-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Lockdowns Loom, But Will The ECB Act?

EXECUTIVE SUMMARY:

- MNI ECB PREVIEW: AHEAD OF EVENTS, OR AT THEIR MERCY?

- GERMANY'S MERKEL MOVES TO SHUTTER BARS AND RESTAURANTS FOR ONE MONTH

- FRANCE "HEADED FOR NATIONAL LOCKDOWN" AS EMMANUEL MACRON ADDRESSES NATION TONIGHT

- MNI CHINA LIQUIDITY INDEX: CONDITIONS BALANCED, POLICY NORMAL

- RATES FIRST BUT NOT ONLY WEAPON FOR R.B.A. - HARPER

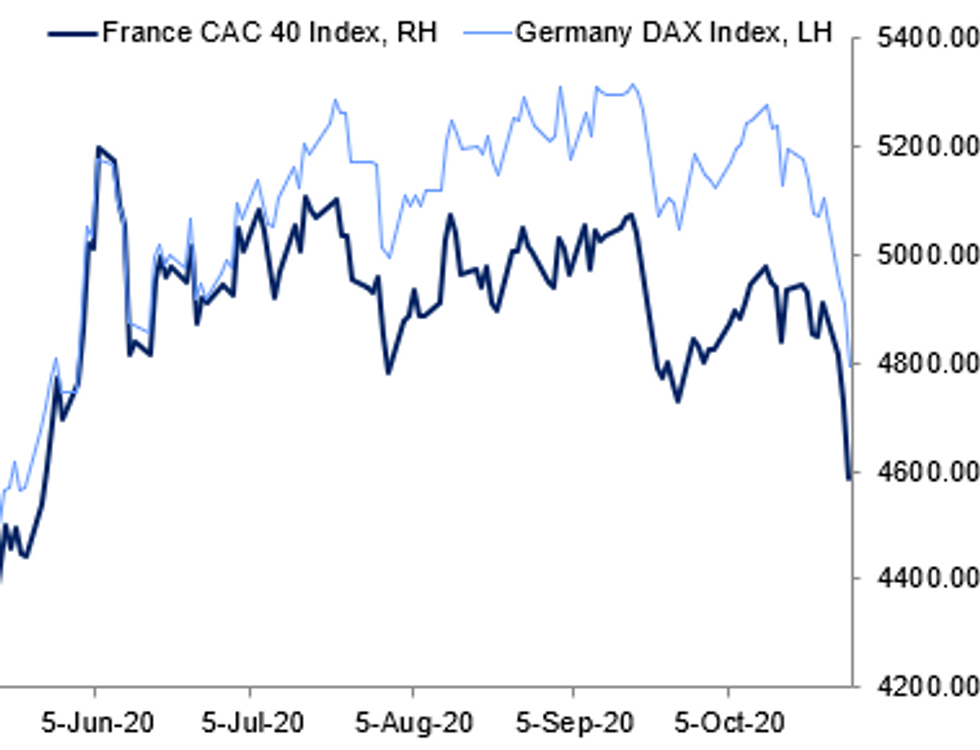

Fig.1: European Equities Hit By Lockdown Talk

NEWS:

ECB - MNI PREVIEW: The ECB must decide whether to wait until the December meeting to get over the hump of upcoming event risks and ascertain the impact of the recent tightening of social restrictions, or act now to ward off intensifying headwinds to the fragile recovery.

- On balance, the ECB is likely to hold fire for now and instead pave the way for further easing in December when there will be more clarity on economic conditions and risk outcomes. The considerable amount of capacity left in the expanded PEPP envelope further strengthens this baseline scenario.

- Nonetheless, the risk of further policy easing in October is non-negligible.

- The coronavirus crisis is moving faster than policymakers are able to divine the associated economic impacts, elevated uncertainty risks becoming self-fulfilling and the inflation path is under grave threat. Please see the MNI website( CLICK HERE)and email for the full PDF publication.

GERMANY (BBG): German Chancellor Angela Merkel is pushing for tougher restrictions on movement and contact, including closing bars, restaurants and leisure facilities until the end of November. In talks with regional premiers later on Wednesday on Germany's coronavirus response, Merkel will also urge citizens to keep private contacts to an absolute minimum, and to avoid all non-urgent private travel, according to a draft federal government briefing paper obtained by Bloomberg.

FRANCE (EVENING STANDARD): French President Emmanuel Macron could set out plans for a new nationwide lockdown later today after a huge spike in Covid-19 deaths. Mr Macron is due to make a televised address at 8pm when it is widely reported that a new month-long national lockdown could be imposed. Other possibilities include a host of local measures, a weekend lockdown and tighter curfews from 7pm extended. Two-thirds of the French population are currently under a nighttime curfew but the PM is reported to have told union bosses these were not enough to control the surge in infections, which on Sunday hit a record of over 52,000 cases.

MNI CHINA LIQUIDITY INDEX: Liquidity was little changed across China's interbank markets in October although they were tighter at the medium-and-longer end of the curve, the latest MNI Liquidity Conditions Index shows. The Liquidity Condition Index picked up to 78.1 in October from September's 75.0, with 62.5% respondents reporting tighter condition on the back of increased bond issuance and tax payments. For full analysis contact sales@marketnews.com

FRANCE DATA: Consumer Sentiment eased by 1pt in Oct following Sep's small uptick to 95 and coming in slightly better than markets expected.- The index remains below the long-term average and the pre-crisis level.

- Household's assessment of the general economic situation in the next 12 monthfell sharply by 7pt amid the resurgence of Covid-19 cases.

- Consumer's opinion regarding their financial situation in the next yeardropped 2pt.* The fear of unemployment edged higher again and remains elevated since thebeginning of the crisis.

- While household's savings intentions in the next 12 months eased slightly,the indicator remains at generally high levels.

- The intentions to make major purchases remained unchanged in Oct andregistered in deep negative territory since the beginning of the pandemic.

RBA: Interest rates remain the first weapon of choice for the Reserve Bank of Australia, despite limited space for further cuts, but it could still ease via further balance sheet expansion, board member Ian Harper told MNI Wednesday. "The notion that monetary policy is exhausted when the cash rate has reached or is close to reaching the effective lower bound is false," Harper said, adding that while the cash rate remains the next item in the central bank's "armoury", it is hardly "the only weapon at its disposal".DATA:

MNI: MNI CHINA LIQUIDITY SURVEY: LIQUIDITY SEEN......>

MNI: MNI CHINA LIQUIDITY SURVEY: LIQUIDITY SEEN LOOSER IN SEP

SEP CHINA LIQUIDITY CONDITIONS INDEX 42.9% VS 65.4% IN AUG

CLS: SEPT CURRENT PBOC POLICY BIAS INDEX 67.9% VS 34.6% AUG

CLS: SEPT CURR ECON 64.3% RESPONDENTS SEE CONDITIONS WORSEN

CLS: CURRENT PBOC GUIDANCE CLARITY STILL CLEAR IN SEPT

FIXED INCOME: Core fixed income marches higher as equities continue to selloff

After a strong start to the European session, core fixed income has continued to grind higher as Covid-19 concerns continue to dominate market focus today. Equity index futures have also continued their declines, particularly in Europe with the DAX leading the was, over 3% lower but other major European indices falling at least 2%.

- Peripheral spreads have continued to widen through the morning. This has led to peripheral bonds at first selling off before recovering some of their gains as they have tracked Bunds higher over the past hour or so.

- As we noted earlier, Chancellor Merkel has been reported as wanting a meeting of the leaders of the federal states today to discuss measures including shutting all bars and restaurants. While President Macron is expected to announce new restrictions at 19:00GMT/20:00CET after a two day meeting of his Covid-19 taskforce in which he is expected to discuss an extended curfew.

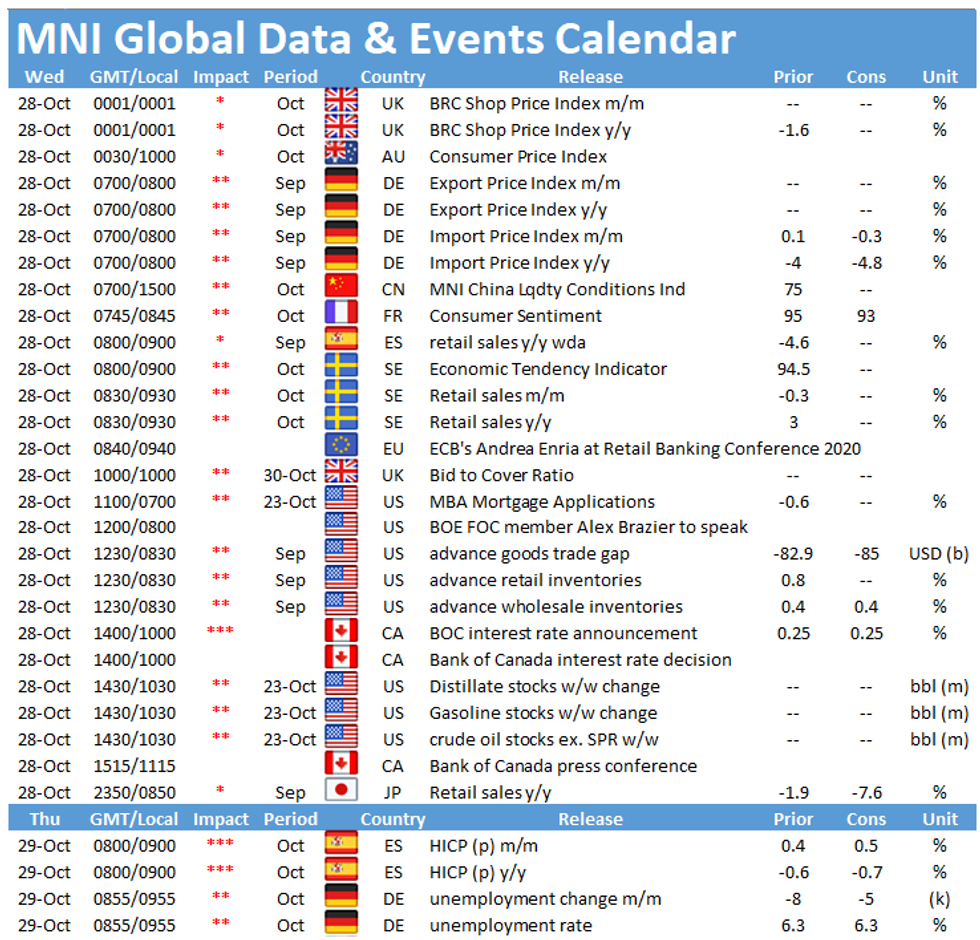

- The calendar is pretty light today with the exception of the Bank of Canada rate announcement.

- TY1 futures are up 0-5+ today at 139-00+ with 10y UST yields down -1.6bp at 0.753% and 2y yields down -0.5bp at 0.143%.

- Bund futures are up 0.39 today at 176.33 with 10y Bund yields down -2.5bp at -0.641% and Schatz yields down -1.4bp at -0.794%.

- Gilt futures are up 0.31 today at 136.25 with 10y yields down -2.2bp at 0.208% and 2y yields down -1.2bp at -0.67%.

FOREX: USD, JPY Gain as Equities Tumble on Lockdown Fears

Risk-off has been the theme of Wednesday so far, with looming risks of stricter lockdown measures across France and Germany weighing on sentiment across equities, currencies and, increasingly, commodities.

- Equities in continental Europe are lower by 1.6-3.2%, dragging US futures lower in tandem, which has helped support the greenback and JPY headed into the NY crossover.

- EUR/USD is under pressure, extending the recent sell-off from 1.1881, the Oct21 high and turning focus to the key near-term trendline support drawn from Sep28 low that today intersects at 1.1740. This level will likely stay in focus headed into tomorrow's ECB rate decision.

- A further decline in WTI and Brent crude oil prices is weighing on commodity-tied currencies, with NOK falling against all others in G10.

- Earnings season continues after Microsoft's poorly received report yesterday (their shares settled lower by 1.7%). Boeing, General Electric, UPS, Visa & Mastercard due ahead of today's open.

EQUITIES: Lower On Lockdown

The rising threat of renewed and prolonged lockdowns in Europe have hit equities hard in early Wednesday trading.

- Asian stocks closed mixed, with Japan's NIKKEI down 67.29 pts or -0.29% at 23418.51 and the TOPIX down 4.98 pts or -0.31% at 1612.55. China's SHANGHAI closed up 14.922 pts or +0.46% at 3269.238 and the HANG SENG ended 78.39 pts lower or -0.32% at 24708.8.

- European equities are sharply lower, with the German Dax down 329.04 pts or -2.73% at 11683.39, FTSE 100 down 118.17 pts or -2.06% at 5623.35, CAC 40 down 145.37 pts or -3.07% at 4598.37 and Euro Stoxx 50 down 74.03 pts or -2.41% at 2980.85.

- U.S. futures are lower too, with the Dow Jones mini down 415 pts or -1.52% at 26951, S&P 500 mini down 40.5 pts or -1.2% at 3342.5, NASDAQ mini down 108 pts or -0.93% at 11478.75.

COMMODITIES: Oil Drops Sharply

Oil is down sharply alongside broader risk aversion, and inventory concerns.

- WTI Crude down $1.45 or -3.66% at $38.21

- Natural Gas down $0 or -0.1% at $3.019

- Gold spot down $4.92 or -0.26% at $1902.66

- Copper down $0.4 or -0.13% at $308.65

- Silver down $0.02 or -0.1% at $24.274

- Platinum up $0.1 or +0.01% at $880.8

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.