-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Cook Eyes Disinflation, Bowman Hawkish View

MNI ASIA MARKETS ANALYSIS: Geopol Tensions, Hawkish Fed Speak

MNI BRIEF: Canada PM Trudeau Loses Another Cabinet Minister

MNI US Open: ECB Speakers' Tone Remains Dovish

EXECUTIVE SUMMARY:

- ECB'S PANETTA SEES NO JUSTIFICATION FOR SLOWING BOND-BUYING

- MNI CHINA LIQUIDITY SURVEY: INFLATION SEEN EASING

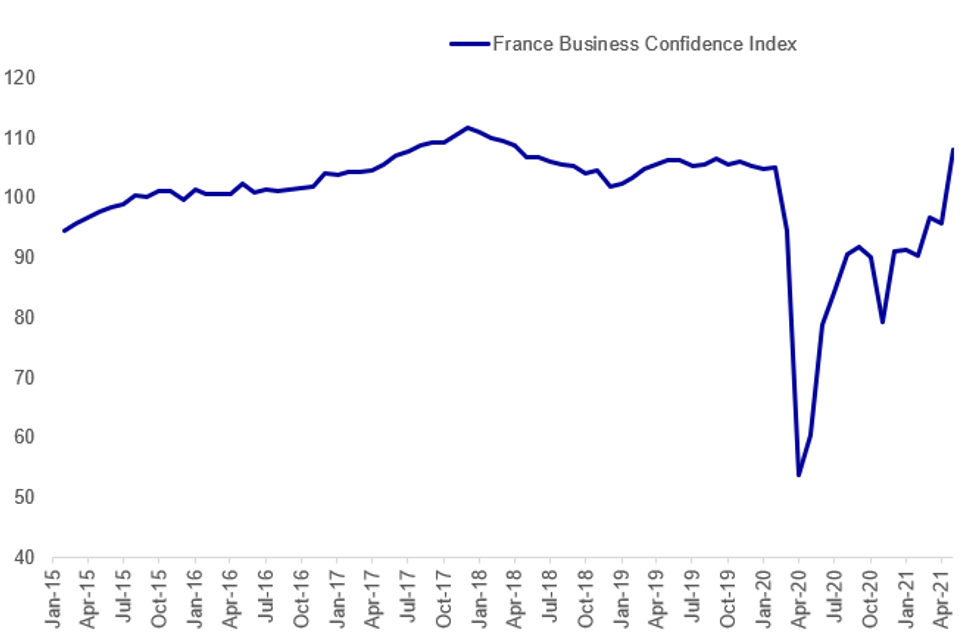

- FRENCH BUSINESS CLIMATE AT HIGHEST SINCE 2018; CONSUMERS ALSO MORE UPBEAT

- CHINA BARS BANKS FROM SELLING COMMODITIES-LINKED PRODUCTS TO RETAIL BUYERS (RTRS SOURCES)

- RBNZ SAYS RATE RISE FORECAST "NOT FORWARD GUIDANCE"

Fig.1: French Business Confidence Rises More Sharply Than Expected In May

Source: INSEE, MNI

Source: INSEE, MNI

NEWS:

ECB (BBG/NIKKEI): European Central Bank Executive Board member Fabio Panetta said he sees no signs of sustained inflation pressures that would allow for a reduction in bond purchases, in the latest move by a top official to downplay expectations of an imminent policy shift. "Only a sustained increase in inflationary pressures, reflected in an upward trend in underlying inflation and bringing inflation and inflation expectations in line with our aim, could justify a reduction in our purchases," Panetta said in an interview with Nikkei published on Wednesday. "But this is not what we projected in March. And, since then, I have not seen changes in financing conditions or the economic outlook that would shift the inflation path upward," he said.

MNI CHINA LIQUIDITY SURVEY: Liquidity across China's interbank market remained relatively loose in May, with overnight and 7-day rates sitting close to official policy ones, signaling that the People's Bank of China will keep monetary policy stable, the latest MNI Liquidity Conditions Index shows. The MNI China Liquidity Condition Index stood at 41.7 in May, up from 34.8 previously, with three quarters of traders surveyed saying conditions were "stable". The index was below 50 for a 7th consecutive month. The higher the index reading, the tighter liquidity appears to survey participants.

MNI CHINA LIQUIDITY SURVEY: Just over half of traders questioned for the MNI China Liquidity Survey said domestic inflation fears were somewhat eased from last month following policy actions by Beijing. In a special question added to the survey, half traders reported an eased concern from last month while 37.5% of the participants still saw inflation as a concern going forward.

CHINA (RTRS): China's banking regulator has asked lenders to stop selling investment products linked to commodities futures to mom-and-pop buyers, three people with knowledge of the matter told Reuters, to curb investment losses amid volatile commodity prices. It has also asked lenders to completely unwind their existing books for these products, which they manufacture and sell to individual investors, said the sources, who are involved in and have been briefed on the decision. The China Banking and Insurance Regulatory Commission's (CBIRC's) order to exit these products has not been reported before. It issued the order this year, two of the sources said.

RBNZ: Economic forecasts which include a rise in official interest rates in the second half of 2022 are "not forward guidance" but are based on confidence that the economy would reach employment and inflation targets, according to Reserve Bank of New Zealand Assistant Governor Christian Hawkesby. Speaking at a press conference following the release of the RBNZ's quarterly Monetary Policy Statement, Hawkesby cautioned that the forecasts are "conditional." "We will revisit the forecasts every six weeks and every three months," said Hawkesby.

UK (BBG): Boris Johnson is facing a barrage of criticism over his handling of the pandemic from his former adviser, Dominic Cummings, who has told a parliamentary committee the prime minister did not take the crisis seriously enough as Covid hit. The ex-aide is giving evidence to a parliamentary hearing about the government's missteps that contributed to the U.K. suffering the worst pandemic death toll in Europe. Cummings leveled the blame at the whole government -- saying ministers and officials had "disastrously" failed the public when people needed them most.

FRANCE/EU/BELARUS (BBG): France's Foreign Affairs Minister Jean-Yves Le Drian says the Belarus decision to force a landing of a Ryanairjet to arrest a dissident journalist is also an attack on the European Union."It's the European Union that's targeted in this affair," Le Drian says in interview on France 2 on Wednesday. The journalist "was exiled in Europe, his wife as well, the airline in question is European, the passengers were European, the flight was European. It's very serious."

EU/ASTRAZENECA (BBG): The European Union attacked AstraZeneca Plc's Covid-19 vaccine supply "failure" and demanded an urgent order for millions more doses in the latest round of a bitter legal dispute over alleged broken promises by the drugmaker.At a hearing that kicked off on Wednesday, a Belgian court is weighing EU claims that there's an emergency situation that merits an order for the drug maker to deliver 20 million more shots than it has promised so far by the end of June. The same court will examine later this year whether Astra violated the terms of its contract.

RIKSBANK: The key financial vulnerabilities in Sweden, with its low public debt levels, come from high household borrowing and its banks' exposure to the highly priced residential and commercial property markets, the Riksbank said in its Financial Stability Report (FSR) published Wednesday. "A crisis in the property market can threaten the stability of the Swedish financial system," it said, with highly leveraged property firms vulnerable to companies cutting back on office usage, hitting the commercial property sector.

DATA:

FR Business Climate At Highest Since Apr 2018

MAY BUS CLIM INDICATOR 108; APR 96r

MAY MFG SENTIMENT 107; APR 104

MAY SERVICES SENTIMENT 107; APR 92

- The French business climate indicator jumped to the highest level since Apr 2018, rising 12pt to 108 and surpassing market expectations (BBG: 97)

- The index registered above the long-term average for the first time since Feb 2020.

- Insee noted that the gradual easing of restrictions in France and other countries provided a significant boost to economic activity in May.

- Service and retail trade sentiment both surged to 107 in May, up from 92 and 90, respectively. While service sector business climate recorded the highest level since Jan 2020, retail trade confidence posted a 17-month high.

- Especially the food and accommodation industries are posting solid gains in business confidence the report noted.

- Business climate in the manufacturing sector rose further as well to 107, its highest level since Apr 2018.

- Employment climate improved as well in to 99.8 in May, up from 92.2 seen in Apr.

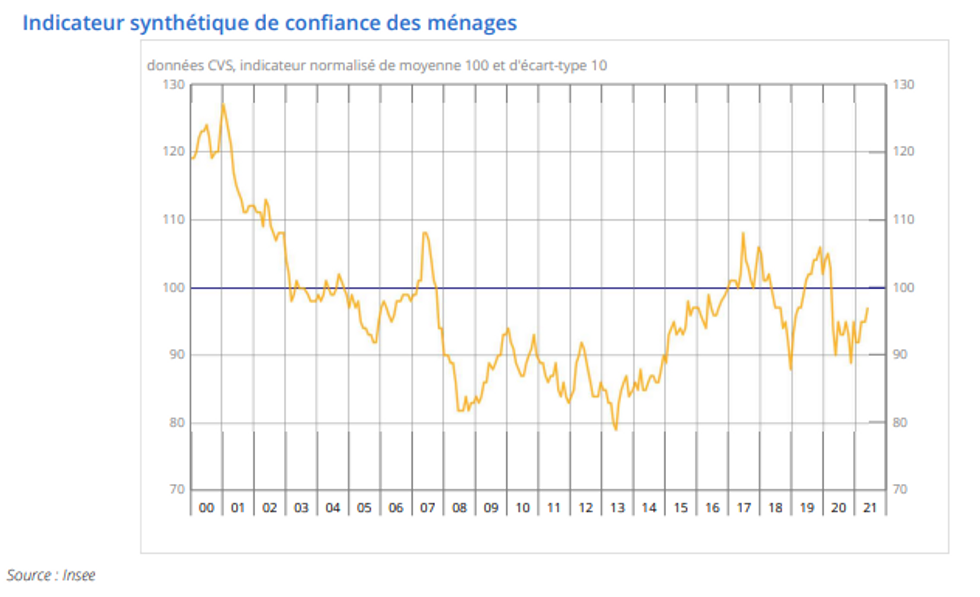

French Consumers More Upbeat in May

FRANCE MAY CONSUMER CONF IND 97; APR 95r

- Consumer confidence rose 3pt to 97 in May, confirming market expectations and showing the highest level since Mar 2020.

- Despite the uptick, the indicator remains below the long-term average of 100.

- The fear of unemployment declined markedly, down 13pt to the lowest level since Mar 2020.

- Household's assessment of their future financial situation and the general economic conditions in the next year saw monthly gains of 3pt and 9pt, respectively.

- Consumer's savings intentions eased slightly by 3pt, but they remain high in a historical context, while intentions to make major purchases remained unchanged.

- Both the current and expected savings capacity rose in May and households expect higher prices in the next 12 months.

- Restrictions have been eased in mid-May in France, which bodes well household confidence. Moreover, the vaccination program is gaining momentum which should provide an additional boost going forward.

Source: Insee

FIXED INCOME: "Premature" tapering comments send Bunds higher

There has been divergence between core global bonds this morning with Bunds and gilts heading higher but Treasuries still lower than yesterday's close (despite recovering some of their overnight losses).

- Bunds have been the biggest movers in core bond space with Bund futures above the psychological 170 level for the first time in 2 weeks. Further comments from ECB's Panetta that discussions of tapering are "premature" follow up comments from Villeroy yesterday.

- TY1 futures are down -0-2+ today at 132-28+ with 10y UST yields up 1.7bp at 1.577% and 2y yields unch at 0.148%.

- Bund futures are up 0.39 today at 170.08 with 10y Bund yields down -2.4bp at -0.192% and Schatz yields up 0.1bp at -0.667%.

- Gilt futures are up 0.21 today at 128.52 with 10y yields down -1.7bp at 0.768% and 2y yields down -0.1bp at 0.011%.

FOREX: NZD At New Highs as RBNZ Hint Hikes to Come

- NZD trades on solid footing, with many sell-side analysts pointing to a hawkish tilt to the RBNZ's policy statement overnight. The new OCR policy path projections now imply rate hikes from Q3 2022, with inflation communications also tweaked. As a result, NZD/USD rallied well, topping the $0.73 level in short order and hitting the best levels since late February in the process.

- At the other end of the table, JPY trades poorly for a second session, although USD/JPY has so far been unable to mount a challenge on the Tuesday high and 50-dma at 109.10.

- AUD is seeing some spillover buying from the NZD rally, while SEK and NOK are retracing slightly lower.

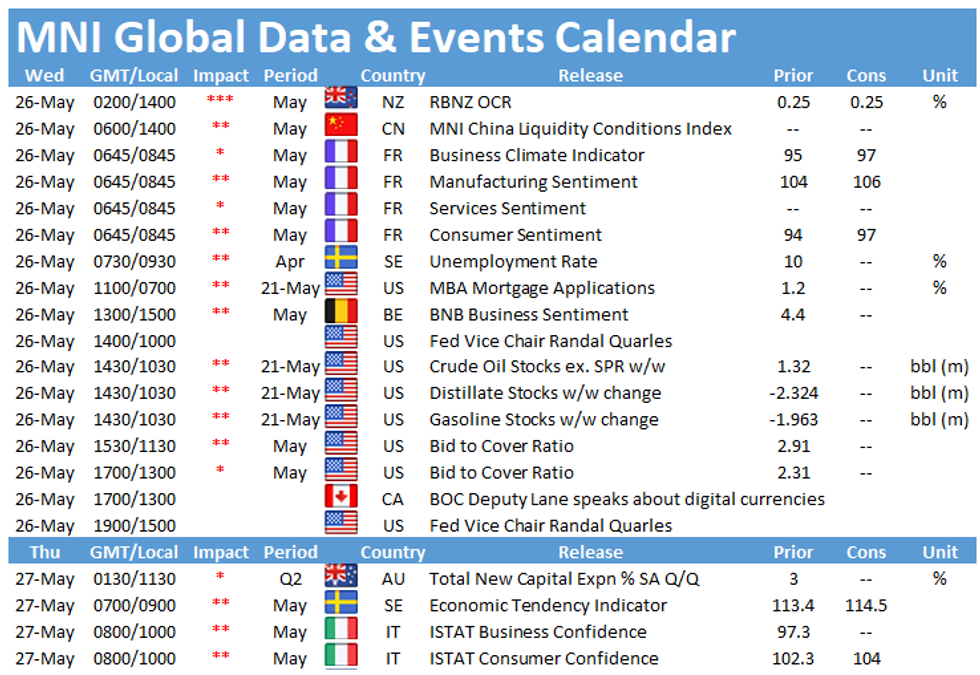

- There are no material economic releases Wednesday, keeping focus on central bank policy for now. ECB's Villeroy, Fed's Quarles and BoC's Lane make up the speaker slate.

EQUITIES: Europe Mixed; US Futures Edge Higher

- Asian markets closed higher, with Japan's NIKKEI up 88.21 pts or +0.31% at 28642.19 and the TOPIX up 1.15 pts or +0.06% at 1920.67. China's SHANGHAI closed up 12.015 pts or +0.34% at 3593.357 and the HANG SENG ended 255.15 pts higher or +0.88% at 29166.01

- European stocks are mixed/flat, with the German Dax up 16.44 pts or +0.11% at 15494.39, FTSE 100 down 6.38 pts or -0.09% at 7043.59, CAC 40 up 6.89 pts or +0.11% at 6411.57 and Euro Stoxx 50 up 5.14 pts or +0.13% at 4044.09.

- U.S. futures are edging higher, with the Dow Jones mini up 92 pts or +0.27% at 34363, S&P 500 mini up 12.5 pts or +0.3% at 4198, NASDAQ mini up 34 pts or +0.25% at 13690.25.

COMMODITIES: Metals Lead Gains; Oil Lagging

- WTI Crude down $0.03 or -0.05% at $66.23

- Natural Gas up $0.03 or +1.17% at $2.953

- Gold spot up $6.13 or +0.32% at $1904.94

- Copper up $2 or +0.44% at $452.7

- Silver up $0.05 or +0.18% at $28.1141

- Platinum up $7.6 or +0.64% at $1204.84

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.