-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Macro Weekly: Politics To The Fore

MNI Credit Weekly: Le Vendredi Noir

MNI US Open: Pound Gains Ground On Euro

EXECUTIVE SUMMARY:

- ITALIAN PRIME MINISTER DRAGHI TO FACE LAST VOTE OF CONFIDENCE TODAY

- VIRUS SPREAD IN ENGLAND FALLS SHARPLY AHEAD OF PM JOHNSON REVIEW

- ROBINHOOD, CITADEL FIGHT CONSPIRACIES AHEAD OF GAMESTOP GRILLING TODAY

- BIG FREEZE IN TEXAS IS BECOMING A GLOBAL OIL MARKET CRISIS (BBG)

- HUAWEI TO MORE THAN HALVE SMARTPHONE OUTPUT IN 2021

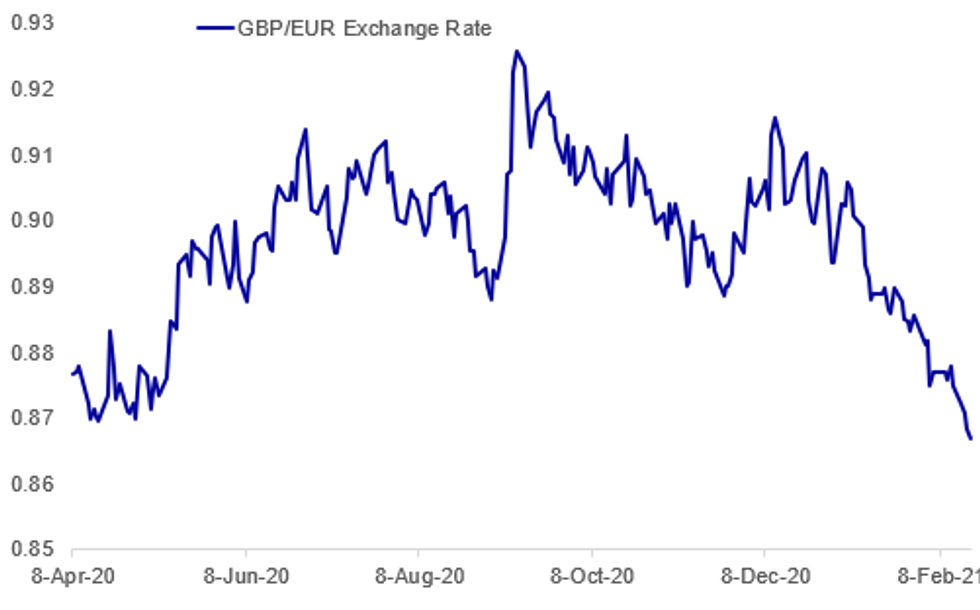

Fig.1: One Way Traffic In Sterling's Favor Since Mid-December

BBG, MNI

BBG, MNI

NEWS:

ITALY (DPA): Italian Prime Minister Mario Draghi will face a vote on confidence in the lower house of parliament on Thursday, the last hurdle for the country's new government inaugurated on Saturday. Draghi has already won a clear majority in the Senate - late Wednesday night, 262 of the chamber's 304 voting members voted in favour of the government, while 40 voted against. Thursday's session is scheduled to start in the larger of the two parliamentary chambers at 9 am (0800 GMT), according to a statement. The vote of confidence for Draghi and his cabinet is to take place in the evening after several hours of debate. Observers expect that the former European Central Bank (ECB) chief will garner a solid majority.

UK (BBG): Coronavirus infections in England have fallen "significantly" in recent weeks, a boost to U.K. Prime Minister Boris Johnson as he weighs how quickly to re-open Britain's economy. National prevalence of the virus was down by two-thirds in the first half of February compared to January, according to a survey by Imperial College London and Ipsos Mori, one of the country's largest coronavirus studies. The number of infected people fell to 51 per 10,000 at the time of the latest survey in February, down from 157 per 10,000 in January.

US (BBG): Robinhood Markets and Citadel, central players in the GameStop Corp. saga that riveted markets last month, plan to deliver a unified message to U.S. lawmakers Thursday: conspiracies swirling in Washington that they worked together to harm retail investors are categorically false. Robinhood Chief Executive Officer Vlad Tenev, whose firm has faced a barrage of questions into whether hedge funds such as Citadel ordered it to prevent customers from adding to their GameStop bets, called such claims "market-distorting rhetoric." Robinhood halted trades due to demands from its clearinghouse that it post more capital to deal with increased risk, he said in written testimony for a hearing before the House Financial Services Committee. Ken Griffin, Citadel's billionaire founder, said in his prepared remarks that he learned Robinhood had barred GameStop buy orders after the restrictions were publicly announced.

HUAWEI (NIKKEI): Huawei Technologies has notified its suppliers that its smartphone component orders will fall by more than 60% this year, Nikkei has learned, as U.S. sanctions continue to bite. Huawei has notified suppliers that it plans to order enough components for 70 million to 80 million smartphones this year, according to people at multiple suppliers. The range represents more than a 60% decline from the 189 million smartphones Huawei shipped last year. The company's component orders have been limited to those for 4G models as it lacks U.S. government permission to import components for 5G models.

ENERGY (BBG): What began as a power issue for a handful of U.S. states is rippling into a shock for the world's oil market.More than 4 million barrels a day of output -- almost 40% of the nation's crude production -- is now offline, according to traders and executives. One of the world's biggest oil refining centers has seen output drastically cut back. The waterways that help U.S. oil flow to the rest of the world have been disrupted for much of the week. Brent crude surged above $65 a barrel on Thursday, a level not seen since last January. Spreads indicating supply tightness also soared.

AIRLINES/COVID (BBG): Air France-KLM is poised to get a fresh government bailout after burning through 2.1 billion euros ($2.5 billion) in the final quarter of last year as a resurgent Covid-19 pandemic delayed any recovery in air travel.Talks are ongoing between the carrier's biggest shareholders, the French and Dutch governments, and the European Commission about a rescue package, according to Chief Financial Officer Frederic Gagey. Air France-KLM reported Thursday it had 9.8 billion euros of liquidity and credit lines at its disposal at the end of 2020 compared with 12.4 billion euros three months earlier.

RUSSIA/COVID (RTRS): Russia plans to register CoviVac, its third COVID-19 vaccine, on Feb. 20, the Interfax news agency reported on Thursday, citing a government website about the coronavirus.

EU: The European Medicines Agency has published its full overview of the authorisation provided for the AstraZeneca/Oxford University Vaccine. A major row erupted in January when an article in the German paper Handelsblatt (incorrectly) claimed that according to a senior gov't source the AZ vaccine was only 8% effective on older age groups. Following this, French President Emmanuel Macron also raised doubts publicly about the efficacy of the vaccine, and several member state health bodies have officially recommended the vaccine is not given to those in older age groups. Today's publication from the EMA confirms its previous view that, "Most of the participants in these studies were between 18 and 55 years old. There were not enough results in older participants (over 55 years old) to provide a figure for how well the vaccine will work in this group. However, protection is expected, given that an immune response is seen in this age group and based on experience with other vaccines; as there is reliable information on safety in this population, EMA's scientific experts considered that the vaccine can be used in older adults."

GERMANY: Debt levels of the German federal states will return to the pre-pandemic levels with 5 to 10 years if the recovery is as expected, a senior researcher at the Ifo Institute said Thursday. Pointing to debt levels as a percentage of regional GDP and not an absolute level, Remo Nitschke said the key consideration will be growth over repayment. "As economic output rises over the coming years, the proportion of debt will fall." he said.

BOJ: Bank of Japan officials believe accumulated debts of firms in the accommodation and hospitality sectors of the Japanese economy will peak around current levels, although they see many still facing tough financing conditions ahead and there remains a risk of a degree of financial instability even as the economy recovers, MNI understands. Officials will continue to monitor the situation ahead of the 6-monthly Financial System Report in mid-April. In the October report, the BOJ judged that businesses had the necessary liquidity to get through the current fiscal year, helped by the BOJ and the government funding measures, and the focus is shifting to how credit costs and stability of financial system will evolve into fiscal 2021.

INDONESIA: Bank Indonesia cut its benchmark rate by 25 basis points and revised growth expectations lower at its monthly meeting held Thursday, in line with the expectations of the MNI State of Play The 25 bps cut in the 7-day reverse repo rate to 3.5% added to the 125 basis points of cuts seen over 2020. The bank last cut rates in November. The deposit facility rate was also cut by 25bps, which is now at 2.75%. as was the lending facility rate, which is now 4.25%. Bank Indonesia also revised its GDP forecast tow between 4.3% and 5.3% for 2021, down from the previous range of 4.8% to 5.8%.

DATA:

No key data in the European morning session.

FIXED INCOME: Retracing the retracement

After strength seen towards the end of yesterday's session and overnight, core fixed income has been steadily moving lower today.

- Bunds and gilts almost moved back to the levels of Tuesday's open but Bunds have retraced around 1/3 of the move higher and gilts around 1/2.

- Equity futures are mixed across Europe but generally lower in the US. Peripheral spreads are generally flat or tighter on the day (with BTP-Bund spreads the biggest movers).

- We have seen a decent amount of supply this morning already with France and Spain selling more than E15bln combined already and with French linkers still to be sold.

- Looking ahead housing data and weekly claims are the highlights of the data calendar. We will receive the Accounts of the January ECB meeting and have speeches from BOE's Saunders, Fed's Brainard and Bostic.

- TY1 futures are up 0-3 today at 135-27 with 10y UST yields up 1.4bp at 1.286% and 2y yields up 0.4bp at 0.110%.

- Bund futures are down -0.17 today at 174.87 with 10y Bund yields up 1.2bp at -0.357% and Schatz yields up 0.5bp at -0.697%.

- Gilt futures are down -0.34 today at 130.97 with 10y yields up 3.3bp at 0.604% and 2y yields up 1.1bp at -0.42%.

FOREX: Greenback Bounce Hits Resistance, GBP Marches On

GBP/USD is staging a decent recovery from the Wednesday lows, with the pair bouncing close to a point since the Asia-Pac close. A generally weak dollar backdrop, twinned with persistent GBP vaccine-driven strength is contributing, with EUR/GBP's break to new multi-month lows a further catalyst.

Equities are a touch softer ahead of the US open, with the e-mini S&P off around 10 points to indicate a lower start at the opening bell today.

AUD initially rose as high as 0.7770 on labour market data was broadly in-line with estimates but the breakdown showed a lower participation rate and less hours worked, but a resumption of greenback weakness has propped the pair into the NY crossover.

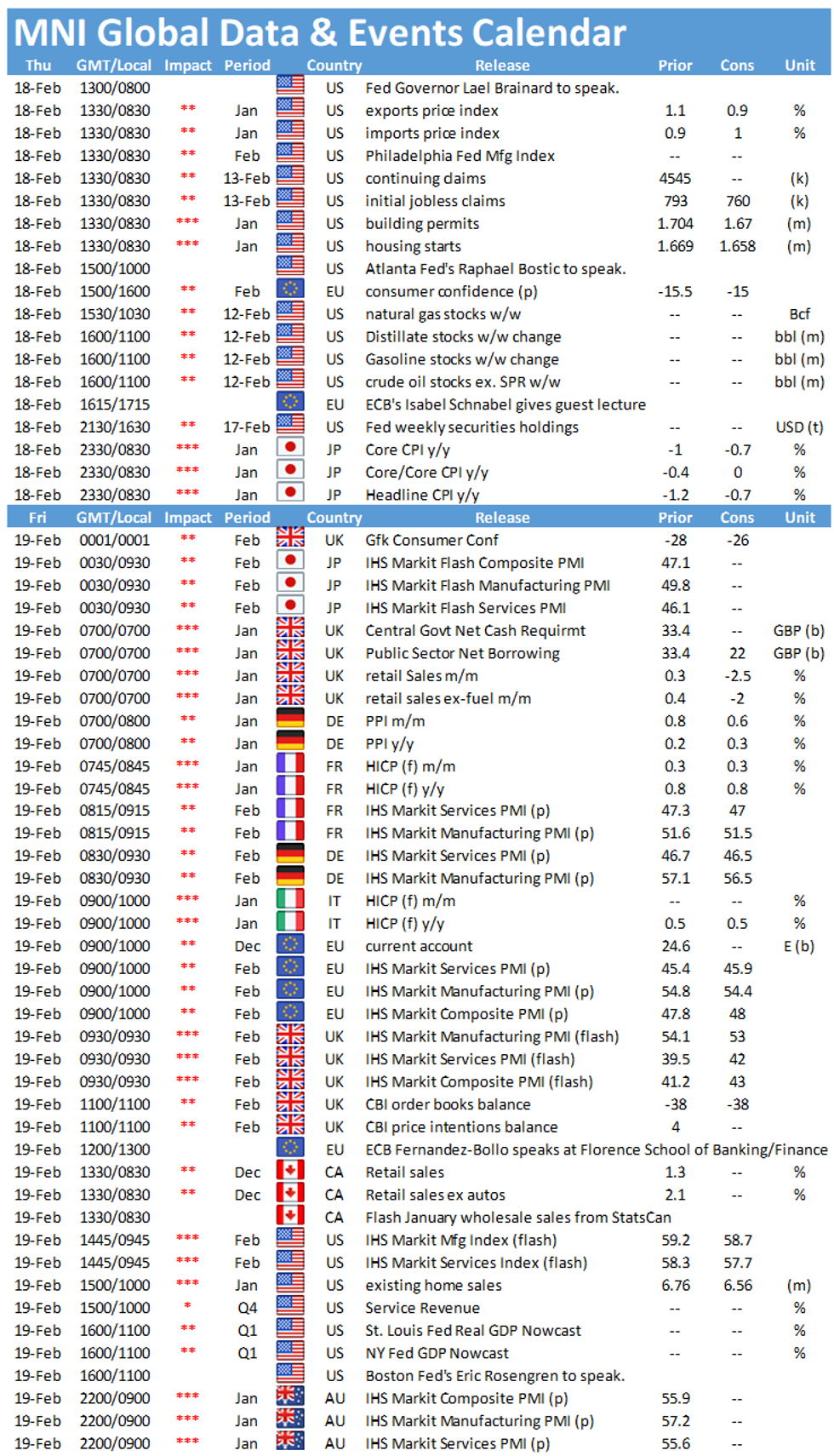

Weekly US jobless claims, housing starts/building permits make up the data schedule Thursday, with Eurozone consumer confidence also due. Central bank speakers include BoE's Saunders, Fed's Brainard & Bostic.

EQUITIES: Modest Early Weakness

- Asian stocks closed mostly lower, with Japan's NIKKEI down 56.1 pts or -0.19% at 30236.09 and the TOPIX down 19.58 pts or -1% at 1941.91. China's SHANGHAI closed up 20.269 pts or +0.55% at 3675.357 and the HANG SENG ended 489.67 pts lower or -1.58% at 30595.27.

- European equities are trading mixed, with the German Dax up 25.7 pts or +0.18% at 13924.13, FTSE 100 down 15.79 pts or -0.24% at 6710, CAC 40 down 9.61 pts or -0.17% at 5769.11 and Euro Stoxx 50 up 1.06 pts or +0.03% at 3702.2.

- U.S. futures are weaker led by sagging tech stocks, with the Dow Jones mini down 33 pts or -0.1% at 31516, S&P 500 mini down 9.25 pts or -0.24% at 3918.75, NASDAQ mini down 67.25 pts or -0.49% at 13632.5.

COMMODITIES: Dollar Weakness Boosts Metals

- WTI Crude up $0.28 or +0.46% at $61.51

- Natural Gas up $0.03 or +0.96% at $3.243

- Gold spot up $11.07 or +0.62% at $1781.74

- Copper up $9.2 or +2.4% at $392.7

- Silver down $0.13 or -0.49% at $27.3221

- Platinum up $13.31 or +1.06% at $1268.49

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.