-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI US OPEN: Euro Back To Parity As USD Slips Further

EXECUTIVE SUMMARY:

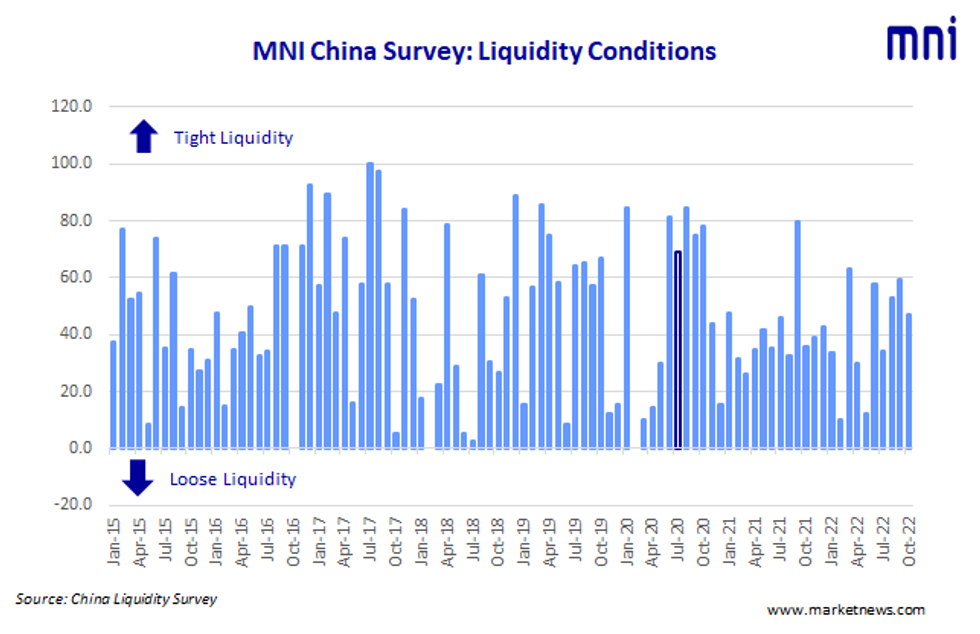

- MNI China Liquidity Index™– Falls To 46.9 in October

- UK Economy Plan May be Delayed Beyond Oct. 31, Cleverly Says

- Banks Warn ECB Of "Serious" Consequences If Loan Terms Tighten

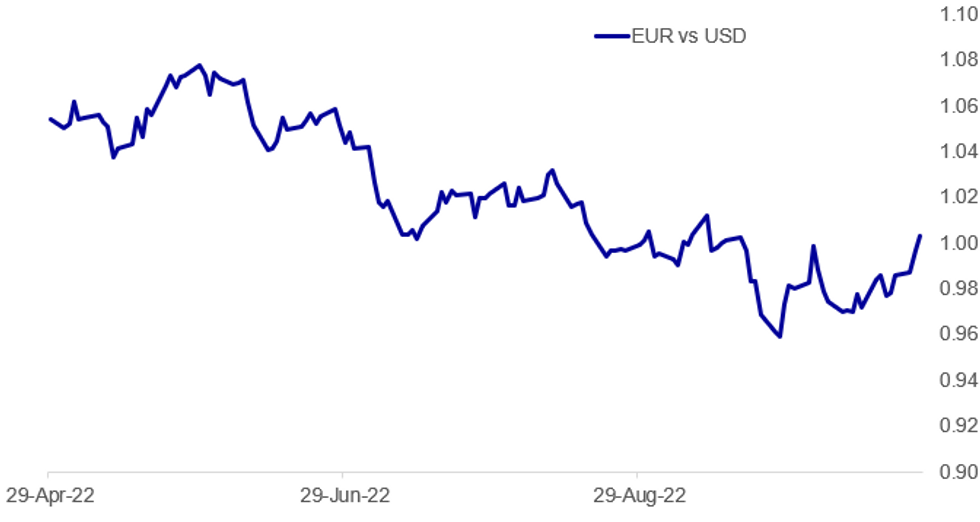

Fig. 1: EURUSD Above 1 For First Time Since Mid-September

Source: BBG, MNI

Source: BBG, MNI

NEWS

UK (BBG): UK Prime Minister Rishi Sunak may delay an economic plan scheduled for Oct. 31 to give him time to square it with his agenda, Foreign Secretary James Cleverly said. “That date was set by the previous prime minister in the anticipation that she would be able to work throughout this period of time on that with the chancellor,” Cleverly said on BBC radio on Wednesday. “I don’t know whether we’re going to be able to stick with that, but we do know that people want to have certainty.”

ECB / EUROPEAN BANKS (BBG): A group of European lenders warned the European Central Bank of “serious negative consequences” if it makes wholesale changes to its ultra-cheap loan program to banks. The region’s retail lenders are asking the Frankfurt-based institution to keep the terms of its so-called TLTRO program largely untouched at a policy meeting Thursday, according to a statement by the European Savings and Retail Banking Group on Wednesday. Along with the damage to the economy and finance industry, the move would imply “high legal risks” for the ECB, the statement said.

ECB / MONEY MARKETS (BBG): The International Capital Market Association writes to the European Central Bank to express industry concerns about conditions in euro area repo and money markets, citing risks to the transmission of monetary policy. Says that while market dislocations have previously been seen around year-end reporting periods and the pandemic panic of March-April 2020, “as we enter a new phase of the monetary policy cycle, with the normalization of interest rates and associated market volatility, the potential for both the scale and frequency of such dislocations is likely to increase”

UK: Speaking to Reuters, IMF managing director Kristalina Georgieva states that she expects new UK Prime Minister Rishi Sunak to 'steer the United Kingdom towards the path of medium-term fiscal sustainability'. Also expects to speak to UK Chancellor of the Exchequer Jeremy Hunt in the coming days. Comes as PM Sunak prepares for his first prime minister's questions in the House of Commons at 1200BST (0700ET, 1300CET)

SNB (BBG): Banks in Switzerland stopped seeking easy currency-trading profits using an emergency dollar swap facility provided by the Federal Reserve, a week after seeking the most funds since 2008. In Wednesday’s auction held at the Swiss National Bank, no cash was taken up. A week ago, 17 banks were allocated $11.09 billion, the biggest amount sought in a single operation since the Global Financial Crisis.

GERMANY/CHINA (MNI): The German gov't has agreed for Chinese shipping giant Cosco to take a stake in the container terminal in Tollerort in the port of Hamburg, a move that has exposed some cracks in the federal coalition. The gov't has agreed to Cosco taking a smaller stake than originally planned (24.9% rather than 35%), but within the 'traffic light' coalition there were notable disagreements on whether the deal should proceed.

FIXED INCOME: Core FI higher; Sunak ponders whether to delay UK fiscal announcement

- Core fixed income has pressed higher this morning with both Bunds and Treasuries marginally exceeding yesterday's highs.

- UK politics is again in focus with PM Sunak holding his first Cabinet meeting this morning and an announcement on the timing of the fiscal statement likely to be announced some time today. The Times reports reported overnight that a delay of a couple of days (to still be ahead of next Thursday's BOE announcement) or a more substantial delay to later in November (and changing to a full Budget) are both options under consideration to allow Sunak some input on the measures.

- In terms of data for the rest of the day, the highlights are US inventory, advanced goods trade data and new home sales. With the ECB meeting tomorrow and the Fed/BOE meeting next week there are headline speakers due today. Focus will instead be on the outcome of tomorrow's meeting with another 75bp hike widely expected, but question marks over whether the ECB will change any terms on its TLTRO operations or introduce reverse tiering.

- TY1 futures are up 0-10 today at 110-28 with 10y UST yields down -4.2bp at 4.061% and 2y yields down -2.7bp at 4.438%.

- Bund futures are unch today at 138.21 with 10y Bund yields up 0.3bp at 2.170% and Schatz yields up 2.3bp at 1.983%.

- Gilt futures are down -0.20 today at 101.18 with 10y yields up 1.4bp at 3.642% and 2y yields up 0.5bp at 3.308%.

FOREX: USD Index Sinks, Through 50-dma Support For First Time in Three Months

- The Greenback saw another wave of weakness in early European hours, with the price action reminiscent of the USD dip after the US equity open on Tuesday.

- EUR/USD is now back above parity for the first time since mid-September and trades north of resistance at the early October highs (0.9999). This narrows the gap with the next upside levels at 1.0051 and the 100-dma of 1.0094. A close at current levels or higher would mark a significant bullish development, and coincides with the USD Index falling through the 50-dma of 110.783 for the first time since early August.

- The USD downtick is similarly notable against the CNH, with USD/CNH off over 1.5% on the day. The price action will raise suspicion of intervention via state-run banks as we've seen in recent weeks - particularly after the pair hit record highs this week and the Chinese authorities conducted a survey of banks to gauge both positioning and market sentiment toward the currency.

- AUDUSD now trades a point above the 20-day EMA - flagged as a key resistance this week - cementing a break to confirm a bullish shift to the technical backdrop. This opens gains toward key resistance at the Oct 4 highs at 0.6547.

- Focus turns to September trade balance data and new home sales from the US, amid growing evidence that the US real estate market is slowing quickly. The Bank of Canada rate decision is also due, with the Bank are seen raising rates by a further 75bps to 4.00%. The BoC's monetary policy report also crosses, followed by a press conference with the BoC governor.

DATA

MNI China Liquidity Index™– Falls To 46.9 in October

Liquidity conditions across China’s interbank market eased in October, as end-quarter MPA stress and Golden week sash needs fell away. The outlook for the economy picked up, helped by the mood music from the 20th Party Congress, the latest MNI liquidity conditions survey showed.

The Liquidity Condition Index, slid to 46.9 from September’s 59.4, with one quarter of the participants reporting a marginal loosening of liquidity conditions. The higher the index reading, the tighter liquidity appears to survey participants.

- The Economy Condition Index stood at 53.1, picking from August's 48.4, with sentiment improved in the wake of easing Covid restrictions.

- The PBOC Policy Bias Index remained below 50 for a 16th consecutive month.

- The Guidance Clarity Index was little changed, as respondents again claim to understand the signals from the PBOC.

The MNI survey collected the opinions of 32 traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed income and currency instruments, and the main funding source for financial institutions. Interviews were conducted October 10 – October 21.

Click below for the full press release:

MNI China Liquidity Index -2022_10 presser.pdf

For full database history and full report on the MNI China Liquidity Index™, please contact:sales@marketnews.com

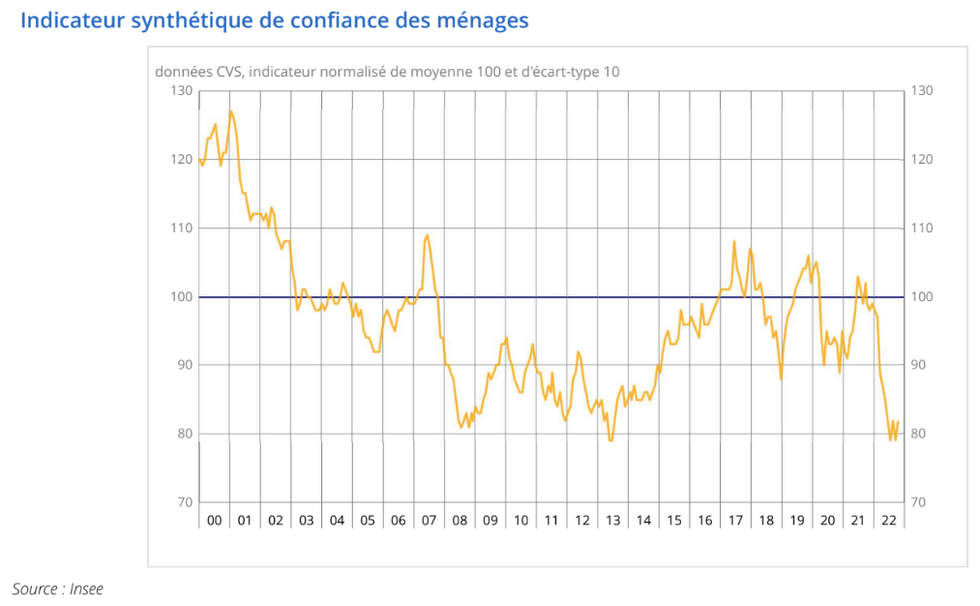

French Consumer Sentiment Boost as Inflation Expectations Stabilise

FRANCE OCT CONSUMER SENTIMENT 82; SEP 79

- French consumer confidence surprised to the upside in October, improving by three points to 82 instead of seeing an expected two-point slide to a fresh record low. The indicator remains pessimistic and below the long-run average of 100.

- Households' expected financial conditions improved in October alongside a marked rebound in future standard of living conditions in France. Unemployment concerns remained stable following a sharp increase in September and inflation expectations also stabilised, despite remaining high.

- This combination of improvements is an early indication that the French consumer likely sees the economy rebounding after the anticipated European winter recession plagued by high energy prices.

- On Friday French GDP is expected to weaken to +0.1% q/q in the Q3 flash estimate (vs +0.5% q/q in Q2), whilst flash HICP data sees another uptick in price growth to +6.5% y/y.

EQUITIES AND COMMODITIES: Precious Metals Gain As Dollar Weakens

EQUITIES:

- Asia Close: Japan's NIKKEI closed up 181.56 pts or +0.67% at 27431.84 and the TOPIX ended 11.07 pts higher or +0.58% at 1918.21. China's SHANGHAI closed up 23.221 pts or +0.78% at 2999.504 and the HANG SENG ended 152.08 pts higher or +1% at 15317.67.

- Europe: German Dax up 93.39 pts or +0.72% at 13052.96, FTSE 100 down 11.78 pts or -0.17% at 7013.48, CAC 40 up 16.33 pts or +0.26% at 6250.55 and Euro Stoxx 50 up 6.22 pts or +0.17% at 3585.58.

- US Futures: Dow Jones mini up 29 pts or +0.09% at 31909, S&P 500 mini down 17.75 pts or -0.46% at 3852.5, NASDAQ mini down 148.5 pts or -1.27% at 11565.25.

COMMODITIES

- WTI Crude down $0.09 or -0.11% at $84.97

- Natural Gas up $0.03 or +0.59% at $5.516

- Gold spot up $19.86 or +1.2% at $1656.98

- Copper up $5.55 or +1.63% at $340.75

- Silver up $0.39 or +1.99% at $19.2915

- Platinum up $15.8 or +1.72% at $923.52

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/10/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/10/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 26/10/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 26/10/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/10/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 26/10/2022 | 1500/1100 |  | CA | BOC Governor Press Conference | |

| 26/10/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/10/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 27/10/2022 | 0030/1130 | ** |  | AU | Trade price indexes |

| 27/10/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/10/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 27/10/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/10/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/10/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 27/10/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 27/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 27/10/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/10/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 27/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/10/2022 | 1245/1445 |  | EU | ECB post-policy decision press conference | |

| 27/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 27/10/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 27/10/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 27/10/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.