-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US Open: Italy Election Talk Hits Risk Appetite

EXECUTIVE SUMMARY:

- ITALY PM CONTE COULD SEEK EARLY ELECTIONS

- BIDEN TO SIGN EXECUTIVE ORDERS TO BOOST PANDEMIC AID, EXPAND FEDERAL WORKER PROTECTIONS

- EUROZONE JANUARY PMIS MIXED; GERMANY IN LINE WHILE FRANCE MISSES

- U.K. SERVICES PMI COMES IN WEAK

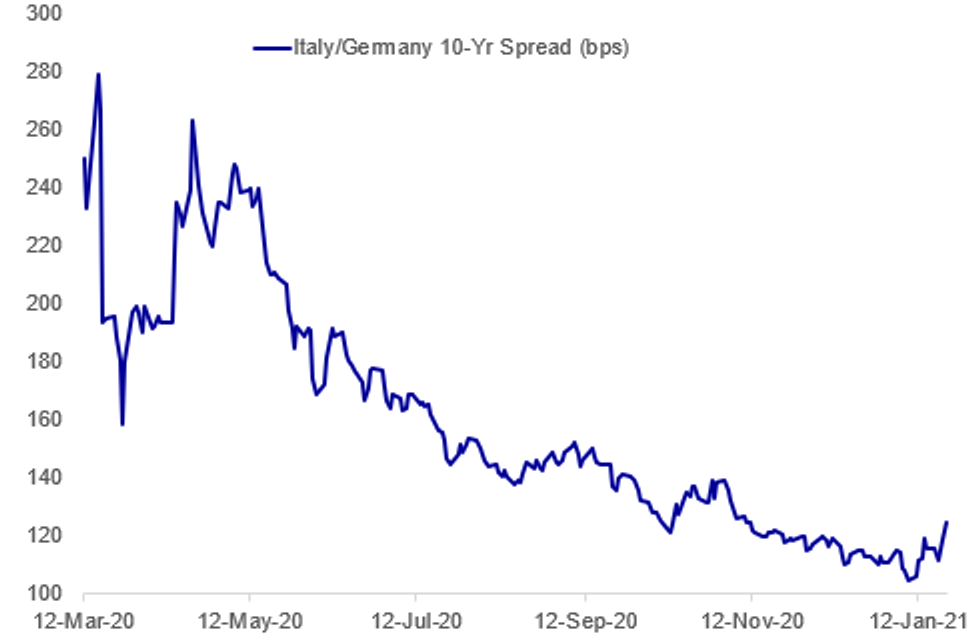

Fig.1: Nascent Return Of Italian Political Risk

BBG, MNI

BBG, MNI

NEWS:

ITALY (MNI POLITICS): Rumours swirling this morning about the prospect of an early election in Italy due to a story from Corriere Della Sera indicating that Prime Minsiter Giuseppe Conte could seek an early election following his gov'ts inability to secure an absolute majority in Tuesday's confidence vote in the Senate.

- Conte has been given two weeks by President Sergio Mattarella to put together a majority gov't.

- The broad expectation is that if a majority gov't cannot be secured the president will seek to put in place a technocratic gov't to govern until the worst effects of the pandemic have passed.

- However, Corriere reporting that based on some hypothetical opinion polling, with Conte as PM candidate for the 5-Star Movement, Conte may be more inclined to seek early elections. Polls say M5S could garner around 20% with Conte as PM candidate compared to 14-16% support gained at present.

- Still remains unlikely that the left could form a majority gov't after the election, with the right-wing bloc in a much stronger position to put together a gov't with Matteo Salvini's League, the Brothers of Italy, and Forza Italia set to be in place to form a majority.

- The junior coalition partner, the centre-left Democratic Party, does not seem inclined towards elections, while the president is also looking for Conte to form a majority gov't with support from minor parties or defecting senators.

U.S. (WSJ): President Biden will sign a pair of executive orders Friday to strengthen the federal safety net, boost economic relief and enhance worker protections, as the U.S. continues to recover from the pandemic-induced recession. Mr. Biden will ask agencies across the government to take immediate steps to enhance federal benefits, such as expanding food assistance, improving distribution of stimulus checks and clarifying that workers may refuse jobs with unsafe working conditions and still qualify for unemployment benefits, administration officials said Thursday. He also intends to issue a second order that would restore collective bargaining power for federal workers, revoke an order from former President Donald Trump that exempted some federal positions from competitive hiring procedures and civil-service protections, and direct agencies to start planning for a $15 minimum wage for federal workers and contractors.

EUROZONE DATA (IHS MARKIT): The headline flash IHS Markit Eurozone Composite PMI fell from 49.1 in December to 47.5 in January, indicating a third successive monthly decline IN business activity and the steepest deterioration since November. However, the last three months have seen the PMI remain higher than during the initial months of the pandemic in the spring of last year, suggesting that the economic impact of the second wave of virus infections has so far been considerably less severe than in the first wave.

GERMANY DATA: German PMI data in line for manufacturing and a bit better for services.

FRANCE DATA: Both the French manufacturing and services PMIs missed expectations by about 2 points. The following are the highlights from the press release: "At the sector level, the decline in output was broad based." "Albeit softer than in December, the degree of optimism was the second strongest since before the escalation of the pandemic last March. Both sectors were confident of a rise in activity over the coming year."

UK DATA: Decent miss for the services and composite PMI data - there's been a harder hit from the lockdown than consensus had expected. However, on services, the press release notes: Hopes of a rebound in the second half of 2021 were signalled by a further rise in the business expectations index during January. The degree of positive sentiment reached its highest since April 2014. GBP offered on the back of weak PMI numbers.

ECB: Inflation expectations from professional forecasters are unchanged in Q1 from three months ago, the European Central Bank's Survey of Professional Forecasters shows, with harmonised prices seen missing the ECB's 'close to but below 2%' target at all points on the horizon. The median forecast sees prices rising 0.9% in 2021, 1.3% in 2022 and 1.5% in 2023. The longer-term forecast is unchanged at 1.7%.

CHINA: Chinese banks have written-off CNY3.05 in non-performing loans in 2020, up from CNY2.3 trillion in 2019, according to a Vice Chairman of China Banking and Insurance Regulatory Commission, Liang Tao. The overall non-performing loan ratio was 1.92%, down 6 bps from the beginning of 2020, Liang added.

DATA:

EZ FLASH JAN MFG PMI 54.7; DEC 55.2

GERMANY FLASH JAN MFG PMI 57.0; DEC 58.3

FRANCE FLASH JAN MFG PMI 51.5; DEC 51.1

FIXED INCOME: Italian politics (again) the driver

Italian politics have again been the biggest driver of fixed income markets this morning, widening peripheral spreads and leading to an underlying safe haven bid for core bonds globally, but particularly Bunds.

- Corriere Della Sera reportied this morning that PM Conte could seek an early election after the government failed to secure an outright majority in the Senate confidence vote earlier this week. The report goes on to say that rather than a technocratic government until the worst of the pandemic is over, Conte wants to capitalise on positive polling indications. The uncertainty has led to BTPs selling off with futures at their lowest levels since mid-November.

- Elsewhere we have also seen flash PMI data this morning. The UK data was the most noteworthy seeing services in particular hit more than consensus expected by the lockdown. This has led to pressure on the pound but gilts only moved modestly higher.

- Looking ahead, its a pretty light calendar this afternoon with existing home sales and the US flash PMI as the highlights.

- TY1 futures are up 0-1+ today at 136-30 with 10y UST yields down -0.7bp at 1.100% and 2y yields up 0.1bp at 0.124%.

- Bund futures are up 0.22 today at 177.02 with 10y Bund yields down -0.7bp at -0.504% and Schatz yields down -0.8bp at -0.711%.

- Gilt futures are up 0.11 today at 134.08 with 10y yields down -1.0bp at 0.319% and 2y yields down -0.8bp at -0.121%.

FOREX: EUR Firm as Jan PMIs Hold Up Well

Following an uneventful conclusion to the ECB rate decision yesterday, the EUR has made further progress this morning - rallying to touch 1.2190 against the USD as prelim January PMI data held up well for Germany and France. This helped nudge the Eurozone-wide manufacturing PMI further into positive territory and helped services beat expectations (albeit still below the 50 mark). EUR is the strongest currency in G10 so far, with EUR/USD narrowing the gap with 1.22.

GBP is softer following a raft of disappointing releases. The always volatile retail sales series missed forecast, with December sales growing only 0.4% on the month despite the proximity to Christmas. November was also revised sharply lower. PMIs followed suit, with both manufacturing and services metrics missing expectations. GBP/USD trades well below 1.37 again, but the week's lows of 1.3520 are still well away.

EUR is the strongest, alongside the USD and CHF this morning, while AUD, NOK and GBP perform poorly.

Focus turns to Canadian retail sales for November, prelim US PMI data and the existing home sales release for December. There are no central bank speakers of note.

EQUITIES: Risk-Off On Italy Pol Risk, Mixed Europe PMIs

- Asian stocks closed weaker, with Japan's NIKKEI down 125.41 pts or -0.44% at 28631.45 and the TOPIX down 4 pts or -0.22% at 1856.64. China's SHANGHAI closed down 14.514 pts or -0.4% at 3606.75 and the HANG SENG ended 479.91 pts lower or -1.6% at 29447.85.

- European stocks are lower, with the German Dax down 117.34 pts or -0.84% at 13780.68, FTSE 100 down 38.59 pts or -0.57% at 6680.54, CAC 40 down 63.53 pts or -1.14% at 5536 and Euro Stoxx 50 down 35.92 pts or -0.99% at 3584.94.

- U.S. futures are lower too, with the Dow Jones mini down 232 pts or -0.75% at 30850, S&P 500 mini down 25 pts or -0.65% at 3821, NASDAQ mini down 68 pts or -0.51% at 13327.5.

COMMODITIES: Weaker Across The Board

- WTI Crude down $1.04 or -1.96% at $52.32

- Natural Gas down $0.06 or -2.53% at $2.428

- Gold spot down $11.63 or -0.62% at $1861.54

- Copper down $6.9 or -1.89% at $359.95

- Silver down $0.52 or -1.99% at $25.5154

- Platinum down $28.07 or -2.48% at $1111.18

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.