-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: ECB Hikes Seen As Inflation Rises

EXECUTIVE SUMMARY

- EUROZONE INFLATION SURPRISES TO THE UPSIDE

- ECB'S MULLER SAYS HIGH INFLATION COULD FORCE CUT IN STIMULUS

- U.S. SAYS IT'S WORKING WITH TAIWAN TO SECURE CHIP SUPPLY CHAIN

- FRANCE / ITALY POST STRONG Q3 GDP GROWTH; GERMANY / SPAIN DISAPPOINT

- ECB PROFESSIONAL FORECASTER SURVEY SEES 2023 INFLATION BELOW TARGET

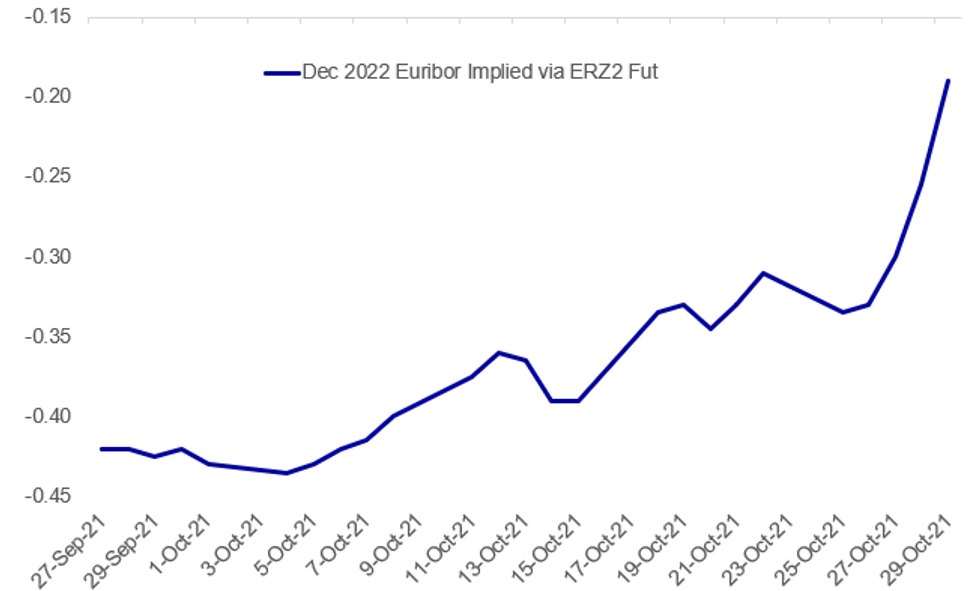

Fig. 1: 2022 ECB Rate Hike Expectations Mounting

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB (RTRS): The European Central Bank can end emergency bond purchases next spring and needs to watch consumer prices as persistently high inflation could require a reduction of stimulus, Estonian central bank chief Madis Mueller said on Friday. Largely repeating the ECB's policy message from Thursday, Mueller said the bank's focus should be on whether inflation leads to an acceleration of wage growth that could drive the pace of price increases above 2% in the longer term. "If this were to happen, the central bank would not be able to continue its policy of large bond purchases and negative interest rates for long," Mueller, a member of the ECB's Governing Council, said in a blog post.

US / TAIWAN / CHIP SUPPLY (BBG): The U.S and Taiwan are working together to secure supply chains, Washington's envoy to Taipei said, as global chip manufacturers face a looming deadline to meet the Biden administration's request for company data. U.S. officials have met leaders of local semiconductor firms, Sandra Oudkirk, director of the American Institute in Taiwan, told reporters Friday in Taipei, adding that they had "excellent safeguards" to protect proprietary information.

ECB: The latest European Central Bank survey of professional forecasters sees a significant uptick in the combined inflation outlook, but prices are still seen below the central bank's forecast in 2023.

- The Q4 survey sees inflation at 2.3% in 2021 and 1.9% in 2022 - both revised higher by 0.4 percentage points.

- More importantly from a policy perspective, inflation has been marked higher in 2023, but only by 0.2 pps to 1.7% - still below the 2% symmetric target adopted under the new policy framework.

- The survey sees GDP growth little changed from the Q3 survey, although average longer-term real GDP expectations have been revised to 1.5% from 1.4% in Q3.

CHINA PROPERTY (BBG): Holders of troubled developer China Oceanwide Holdings Co.'s unit seized its shares in a billion-dollar property project in San Francisco. Overseas credit holders of Oceanwide's two offshore units have taken over their entire holdings in the project, the developer said in a Thursday Shenzhen stock exchange filing. The two dollar notes, worth a combined HK$2.6 billion ($334 million), have matured.

JAPAN: Japan's consumer confidence index in October posted a second straight rise in October two of the four components improved from the previous month and the Cabinet Office upgraded its assessment, data released on Friday showed. The index rose to 39.2 in October, the highest since May 2019 when it was at 39., from 37.8 in September, the Consumer Confidence Survey showed. The survey was conducted from Oct. 7 to Oct. 20.

UK - FRANCE - EU (RTRS): Britain reserves the right to respond to France's detention of a British scallop trawler in French waters, British Environment Secretary George Eustice said on Friday as a row over post-Brexit fishing rights deteriorated. "We obviously reserve the ability to be able to respond in a proportionate way, " Eustice told Sky News. Britain's foreign secretary has summoned the French ambassador to London to a meeting on Friday.

CRYPTO (BBG): Ether, the second-largest cryptocurrency, soared to a record above $4,400 Friday on bullish sentiment surrounding an upgrade to the Ethereum network and rival Bitcoin's recent rally to a high of its own. The digital asset gained as much as 3.5% to $4,403.93, topping the previous record of $4,379.62 reached in May. Other smaller tokens including Binance Coin and Solana rallied. Ether is now worth about $520 billion, according to data from CoinGecko.com.

DATA:

France October HICP Rises 3.2% Y/Y

French October flash harmonized inflation came in at 3.2% Friday, accelerating from the 2.7% seen in September and ahead of expectations of a rise to 3.1%.

- According to Insee, energy and services were the main drivers, with HICP up 0.5% m/m.

- CPI, the domestic measure, rose to 2.6% y/y in Oct from 2.2% in Sep.

Euro area inflation, due at 1000BST, will also continue is march higher in October, with market expectations of a rise to 3.7% y/y. However, after the release of preliminary data from Spain and Germany and now France all surprising to the upside, there is a risk the October EZ release could also be an upside beat -- perhaps even closing in on 4%, or double the ECB's price target.

French annual CPI

Source: Insee

MNI: ITALY OCT PRELIM HICP +0.8% M/M, +3.1 Y/Y (SEP +2.9% Y/Y)

EZ OCT FLASH HICP +0.8% M/M; +4.1% Y/Y; SEP +3.4% Y/Y

MNI: SPAIN Q3 FLASH GDP +2.0% Q/Q SA, +2.7% Y/Y WDA

ITALY Q3 FLASH GDP +2.6% Q/Q SA, +3.8% Y/Y WDA

MNI: GERMANY FLASH Q3 GDP +1.8% Q/Q SA, +2.5% Y/Y WDA

MNI: SPAIN Q3 FLASH GDP +2.0% Q/Q SA, +2.7% Y/Y WDA

BOND SUMMARY: Remains under pressure ahead of US Core PCE

- A much calmer session for EGBs and Bund, but we remains nonetheless in deep negative territory, albeit still within yesterday's ranges

- Market awaits the US PCE core inflation data this afternoon.

- Most of the action has been in the BTP with another decent volumes session for BTPs and big widening moves in the BTP/Bund spread by another 7.4bps.

- The Italian 10yr yield is right now testing the 2021 high at 1.160% and highest level since July 2020.

- BTP/Bund now target the 2021 widest level at 126.0737.

- Gilts have mostly traded inline with Bund, albeit 0.9bp wider.UK 5/30s lean steeper, but we still trade at multi year low.

- US Treasuries are better offered with EGBs, but we trade within overnight ranges.

- The US, German spread is tighter today

- Looking ahead, US Core PCE, MNI Chicago PMI and Final Michigan are the data release.

- Gilt futures are down -0.50 today at 124.99 with 10y yields up 3.7bp at 1.042% and 2y yields up 1.4bp at 0.653%

- Bund futures are down -0.69 today at 168.37 with 10y Bund yields up 3.0bp at -0.107% and Schatz yields up 1.1bp at -0.612%.

- BTP futures are down -1.75 today at 148.69 with 10y yields up 11.4bp at 1.164% and 2y yields up 9.0bp at -0.25%.

- OAT futures are down -0.97 today at 164.34 with 10y yields up 4.9bp at 0.262% and 2y yields up 0.7bp at -0.647%.

FOREX: Dollar Clawing Back Small Portion of Losses

- The greenback trades toward the top-end of the G10 table so far Friday, with the dollar inching higher against most others. This reverses a small part of the Thursday weakness, dragging EUR/USD off the 1.1692 highs to trade either side of the 1.1650 level ahead of NY hours.

- Equity indices generally trade lower, with European markets off 0.5-0.8%. This has worked in favour of CHF which puts USD/CHF at fresh multi-month lows. This keeps focus on the 0.9100 handle, with EUR/CHF adding downside pressure. EUR/CHF has traded through the lows printed earlier in the week, putting the cross in close proximity to the 1.0607 level printed in July 2020.

- NOK, NZD and SEK are the poorest performers, with the greenback, CHF and CAD among the strongest so far.

- The US personal income/spending and PCE data later today takes focus, with PCE deflator seen inching higher to 4.4% for the Y/Y reading. MNI Chicago PMI crosses shortly afterwards, with markets seeing a moderation to 63.5. Canadian GDP and a joint meeting between G20 finance and health ministers are also due.

EQUITIES: Stocks Sag On Apple/Amazon Earnings Reports

- Asian stock markets closed mixed, with Japan's NIKKEI up 72.6 pts or +0.25% at 28892.69 and the TOPIX up 1.52 pts or +0.08% at 2001.18. China's SHANGHAI closed up 28.919 pts or +0.82% at 3547.336 and the HANG SENG ended 178.49 pts lower or -0.7% at 25377.24

- European equities are weaker, with the German Dax down 116.77 pts or -0.74% at 15696.33, FTSE 100 down 29.93 pts or -0.41% at 7249.47, CAC 40 down 27.36 pts or -0.4% at 6804.22 and Euro Stoxx 50 down 29.3 pts or -0.69% at 4233.87.

- U.S. futures are lower following disappointing quarterly results from giants Amazon and Apple, with the Dow Jones mini down 76 pts or -0.21% at 35537, S&P 500 mini down 23.25 pts or -0.51% at 4564.25, NASDAQ mini down 133.5 pts or -0.85% at 15631.25.

COMMODITIES: Precious Metals Weaken As Dollar Regains Some Ground

- WTI Crude down $0.01 or -0.01% at $82.84

- Natural Gas down $0 or -0.03% at $5.735

- Gold spot down $7.24 or -0.4% at $1797.29

- Copper down $2.2 or -0.5% at $442.15

- Silver down $0.2 or -0.85% at $23.9036

- Platinum down $3.15 or -0.31% at $1017.75

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.