MNI US OPEN - SNB Cuts Policy Rate, Riksbank Unchanged

EXECUTIVE SUMMARY

- MNI BOE PREVIEW - UNCERTAIN VOTE SPLIT, NEAR CERTAIN OUTCOME AND GUIDANCE

- SNB CUTS POLICY RATE TO 0.25%, OUTLOOK UNCERTAIN

- RIKSBANK LEAVES POLICY ON HOLD; SEES IT FLATLINING

- TRUMP SAYS FED WOULD BE BETTER CUTTING RATES AS TARIFFS START

- HAMAS CLAIMS TALKS w/MEDIATORS ONGOING AMID RENEWED ISRAELI OFFENSIVE

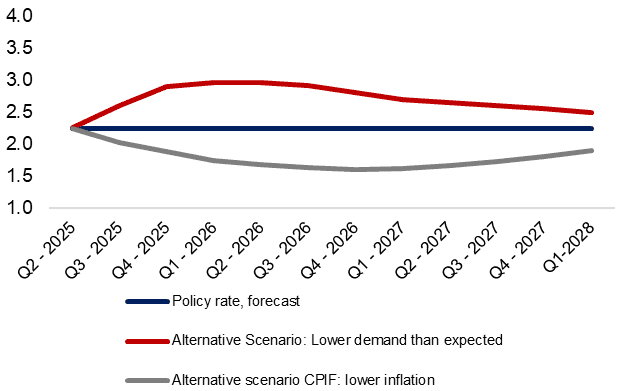

Figure 1: Riksbank March MPC Alternative Scenarios

Source: Riksbank, MNI

CENTRAL BANKS

MNI BOE PREVIEW - MARCH 2025: Uncertain Vote Split, Near Certain Outcome and Guidance

It would be a huge surprise to us, markets and sellside economists if there was anything other than a pause in the MPC’s cutting cycle at the March meeting with unchanged guidance. Probably the most interesting unknown is the voting split, with the number of plausible dovish dissents ranging from two to four – we suspect with a low conviction that there could be three, one more than consensus – although even this is unlikely to give a huge signal over future policy.

MNI FED REVIEW - MARCH 2025: Team Transitory Is Back

The market reaction to both the March FOMC’s economic projections/statement release and the press conference was notably dovish. Rate futures ended the event implying 65bp of cuts for 2025, up from 56bp before the meeting, and 61bp before Chair Powell took to the podium – in other words, leaning increasingly toward 3x 25bp cuts this year than 2. To our ear, though, Powell was actually neutral-to-cautious, reflecting the hawkish shift in the Dot Plot distribution and the increasing uncertainty in the outlook keeping the Committee hesitant to make their next move.

MNI BOJ REVIEW - MARCH 2025: On Hold Amid Uncertainty

The Bank of Japan (BoJ) kept its policy rate unchanged at 0.50% during its recent monetary policy meeting, a decision that was widely expected by market consensus. The 9-0 vote indicated strong unanimity among policymakers, with no serious consideration given to a consecutive rate hike following the January increase.

SNB (MNI): SNB Cuts Policy Rate to 0.25%, Outlook Uncertain

The Swiss National Bank cut its benchmark Policy Rate by 25 basis points to 0.25%, saying that this would ensure that "monetary conditions remain appropriate, given the low inflationary pressure and the heightened downside risks to inflation." Banks’ sight deposits held at the SNB will be remunerated at the SNB policy rate up to a certain threshold, and at 0% above

this threshold. The SNB said it remains remains willing to act in the foreign exchange market as necessary.

RIKSBANK (MNI): Riksbank Leaves Policy on Hold; Sees It Flatlining

The Riksbank left its policy rate on hold at 2.25% Thursday and predicted that it would now flatline throughout its three year forecast. The RIksbank, having cut rapidly, is now signalling that rates have troughed and a prolonged period of stability will follow, although it acknowledged substantial risks on either side. The forecasts showed the policy rate still around its crurrent rate in the first quater of 2028.

CHINA (MNI): China's March LPR Unchanged

MNI (Beijing) China's Loan Prime Rate remained unchanged on Thursday according to a People's Bank of China statement, in line with expectations as some economic indicators reflected a continued recovery. The LPR was held at 3.1% for the one-year maturity and 3.6% for the five-year and over rate. Both benchmarks fell in October by 25 basis points, the largest cuts since the reform of the new LPR pricing system in 2019, following the PBOC’s 20bp reduction on its 7-day reverse repo rate in September. Thursday's decision was largely anticipated.

BRAZIL (MNI): BCB to Slow Hiking Pace, Magnitude Still Uncertain

The Central Bank of Brazil signaled a smaller rate hike at its next meeting in May, though the magnitude is not clear yet, while the slowing pace of tightening suggests the cycle may be nearing its end. The forward guidance accompanied Wednesday’s decision to raise the Selic rate by 100 basis points to 14.25%, the highest level since August 2016. The move marked the fifth consecutive increase in rateand the third of 100 basis points.

TAIWAN (BBG): Taiwan Holds Key Rate as It Weighs Trump, AI Uncertainties

Taiwan held its benchmark interest rate at the highest level since 2008 as policymakers consider potential chip tariffs from the Trump administration, the outlook for the AI frenzy and inflation. The policy rate stayed at 2%, the central bank in Taipei said in a statement Thursday. All 29 economists surveyed by Bloomberg had expected it to remain steady for the fourth straight quarter.

MNI SARB PREVIEW - MARCH 2025: Considering Pause

The SouthAfricanReserveBank may take a pause after a sequence of three consecutive 25bp interest-rate cuts as uncertainty around domestic fiscal policy and global trade tensions cloud the outlook. Although domestic conditions arguably leave room for another step in the monetary easing cycle, the SARB’s hawkish approach will likely prompt policymakers to err on the side of caution.

NEWS

US (BBG): Trump Says Fed Would Be Better Cutting Rates as Tariffs Start

“The Fed would be MUCH better off CUTTING RATES as U.S.Tariffs start to transition (ease!) their way into the economy,” President Donald Trump says in a post on Truth Social. “Do the right thing,” Trump says in post.

US (WSJ): Trump Officials Circulate Plan That Would Overhaul USAID

The Trump administration is crafting plans to reorganize the U.S. Agency for International Development, which had been dismantled by Elon Musk’s Department of Government Efficiency, according to a memo detailing the plans. The agency would be renamed the U.S. Agency for International Humanitarian Assistance and fall under the control of the State Department to help enhance national security and counter adversaries like China, according to the memo, viewed by The Wall Street Journal. USAID had long operated as an independent agency with its own administrator.

US/INDIA (BBG): Trump Says India Won’t Avoid Being Hit by Tariffs on April 2

US President Donald Trump said India will be hit by like-for-like duties from April 2, even as officials in New Delhi scurry to appease Washington by reducing trade barriers. India is “one of the highest tariffing nations in the world,” Trump said on Wednesday in an interview with conservative media outlet Breitbart News. “I believe they’re going to probably going to be lowering those tariffs substantially, but on April 2, we will be charging them the same tariffs they charge us.”

US/JAPAN (BBG): US Likely to Halt Planned Military Expansion in Japan: NBC

The US government is likely to stop a planned expansion of US Forces in Japan to save costs, NBC News reported, citing a Pentagon briefing it reviewed. Briefing showed plan would save $1.18 billion but comes with “political risks with Japan” and could result in reduced command and control west of the international dateline, NBC says.

CANADA (BBG): Canada’s Carney Set to Call Snap Election for April 28: Globe

Canadian Prime Minister Mark Carney is poised to call a snap federal election on Sunday for an expected vote on April 28, the Globe and Mail reports, citing two sources familiar with the matter. A final call on the April 28 vote will be made by Carney, the sources said.

ISRAEL (MNI): Hamas Claims Talks w/Mediators Ongoing Amid Renewed Israeli Offensive

Reuters reports comments from Hamas spox Abdel Latif al-Qanoa claiming that talks with mediators from Qatar and Egypt are ongoing amid Israel's renewed assault on Gaza. The talks aim to 'push Israel to abide by the ceasefire deal'. Hamas has restated its commitment to the deal signed in January, but recently this has not been the deal on the table. Instead, a new proposal from US Middle East envoy Steven Witkoff has been the deal on offer. This envisages an extension of the first phase deal to allow for the release of more Israeli hostages in exchange for a greater flow of aid into Gaza before phase two talks on a more lasting ceasefire.

RUSSIA/UKRAINE (BBG): Russia and Ukraine Keep Up Drone Attacks Amid Truce on Energy

Russia and Ukraine exchanged mass drone attacks overnight, even as the two countries declared they’re ready to observe a moratorium on strikes against energy infrastructure sought by US President Donald Trump. Russia sent 171 explosive-laden Shahed drones toward Ukraine, up from 145 and 137 in the previous two days, the Ukrainian Air Force command reported Thursday. Air defenses intercepted most of the drones, though 10 people were hurt and several buildings were damaged in the central city of Kropyvnytskyi, Ukraine’s State Emergency Service said on Telegram.

ECB (MNI): Tariffs Could Add 50bps to Inflation - ECB's Lagarde

A trade war with U.S tariffs would make the eurozone's price outlook "significantly more uncertain," potentially adding 0.5 percentage point to inflation, European President Christine Lagarde told the European Parliament's ECON committee. In the near term, EU retaliatory measures and a weaker euro exchange rate "resulting from lower U.S.demand for European products" could lift inflation by around half a percentage point Lagarde said. The effect would ease in the medium term due to lower economic activity dampening inflationary pressures, she said.

EUROPE (POLITICO): EU Slams the Door on US in Colossal Defense Plan

United States arms-makers are being frozen out of the European Union’s massive new defense spending plan, which aims to splash the cash for EU and allied countries, according to defense spending plans released Wednesday. Also left out — for now — is the United Kingdom. “We must buy more European. Because that means strengthening the European defense technological and industrial base,” said Commission President Ursula von der Leyen in announcing the Readiness 2030 program.

EUROPE/CANADA (BBG): Canada Seeks Defense Ties and Deals With Europe as US Pulls Back

Canada has floated doing major defense deals with Europe and improving the continent’s access to its critical minerals in response to President Donald Trump’s threats and his pullback from US defense commitments. Canada is seeking closer defense industry cooperation with Italy and the European Union as “a matter of urgency,” Elissa Golberg, its ambassador in Rome, wrote to Italy’s finance, foreign affairs, defense and enterprise ministers on Monday.

EUROPE (BBG): Germany, France Push to Lower EU Gas Storage Goal From Next Year

Germany and France are among a group of countries pushing to lower the European Union’s headline target for filling gas storages over the next two years. That objective of ensuring inventories are 90% full by Nov. 1 is designed to provide the region with energy security through a cold winter. However, some nations complain that the goal’s rigidity can contribute to market speculation, as traders anticipate purchases before the deadline.

EU/HUNGARY (FT): EU Probes BYD Plant in Hungary Over Unfair Chinese Subsidies

Brussels is investigating whether China provided unfair subsidies for a BYD electric car plant in Hungary, in a highly sensitive move to target the deepening economic ties between Beijing and Viktor Orbán. The European Commission is in the preliminary stages of a foreign subsidy probe into the BYD plant, two people familiar with the matter told the Financial Times, in a step that will further raise trade tensions with Beijing.

TURKEY (BBG): Turkish Market Selloff Shows Signs of Easing After Turmoil

Turkish Market Selloff Shows Signs of Easing After TurmoilThe selloff in Turkish assets eased as authorities announced steps to curb volatility after the detention of President Recep Tayyip Erdogan’s main political rival sparked a market rout. The Turkish currency pared declines to trade little changed at 37.8869 per dollar after the central bank said it would start lira-settled forward currency sales to avoid potential exchange-rate swings and balance liquidity in the market.

CORPORATE (FT): Nvidia to Spend Hundreds of Billions on US Supply Chain, Says Chief

Nvidia will spend hundreds of billions of dollars on chips and other electronics manufactured in the US over the next four years, its chief executive has said, as the company tilts its supply chain back from Asia in the face of Donald Trump’s tariff threats. The huge spending projection from the world’s most valuable semiconductor group follows multibillion-dollar US investment plans announced by other technology companies including Apple, as the impact of Trump’s “America First” trade policies ripples through the global economy.

DATA

UK DATA (MNI): UK Wage Growth Remians Challenge for BOE - ONS

- UK JAN AVE WEEKLY EARNINGS EX-BONUS +5.9% YY

- UK JAN AVE WEEKLY EARNINGS +5.8% YY

- UK FEB CLAIMANT CHG +44200

- UK FEB CLAIMANT RATE +4.7%

UK average regular earnings ex-bonuses rose 5.9% in the year to January, while total earnings rose 5.8%, the Office for National Statistics said Thursday. The UK survey data has been seen as less than fully reliable in recent quartrs, but according to the ONS, RTI pay data showed a similar annual growth rate. Annual growth in real terms, adjusted for inflation using the CPI measure, real pay was 3.1% and 3.2% respectively.

The details of the UK labour market report are mixed under the surface. PAYE pay continues its downtrend, vacancies and LFS data are generally stable while HMRC payrolls employment was higher than expected and revised up (but remains prone to large revisions). Overall, we don't think there is anything here to change any MPC member's view. Looking more into the data - HMRC PAYE median pay continued its downtrend, coming in at 4.92%Y/Y in February 2025. January was revised up from 5.01% to 5.28%Y/Y. The 4.92%Y/Y print is the lowest since May 2022.

GERMANY DATA (MNI): German February PPI ex-Energy Slightly Accelerates

- GERMANY FEB PRODUCER PRICES -0.2% M/M, 0.7% Y/Y

German PPI rose by 0.7% Y/Y in February, remaining below consensus expectations of 1.0% Y/Y regardless of an acceleration from January's 0.5% Y/Y. On a sequential comparison, PPI was -0.2% M/M (0.2% cons; -0.1% prior). Energy deflation was less prominent than before, at -0.8% Y/Y (vs -1.0% prior) - that is counter to the details of the February CPI print, where energy went further into negative territory. That leaves ex-energy PPI 0.2pp higher than in January, at 1.4% Y/Y.

CHINA DATA (MNI): China Outward Investment Up in Jan Feb

MNI (Beijing) China’s overseas non-financial direct investment reached USD23 billion during January and February, a year-on-year increase of 9.1%, with Belt and Road destinations receiving USD5.50 billion, a year-on-year increase of 17.5%, He Yongqian, spokesperson for the Ministry of Commerce told reporters on Thursday. Looking ahead, the ministry will support foreign-invested enterprises to participate in large-scale equipment renewal, consumer goods trade-in schemes and government procurement activities to ensure fair competition, He added.

CHINA DATA (MNI): China Grid Investment Up During Jan Feb

MNI (Beijing) China’s investment in power grid projects totalled CNY43.6 billion during January and February, up 33.5% y/y, data from the National Energy Administration showed on Thursday. By the end of February, the nation’s cumulative installed power generation capacity nationwide reached 3.4 billion kilowatts, an increase of 14.5% y/y, with solar and wind power capacity up 42.9% and 17.6% y/y.

AUSTRALIA DATA (MNI): Aussie Unemployment Steady, Jobs Fall

- AUSTRALIA FEB UNEMPLOYMENT RATE +4.1%

- AUSTRALIA FEB EMPLOYED PERSONS CHANGE -52.8K

- AUSTRALIA FEB F-T EMPLOYED PERSONS CHANGE -35.7K

- AUSTRALIA FEB LABOR PARTICIPATION RATE +66.8%

Australia’s unemployment rate held steady at 4.1% over February, in line with expectations, while employment fell by 52,800, lower than the 30,000 jobs expected, data from the Australian Bureau of Statistics showed. “Fewer older workers returning to work in February contributed to the fall in employment this month, with lower levels of employment in the older age groups in February 2025 compared with 2024,” said Bjorn Jarvis, head of labour statistics at the ABS.

NEW ZEALAND DATA (MNI): Q4 Driven by Higher Tourism Spending, Construction Struggled

Growth in Q4 was stronger than both consensus and the RBNZ projected. Production-based GDP rose 0.7% q/q but was still down 1.1% y/y after -1.1% q/q & -1.6% y/y, while expenditure-based GDP increased 0.8% q/q to be down only 0.4% y/y following Q3's -0.9% q/q & -1.2% y/y. The recovery was fairly broad-based with 11 of 16 industries seeing growth and most expenditure components rising. 25bp rate cuts in both April and May remain likely to support the private sector.

FOREX: USD Erases Post-Fed Losses, With Heavy Volume GBP, EUR Sales

- The greenback has more than erased the post-Fed weakness on this latest leg higher - EUR/USD and GBP/USD now comfortably through yesterday's lows, accelerating the price action as volumes really pick up on the break. No specific headline or news trigger behind this move, which isn't being endorsed by cross-market moves: the front-end of the US curve is holding yesterday's drift lower, although US equity futures are edging off the better levels and moving closer toward unchanged.

- As a result, the USD's comfortably the best performer so far, with JPY not far behind. AUD and NZD continue to underperform, meaning NZD/USD has slipped closer toward the 100-dma of 0.5738, opening a >50 pip gap with the mid-week high. AUD/NZD is posting a strong daily candle pattern, having bounced 50 pips off the pullback and cycle low, taking out yesterday's high in the process.

- Rate decisions so far this morning have more-or-less toed the line in Switzerland and Sweden, with the BoE also expected unchanged later today. Weekly US claims data is the calendar highlight, although the central bank speaker slate is busy: 8 ECB speakers are due, headlined by ECB's Lagarde who's appearing in front of an EU parliamentary hearing.

EGBS: Underperform Core Peers, Supply From Spain, France and Ireland Due Today

A pullback in European equity futures has provided light support to core EGBs, though an uptick in Brent crude oil prices and impending Spanish and French supply has capped topside intraday. Broader EGB underperformance versus Gilts and Tsys can be attributed to continued focus on the sea change in European fiscal policy, the Fed-driven nature of the bid in bonds and Gilt's higher beta to Tsys.

- The dovish reaction to yesterday’s FOMC decision and press conference still leaves Bund futures +31 ticks versus yesterday’s settlement levels at 128.42.

- A bearish technical theme remains intact, but the gap has narrowed to initial resistance at 128.94, the 20-day EMA.

- German yields are 1.5-3.5bps lower, with the belly of the curve outperforming. German ASWs vs. 3-month Euribor are little changed across the curve.

- Sovereign supply is due from Spain, France and Ireland this morning.

- 10-year EGB spreads to Bunds are biased wider as a result of the equity weakness.

GILTS: Futures Through Resistance, BoE Eyed

Gilts have rallied, with weakness in European equities and spillover from the post-Fed bid in Tsys providing support this morning.

- Futures have broken above key resistance at the March 7 high (92.63).

- Fresh extension higher would target the Mar 4 low (93.06), a break there would deepen the threat to the bearish technical theme.

- Yields 3.5-5.5bp lower, 10s outperform.

- 10s 2bp tighter vs. Bunds, spread last ~181bp. Multi-week range intact.

- It would be a huge surprise to us, markets and sell-side economists if there was anything other than a pause in the MPC’s cutting cycle come the end of today’s decision, with unchanged guidance also expected.

- The vote split is set to garner much of the interest, with the number of plausible dovish dissents ranging from two to four - we suspect, with a low conviction, that there could be three, one more than consensus.

- BoE-dated OIS shows ~54bp of cuts through year-end, with some erroneous BBG quotes now smoothed out, market indicating ~17bp of cuts through May, 22.5bp through June and 36bp through August. We look for the next cut to come in May.

- SONIA futures move dovishly in sympathy with the move in the long end, last flat to +5.0.

EQUITIES: Eurostoxx 50 Futures Holding Onto This Week's Gains

Eurostoxx 50 futures have recovered from their recent lows and the contract is holding on to this week’s gains. The M/T trend direction remains up and the recent pullback is considered corrective. Support to watch is the 50-day EMA, at 5555.52. It has recently been pierced. A clear break of it would highlight a stronger short-term bear threat and suggest scope for a retracement towards 5202.00, a Fibonacci retracement. A continuation higher would open 5600. The trend condition in S&P E-Minis is bearish. Moving average studies are unchanged and remain in a bear-mode set-up highlighting a dominant downtrend. Sights are on 5483.50, a Fibonacci projection. Note that the short-term trend condition is oversold. Recent gains are considered corrective and the bounce is allowing this set-up to unwind. Firm resistance to watch is 5955.55, the 50-day EMA.

- In China the SHANGHAI closed lower by 17.481 pts or -0.51% at 3408.948 and the HANG SENG ended 551.19 pts lower or -2.23% at 24219.95.

- Across Europe, Germany's DAX trades lower by 30.62 pts or -0.13% at 23255.46, FTSE 100 higher by 32.34 pts or +0.37% at 8739.12, CAC 40 down 11.39 pts or -0.14% at 8158.77 and Euro Stoxx 50 up 5.32 pts or +0.1% at 5511.95.

- Dow Jones mini up 139 pts or +0.33% at 42134, S&P 500 mini up 27 pts or +0.48% at 5705.5, NASDAQ mini up 113.75 pts or +0.58% at 19860.5.

Time: 08:50 GMT

COMMODITIES: WTI Future MA Studies Remain in Bear Mode Position

A bearish condition in WTI futures remains intact and the latest round of gains appear corrective - for now. Recent weakness resulted in a breach of $69.80, the Feb 4 low. This confirmed a resumption of the downtrend that started Jan 15 and has paved the way for an extension towards $63.73 next, the Oct 10 ‘24 low. MA studies are in a bear-mode position, highlighting a dominant downtrend. Key pivot resistance to watch is $69.20, 50-day EMA. A clear uptrend in Gold is intact and this week’s resumption of the bull cycle reinforces current conditions. The yellow metal has cleared the psychological $3000.0 handle. Today’s fresh trend high reinforces the bull theme and sights are on 3079.2 next, a Fibonacci projection. Note that moving average studies are in a bull-mode position, highlighting a dominant uptrend and positive market sentiment. Support is at $29443.8, the 20-day EMA.

- WTI Crude up $0.52 or +0.77% at $67.68

- Natural Gas down $0.08 or -1.86% at $4.168

- Gold spot down $6.38 or -0.21% at $3041.36

- Copper up $1.6 or +0.31% at $511.85

- Silver down $0.26 or -0.77% at $33.5465

- Platinum down $3.75 or -0.38% at $994.15

Time: 08:50 GMT

| Date | GMT/Local | Impact | Country | Event |

| 20/03/2025 | 1000/1100 | ** | Construction Production | |

| 20/03/2025 | 1100/1100 | ** | CBI Industrial Trends | |

| 20/03/2025 | 1200/1200 | *** | Bank Of England Interest Rate | |

| 20/03/2025 | 1200/1200 | *** | Bank Of England Interest Rate | |

| 20/03/2025 | 1200/1300 | ECB's Lane At UCC Economics Society's Conference | ||

| 20/03/2025 | 1200/1200 | Agents summary of business conditions | ||

| 20/03/2025 | 1230/0830 | * | Industrial Product and Raw Material Price Index | |

| 20/03/2025 | 1230/0830 | *** | Jobless Claims | |

| 20/03/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 20/03/2025 | 1230/0830 | ** | Philadelphia Fed Manufacturing Index | |

| 20/03/2025 | 1230/0830 | * | Current Account Balance | |

| 20/03/2025 | 1400/1000 | *** | NAR existing home sales | |

| 20/03/2025 | 1430/1030 | ** | Natural Gas Stocks | |

| 20/03/2025 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 20/03/2025 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 20/03/2025 | 1650/1250 | BOC Governor speaks in Calgary | ||

| 20/03/2025 | 1700/1300 | ** | US Treasury Auction Result for TIPS 10 Year Note | |

| 21/03/2025 | 2330/0830 | *** | CPI | |

| 21/03/2025 | 0001/0001 | ** | Gfk Monthly Consumer Confidence | |

| 21/03/2025 | 0700/0700 | *** | Public Sector Finances | |

| 21/03/2025 | 0745/0845 | ** | Manufacturing Sentiment | |

| 21/03/2025 | 0900/1000 | ** | EZ Current Account | |

| 21/03/2025 | 1230/0830 | ** | Retail Trade | |

| 21/03/2025 | 1305/0905 | New York Fed's John Williams | ||

| 21/03/2025 | 1500/1600 | ** | Consumer Confidence Indicator (p) | |

| 21/03/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 21/03/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly |