-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China May Inject CNY1 Trln To Replenish Big Banks

MNI US Open: Third Wave Fears Loom Over European Recovery

EXECUTIVE SUMMARY:

- B.O.J. KURODA: PREMATURE TO DISCUSS EASY POLICY EXIT; B.O.J. MOVE NOT JGB BAND WIDENING

- GERMANY WARNS OF THIRD WAVE AS FRENCH P.M. LOCKS DOWN PARIS

- U.K. EDGES CLOSER TOWARD LIMITED BREXIT FINANCE DEAL WITH E.U.

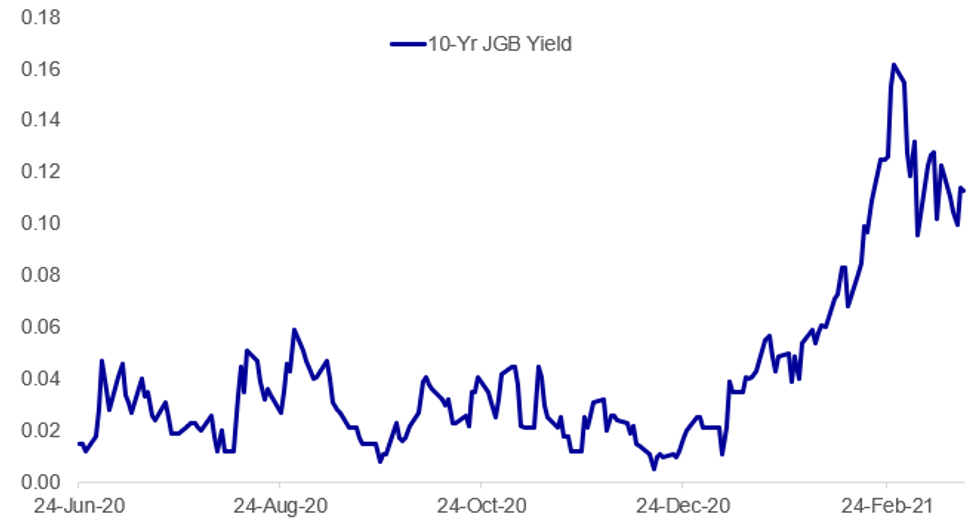

Fig. 1: BOJ Puts 10-Yr Yield In Focus

NEWS:

BOJ: There was no change in overall policy emphasis from Bank of Japan Governor Haruhiko Kuroda Friday, as he reiterated to reporters that it is premature to discuss the exit from easy policy, adding such discussions were not appropriate to discuss an exit of easy policy" as the 2% price target hasn't yet been achieved. His comments came after the BOJ largely left monetary policy settings unchanged at the March meeting, just tweaking some messaging. Looking at the forex markets, he restated the BOJ's stance that the yen should move stably and reflect economic fundamentals: "I don't think that there are problems with regard to the recent movements of foreign exchange rates," he said.

BOJ: The Bank of Japan did not widen the tolerated trading band for the benchmark 10-year JGB Friday, but just clarified the ambiguous position going into the meeting, Governor Haruhiko noted in a post-meeting press conference Friday. Kuroda had told legislators earlier this week the BOJ would not look to extend the trading range at this meeting. Logically, he will hang his comments on the fact the BOJ previously had an uncodified range of -/+ 20 bps but had previously allowed 10-year yields to fall to -0.29%.

GERMANY / FRANCE / EU/ COVID: An official from Germany's Robert Koch Institute delivering remarks this morning says that the country may be in a similar situation at Easter as it found itself at Christmas, with infection numbers now 'rising exponentially' and warning that there are 'not enough vaccines in Europe to stop the third wave alone'.

- Says that due to this the relaxation in restrictions in the coming weeks that had been mooted may not be possible.

- This comes a day after an announcement from French Prime Minister Jean Castex that Paris, its surrounding areas and 15 other departements will be placed into a form of lockdown for four weeks from midnight tonight to contain a spike in new cases.

- The lockdown will not be as strict as previous measures, with non-essential retail forced to close but schools and hairdressers remaining open.

- Both of these escalations come as the EMA gave the green light once again yesterday to the AstraZeneca COVID-19 vaccine.

- The spat between the UK and EU over vaccine supply may show some minor signs of cooling off, with UK PM Boris Johnson speaking to his Belgian counterpart Alexander De Croo yesterday. The UK is the primary hub of AZ vaccine manufacturing in Europe, while the same is true of Belgium for the Pfizer/BioNTech vaccine. Any bilateral improvements in relations, though, remain at risk from aggressive action from the European Commission and Council, which could implement export bans on vaccines to the UK in the coming days or weeks.

UK/EU (BBG): Britain and the European Union are inching closer to reaching a co-operation agreement on financial regulation by the end of this month in a step that could help give firms in the City of London more access to the single market. The EU could grant the U.K. so-called partial regulatory equivalence for some financial products once the separate memorandum of understanding on financial regulation is reached, according to a person familiar with the negotiations.

UK DATA: UK borrowing rose rose sharply between January and February, despite an increase in self-assessment tax receipts, but borrowing is on track to fall short of OBR forecasts for the full fiscal year, data released on Friday by the Office for National Statistics showed.

DATA:

FIXED INCOME: Bull Flattening is the dominant theme

Global bull flattening the dominant theme.

- EGBs and Bund are bull flatter, unwinding the steepening bias to trade back toward pre FOMC level.

- With the lack of data or risk events, desk are likely positioning, squaring going into the weekend.

- Peripherals trade wider against the German 10yr, with Greece by 1bp.

- Similar story for Gilts, with the contract trading in tandem with EGBs

- 5/30s Gilt curve trades near the session low at 95.535, from a 100.963 high.

- US Treasuries, sees long end outperforming, as in EGBs and the UK, some corrective unwind, following the big steepening bias post FOMC.

- US 5/30s are now well below pre FOMC.

- US 10yr yields failed just ahead of the important resistance at 1.7811% (50% retrace of the 2018-2020 fall), printing at 1.7526% high yesterday, and trending circa 1.6767% during our European open.

- US 5/30s support is eyed at Wednesday's low 153.162

- Looking ahead, we have no data of note, besides the Canadian retail sales, and on the speaker front, ECB Panetta, Vasle and BoE Cunliffe.

- After markets, rating from S&P on Belgium and Spain, Moody on EU and Portugal, DBRS on Greece

FOREX: Markets More Steady, Central Banks Digested

- Markets are more steady early Friday, with traders digesting the deluge of central bank decisions this week. NOK is seeing some support as the oil price stabilises following yesterday's sharp drawdown, with underlying support also stemming from the steeper rate path projections outlined by the Norges Bank yesterday.

- CHF and EUR are among the morning's worst performing currencies, with ongoing vaccine ire over the rollout of the AstraZeneca treatment across the EU raising concerns over the continent's recovery plans. EUR/USD is circling overnight lows at 1.1902.

- In recent trade, GBP has seen some modest strength helping buoy GBP/USD toward 1.3960 as wires report that the UK and EU is edging closer to a limited finance trade deal with the European Union.

- Focus turns to the Russian rate decision (expected unchanged at 4.25%) and Canadian retail sales data for January. Speeches are due from ECB's Panetta & Vasle and BoE's Cunliffe.

EQUITIES: US Futures Off Lows

- Asian stocks closed mixed, with Japan's NIKKEI down 424.7 pts or -1.41% at 29792.05 and the TOPIX up 3.7 pts or +0.18% at 2012.21. China's SHANGHAI closed down 58.405 pts or -1.69% at 3404.663 and the HANG SENG ended 414.78 pts lower or -1.41% at 28990.94.

- European stocks are lower, with the German Dax down 50.37 pts or -0.34% at 14722.78, FTSE 100 down 39.19 pts or -0.58% at 6741.52, CAC 40 down 37.51 pts or -0.62% at 6025.22 and Euro Stoxx 50 down 17.27 pts or -0.45% at 3850.03.

- U.S. futures are stronger, with the Dow Jones mini up 62 pts or +0.19% at 32942, S&P 500 mini up 13.25 pts or +0.34% at 3929.75, NASDAQ mini up 99 pts or +0.77% at 12894.5.

COMMODITIES: Oil Regains Some Ground

- WTI Crude up $0.98 or +1.63% at $60.97

- Natural Gas up $0.03 or +1.05% at $2.507

- Gold spot up $6.55 or +0.38% at $1743.29

- Copper down $2.9 or -0.71% at $407.95

- Silver up $0.06 or +0.25% at $26.1365

- Platinum down $1.7 or -0.14% at $1208.22

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.