-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Risk Assets Hit On Multiple Fronts

EXECUTIVE SUMMARY

- EUROPEAN COUNCIL SUMMIT GETS UNDERWAY TODAY, WITH BREXIT IN FOCUS

- E.U. LEADERS COULD HOLD EMERGENCY BREXIT SUMMIT IN NOVEMBER

- LONDON TO MOVE TO TIER 2 LOCKDOWN FROM MIDNIGHT FRIDAY: REPORTS

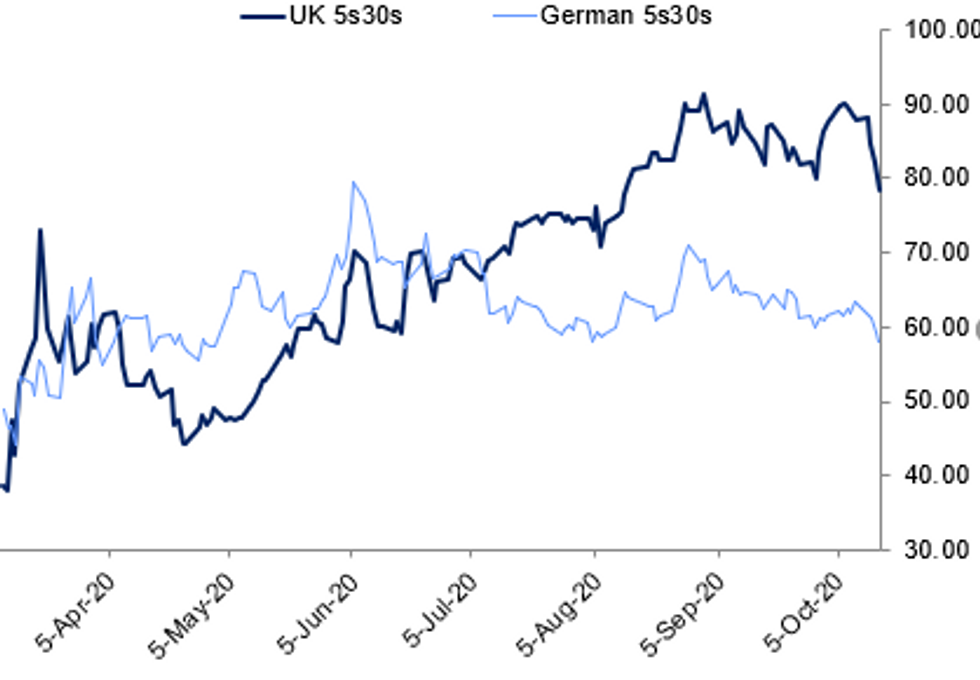

Fig.1: Yield Curves Flatten Amid Risk-Off Move

Bloomberg, MNI

Bloomberg, MNI

NEWS:

UK/EU (MNI): European Council summit gets underway in Brussels today, with all EU-27 member state leaders expected to be in attendance, except for Polish PM Mateusz Morawiecki who is self-isolating after coming into contact with someone carrying the COVID-19 virus.

- Major topic to be discussed is Brexit. The summit was initially intended as a chance for MS leaders to give their approval to a deal agreed between the EU and UK, but this has not yet proved possible. Instead, the EU's chief negotiator Michel Barnier will give an update on talks to MS leaders. The talks on Brexit, initially penciled in for the afternoon of the first day of the summit are believed to have been moved to the evening to be discussed over dinner.

- The update from Barnier comes after a phone call last night between UK PM Boris Johnson, Commission President Ursula von der Leyen, and Council President Charles Michel. During the call both sides are said to have expressed frustration with the lack of progress made.

- The UK's initial deadline for a deal to be reached is today, but this has been extended to tomorrow to allow the UK gov't to see the conclusions made during the EUCO summit. The widespread expectation among observers is that the UK gov't will not stick to this deadline and walk away from talks, but instead will allow talks to continue for the coming several weeks.

- EUCO Timeline: 1330CET (1230BST, 0730ET): Member state leaders begin to arrive at the Europa Building in Brussels. 1500CET (1400BST, 0900ET): Roundtable between leaders and EU institutional heads gets underway. Late evening Brussels time: Press conference after first day of meeting.

- Aside from Brexit, the EUCO summit is also set to discuss the multiannual financial framework. The EU's long-term budget was not intended to be on the summit's schedule, but the increases to the budget (previously agreed to by leaders) requested by the European Parliament are said to be so large that they exceed the mandate of the Council's negotiators, requiring member state heads to make the final decision.

UK/EU (TELEGRAPH): European Union leaders are expected to hold an emergency summit in mid-November to give their political blessing to the free trade agreement with Britain. Senior EU diplomats targeted meetings in Berlin on November 15 and 16 as the moment heads of state and government would give their blessing to the deal,if trade negotiations with Britain continue past Friday and are successful.

UK: London To Enter Tier 2 COVID-19 Restrictions From Midnight Friday

Wires reporting that London is set to move into tier two COVID-19 restrictions from midnight on Friday due to rising case numbers in the capital city.

* Entering the 'high' alert level will see indoor mixing between different households banned.

UK: Modest UK Secured Lending Availability Uptick: BOE UK banks saw an increased availability of secured credit to households in Q3, with a similar availability expected in Q4, the Bank of England's latest Credit Conditions survey: showed. Availability of unsecured credit decreased and and would likely see a further decrease over the Q4 reporting period, the survey said. The BOE also noted that enders reported overall availability of credit to the corporate sector increased slightly in Q3, increasing slightly for small and medium businesses but decreasing slightly for large firms. Overall availability was expected to decrease in Q4.

ITALY (BBG): Italy general government debt grew from EU2.561 trillion in July, Bank of Italy says in its public-finances supplement.

DATA:

FIXED INCOME: Bunds yields lowest levels since March on Covid/US fiscal concerns

Risk-off sentiment has been driving markets with Covid-19 concerns and US fiscal stimulus hopes fading. Equities have sold off with core fixed income rallying and peripheral spreads widening.

- Covid-19 cases continue to pick up, particularly in the UK and Europe. The UK is reported to be imminently placing London in Tier 2 restrictions and several parts of the north into the highest Tier 3 restrictions. President Macron has announced a curfew for Paris in the evenings while Germany has recorded its highest daily increase in Covid-19 cases since the pandemic began.

- On the US side, Mnuchin has confirmed that it will be difficult to get any agreement on fiscal stimulus before next month's elections.

- In core fixed income Bunds are outperforming both Treasuries and gilts. Bund yields have broken below the May 5 low of -0.591% and now are at their lowest levels since March 13 - a period when Covid-19 was starting to escalate in Europe and at a stage when markets were recovering a little after becoming dysfunctional.

- Later today there will be a number of Fed speakers, Empire manufacturing, claims data and the Philly Fed.

- TY1 futures are up 0-5 today at 139-12 with 10y UST yields down -2.8bp at 0.698% and 2y yields down -0.5bp at 0.136%.

- Bund futures are up 0.61 today at 175.96 with 10y Bund yields down -3.6bp at -0.618% and Schatz yields down -2.0bp at -0.770%.

- Gilt futures are up 0.40 today at 136.47 with 10y yields down -3.0bp at 0.188% and 2y yields up 0.2bp at -0.50%.

FOREX SUMMARY

A super busy session for FX and across assets.

- Risk Off hit hard on the Govies opening bell.

- Chance of a US Stimulus package before the election, are all but gone according to Mnuchin, blaming politics.

- France is "a couvre feu" following Covid spikes, and the data across Europe paint a bleak picture, with numbers worst than the initial first wave.

- These have been the drivers, and USD took its cue and rallied across the board.

- Worth noting that volumes on Core Bonds are running close to 190% averages for this time of the day, with buying pushing yields to new lows.

- USD test high of the day against EUR, GBP, AUD, JPY, CAD, SEK NOK, PLN, ZAR, MXN, and we are still seeing buying momentum at the time of typing.

- CEE FX have felt the pinch with the EUR under pressure, but also having their own issues on Covid cases for Eastern Europe. EURCZK, EURHUF, and EURPLN are testing high of the session.

- AUD is the worst performing currency against the USD in G10, down 1.23%,

- Risk Off and RBA Gov Lowe's speech which was widely interpreted as dovish, has weighted on the Aussie.

- AUDUSD is off the lows at 0.7074 at the time of typing.

- Looking ahead, US Jobless is the data of interest, while BoE Cunliffe, BoC Tim Lane, ECB Lagarde, Fed Bostic, Bullard, Quarles, Kaplan, Barkin, and Kashkari are the schedule speakers.

- ALL EYES of course on the EU Summit

EQUITIES: European Stocks Sharply Lower

The risk-on atmosphere stemming from COVID 2nd wave concerns and fading hopes of US fiscal stimulus has continued overnight, with European stocks dropping sharply on weak earnings results (also Brexit concerns amid EU summit Thu-Fri). In US earnings, Morgan Stanley headlines the docket at 0730ET/1230BST.

- Asian stocks closed mixed, with Japan's NIKKEI down 119.5 pts or -0.51% at 23507.23 and the TOPIX down 12.11 pts or -0.74% at 1631.79. China's SHANGHAI closed down 8.595 pts or -0.26% at 3332.183 and the HANG SENG ended 508.55 pts lower or -2.06% at 24158.54.

- European bourses are down sharply, with the German Dax down 392.09 pts or -3.01% at 12630.33, FTSE 100 down 141.2 pts or -2.38% at 5793.77, CAC 40 down 121.39 pts or -2.46% at 4819.84 and Euro Stoxx 50 down 86.3 pts or -2.64% at 3185.68.

- U.S. futures are lower too, with the Dow Jones mini down 260 pts or -0.92% at 28149, S&P 500 mini down 36 pts or -1.03% at 3444, NASDAQ mini down 207.5 pts or -1.73% at 11762.75.

COMMODITIES: Weaker On Risk-Off+USD Strength

Commodities are weaker across the board, with precious metals suffering especially from a stronger dollar, and crude down on general risk-off.

- WTI Crude down $0.66 or -1.61% at $40.37

- Natural Gas up $0.12 or +4.63% at $2.759

- Gold spot down $10.41 or -0.55% at $1890.52

- Copper down $1.45 or -0.48% at $303.65

- Silver down $0.4 or -1.66% at $23.8195

- Platinum down $5.14 or -0.6% at $856.16

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.