-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Eurozone PPI Hits an Alltime High

EXECUTIVE SUMMARY:

- EUROZONE PIPELINE INFLATION AT A RECORD HIGH

- MORE FOCUS ON UPSIDE SURPRISE IN TODAY'S NFP

- MARKET MAINTAINS A POSITIVE USD BIAS AHEAD OF JOBS DATA

Eurozone PPI hits an alltime high:

NEWS:

Eurozone (MNI): German Auto Sector Sentiment At Near 3-Yr High: Ifo

German car manufacturers saw business improve further in June, with global demand for autos increasing, data the Ifo institute said Friday. While the business situations indicator jumped from 37.8pt in May to an almost 3-year high of 44.2pt in June, expectations only ticked up to 3.2pt from -1.6pt seen last month. Auto manufacturers expect production to grow more slowly going forward and they are more optimistic regarding exports, but companies continue to plan for job cuts. "The cutbacks are likely to hit production in particular," said Oliver Falck, Director of the ifo Center for Industrial Organization and New Technologies.

ECB (Bloomberg): ECB's Lagarde: Recovery Getting Under Way But Remains Fragile

"Prices need to increase in a gradual, stable and sustainable manner. For that we need a sustainable economic recovery. But we are not there yet," European Central Bank President Christine Lagarde says in interview with La Provence. "We will see a return to lower rates of inflation as indicated in our projections". Helicopter money "is a matter for the budgetary authorities, not a central bank"

Thailand (MNI): Bank of Thailand Sees Toolbox Emptying

Thailand's central bank sees limited policy options left in its toolbox and is reluctant to cut interest rates further as the baht weakens, preferring to rely on its debt relief program and government fiscal measures to support the sluggish economy, MNI understands. With the baht trading at a-near-12-month weak point of THB34.05 to the U.S. dollar, the central bank believes its main role now is underpinning the currency while the government does the heavy lifting towards recovery.

OPEC (Bloomberg): OPEC+ Seeks Way Out of Standoff That's Blocking Oil-Supply Hike

OPEC+ entered a phase of tense internal diplomacy as it sought to resolve a dispute that's blocking measures to ease rising oil prices.If Friday's efforts fail, the world may not get the extra crude supplies it was expecting. That would squeeze an already tight market, risking a further inflationary price spike.

DATA:

MNI DATA BRIEF: Eurozone Pipeline Inflation At Record High

Eurozone producer prices surged to a record high of 9.6% in May, Eurostat said Friday, building on April's 13-year high of 7.6%. Just 6 months ago, in December, eurozone PPI stood at -1.1% y/y.

Energy prices jumped to 25.1% in May and prices for intermediate goods accelerated sharply as well at 9.2%. Survey evidence, such as the EZ manufacturing PMI for June:https://www.markiteconomics.com/Public/Home/PressR..., suggests another increase in input prices due to supply-side constraints. Additionally, the report saw an uptick in output prices as well, as companies pass on the higher costs.

Jun Nonfarm Payrolls: More Focus On Upside Surprise

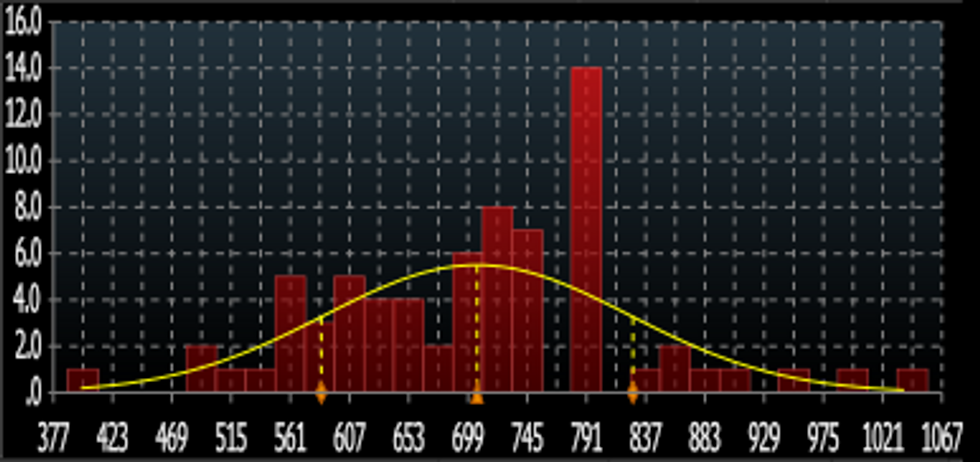

June nonfarm payrolls (out Friday, 0830ET/1330BST) are seen rising by 720k (BBG median) vs +559k in May, with the range of estimates running from 400k-1050k with standard distribution of 121k (see chart).

- The unemployment rate is seen falling to 5.6% vs 5.8% in May, with average hourly earnings slowing to +0.3% M/M from +0.5% prior.

- As our data team reports, while new graduates and students off for the summer likely expanded the labor pool, the supply of available workers last month remained muted, keeping upward pressure on wages.

- The sell-side forecasts we've seen mostly expect a strong contribution from government payrolls due largely to fewer-than-usual June layoffs in the education sector.

- Market reaction is likely to be more pronounced on an upside beat rather than a downside miss.

- This is because a weaker-than-expected headline figure will probably be seen as a supply-side rather than demand-side issue, and one that's already taken into account by the Fed; on the other hand a figure of say 1mn+ could reignite concerns about an earlier rate hike liftoff.

- The timing ahead of the holiday weekend is also a consideration: JPM points out that Tsy yields "are sensitive to payroll surprises, and that these moves can be amplified when employment data are released on holiday-shortened trading sessions."

Distribution of Estimates For Jun Nonfarm Payroll Growth ('000s on x-axis)Source: BBG Survey, MNI

Distribution of Estimates For Jun Nonfarm Payroll Growth ('000s on x-axis)Source: BBG Survey, MNI

Markets Maintain Modest Positive USD Bias Headed Into NFP

- Headed into Friday's payrolls release, markets expect a further improvement in job gains to 720k from 559k in May. The Whisper number is at a more bullish 800k, which would mark the highest since August last year.

- In rates space, speculators continue to trim their short position in the very long end, with the overall net short for Long Bond futures shrinking from October 2020's low of 260k net short to this month's short of just 60k.

- This leaves markets with a flattening bias: short of the front-end (2 - 5yr), neutral of the belly, while maintaining a bias to close shorts in the very long (Long bonds and ultras) end of the Treasury curve.

- For currencies, a volume-weighted USD 3m Risk Reversal (below) retains a very modest USD upside bias, but is well off the best levels of 2021, which may indicate USD positioning is softer than it had been at the beginning of the year.

- Interest has been building in topside USD strikes, most notably at Y111.75 in USD/JPY, at which over $2bln in call options are due to expire at the post-NFP NY cut. This would narrow the gap with key resistance at the 112.23 Feb 20, 2020 high.

FOREX: USD on Front Foot Pre-Payrolls

- The greenback is edging higher early Friday, with EUR/USD and GBP/USD pushing to new weekly lows in an extension of the week's dominant trade. USD strength comes despite 10y yields holding under pressure for much of the past few days, with 10y yield circling the Wednesday lows of 1.4359%.

- The JPY is similarly firm, with EUR/JPY rejecting yesterday's test of the 132.47 50-dma. A failure to break and close above this mark has prompted a near-term pullback, with 131.28 the first downside target.

- AUD, NZD are among the session's poorest performers as markets consolidate ahead of the jobs release. Commodity-tied currencies watch the OPEC+ meeting, which unexpectedly extends into another day after the UAE threatened to withdraw support for any agreement.

- Focus is unsurprisingly on the US jobs report, with markets expecting 720k jobs added, an uptick from May's 559k. Nonetheless, this month's whisper number is a touch higher at 800k.

BOND SUMMARY: Fixed income moves higher ahead of payrolls

Normally in the European morning session ahead of the US employment report, we note that markets have been steady. This has not been the case today with Treasuries moving above yesterday's highs while Bunds are approaching their June 21 high and gilts their June 11 high.

- June nonfarm payrolls (out Friday, 0830ET/1330BST) are seen rising by 720k (BBG median) vs +559k in May, with the range of estimates running from 400k-1050k with standard distribution of 121k. Market reaction is likely to be more pronounced on an upside beat rather than a downside miss. This is because a weaker-than-expected headline figure will probably be seen as a supply-side rather than demand-side issue, and one that's already taken into account by the Fed; on the other hand a figure of say 1mn+ could reignite concerns about an earlier rate hike liftoff.

- We also have US trade, factory orders and the final print of durable goods all due for release later today.

- TY1 futures are up 0-6 today at 132-14+ with 10y UST yields down -0.9bp at 1.450% and 2y yields up 0.3bp at 0.258%.

- Bund futures are up 0.42 today at 172.96 with 10y Bund yields down -2.5bp at -0.227% and Schatz yields down -0.5bp at -0.676%.

- Gilt futures are up 0.22 today at 128.24 with 10y yields down -2.3bp at 0.706% and 2y yields up 0.3bp at 0.065%.

EQUITY LEVELS UPDATE: European stocks edge higher, US largely unch

- Japan's NIKKEI up 76.24 pts or +0.27% at 28783.28 and the TOPIX up 17.1 pts or +0.88% at 1956.31

- China's SHANGHAI closed down 70.021 pts or -1.95% at 3518.76 and the HANG SENG ended 517.53 pts lower or -1.8% at 28310.42

- German Dax up 37.25 pts or +0.24% at 15639.5, FTSE 100 up 13.1 pts or +0.18% at 7136.93, CAC 40 down 3.3 pts or -0.05% at 6549.81 and Euro Stoxx 50 up 4.1 pts or +0.1% at 4082.82.

- Dow Jones mini down 11 pts or -0.03% at 34502, S&P 500 mini up 1.25 pts or +0.03% at 4312, NASDAQ mini up 17 pts or +0.12% at 14566.

COMMODITY LEVELS UPDATE: Copper and platinum gain ahead of payrolls

- WTI Crude down $0.12 or -0.16% at $75.07

- Natural Gas down $0.03 or -0.71% at $3.637

- Gold spot up $6.06 or +0.34% at $1783.4

- Copper up $2.9 or +0.68% at $426.35

- Silver up $0.1 or +0.39% at $26.1313

- Platinum up $6.36 or +0.59% at $1093.49

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.