-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Evergrande Concerns Ripple Into Europe and US

EXECUTIVE SUMMARY:

- CREDIT MARKET FALLOUT FROM EVERGRANDE MOUNTS AS DEADLINES LOOM

- CHINESE PROPERTY DEVELOPER SINIC HALTS TRADING AFTER SINKING 87%

- WAGE WEAKNESS SPURRED RBA QE EXTENSION (MNI INSIGHT)

- CANADIAN ELECTION TODAY, WITH LIBERALS AND CONSERVATIVES NECK-AND-NECK

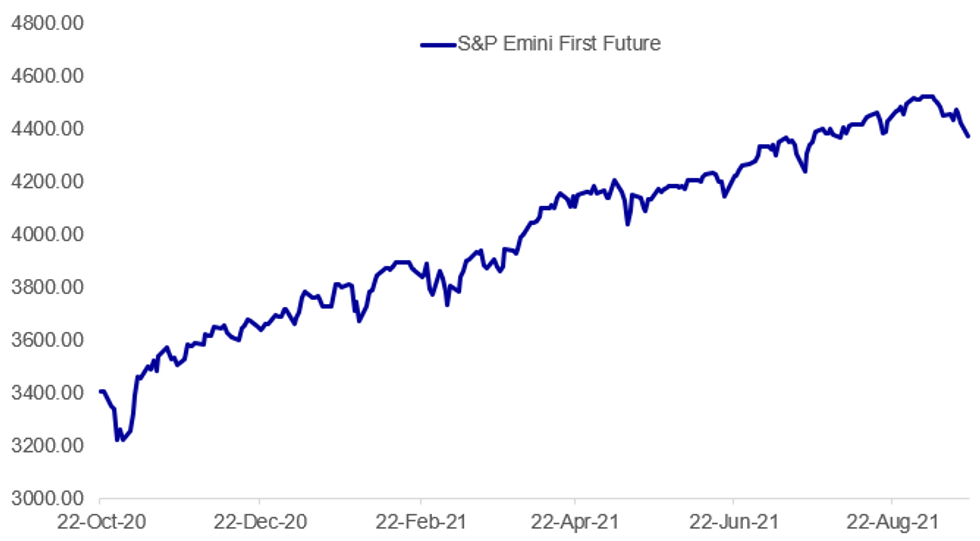

Fig. 1: U.S. Equity Futures Weaken

Source: BBG, MNI

Source: BBG, MNI

NEWS:

CHINA / EVERGRANDE (BBG): Contagion from China Evergrande Group is spreading in Asian credit markets as the distressed developer and largest issuer of junk bonds in the region faces interest payment deadlines.The average price of high-yield dollar notes from Chinese borrowers slid some 2 cents Monday, set for the worst decline in about a year. That dragged down prices in the broader market for Asian junk bonds by 1-2 cents, traders said.Even debt with investment-grade ratings was stung. Yield premiums on notes from Country Garden Holdings Co., China's largest developer by sales, widenedto a record. Those on securities from Ping An Insurance, the country's largest insurer by market value, blew out the most in about 18 months as concerns grew about insurers' real estate exposure.

CHINA / EVERGRANDE (BBG): Growing investor angst about China's real estate crackdown rippled through markets on Monday, adding pressure on Xi Jinping's government to prevent financial contagion from destabilizing the world's second-largest economy. Hong Kong real estate giants including Henderson Land Development Co.suffered the biggest selloff in more than a year as traders speculated China will extend its property clampdown to the financial hub. Intensifying concerns about China Evergrande Group's debt crisis dragged down everything from bank stocks to Ping An Insurance Group Co. and high-yield dollar bonds. One little-known Chinese property developer plunged 87% before shares were halted.

CHINA (BBG): Sinic Holdings Group Co. has halted trading after an 87% slump in its shares Monday afternoon. The Shanghai-based developer didn't give any reason for the trading halt in Hong Kong. The sudden selloff in the last two hours leading up to the suspension was accompanied by a surge in trading volume that was about 14 times its average in the past year, according to Bloomberg-compiled data.

COMMODITIES (BBG): Iron ore extended its slump below $100 a ton as China stepped up restrictions on industrial activity in some provinces. Futures in Singapore tumbled as much as 12% on Monday in thin trading due to a holiday in China. Prices have collapsed about 60% since a record in May, and are below three figures for the first time in more than a year, as Chinese demand wanes.The world's biggest steelmaker is intensifying steel production curbs to meet a target for lower volumes this year as it pushes forward with its vow to be carbon neutral by 2060. More recently, restrictions have focused on improving air quality for the Winter Olympics next year.

RBA (MNI INSIGHT): The Reserve Bank of Australia's surprise decision earlier this month to prolong its bond-buying programme to February from November was particularly motivated by concerns that wage rises were stalling as fresh Covid outbreaks slowed recovery, MNI understands. On MNI Policy MainWire now, for more details please contact sales@marketnews.com

CANADA: Canadians go to the polls today, with the governing Liberal Party of PM Justin Trudeau and the main opposition Conservative Party of Erin O'Toole neck-and-neck in opinion polls.

- Voting begins in the easternmost province of Newfoundland and Labrador at 0830 local time (0700ET, 1200BST, 1300CET), with the final polling stations closing in British Columbia at 1900PST (2200ET, 0300BST, 0400CET).

- In the final set of opinion polls released on Sunday 19 September, the highest polling score for the Liberals was 33% and the party's largest lead over the Conservatives was 6%. The highest Conservative support level was also 33%, with its greatest lead over the Liberals standing at 4%.

- Based on 338canada.com's election simulator, if the EKOS poll (which is the best poll for the Liberals) is an accurate projection of the final vote share then PM Trudeau's party could secure a majority in the House of Commons with 185 seats to the Conservatives' 84.

- If the Forum Poll (the best for the Conservatives) is more accurate, though, then the simulator projects a hung parliament with the Conservatives as the largest party with 163 seats to the Liberals 121.

FRANCE / UK / US (BBG): Emmanuel Macron is making it clear that French fury isn't ebbing after Australia canceled a $66 billion submarine order in favor of a new defense pact with the U.S. and Britain.After the deal was announced on Wednesday, the French president recalled ambassadors to Washington and Canberra and canceled events, a symbolic gesture rare among such close allies. French officials say Macron is looking for an adequate response, and they've been renewing his calls for Europe to boost its own defense capabilities.

BOE (BBG/FT): Gertjan Vlieghe to become Element Capital's chief economist, FT reports, citing the hedge fund. Vlieghe is set to join before year-end and will be based in London.

DATA:

No key data released in the European morning session.

FIXED INCOME: Moving higher as risk-off sentiment bites

There has been a distinctly risk-off feel to markets this morning with Bund futures surpassing Thursday's highs while Treasury and gilt futures are close to Friday's highs. Eurozone peripheral spreads have widened across the board.

- Equities are in the red across the board with the DAX down around 2% and the Hang Seng closing down more than 3% lower. Evergrande seems to be driving the market moves today.

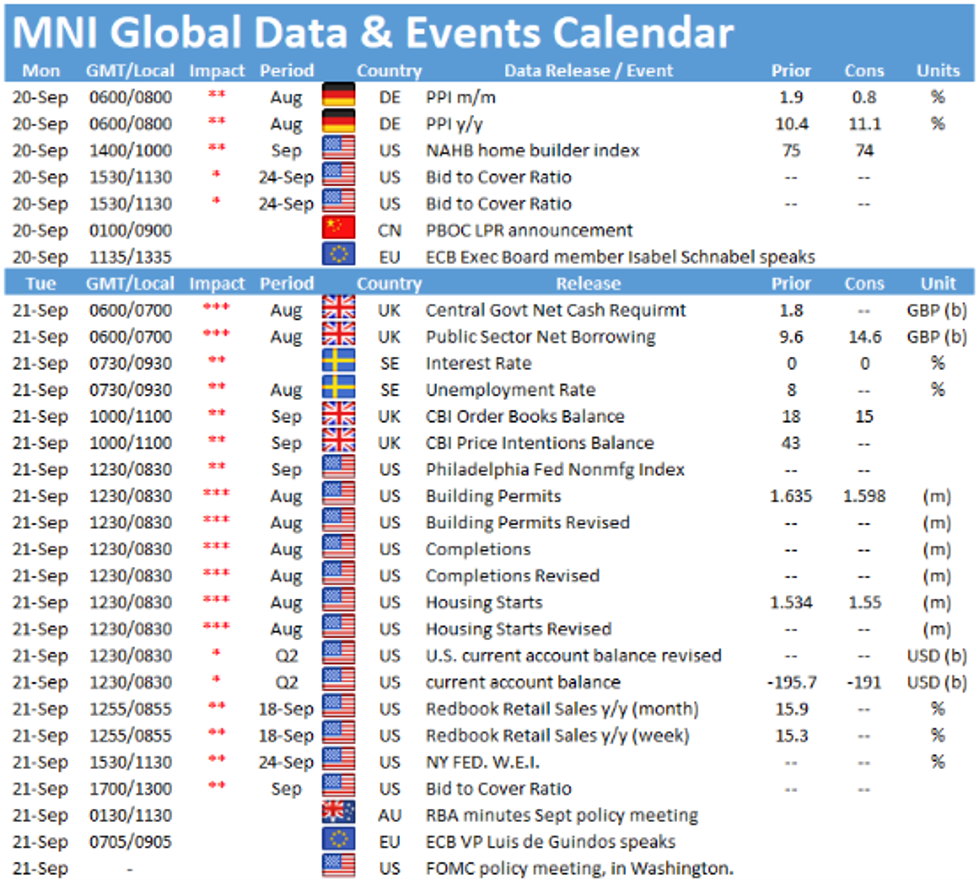

- Today's calendar is fairly light with German PPI having come in higher than expected while the ECB's Schnabel and Villeroy are both due to speak. However, markets are already looking ahead to Wednesday's FOMC meeting where there will be particular focus on the dot plot with the addition of 2024 for the first time.

- TY1 futures are up 0-7 today at 133-00 with 10y UST yields down -2.8bp at 1.336% and 2y yields down -0.2bp at 0.222%.

- Bund futures are up 0.46 today at 171.46 with 10y Bund yields down -2.9bp at -0.310% and Schatz yields down -1.3bp at -0.725%.

- Gilt futures are up 0.36 today at 127.30 with 10y yields down -3.1bp at 0.814% and 2y yields down -1.7bp at 0.270%.

FOREX: China Risk and Fed Fears Work in Favour of Haven FX

- Extending the themes seen at the tail-end of last week, risk-off pervades across asset markets early Monday. Lingering concerns over a possible Evergrande default in China and wobbles ahead of Wednesday's FOMC meeting are sending stocks lower and providing a solid bid for haven currencies.

- While markets were highly aware of the risks surrounding real estate giant Evergrande over the past fortnight or so, these fears compounded early Monday as investors become concerned over the risk of the Chinese authorities clamping down on real estate speculation across Hong Kong. This, twinned with risks of a hawkish surprise from Wednesday's Fed projections leaves the greenback and JPY as comfortably the best performers across G10.

- Weaker equity and commodity markets are working against the growth and oil proxies, keeping NOK, SEK and AUD on the backfoot.

- ECB's Schnabel and Villeroy are due to speak as well as the release of the US NAHB Housing Market Index.

EQUITIES: Asia Weakness Spills Over To Europe / US; Commod / Financials-Led

- Several Asian markets are closed for holiday, but the HANG SENG ended 821.62 pts lower or -3.3% at 24099.14.

- European stocks are down sharply, with the German Dax down 304.61 pts or -1.97% at 15490.17, FTSE 100 down 96.12 pts or -1.38% at 6963.64, CAC 40 down 139.23 pts or -2.12% at 6570.19 and Euro Stoxx 50 down 78.07 pts or -1.89% at 4130.84.

- U.S. futures are under pressure too, with the Dow Jones mini down 464 pts or -1.35% at 34000, S&P 500 mini down 48 pts or -1.09% at 4373.75, NASDAQ mini down 141.5 pts or -0.92% at 15184.5.

COMMODITIES: Industrial Metals Dropping Sharply

- WTI Crude down $1.3 or -1.81% at $71.31

- Natural Gas down $0.09 or -1.8% at $5.025

- Gold spot up $1.67 or +0.1% at $1753.35

- Copper down $9.1 or -2.14% at $416.8

- Silver up $0.1 or +0.44% at $22.4865

- Platinum down $13.66 or -1.45% at $924.12

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.