-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Tsy Yields Touch Fresh Lows

EXECUTIVE SUMMARY:

- ECB'S HOLZMANN: INFLATION ABOVE 3% WOULD PROMPT STRATEGY REVIEW

- UK GDP HIGHER IN APRIL AS SERVICES REOPEN

- MERKEL CHIEF OF STAFF RULES OUT ANOTHER HARD LOCKDOWN

- IEA: GLOBAL OIL DEMAND BACK TO PRE-PANDEMIC LEVELS BY END-2022

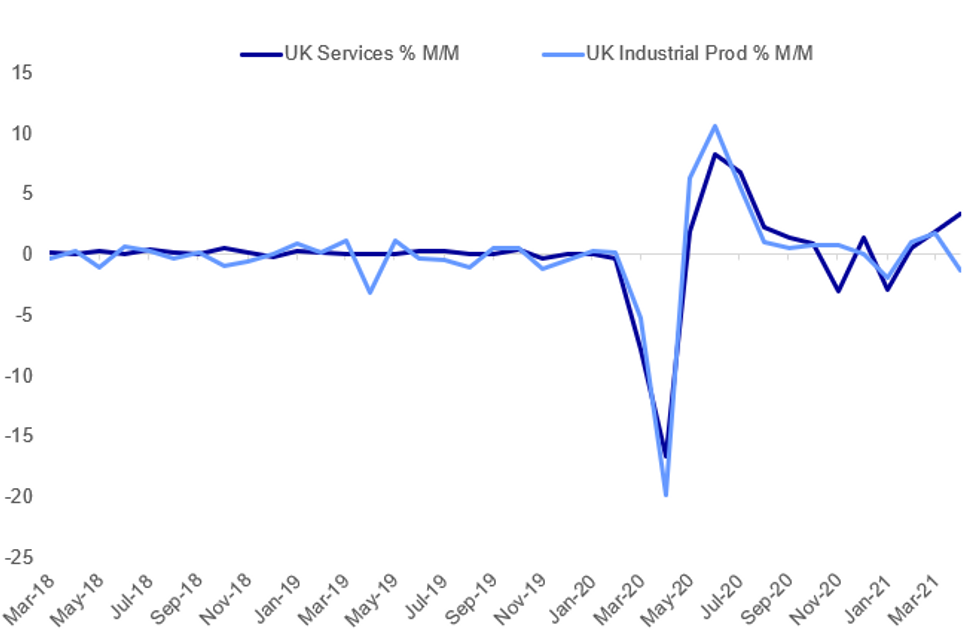

Fig. 1: UK Services Impress, Industry Disappoints In April

Source: ONS, MNI

Source: ONS, MNI

NEWS:

E.C.B. (BBG): The European Central Bank would need to review its monetary policy approach if euro area inflation quickened past 3%, Governing Council member Robert Holzmann says at briefing of Austrian central bank. Holzmann says too early to say what consequences for policy would be. Says rate setters monitoring impact of quickening U.S. inflation. Dynamic in input prices has had smaller impact on inflation expectations than awaited.

E.U./E.C.B. (BBG): European Union rules meant to rein in excessive borrowing by its member states need to become more flexible in order to allow for more public investment outside of extreme circumstances, said Klaas Knot, the president of the Dutch central bank.Governments should be able to boost economic growth through spending when interest rates are low and central banks lack room for maneuver, which the current rulebook doesn't sufficiently cater for, Knot said. While the suspension of the EU's debt limits during the pandemic was welcome, such an "all-or-nothing" approach isn't the best way to achieve a balanced economy, he said.

GERMANY (BBG) Germany may encounter a fourth wave of the pandemic as a result of the Delta variant that's spreading across the U.K., but it won't spur another hard lockdown of the kind the country experienced in the winter, Chancellor Angela Merkel's chief of staff told RTL/ntv in an interview.

OIL: The latest International Energy Agency (IEA) monthly report states that the body believes that oil demand will return back to pre-pandemic levels by the end of next year.

- Says that by end-2022 global oil demand will reach 100.6mn b/d.

- Report states that "OPEC+ needs to open the taps to keep the world oil markets adequately supplied"

- "The pace at which the OPEC+ cuts can be unwound will depend not only on the success in containing the spread of the virus and demand growth but also the timing of the eventual return of Iranian barrels to the market."

UK-EU (BBG): The U.K. and EU can still reach an accord on the Brexit deal's Northern Ireland protocol, Ireland's finance minister said."Despite the challenges that we have there at the moment, I do believe we will get an agreement," Paschal Donohoe told RTE Radio on Friday."There are flexibilities and abilities within" the protocol "with regard to agricultural checks that will massively reduce the number of tests and administration that needs to be done. I hope that can form the basis for an agreement," he added.

BOE/BIS: The Bank of England and the Bank of International Settlements are launching a BIS Innovation Hub CentrE to boost collaboration between stakeholders in the financial sector. The London hub will be the 4th new centre opened in the last 2 years, following on from centres in Toronto, Frankfurt/Paris and Stockholm.

DATA:

UK DATA: GDP Higher In April As Services Reopen

UK output rose by 2.3% between March and April, a shade below expectations, powered by a higher-than-forecast 3.4% jump in services as non-essential shops, outdoor dining and personal services reopened on 12 April, the Office for National Statistics said. Services accounted for 2.87 percentage points of total growth, led by a 8.9% surge in wholesale and retail trading, the biggest rise since June of 2020.

Production fell by 1.3%, confounding forecasts of a 1.2% increase, dampened by a 15% fall in mining and quarrying as oil and gas fields closed for routine maintenance. Manufacturing declined by 0.3%, with transport equipment particularly weak, partially due to a shortage of semiconductors in the automobile industry. Construction output declined by 2.0%, compared defying forecasts of a 1.0% rise.

Output now stands 3.7% below its pre-pandemic level, but has increased by 1.2% above its initial peak hit last October.

UK APR GDP +2.3% M/M (MEDIAN +2.4%, MAR +2.1%,)

UK DATA: Trade Gap Falls As Non-EU Imports Outperform

The UK's April headline trade deficit narrowed to GBP0.935 billion from GBP1.966 billion as EU imports remain weak after the UK left the transitional trading period with the EU at the end of 2020. Imports from non-EU countries hit GBP20.1 billion, topping the GBP 18.4 billion from EU nations, extending a trend that began in January. Exports to the EU rose by 2.0% in April, but remain 5.1% below the level of December (compared to a 7.0% shortfall in March).

Imports to the EU have recovered more slowly. Despite a 3.2% increase in April, EU imports remain 19.5% below December levels (down from 22.1% in March). Excluding precious metals, the underlying trade deficit widened to GBP1.9 billion from GBP 587 million in March.

FIXED INCOME: Core FI rally continues (but peripheral spread tighten)

The rally in core fixed income has continued this morning despite the 5.0% US CPI print yesterday.

- The moves are biggest in gilts where 10-year yields are down 5bp at the time of writing. Concerns that the easing pencilled in for June 21 is weighing on sentiment while the market is also concerned about the EU-UK dispute surrounding the Northern Ireland protocal.

- Bunds are higher on the day but peripheral spreads are also narrowing as the market shows its relief that the ECB will continue buying bonds at a significantly faster pace than through Q1.

- Michigan confidence is the only noteworthy calendar item today.

- It will be interesting to see how markets close the week, with many citing the moves this week as a positioning clear-out.

- TY1 futures are up 0-5+ today at 133-03+ with 10y UST yields up 0.3bp at 1.436% and 2y yields down -0.2bp at 0.144%.

- Bund futures are up 0.54 today at 173.07 with 10y Bund yields down -2.5bp at -0.282% and Schatz yields down -0.2bp at -0.692%.

- Gilt futures are up 0.60 today at 128.29 with 10y yields down -5.0bp at 0.696% and 2y yields down -1.3bp at 0.047%.

FOREX: Greenback Firmer Despite Soggy US Yields

- The US yield curve remains under pressure early Friday, with the 10y yield narrowing in on the 1.42%, a level not crossed since early March. Despite soft yields, the greenback is modestly firmer ahead of NY hours, keeping most major pairs under pressure. GBP/USD has rolled off of overnight highs of 1.4185, with EUR/USD also now below pre-ECB levels.

- The resumption of the broad uptrend in US equities has filtered through to European markets this morning, helping underpin sentiment and buoy the likes of AUD, NZD across G10.

- This modest risk-on sentiment has resulted in lower JPY, although USD/JPY remains well below the Thursday high of 109.80.

- NOK is sliding for a second session despite the rebound in oil prices, as markets continue to pre-position ahead of next Thursday's Norges decision. Weak inflation numbers this week have prompted traders to price out the likelihood of a firm signal that rate hikes could come as soon as this September. USD/NOK is higher, but remains below 50-dma resistance of 8.3318.

- The data slate is light Friday, with Prelim University of Michigan sentiment numbers the highlight.

EQUITIES: S&P Futs Still Hovering Around All-Time Highs

- Asian stocks closed mixed, with Japan's NIKKEI down 9.83 pts or -0.03% at 28948.73 and the TOPIX down 2.71 pts or -0.14% at 1954.02. China's SHANGHAI closed down 21.111 pts or -0.58% at 3589.748 and the HANG SENG ended 103.25 pts higher or +0.36% at 28842.13

- European equities are higher, with the German Dax up 11.65 pts or +0.07% at 15571.79, FTSE 100 up 37.42 pts or +0.53% at 7122.32, CAC 40 up 28.34 pts or +0.43% at 6561.68 and Euro Stoxx 50 up 10.35 pts or +0.25% at 4103.51.

- U.S. futures have edged higher, with the Dow Jones mini up 34 pts or +0.1% at 34494, S&P 500 mini up 2.25 pts or +0.05% at 4240.25, NASDAQ mini up 6.5 pts or +0.05% at 13966.

COMMODITIES: Copper Jumps As Reflation Trade Regains Ground

- WTI Crude up $0.2 or +0.28% at $70.43

- Natural Gas up $0.1 or +3.21% at $3.246

- Gold spot down $1.96 or -0.1% at $1900.22

- Copper up $8.2 or +1.83% at $454.4

- Silver up $0.19 or +0.67% at $28.2137

- Platinum up $1.66 or +0.14% at $1160.05

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.