-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: RBA Sets Dovish Global Tone

EXECUTIVE SUMMARY:

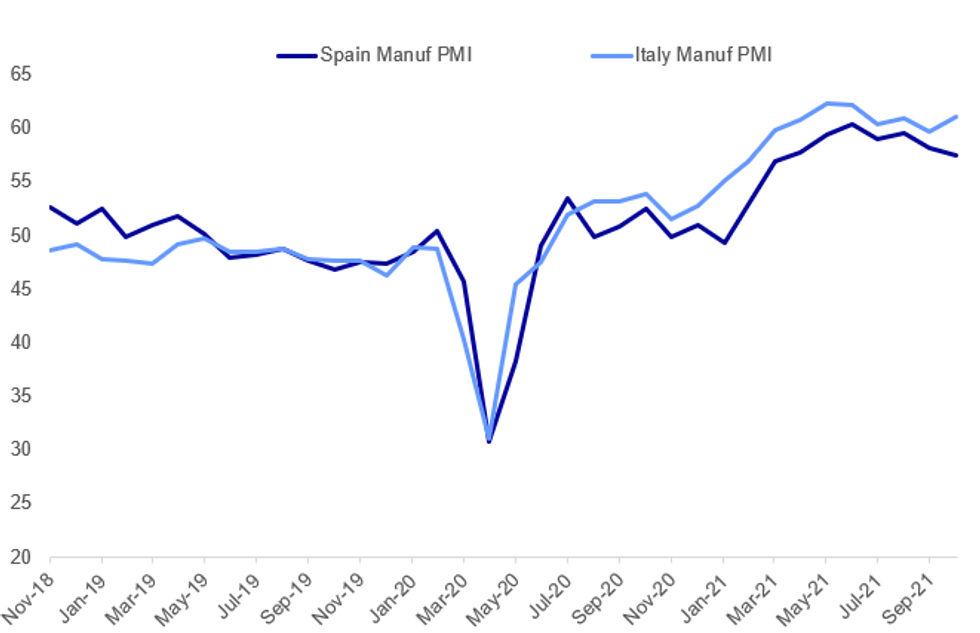

- SPANISH MANUF PMI DISAPPOINTS; ITALY UNEXPECTEDLY GAINS

- AMBIGUITY ON INFLATION CLOUDS RBA RATE VIEW (MNI STATE OF PLAY)

- IRON ORE TUMBLES AS CHINA'S CURBS ON STEEL OUTPUT ROIL MARKET

Fig. 1: Eurozone Manufacturing PMIs Remain Expansionary

Source: MNI, IHS Markit

Source: MNI, IHS Markit

NEWS:

RBA (MNI STATE OF PLAY): The Reserve Bank of Australia has abandoned its yield targeting program for government bonds and has revised its inflation forecasts, but RBA Governor Philip Lowe insists that this does not mean that the central bank will raise interest rates before 2024. After the Tuesday board meeting, at which the bank left interest rates on hold as expected at a record low 0.10%, the RBA's outlook has become ambiguous and will be determined by the progress of inflation to be "sustainably" within the banks' 2% to 3% target range.

COMMODITIES (BBG): Iron ore futures extended losses below $100 a ton on shrinking steel output in China and signs economic growth is facing mounting headwinds.Prices in Singapore slumped for a fifth day as the world's top steelmaker ramped up efforts to cap annual steel volumes. While China has imposed curbs on production throughout 2021, restrictions are now being rolled out more frequently and limits have been extended into the first quarter in an effort to ensure blue skies for the Winter Olympics.

U.S. (BBG): The American nuclear submarine damaged last month in the South China Sea hit an uncharted seamount, USNI News reported, an explanation that would ease concerns that it had collided with a foreign vessel in the contested waterway. An investigation into the Oct. 2 collision involving the USS Connecticut found the submarine had struck a previously unknown submerged feature, the U.S. Naval Institute website reported, citing a legislative source and two defense officials familiar with the findings. The matter has been sent to Vice Admiral Karl Thomas, the Seventh Fleet commander, for review whether further actions are warranted.

HUAWEI (BBG): Huawei Technologies Co. is in advanced talks to sell its x86 server business after the U.S. blacklisting of the company made it difficult to secure processors from Intel Corp., the latest blow to the Chinese technology giant from American sanctions, according to people familiar with the matter.The Shenzhen-based company is selling the server business to a consortium that includes at least one government-backed buyer, the people said, asking not to be identified because the negotiations aren't public. The precise value of the deal couldn't be learned, but it's likely billions of yuan, they said.

PORTUGAL ISSUANCE (BBG): The Portuguese government is continuing to study the issuance of green debt, Jornal de Negocios reports, citing Secretary of State for Finance Joao Nuno Mendes. Mendes didn't provide a specific date and said he would want it to happen during 2022The size of the issuance would have to be in the scale of EU3b to EU4b to provide investors with liquidity and to allow the interest rate to be lower

JAPAN: Bank of Japan Governor Haruhiko Kuroda met on Tuesday with Finance Minister Shunichi Suzuki and Minister in charge of economic revitalization Daishiro Yamagiwa to exchange views on economic and financial conditions as well as prices, the BOJ said. They agreed to continue broadly to communicate mutually and the government and the BOJ will cooperate by implementing individual roles along with a joint statement made in January 2013. Further details aren't available.

DATA:

ITALY DATA: Manufacturing PMI surprises to the upside

- Italy manufacturing PMI surprises slightly to the upside at 61.1 (59.6 exp, 59.7 prev)

- From the Markit press release:

- "Output rises steeply again amid quickest uplift in orders for four months"

- "October data also highlighted a further lengthening of supplier delivery times, with delays among the most severe on record. Supply issues stemmed from material shortages and logistical issues, according to panellists."

- "These constraints continued to feed through to price pressures during October. Average cost burdens rose further, with the rate of inflation the third-quickest on record.

FRANCE DATA: Manufacturing PMI 53.6 (flash was 53.5)

Manufacturing PMI 53.6 (flash was 53.5)

GERMAN DATA: PMI manufacturing revised down to 57.8

Flash was 58.2

EUROZONE DATA: Manufacturing PMI revised a little down to 58.3

Flash was 58.5

FIXED INCOME: Moving on up

- Fixed income has been moving higher this morning with a number of triggers: positioning ahead of the Fed/BoE, a stabilisation in EGB peripheral spreads (particularly BTPs) after spreads broke higher following last week's ECB meeting, the reaction to the RBA and some concern about Covid cases closing some schools in Beijing.

- While bond futures remain near their highs of the days, there have also been decent moves higher in STIR. Euribor Reds/Greens are leading the way higher, up over 10 ticks today. The short sterling strip is up around 8 ticks through the Reds while Eurodollar Reds are up 6-8 ticks.

- TY1 futures are up 0-7+ today at 130-28+ with 10y UST yields down -0.5bp at 1.552% and 2y yields down -2.8bp at 0.473%.

- Bund futures are up 0.70 today at 168.85 with 10y Bund yields down -3.5bp at -0.139% and Schatz yields down -4.1bp at -0.680%.

- Gilt futures are up 0.52 today at 125.17 with 10y yields down -3.7bp at 1.022% and 2y yields down -3.5bp at 0.649%.

FOREX: AUD loses further ground

- The Dollar is mostly better bid during our European morning session.

- The USD trades in the green against all G10, besides the Yen, as US yield fades this morning.

- Overnight story was the Dovish RBA, scrapping its April 2024 0.1% Bond yield target, and putting cold water over aggressive tightening.

- AUD was sold overnight and remains deep in the red against all majors,

- In G10s, JPY is the best performer versus the Aussie, up 1.10%.

- Further downside extension in AUDJPY eye a test at the 22nd October low at 84.609.

- AUDUSD is near immediate support at 0.7454 Low Oct 22.

- A more subdued session for other crosses, EURUSD is better offered , but trades in a more limited range.

- EURUSD sees large option expiry for today, with 1.82bn at 1.1585, which could act as a magnet. for the pair.

- Initial support for EURUSD moves up to 1.1582, and break below the latter sees extensions to 1.1535/24 Low Oct 29 / Low Oct 12 and the bear trigger.

- Last week/Month saw good demand in EURUSD ahead of 1.1500, in the outright spot but also via options with put sellers.

- The last time EURUSD traded below 1.1500 was July 2020.

- .Looking ahead, very little on the data front, speakers include ECB Elderson and de Cos

EQUITIES: Futures Back Near Flat After Asia-Pac Weakness

- Asian equities closed lower, with Japan's NIKKEI down 126.18 pts or -0.43% at 29520.9 and the TOPIX down 13.05 pts or -0.64% at 2031.67. China's SHANGHAI closed down 38.851 pts or -1.1% at 3505.628 and the HANG SENG ended 54.65 pts lower or -0.22% at 25099.67

- European stocks are mixed, with the German Dax up 59.74 pts or +0.38% at 15806.29, FTSE 100 down 33.02 pts or -0.45% at 7288.62, CAC 40 up 4.44 pts or +0.06% at 6893.29 and Euro Stoxx 50 down 2.15 pts or -0.05% at 4280.47.

- U.S. futures are a shade weaker, with the Dow Jones mini down 36 pts or -0.1% at 35764, S&P 500 mini down 5 pts or -0.11% at 4600.75, NASDAQ mini down 31.25 pts or -0.2% at 15863.

COMMODITIES: Global Growth Concerns Weigh On Metals

- WTI Crude up $0.15 or +0.18% at $84.04

- Natural Gas up $0.12 or +2.31% at $5.282

- Gold spot up $1.52 or +0.08% at $1794.6

- Copper down $4.6 or -1.05% at $434.7

- Silver down $0.09 or -0.35% at $24.0168

- Platinum down $10.5 or -0.98% at $1059.02

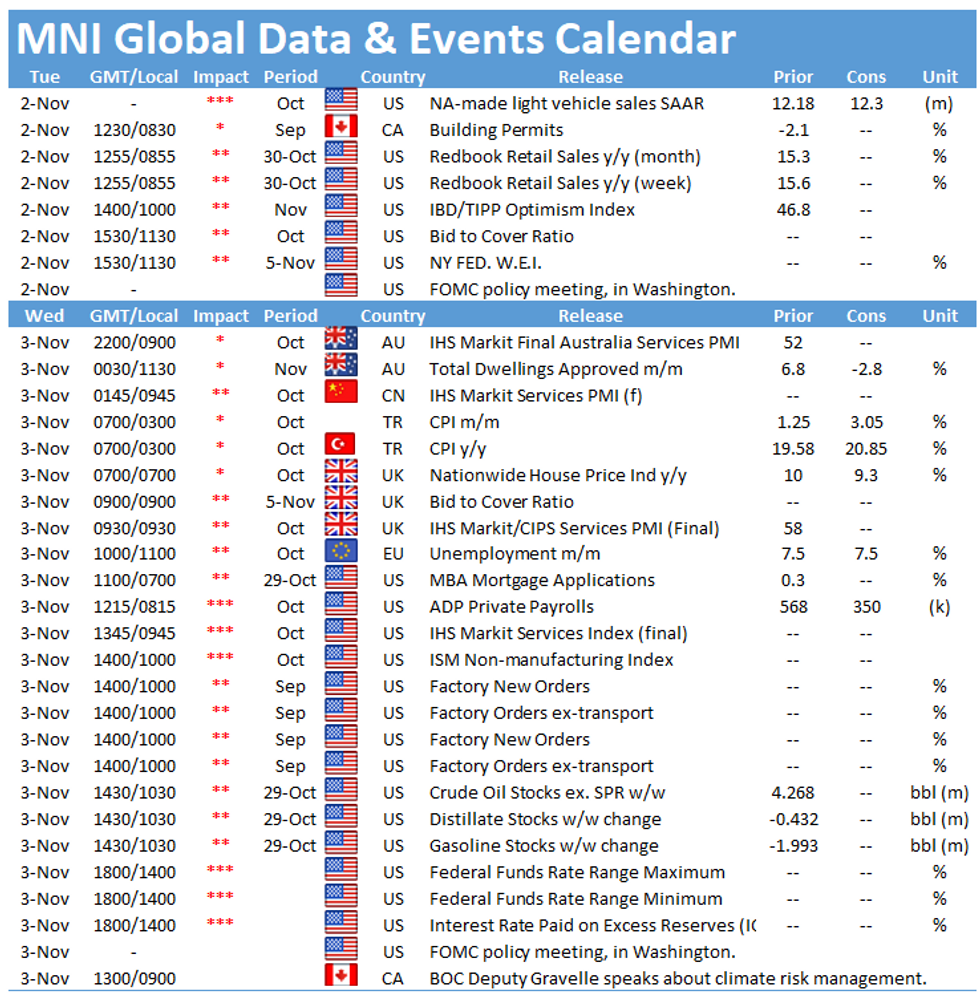

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.