-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: European PMIs Show Mixed Momentum

EXECUTIVE SUMMARY:

- GERMAN JULY FLASH PMI IMPRESSES; FRANCE SLIGHTLY DISAPPOINTS

- U.K. PMIS SHOW SLOWEST ACTIVITY SINCE MARCH, SUPPLY / LABOUR CONSTRAINTS NOTED

- E.C.B. HAWK WUNSCH SAYS DISSENT SHOULDN'T BE DRAMATIZED

- CHINA CLOSELY MONITORING RISKS FROM FED POLICY CHANGES: SAFE

- E.U. TALKS WITH U.S. ON VACCINE PASSPORTS MAKING LITTLE PROGRESS

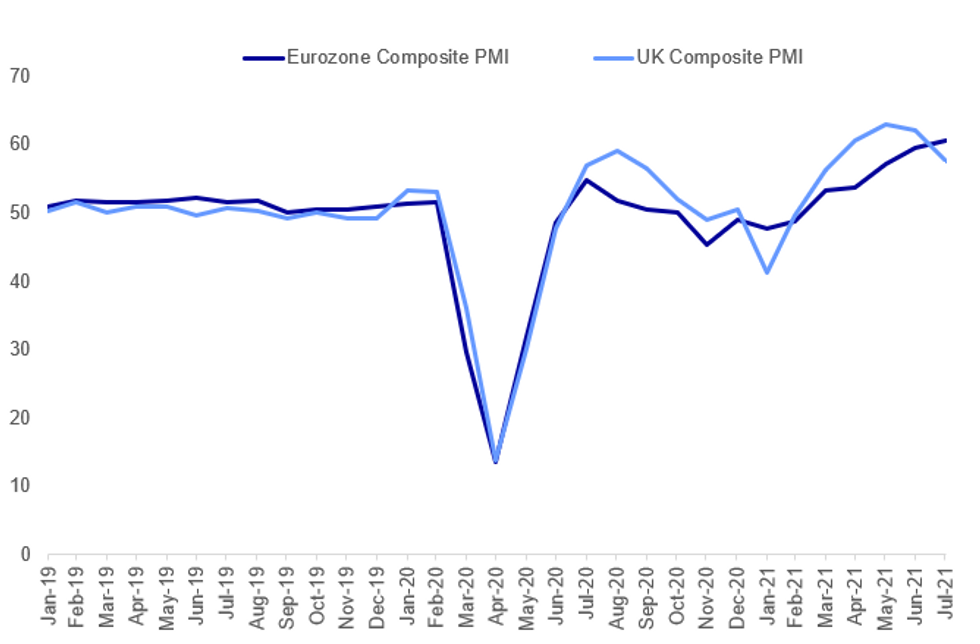

Fig. 1: European Flash July PMIs

Source: IHS Markit, MNI

Source: IHS Markit, MNI

NEWS:

E.C.B. (CNBC): One of the more hawkish members of the European Central Bank has sought to downplay the division seen at the Frankfurt institution this week, saying that he is still supportive of accommodative policy. "We all agree we want to be supportive in this phase of the recovery, we all actually want to go to 2%, so my dissent shouldn't be dramatized," Belgian central bank governor and ECB member Pierre Wunsch told CNBC. But he said he was reluctant to commit to the potential five or six-year time horizon for dovish policy to remain in place, in line with market expectations, given the possible risks that could force the central bank to change course. "The most important conclusion of the retreat actually, and our new strategy, is what I would call a 'no regret' conclusion, in that we all agree that what we have been doing in the last few years was necessary and proportional," Wunsch said.

CHINA (BBG): China is closely monitoring risks from Fed's policy changes, and is well prepared, Wang Chunying, spokesperson for the State Administration of Foreign Exchange, says at a briefing. China is prepared for the worst situation brougt by Fed's policy changes. The yuan was more stable than currencies of other emerging nations so far this year.

E.U./U.S. (BBG): Negotiations between the European Union and the U.S. torecognise each other's vaccination passes are struggling to make headway due to the absence of a federal certification system in America, according to a diplomatic memo seen by Bloomberg.EU ambassadors were told at a meeting on Thursday that the European Commission is, however, in an advanced stage of talks with the U.K., and in contact with Japan, Australia and Canada. Discussions with Ottawa were described as promising and officials are hoping that the EU's Covid certificates will be recognised in September when Canada is due to reopen travel to vaccinated non-U.S. travelers, the memo says.

U.S. / HOUSING (WSJ): The Biden administration on Friday plans to expand assistance programs for borrowers who fell behind on their mortgages during the Covid-19 pandemic and continue to face economic hardship, a bid to prevent a sharp rise in foreclosures over the coming months. New modification options will be offered for borrowers with Federal Housing Administration loans and other federally guaranteed mortgages, administration officials said. The changes would aim to extend the length of their mortgages and lock in lower monthly principal and interest payments to keep more borrowers in their homes.

CHINA-U.S.: US Deputy Secretary of State Wendy Sherman's trip to Tianjin, China has been confirmed for 25-26 July, where she will meet with both Foreign Secretary Wang Yi and Vice Foreign Minister Xie Feng. Ahead of the trip foreign ministry spokesman Zhao Lijian stated that US-China relations should 'be based on mutual respect'. Comes after the US gov't said that Sherman should be "dealing with China from a position of strength,", a comment seen as disrespectful by Beijing. In response Zhao stated that "We didn't accept it [US disrespect] in Anchorage, let alone in Tianjin,"

DATA:

GERMAN DATA: July Flash PMI: Strong Services, And "Unprecedented" Hiring

German flash June PMI exceeded expectations across the board: Services of 62.2 (59.5 exp, 57.5 prior), Manufacturing of 62.6 (62.5 exp., 63.4 prior), and composite 62.5 (60.7 exp., 60.1 prior).

- The composite and services figures were all-time highs (going back to the start of the respective series in 1997-98).

- From the IHS Markit release, "the uptick in the index was driven by an ongoing rapid recovery in services activity, linked to the easing of virus containment measures and growing demand".

- On employment: "Buoyed by strengthening demand and growing capacity pressures, firms took on staff at an unprecedented rate during the month."

- On prices: "On the price front, rates of increase in input cost and output charges showed a slight correction from May's record highs, but nevertheless pointed to ongoing strong inflationary pressures as supply struggled to keep pace with demand...The combined rate of inflation was the second-fastest seen since this series began in September 2002."

FRANCE DATA: July Flash PMI: Modest Deceleration

French July flash PMI data disappointed to the downside, with faster-than-expected deceleration: Services of 57.0 (vs 58.8 exp., 57.8 prior); manufacturing of 58.1 (58.3 exp., 59.0 prior), and composite of 56.8 (58.4 exp., 57.4 prior).

- From the IHS Markit report: "Growth was spurred on by further intakes of new business, which grew at one of the fastest rates seen in over three years. Service sector output growth continued to surpass that seen in the manufacturing sector amid looser lockdown restrictions. That was in spite of a faster increase in goods production."

- On employment: "French private sector businesses increased their workforce numbers during July. Staffing levels grew at a modest pace across both manufacturers and service providers, although in both cases rates of job creation slowed compared to June."

- On prices: "As a consequence of ... supply chain issues, French private sector companies observed rising input costs during July. By sector, manufacturers recorded substantially faster input price inflation than service providers, but in both cases price gains were firmer than in June. Overall, private sector input cost inflation was the strongest since May 2011. Firms continued to pass higher costs on to their clients through increases in their selling prices. That said, the extent to which output charges were raised was marginally softer than in June."

U.K. DATA: July Flash PMI: "Shortages Of Staff And Materials Hinder Recovery"

UK July flash PMI data came in much weaker than expected: Services 57.8 (62.0 expected, 62.4 prior), Manufacturing 60.4 (62.4 exp., 63.9 prior), and Composite 57.7 (61.5 exp., 62.2 prior).

- From the IHS Markit report: "The speed of recovery was the weakest since March, with survey respondents widely reporting staff and raw material shortages due to the pandemic. Concerns about the loss of momentum contributed to the lowest degree of optimism towards the business outlook for nine months."

- On employment: "difficulties recruiting staff remained a key factor holding back efforts to boost business capacity. Employment growth eased to its slowest since March, with survey respondents often citing a lack of candidates to fill vacancies and an unusually large number of staff departures."

- On prices: "Average cost burdens increased at the fastest pace since the survey began in January 1998, fuelled by a steeper rise in the service sector. This was linked to wage inflation, higher transport bills and price hikes by suppliers. Manufacturers also recorded another rapid upturn in purchasing prices, but the rate of inflation eased from June's all-time high."

UK DATA: Retail Sales Up in Jun

UK JUN RETAIL SALES +0.5% M/M; +9.7% Y/Y

UK JUN RETAIL SALES EX-FUEL +0.3% M/M; +7.4% Y/Y

UK MAY TOTAL SALES REVISED AT -1.3% M/M

UK JUN RETAIL SALES DEFLATOR +3.1% Y/Y; EX-FUEL +1.9% Y/Y

- UK retail sales increased by 0.5% in Jun, in contrast to markets looking for a flat reading (BBG: 0.0%). This follows a decrease in May which was driven by falling food sales. Nevertheless, sales are 9.5% above the pre-pandemic level.

- Annual sales registered at 9.7%, after rising sharply by 24.6 and coming in better than markets expected (BBG: 9.2%).

- Food and drink sales provided the largest upward contribution, rising by 4.2%, which is the highest level since Mar 2020. The ONS noted that sales were boosted by football fans enjoying the Euros.

- Non-food stores and particularly household goods stores declined in Jun, down by 1.7% and 10.9%, respectively, while non-store retailing fell for the second month in a row (-3.7%).

- Fuel sales rose by 2.3% in Jun, recording the fourth consecutive increase as people increased the amount of travel. However, the level of fuel sales remains 2.1% below the pre-pandemic level, the ONS noted.

- The proportion of online sales eased further in Jun to 26,7%, which is the lowest level since Mar 2020.

FIXED INCOME: Risk on tone, keeps the lid on Govies

- Early focus in EGBs was on the European PMI services releases.

- France missed, Germany and EU beat expectations.

- Bunds are in turn better offered, with the contract also taking its cue from the Risk on tone, as Equities rallies since 07.00bst, and gaining further traction on the EU cash open.

- Peripherals are all trading tighter, with Greece leading by 2.5bps against the German 10yr.

- Gilts are also better offered this morning, helped by the Retail sales beat although PMIs missed expectations.

- Nonetheless, price action has been limited as we close out a very volatile busy week, and the contract stick to a 20 ticks range (129.50/129.70).

- US Treasuries have also been better offered as Mini S&P edges back towards the record high, now at 4379.25, with the record high situated at 4384.5.

- Curves are generally all trading bear steeper

- US 5s/30s, is still well short of yesterday's steepest level

- Looking ahead, We get Canadian Retail Sales, US PMIs Services.

- And tonight, after markets, RATINGS: Moody's on Cyprus and DBRS on EFSF, ESM

FOREX: Risk Appetite Returns, Sending JPY to Bottom of the Pile

- Equity markets have resumed the incline, with the e-mini S&P narrowing the gap with the mid-July alltime highs to 5 points. The resumption of risk appetite has worked against haven currencies, leaving the JPY the poorest performer in G10 so far Friday.

- EUR continues to hold the post-ECB losses, with EUR/USD circling Thursday's worst levels of 1.1757. This keeps the outlook bearish, with first support undercutting at 1.1738 ahead of the key level of 1.1704. A heavy slate of option expiries layered between 1.17--1.1800 today could keep spot muted going forward.

- Greenback has resumed recent strength, with the USD index closing in on the multi-month highs printed earlier this week at 93.191.

- The data slate thins out headed into the close of the week, with Canadian retail sales and the flash Markit PMI data from the US the last few releases. There are no notable central bank speakers.

EQUITIES: S&P Futures Heading Back Toward All-Time Highs

- Asian markets closed weaker (Japan is closed for holiday). China's SHANGHAI closed down 24.338 pts or -0.68% at 3550.396 and the HANG SENG ended 401.86 pts lower or -1.45% at 27321.98.

- European equities are gaining, with the German Dax up 101.62 pts or +0.66% at 15601.45, FTSE 100 up 46.27 pts or +0.66% at 7016.87, CAC 40 up 48.69 pts or +0.75% at 6523.18 and Euro Stoxx 50 up 32.98 pts or +0.81% at 4081.07.

- U.S. futures are higher, with the Dow Jones mini up 137 pts or +0.39% at 34846, S&P 500 mini up 19.5 pts or +0.45% at 4379, NASDAQ mini up 75.5 pts or +0.51% at 15004.

COMMODITIES: Precious Metals Retrace With Dollar Edging Higher

- WTI Crude up $0.03 or +0.04% at $71.73

- Natural Gas down $0.01 or -0.17% at $4.005

- Gold spot down $1.97 or -0.11% at $1807.98

- Copper up $1 or +0.23% at $433.95

- Silver down $0.1 or -0.38% at $25.3409

- Platinum down $8.41 or -0.77% at $1092.7

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.