-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - AUD/JPY Finds Bottom on China News

MNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI US OPEN - IDF Presents Government With Possible Iran Responses

EXECUTIVE SUMMARY:

- IDF PRESENTS GOVERNMENT WITH POSSIBLE RESPONSES TO IRAN STRIKES

- ISRAEL HAS TO AVOID ESCALATION IN IRAN RESPONSE - MACRON

- RETAIL SALES GROWTH SEEN SLOWING IN MARCH

- EUROZONE IP SEES M/M IMPROVEMENT, ALTHOUGH Y/Y REMAINS WEAK

NEWS

ISRAEL (MNI): IDF Presents Gov't With Poss Responses To Iran Strikes Amid Global Focus

Wires reporting that the Israeli army has presented the gov't with a list of possible responses to the Iranian drone/missile strikes on Israeli territory over the weekend. The list comes after a meeting of the Israeli war cabinet on14 April at which reports :https://www.timesofisrael.com/war-cabinet-said-to-... that no decision was made, although the ministers are seen to be leaning closer to retaliation than non-retaliation.

IRAN/ISRAEL (BBG): Iran’s Attack on Israel Sparks Race to Avert a Full-Blown War

The huge salvo of missiles and drones launched from the arid plains of Iran toward Israel was the kind of direct conflict between the Middle East powers that the world had long feared would mark the explosion of a full-blown regional war. But behind the unprecedented nature of the attack was a dance of diplomatic signaling that allowed both sides to claim success, raising the risk of a broader conflict without making it a certainty.

ISRAEL (NYT): After Iran’s Barrage, Israel Questions What Might Be Next for the Gaza War

Within moments of Israel and its allies shooting down a fusillade of Iranian missiles and drones this weekend, many began wondering what the latest exchange between Israel and Iran would mean for the war in the Gaza Strip. Israeli military analysts were divided on whether a more direct confrontation with Iran would alter the war in Gaza, now in its sixth month. The next fulcrum in that war could hinge on whether Israel decides to pursue Hamas in the southern city of Rafah, where more than a million Palestinians have fled amid a spiraling humanitarian crisis.

ECB (BBG): ECB’s Simkus Sees Three Rate Cuts in 2024, Chance of Fourth

European Central Bank Governing Council member Gediminas Simkus said borrowing costs will decline this year, predicting at least three such moves. “I see a higher than 50% chance there will be more than three cuts this year,” Simkus told reporters in Vilnius. “I see a higher than zero chance that an interest rate cut may follow also in July. The July decision will be important in setting the trajectory.”

EU/CHINA (BBG): EU Is Set to Launch China Probe on Medical Device Procurement

The European Union is set to launch an investigation into China’s procurement of medical devices as it seeks to address concerns that Beijing’s policies are unfairly favoring domestic suppliers. The probe may be announced as early as mid-April and could result in the bloc curtailing Chinese access to its tenders, according to people familiar with the matter. It would constitute a first outing for the EU’s so-called International Procurement Instrument, or IPI, a 2022 law that’s meant to promote reciprocity in access to public procurement markets.

ISRAEL/IRAN (BBG): Israel Has to Avoid Escalation in Iran Response, Macron Says

French President Emmanuel Macron urged Israel to respond to Iran’s attack over the weekend in “a calibrated manner” to avoid an escalation in the hostilities. “We’re going to do everything we can to avoid flare-ups, in other words, escalation, and try to convince Israel that we shouldn’t respond by escalating, but rather by isolating Iran,”

BOJ (RTRS): BOJ May Place Less Emphasis on Inflation in Policy Setting

The Bank of Japan is shifting to a more discretionary approach to monetary policy setting, Reuters reports, citing people familiar with the matter.Forecasts for inflation staying at around its 2% target through early 2027 alone won’t indicate a near-term rate hike, Reuters cites three people familiar as saying

SINGAPORE (BBG): Singapore PM Lee to Hand Reins to Wong After Two Decades

Singapore Prime Minister Lee Hsien Loong, 72, will step down May 15 as part of a long-planned succession, ending a two-decade run and ushering in a new era led by his deputy Lawrence Wong. Deputy Prime Minister Wong, 51, who’s also finance minister, will become the city-state’s fourth premier the same day. Wong has the unanimous support of the ruling party lawmakers, according to a statement issued by the Prime Minister’s Office on Monday.

CHINA (MNI): Stimulus Seen Boosting China Manufacturing, Overcapacity

China’s manufacturing investment is set to maintain strong growth throughout the year thanks to policy stimulus, but weak demand means overcapacity will grow as well, depressing corporate profits and adding to the potential for trade friction, advisors and analysts told MNI. Government pledges to support large-scale equipment upgrades and trade-in schemes to boost demand for cars and home appliances should ensure rapid growth in manufacturing investment.

CHINA (MNI): China H2 Commodities Demand To Show Mixed Sector

Chinese demand for steel and copper construction products will fall over the second half despite government support measures, while appetite for those commodities used in manufacturing will grow as industrial output strengthens, local researchers have told MNI. Linda Lin, manager of CRU Shanghai, a commodities research firm, noted demand for long steel products – mainly used in construction – will fall 1.5% y/y, while sheet demand – common for manufacturing – will rise by 2%.

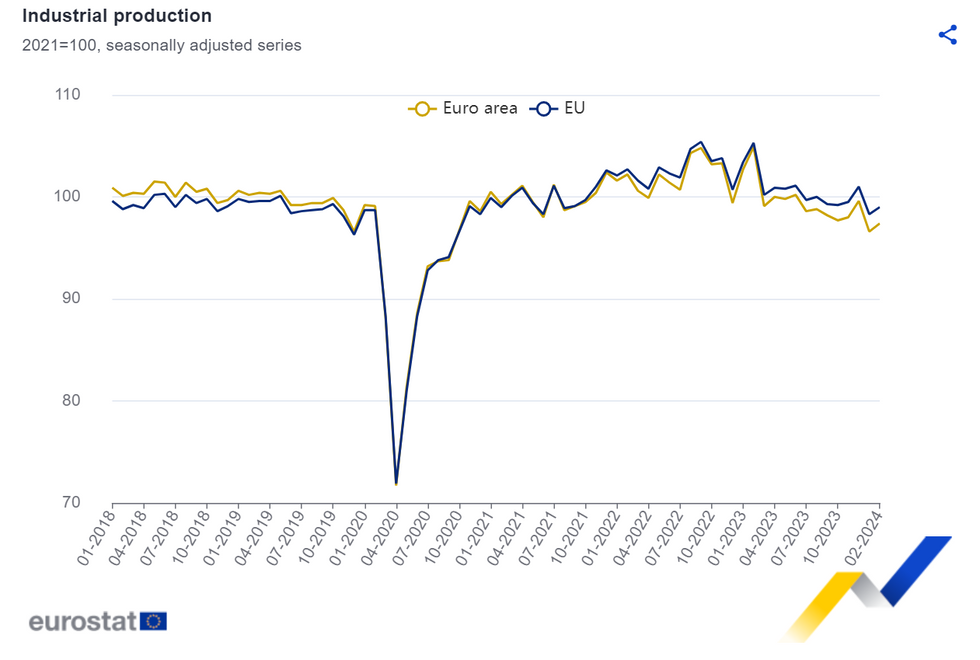

EUROZONE DATA: IP M/M Improvement Broadbased Although Y/Y Remains Weak

Eurozone industrial production rose in-line with expectations in February at 0.8% M/M (vs 0.8% M/M consensus) with the prior revised up slightly to -3.0% M/M prior from -3.2% M/M. The annual reading however, was weaker than expected, at -6.4% Y/Y (vs -5.5% Y/Y consensus, -6.6% Y/Y prior revised from -6.7% Y/Y).

- The February monthly rise is somewhat driven by Ireland, which saw production rise +3.8% M/M after a huge fall of 26.9% M/M in January - once again making it difficult to read a signal from the aggregate figures.

- Looking at the largest members of the Eurozone, results were mostly positive: With Germany (+1.1% M/M), Spain (+1.3% M/M), France (+0.2% M/M), Italy (+0.1% M/M), and the Netherlands (+0.8% M/M) all seeing production rise M/M. Whilst, Belgium (-2.7% M/M) saw its second consecutive monthly production decline.

- From a sectoral perspective, 3 of 5 sub-components rose. Specifically, the M/M rise was driven by a gain of +1.4% M/M in Durable consumer goods (vs -1.2% M/M prior), followed by a rise of of 1.2% M/M in Capital goods production (vs -15.5% M/M prior), and +0.5% M/M in Intermediate goods - the 2nd gain in Intermediate goods since September.

- Meanwhile, Energy production fell for the first time since September 2023 by 3.0% M/M, and Non-durable consumer goods fell for the 3rd consecutive month by 0.9% M/M.

FOREX: Havens See No Support On Uptick in Geopolitical Risk

- Markets trade solidly despite the uptick in geopolitical tensions over the weekend and the direct Iranian attack on Israeli soil that drew support from US, British and French military assets. Haven currencies have found no support, with USD/JPY instead reverting higher - putting JPY lower against all others in G10.

- USD/JPY traded well from the open, putting the pair at fresh multi-decade highs up at 153.97 - marking another session of gains despite the background threat of intervention from the Japanese authorities.

- GBP trades more favourably on the day, but is holding the bulk of the losses posted into the Friday close. GBP/USD remains below the 200-dma, broken last week at 1.2582, and a softer-than-expected CPI release this week could open last week's lows and first support at 1.2427.

- Similarly, CAD has recovered off last week's lowest levels, keeping the near-term top at last week's 1.3787 the next upside level for USD/CAD. Any further pullback in the pair opens 1.3714 as initial support ahead of 1.3669.

- US retail sales mark the highlight Monday, with consensus looking for retail sales to slow to 0.4% from 0.6% previously. Empire manufacturing is also due, as well as speeches from BoE's Breeden, ECB's Lane & de Cos as well as Fed's Williams.

EGBS: Softer As Geopolitical Risk Premia Ease

Core/semi-core EGBs are softer this morning, as markets assess weekend developments in the Middle East and tentatively assign a reduced risk of further escalation in tensions at this stage.

- Bunds are -47 at 132.24. A bear threat remains present, with Friday’s gains deemed a correction at this stage. The first support is 131.31 (April 11 low) while the key support and bear trigger remains at 131.23 (Feb 29 low).

- Lower than expected February Eurozone IP (-6.4% Y/Y vs -5.5% cons) will have eased some pressure on the space, but we note that Ireland’s -34.9% Y/Y skewed the data to the downside.

- The German and French cash curves have bear steepened this morning, while 10-year periphery spreads to Bunds are generally tighter.

- Tomorrow’s German ZEW survey and Wednesday’s Eurozone March final CPI headline the regional data calendar this week, alongside several ECB speakers.

- ECB’s Simkus noted this morning that he sees a chance of a July cut alongside June.

- We also receive remarks from ECB Chief Economist Lane at 1300BST/1400CET today, with de Cos speaking later this evening.

GILTS: Holding Lower, Geopolitics Dominates

Gilts maintain the bulk of their early Monday losses, with the Israel-Iran situation avoiding the worst-case scenario, at least for now.

- Gilt futures last -58 at 97.35 (97.23-51 range). The initial support cluster lies at the Feb 29/Apr 11 low (96.83/82).

- Cash gilt yields are 2.0-5.5bp higher, with 2s10s steepening more than 5s30s.

- SONIA futures also hold the bulk of today’s early losses, last 0.5-6.5 lower.

- BoE-dated OIS sits off session extremes, showing ~53bp of ’24 cuts vs. closer to 55bp late Friday.

- Local headline flow has not been consequential for markets, offering little new.

- Looking ahead, comments from BoE’s Breeden shouldn’t be a market mover as they are set to focus on the payments system.

- We will also see the BoE sell GBP600mn of gilts from its APF holdings later today (stepped down from the GBP650mn offerings in Q1).

- That leaves tomorrow’s labour market report as the first major scheduled domestic risk event of the week, with focus set to fall on wage dynamics ahead of Wednesday’s CPI release.

EQUITIES: Eurostoxx Dip Finds Support

The trend condition in S&P E-Minis is unchanged and remains bullish. Near-term, the recent move down appears to be a correction and this is allowing an overbought signal to unwind. The contract has recently breached bull channel support. Eurostoxx 50 futures are trading closer to their recent lows. A corrective cycle remains in play and the move down this month is allowing an overbought trend condition to unwind. The break of support around the 20-day EMA suggests potential for a deeper retracement.

- Japan's NIKKEI closed lower by 290.75 pts or -0.74% at 39232.8 and the TOPIX ended 6.44 pts lower or -0.23% at 2753.2.

- Elsewhere, in China the SHANGHAI closed higher by 37.905 pts or +1.26% at 3057.378 and the HANG SENG ended 121.23 pts lower or -0.73% at 16600.46.

- Across Europe, Germany's DAX trades higher by 136.58 pts or +0.76% at 18056.8, FTSE 100 lower by 38.76 pts or -0.48% at 7956.44, CAC 40 up 46.09 pts or +0.58% at 8053.16 and Euro Stoxx 50 up 38.85 pts or +0.78% at 4990.94.

- Dow Jones mini up 154 pts or +0.4% at 38400, S&P 500 mini up 25.25 pts or +0.49% at 5190.75, NASDAQ mini up 93.5 pts or +0.51% at 18273.

COMMODITIES: Bull Theme in WTI Persists, But No Breakout Despite Iran Attacks

The trend condition in Gold remains bullish and the yellow metal traded higher Friday, extending the current impulsive bull phase. The move higher maintains the price sequence of higher highs and higher lows and note that moving average studies are in a bull-mode condition. A bull theme in WTI futures remains intact and the contract is consolidating but trading closer to its recent highs. Recent gains reinforced current bullish conditions and confirmed a resumption of the uptrend.

- WTI Crude down $1.04 or -1.21% at $84.59

- Natural Gas down $0 or -0.23% at $1.766

- Gold spot up $5.99 or +0.26% at $2350.84

- Copper up $4.9 or +1.15% at $430.7

- Silver up $0.43 or +1.53% at $28.3102

- Platinum down $6.75 or -0.69% at $970.12

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/04/2024 | 1115/1215 |  | UK | BoEs Breeden on Payments Innovation | |

| 15/04/2024 | 1200/1400 |  | EU | ECB's Lane Lecture at University College Dublin | |

| 15/04/2024 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/04/2024 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 15/04/2024 | 1230/0830 | *** |  | US | Retail Sales |

| 15/04/2024 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/04/2024 | 1400/1000 | * |  | US | Business Inventories |

| 15/04/2024 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 15/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 15/04/2024 | 0000/2000 |  | US | San Francisco Fed's Mary Daly | |

| 16/04/2024 | 0200/1000 | *** |  | CN | GDP |

| 16/04/2024 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 16/04/2024 | 0200/1000 | *** |  | CN | Retail Sales |

| 16/04/2024 | 0200/1000 | *** |  | CN | Industrial Output |

| 16/04/2024 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate M/M |

| 16/04/2024 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 16/04/2024 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/04/2024 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/04/2024 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/04/2024 | 0900/1100 | * |  | EU | Trade Balance |

| 16/04/2024 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 16/04/2024 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 16/04/2024 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/04/2024 | 1230/0830 | *** |  | CA | CPI |

| 16/04/2024 | 1230/0830 | *** |  | US | Housing Starts |

| 16/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/04/2024 | 1300/0900 |  | US | Fed Vice Chair Philip Jefferson | |

| 16/04/2024 | 1315/0915 | *** |  | US | Industrial Production |

| 16/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 16/04/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 16/04/2024 | 1630/1230 |  | US | New York Fed President John Williams | |

| 16/04/2024 | 1700/1800 |  | UK | BoE's Bailey Interview On IMF Today | |

| 16/04/2024 | 1700/1300 |  | US | Richmond Fed's Tom Barkin | |

| 16/04/2024 | 1715/1315 |  | US | Fed Chair Jerome Powell | |

| 16/04/2024 | 2000/1600 |  | CA | Canada federal budget | |

| 17/04/2024 | 2245/1045 | *** |  | NZ | CPI inflation quarterly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.