-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: End Of An Era As Japan's Abe Resigns ****TEST 2****

EXECUTIVE SUMMARY:

- JAPAN PM ABE RESIGNS, REFUSES TO SPECULATE ON SUCCESSOR

- BOJ ON WATCH FOR MARKET REACTION TO ABE NEWS (MNI POLICY)

- EUROZONE/ITALIAN CONFIDENCE RISES IN AUGUST

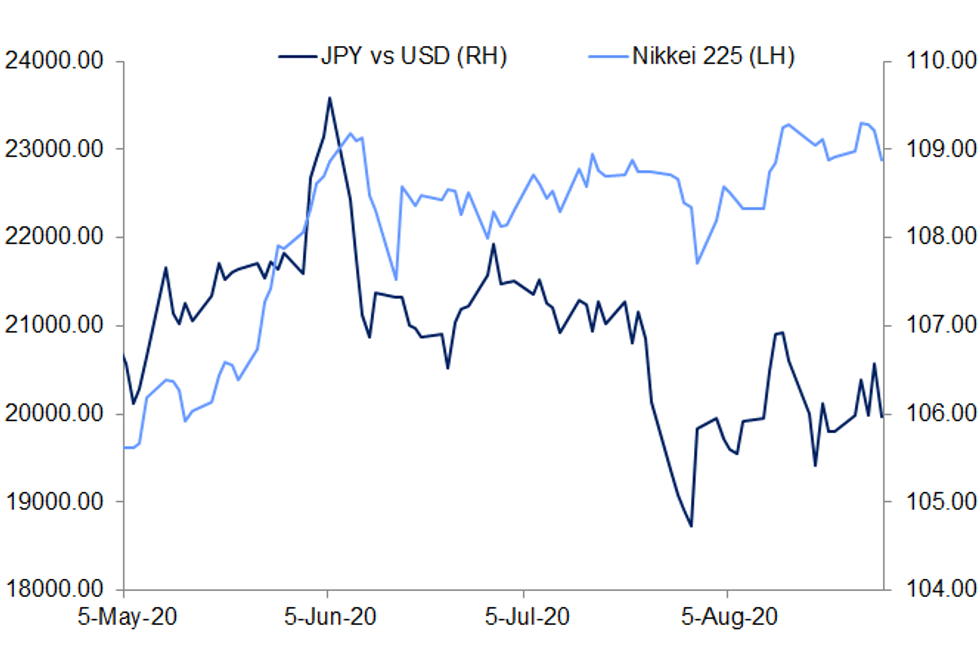

Fig.1: Yen Stronger, Nikkei Weaker On Abe Resignation

Source: Bloomberg, MNI

NEWS:

JAPAN (AP): Japan's longest-serving prime minister, Shinzo Abe, said on Friday that he intends to step down because a chronic health problem has resurfaced. He told reporters that it was "gut wrenching" to leave so many of his goals unfinished. Abe has had ulcerative colitis since he was a teenager and has said the condition was controlled with treatment. Concerns about Abe's health began this summer and grew this month when he visited a Tokyo hospital two weeks in a row for unspecified health checkups. He is now on a new treatment that requires IV injections, he said. While there is some improvement, there is no guarantee that it will cure his condition and so he decided to step down after treatment Monday, he said.

JAPAN: Following the announcement of his resignation, Japanese Prime Minister Shinzo Abe refused to speculate on or put forward the name of any potential successor, stating that he will leave it up to his governing Liberal Democratic Party to find a new leader and that all the names mentioned so far are 'very promising'.

BOJ (MNI POLICY): The Bank of Japan will keep a watchful eye on financial markets in coming hours and days as Japan's Prime Minister Shinzo Abe announced his intended resignation Friday on health grounds. The Nikkei stock index fell and the yen strengthened in knee-jerk reactions immediately after local media reports circulated, before reversing some of the move.

BOJ (MNI POLICY): The Bank of Japan said Friday that the bank has decided to leave the frequency and scale of each JGB buying operation unchanged from in September from the previous month. The BOJ has said that the bank would conduct purchases in a flexible manner, taking account of market conditions, aiming to achieve the target level of a long-term interest rate specified by the guideline for market operations. Depending on conditions, purchase size per auction could be set at a fixed amount or to an unlimited amount, the BOJ added.

CHINA (MNI POLICY): The Chinese Communist Party's official newspaper has endorsed Chairman Xi Jinping's "Dual Circulation" development model, seeking to present it as a strategic guidance for China's long-term growth. In Friday's overseas edition, the People's Daily said the new slogan is a response to new developments and complex changes in China's internal and external environment, denying that China has been forced to shift toward internal consumption as the main economic driver.

PBOC: The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. This resulted in a net drain of CNY100 billion given the maturity of CNY150 billion of reverse repos, according to Wind Information.

RATINGS: Rating reviews of note scheduled for after hours on Friday include:

* Fitch on Ireland (current rating: A+; Outlook Stable) & Norway (current rating: AAA; Outlook Stable).

* Moody's on the EFSF (current rating: Aa1; Outlook Stable) & the ESM (current rating: Aa1; Outlook Stable).

DATA:

- The report notes that both regions (EZ and EU) have made up about 60% of the combined losses of Mar and Apr.

- Among the largest economies, France (+9.3pt), the Netherlands (+7.1pt), Germany (+5.9pt) and Italy (+2.7pt) saw the largest gains, while Spain's index declined by 2.5pt.

- Aug's increase was driven by a sharp rise in service sentiment, up 8.9pt, followed by retail trade confidence which edged up 4.8pt* Manufacturing sentiment improved 3.5pt, while confidence in the construction sector gained 0.8pt.

- Consumer sentiment registered in line with the flash result showing a small uptick by 0.3pt.

- Despite the recent increases, all sub indicators remain well below their pre-covid levels in Aug.

ITALY DATA: Italy Business Sentiment Rose in Aug

- Aug SA manufacturing morale 86.1 vs Jul 85.3

- Aug composite business sentiment indicator 80.8 vs Jul 77.0

- 3rd consecutive m/m uptick post Covid-19 crisis--Istat says

- Aug intermed. gds up, capital, consumer goods down--Istat says

- Manufacturing current orders -42.4 in Aug vs -47.8 in Jul

- 3-month manuf. output outlook -4.0 vs -3.1 in Jul

- Current manufacturing inventory levels up +7.9 vs +5.9 in Jul

ITALY DATA: Italy Consumer Confidence Ticks Up in Aug

- Aug SA consumer confidence 100.8 vs Jul 100.1

- Italy Aug consumer index ticks up after July dip--ISTAT

- Consumers' sentiment on economy up to 90.1 from Jul 85.9

- Confidence in future outlook rose to 105.3 from Jul 104.3

- Sentiment on their personal climate down to 104.9 vs Jul 105

FRANCE DATA: FRANCE AUG FLASH HICP -0.1% M/M, +0.2% Y/Y;JUL 0.9% Y/Y

- FRANCE AUG FLASH CPI -0.1% M/M, +0.2% Y/Y; JUL +0.8% Y/Y

FRANCE DATA: FRANCE Q2 FINAL REAL SA GDP -13.8% Q/Q, -18.9% Y/Y

SWISS DATA: SWISS AUG KOF ECON BAROMETER 110.2; JUL 86.0r

BOND SUMMARY: Well above average volumes in Bund

Most of the action has clearly been noted in the Bund contract.

- The German 10 year is having an impressive session, albeit in a fairly tight range, having traded over 400k lots in just over 3 hours, so well above averages.

- Desk report that Buba involvement may have been the main factor, to explainthe volume.

- Month end is a non factor, given the tiny extensions expected for this monthat +0.02yr.

- Peripheral spreads have been mixed with Italy trading at one end, 1.1bpswider, while Greece trades 1.7bps tighter

- Gilt curve is on the margin bear steeper, but the 10yr has traded in linewith EGBs, with the contract sitting 13 ticks lower.

- Focus for the UK today, will be BOE Governor Bailey due to speak at JacksonHole.

- US Treasuries have recovered some of their overnight losses, following betterequity selling since the EU cash Equity open, but indices have since paired some of their losses at the time of typing.

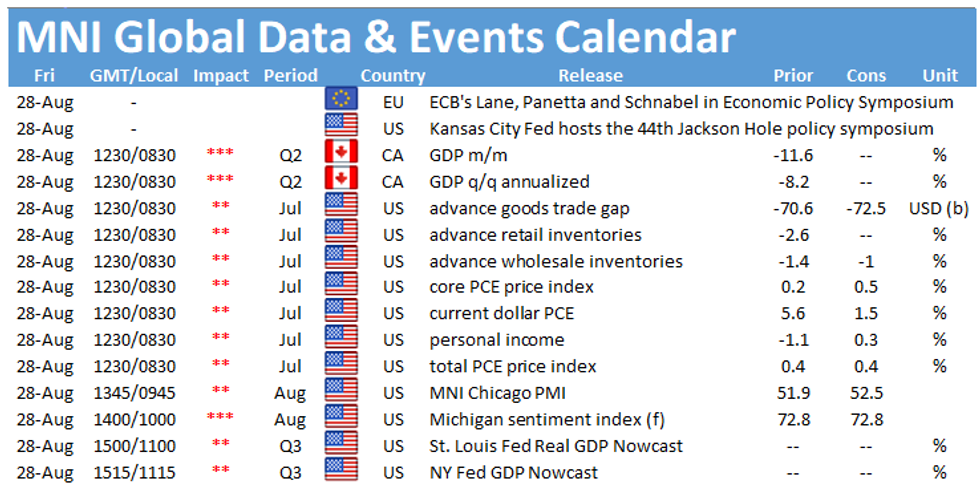

- Looking towards the afternoon, Jackson Hole remains in focus, while on thedata front, we get Canadian GDP, US personal income/spending and the MNI Chicago Business Barometer.

- Markets are still clearly feeling the after-effects of Powell's Jackson Hole appearance, with the greenback the weakest in G10 early Friday. After an initial mixed response to Powell's speech, the USD index is now within striking distance of cycle lows printed mid-August, This has helped give most major pairs another leg higher, resulting in new cycle highs for the likes of AUD and CAD vs. the USD.

- Headlines this morning have focused on the resignation of the Japanese PM Abe. His health complications had been known this week, however his resignation today was slightly unexpected and ahead of schedule. Markets responded by buying JPY on uncertainty over his flagship Abenomics policies, but normal service is expected to resume with his successor likely to continue the well-received policy and BoJ policy expected to remain supportive.

- Focus Friday turns to month-end flows that may come a little early due to the UK bank holiday on Monday. Canadian GDP, personal income/spending and MNI Chicago Business Barometer figures are the data highlights Friday. BoE's Bailey is the headline speaker from the ongoing Jackson Hole policy conference.

- Japan's NIKKEI down 326.21 pts or -1.41% at 22882.65 and the TOPIX down 11.02 pts or -0.68% at 1604.87. China's SHANGHAI closed up 53.694 pts or +1.6% at 3403.807 and the HANG SENG ended 140.91 pts higher or +0.56% at 25422.06

- European equities have bounced from lows, with the German Dax down 41.79 pts or -0.32% at 13074.04, FTSE 100 up 14.05 pts or +0.23% at 6009.22, CAC 40 down 2.67 pts or -0.05% at 5016.15 and Euro Stoxx 50 down 5.35 pts or -0.16% at 3327.61.

- U.S. futures are flat-to-higher, with the Dow Jones mini up 137 pts or +0.48%at 28628, S&P 500 mini up 12.5 pts or +0.36% at 3499.25, NASDAQ mini up 2.5 pts or +0.02% at 11954.25.

Gold and Silver are the biggest winners from the US dollar weakening.

- WTI Crude down $0.17 or -0.4% at $42.96

- Natural Gas up $0.01 or +0.37% at $2.728

- Gold spot up $23.52 or +1.22% at $1959.41

- Copper up $3.9 or +1.3% at $303.15

- Silver up $0.39 or +1.45% at $27.5615

- Platinum up $6.55 or +0.71% at $935.05

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.