy rate and deposit rate at -0.75% at their quarterly decision, as predicted by economists. They also pledged to continue foreign-exchange interventions, though now only "as necessary" instead of their previous commitment in December to do so "more strongly."

SNB: No real surprises in the SNB policy assessment. Small tick higher in CPI forecasts, largely inline with expectations. "The economic recovery is therefore likely to regain momentum from the second quarter". Highlights output gap once again: "However, production capacity will remain underutilised for some time yet. "

GERMANY/COVID (BBG): Chancellor Angela Merkel called on Germans to be more optimistic and pull together to beat the coronavirus. "You can't achieve anything if you only ever see the negative," she told lawmakers in Berlin on Thursday, a day after making a rare public apology over a botched plan for a hard Easter lockdown. While aggressive mutations are equivalent to a new pandemic, she said there's "light at the end of the tunnel" as faster immunizations and widespread testing offer a path out of the crisis, imploring people to remain hopeful.

BOJ (MNI INSIGHT): The Bank of Japan will likely tolerate the 10-year yield falling to around -0.30% under its new policy framework, but will be concerned if that triggers a sharp drop in longer-end bond yields, which could be economically damaging and tough to counter, MNI understands. For full article contact sales@marketnews.com

SUEZ CANAL (BBG): An elite team is tackling the monumental challenge of freeing the massive container vessel that's blocking the Suez Canal, as a backlog of ships continued to build up for a third day in what is arguably the world's most important waterway. Work to re-float the Ever Given and free up oceangoing carriers hauling almost $10 billion of oil and consumer goods resumed Thursday in Egypt. Tugs and diggers have so far failed to budge the vessel, and some experts say the crisis could drag on till Monday. The Suez Canal Authority temporarily suspended traffic along the waterway on Thursday.

NETHERLANDS: Talks attempting to put together a governing coalition in the Netherlands have been halted after two Cabinet members tested positive for COVID-19. Prime Minister Mark Rutte was in the same room as the two individuals but was socially distanced and so is not self-isolating. He has tested negative and will take another test in 5 days.

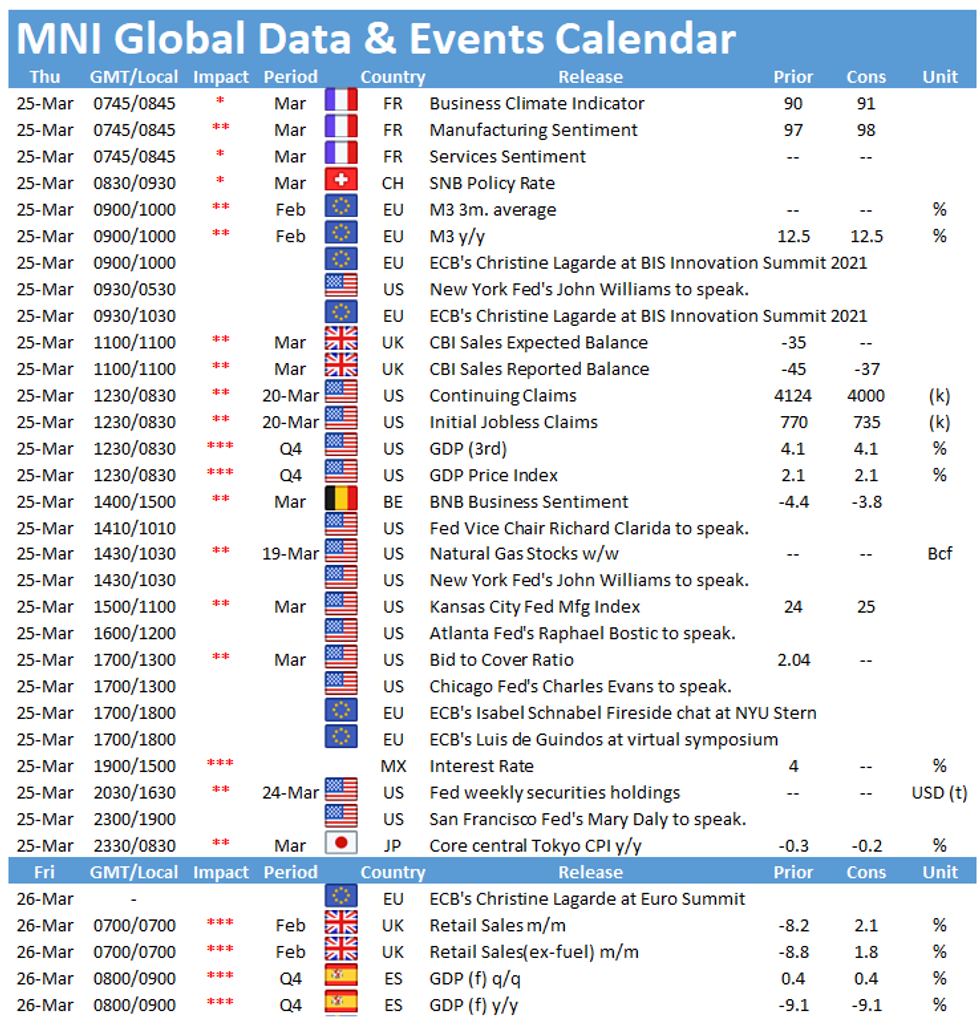

DATA:

FR Business Climate Surged in March

MAR BUS CLIM INDICATOR 97; FEB 90

MAR MFG SENTIMENT 98; FEB 98r

MAR SERVICES SENTIMENT 95; FEB 89r

- French business climate jumped to 97 in Mar, up 7pt from 90 recorded in Feb and coming in stronger than markets expected (BBG: 91).

- The headline business climate indicator rose to the highest level since the start of the health crisis, shifting towards its long-term average (100)

- Mar's uptick was driven by a solid rebound in service business climate, rising 6pt to 95, its highest level since Sep 2020.

- Similarly, retail trade business climate increased 5pt to a five-month high of 94.

- Business climate in the manufacturing sector remained at Feb's upward revised level of 98 in Mar.

- Employment climate ticked up 6pt to 92 in Mar, marking the highest level since Sep 2020.

- Nevertheless, all indicators continue to post readings below the long-term averages.

FIXED INCOME: EU's vaccine policy in focus for markets

It has been a mixed morning for core fixed income today with gilts and Bunds a bit higher but Treasuries a bit lower.

- The focus today will be on the virtual EU Summit where vaccines are likely to be the market focus. Our political risk team notes there will be three main issues: 1) whether there will be export blocks from the EU (looking likely to not have formal blocks based on the latest news reports), 2) internal negotiations on how vaccines are being distributed internally within the EU, 3) whether Russian vaccines will be approved within the EU - which has wider implications for EU-US relations.

- There are also a number of central bank speakers due today, primarily due to the ongoing virtual BIS conference.

- TY1 futures are down -0-1 today at 132-02 with 10y UST yields up 1.0bp at 1.620% and 2y yields down -0.4bp at 0.144%.

- Bund futures are up 0.22 today at 172.39 with 10y Bund yields down -1.5bp at -0.369% and Schatz yields down -0.5bp at -0.723%.

- Gilt futures are up 0.20 today at 128.65 with 10y yields down -2.4bp at 0.733% and 2y yields down -1.5bp at 0.041%.

FOREX: EUR/USD Circling Key Support

- Currency markets are in flux early Thursday, with most major pairs trading within recent ranges amid a lack of major macro or news catalysts. EUR/USD is a slight stand-out, with the pair circling, but not quite breaking, the 1.18 handle. A break through here would be a considerable bearish signal, opening initially 1.1752, the 1.236 projection of the Jan 6 - Feb 5 - Feb - 25 price swing.

- Antipodean currencies modestly outperform, with AUD and NZD higher, reflecting a minor bounce after recent slides. AUD/USD continues to trade on either side of the $0.76 handle, with yesterday's lows at $0.7580 needing to give way before the recent downleg resumes.

- Focus turns to the data slate Thursday, with initial jobless claims and tertiary GDP data crossing from the US. Central bank speak also a highlight, with Fed's Clarida, Bostic, Evans and Daly all due as well as ECB's Schnabel & de Guindos and BoE's Bailey.

- Central bank decisions also cross from the South African and Mexican central banks.

EQUITIES: Ticking Higher, Tech Leading

- Asian stock markets closed mixed, with Japan's NIKKEI up 324.36 pts or +1.14% at 28729.88 and the TOPIX up 26.97 pts or +1.4% at 1955.55. China's SHANGHAI closed down 3.469 pts or -0.1% at 3363.592 and the HANG SENG ended 18.53 pts lower or -0.07% at 27899.61.

- European equities are mixed, with the German Dax down 25.54 pts or -0.17% at 14592.97, FTSE 100 up 10.25 pts or +0.15% at 6707.33, CAC 40 down 7.94 pts or -0.13% at 5926.1 and Euro Stoxx 50 down 8.5 pts or -0.22% at 3826.49.

- U.S. futures are up slightly, with the Dow Jones mini up 73 pts or +0.23% at 32392, S&P 500 mini up 9.5 pts or +0.24% at 3890.25, NASDAQ mini up 45 pts or +0.35% at 12839.

COMMODITIES: Oil Slips As Suez Blockage Continues

- WTI Crude down $1.01 or -1.65% at $60.19

- Natural Gas down $0 or -0.16% at $2.518

- Gold spot down $3.08 or -0.18% at $1733.04

- Copper down $9.75 or -2.4% at $396.55

- Silver down $0.16 or -0.63% at $24.9544

- Platinum down $4.01 or -0.34% at $1168.97

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.